DIPLOMA IN INTERNATIONAL FINANCIAL REPORTING

DIPLOMA IN INTERNATIONAL FINANCIAL REPORTING STANDARDS (20)

ASSIGNMENT 1 - Instructions

The submission date is on or before 5.30p.m. Monday 4 th

November 2013.

You must submit your answers typed or scanned via email to assignments@charteredaccountants.ie

.

If you have any queries please contact Niamh O’Sullivan, Exam and Assignment Coordinator.

Format

•

Candidates must submit typed answers electronically , in one document, (along with scanned copies of forms/ appendices, as relevant) Should more than one document be submitted, the

Institute shall not be liable for the assignment being printed/ collated in the correct order but

• every attempt will be made to ensure assignments are correct and complete for examiner review.

Your assignment must include a signed Title and Declaration of Ownership page, (template provided below) as the cover page of your assignment. Any submission not accompanied by a

•

• signed Declaration page will not be accepted.

Except for the title page, all pages should be numbered .

Page Count - page counts, if specified, must be adhered to. Any pages over the number indicated page count will be disregarded by the marker.

•

•

The font size should be no less than font size 11 and page margins should not be less than

2.5cm on each side.

Please make sure that the file is printable on A4 paper , without the need to alter it.

Submissions in PDF format will meet these requirements; will reduce file size and help avoid email server errors. PDF will also ensure that your data and layout is secure and presented to the marker as you had intended. There are a number of online PDF generators available i.e. www.freepdfconvert.com/ which will convert your files to this format.

•

You must retain the question paper and a photocopy or electronic copy of your submitted answer and be able to produce this if requested to do so.

•

You will receive your marks and comments once all assignments have been marked, but your assessment script will not be returned to you.

Acknowledgement of receipt

•

•

An e-mail acknowledgement of receipt will be issued within two working days.

This email should be retained as proof of submission. If an acknowledgement has not been received, please contact the Learning and Development Department on 01 637 7339/7316 or email at assignments@charteredaccountants.ie

.

Late Submissions - Penalties

•

Assignments submitted after the official submission date, for which an extension has not been

•

• agreed in writing, will be deemed as late.

Assignments deemed late will attract the following penalties:

−

Up to 1 day late – 10% reduction in the mark awarded.

−

Up to 3 days – 20% reduction in the mark awarded

−

Up to 4 days late – 30% reduction in the mark awarded

−

Up to 5 days late – 40% reduction in the mark awarded

−

Up to 6 days late – 50% reduction in the mark awarded

−

More than 6 days late – assignment will not be accepted.

If no submission or communication has been received seven days after the submission date and an extension has not been awarded, it will be assumed that no submission is being made and the candidate accepts that they will have to defer submitting their assignment until the next session of the course, resulting in a delay of the awarding of their qualification.

Page 1 of 6

Extensions

A maximum of one (1) extension is allowed per course per participant.

1. An extension request must be made, in writing, using the ‘ Extension Request form ’ provided with your course materials, not later than five (5) working days before the due date for the assignment, for the attention of Niamh O’ Sullivan, Exam and Assignment Coordinator, explaining the reason the extension is being sought and must be accompanied by the necessary supporting documentation .

Extension requests will not be considered for the following circumstances:

•

Holidays

•

•

•

•

Unexpected increase in workload/ other commitments

Weddings

Technical/ computer issues

Mistaking submission date as later than printed on assignment

2. Extensions will usually be granted for no more than one (1) week beyond the due date and in exceptional circumstances only such as:

•

•

Certified illness

Other defined exceptional cases

Longer periods may be granted, in extreme cases, but in any event these may not exceed one

(1) month. Requests will be dealt with on a case-by-case basis and an extension is granted entirely at the discretion of the Learning and Development Manager.

3. Candidates will receive an email responding to the extension request within two (2) working days and this email should be retained as proof of the request. If an acknowledgement has not been received, candidates are responsible for contacting the Learning and Development

Department and requesting confirmation. This receipt will be the only acceptable evidence that an extension has been sought and granted.

4. NB - All other regulations apply to those in receipt of an extension, including the penalties for late submission, based on the extended submission date.

