CRA Reneges on Longstanding Assessment Agreement

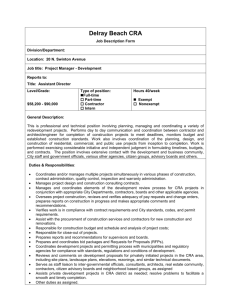

advertisement

CRA Reneges on Longstanding Assessment Agreement In Szymczyk v. The Queen (2014 TCC 380), the TCC addressed the question whether the taxpayer correctly reported standby charge and operating expense benefits in his 2008 and 2009 taxation years as an employee of General Motors of Canada Ltd. (GM). The issue at the heart of the decision was whether the CRA could renege on a longstanding agreement with GM that allowed GM to use a simplified method to compute standby charge and operating expense benefits of its employees. The taxpayer argued that the CRA was estopped from assessing him contrary to that agreement. The TCC did not agree. GM’s Agreement with the CRA For more than 28 years, the CRA had allowed GM to report its standby charge and operating expense benefits for employees using a simplified averaging method rather than computing the benefit separately for each individual employee. The CRA