5. An extension arrangement will result in the delay of issuing a mark for the script.

Group work and collaboration (Guidelines on plagiarism provided below)

Participants may collaborate in their initial non-written preparation of an assignment, but the written assignment itself must remain the work of the individual candidate. Group submissions are not permitted and any evidence of this will be considered as plagiarism by candidates who may be subject to disciplinary action. If plagiarism or personation is suspected, this will be investigated by the

Learning and Development department and if the instance is confirmed as plagiarism or personation the following penalties may be imposed:

•

Awarding a reduced mark for the assignment; or

•

•

•

Awarding a mark of zero for the assignment; or

The participant may be required to re-submit the assignment; or

The participant may be required to re-submit the assignment with a pre-specified maximum possible mark awarded.

Results

•

Assignment results will be issued by email approximately four weeks following submission.

•

Any participant unsuccessful in gaining a pass mark in an assignment (i.e. 50%) may be permitted to resubmit their assignment, within a specified timeframe, for a maximum achievable mark of 50%. An Assignment Resubmission form must be submitted along with a resubmitted assignment.

Queries

Any queries in relation to an assignment should be emailed to assignments@charteredaccountants.ie

no more than one week following the release of an assignment.

Page 2 of 6

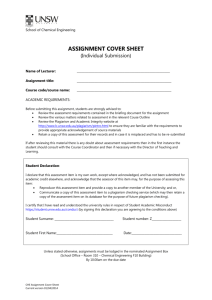

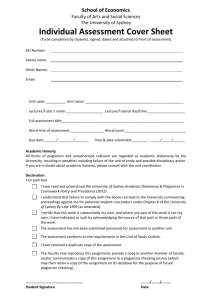

Ownership & title page:

By submitting your solutions for marking, you are confirming that it is all your own work and are required to complete and attach the Declaration of Ownership appended below.

Please fill in the following template title page and attach it to the Assignment that you submit:

Chartered Accountants Ireland – Diploma in IFRS (20)

Course Assignment 1

Name and Surname:

Date of submission:

DECLARATION OF OWNERSHIP

•

I confirm that I have read and understood the Chartered Accountants Ireland guidelines on plagiarism, that I understand the meaning of plagiarism and that I may be penalised for submitting work that has been plagiarised.

•

I declare that all material presented in the accompanying work is entirely my own work except where explicitly and individually indicated and that all sources used in its preparation and all quotations are clearly cited.

Should this statement prove to be untrue, I recognise the right of Director of Lifelong Learning and

Support to recommend what action should be taken in line with Chartered Accountants Ireland disciplinary regulations.

Signed _____________________________________________

Print Name _____________________________________________

Dated _____________________________________________

Page 3 of 6

Guidelines on plagiarism

If you submit an assignment that contains work that is not your own, without indicating this to the marker (acknowledging your sources), you are committing ‘plagiarism’. This might occur in an assignment when you;

1. Present work authored by a third party, including friends, family, or work purchased through internet

2. Present work copied extensively with only minor changes from the internet, books, journals or any other source;

3. Use improper paraphrasing of a passage without due acknowledgement of the original source;

4. Fail to include citation of all original sources;

5. Represent collaborative work as one’s own;

6. Copy or download figures, photographs, pictures or diagrams without acknowledging your sources.

7. Copy from the notes or essays of a fellow course participants.

Plagiarism is a serious offence. While plagiarism may be easy to commit unintentionally or due to inexperience, it is defined by the act not the intention. All participants are responsible for being familiar with the Chartered Accountants Ireland’s policy statement on plagiarism and are encouraged, if in doubt, to seek guidance.

Although you are encouraged to show the results of your reading by referring to and quoting from works on your subject, copying from such sources without acknowledgement is deemed to be plagiarism and will not be accepted by the Institute. You are encouraged to collaborate with others in studying, but submitted work copied from or written jointly with others is not acceptable, unless collaboration is required in the particular assignment.

Submitting work that has been done by someone else and persistent borrowing of other people’s work without citation are obvious instances of plagiarism and are regarded as cheating.

Failure to comply with these guidelines may result in disciplinary procedures being pursued by the

Chartered Accountants Ireland, which may lead to expulsion from the course and possible referral, where appropriate, to the Chartered Accountants Regulatory Board (CARB).

References:

The Open University. Plagiarism, What constitutes plagiarism or cheating?

( http://www.open.ac.uk/student-policies/objects/d3418.pdf

)

[accessed 5 th

November 2008]

University College Dublin. Plagiarism statement, Plagiarism Policy and Procedures

( http://www.ucd.ie/registry/academicsecretariat/plag_pol_proc.pdf1

)

[accessed 3 rd

November 2008]

Page 4 of 6

ASSIGNMENT 1 - OCTOBER 2013

BACKGROUND INFORMATION

JOBCENT a not-for-profit organisation was set up in 2012 by Peter Donoghoe and Fran Maher when they were both made redundant from their roles as senior recruitment agents with a large recruitment agency based on Dublin. The aim of the organisation is to provide support, guidance and assistance to unemployed jobseekers in their efforts to find employment, retrain etc.

Peter and Fran met with officials from The Department of Social Protection in the initial stages of their plans to seek some financial support. The officials were very impressed and supportive of their initiative. Despite significant budgetary constraints they offered the organisation a €150,000 contribution payable in three instalments in June 2012, 2013 and 2014 to assist it with its efforts.

To the delight of both Peter and Fran the officials were also in a position to offer the organisation two offices and a meeting room in a section of the Department’s offices on a rent free basis for a period of three years. This arrangement is to be reviewed after the three year period.

With a premises and a financial contribution commitment from The Department of Social Protection “in the bag” Peter and Fran’s next step was to publicise their organisation and its services. €30,000 was spent on marketing and PR activities during 2012 as follows

•

€5,000 Website design, set up

•

€5,000 Leaflets, flyers, posters design and distribution throughout Dublin

•

•

€5,000 Radio ad campaign

€5,000 Sponsorship of a major job recruitment conference and workshop week organised by employer agencies

•

€10,000 1 year subscription to a national newspapers job supplement giving the organisation editorial and advertising rights in the monthly supplement for 1 year

Peter and Fran paid €5,000 personally for the refurbishment of the offices. They have set their annual gross salaries at €25,000 each and hope to fund the payment of this through donations from interest groups.

JOBCENT hired a part time administrator in July 2012 for €20,000 per annum and it is expected that all other administrative expenses would total €25,000 annually.

By the end of 2012, with publicity growing for the organisation, JOBCENT had received donations totalling €20,000 from various businesses and interest groups who wanted to support the good work of the organisation. As at 31 December 2012 a further €15,000 has been committed from three large companies operating in Ireland who have committed to support the organisations activities as part of their own CSR initiatives.

Neither Peter nor Fran have any financial accounting expertise and are anxious that the financial records of JOBCENT are kept up to date. They also feel that in order to attract further donations potential donors would be interested in seeing a set of financial statements for the organisation. They have heard mention of the Conceptual Framework for Financial Reporting and International Financial

Reporting Standards and have decided that they want the financial statements of JOBCENT to be prepared in accordance with these standards.

REQUIREMENT:

Peter and Fran have contacted you, a Chartered Accountant, to assist them in preparing financial statements for the year ended 31 December 2012.

You have been asked to:

•

Prepare a Statement of profit or loss and other comprehensive income for the year ended 31

December 2012 based on the information above. Make whatever assumptions are necessary to complete the statement.

Page 5 of 6

•

Prepare a Statement of financial statement as at 31 December 2012. Make whatever assumptions are necessary to complete the statement.

In addition Peter and Fran would like you to explain the accounting treatment of the following transactions (refer to the Conceptual Framework for Financial Reporting and relevant IFRS or other guidance where appropriate):

•

Use of the Department of Social Protection offices

•

Contribution received and receivable from the Department of Social Protection

•

€30,000 marketing costs-can any of these costs be capitalised in the Statement of Financial

Position of JOBCENT

•

€5,000 paid by Peter and Fran for refurbishment of the offices

•

Donations received and receivables

Total 33 Marks

Page 6 of 6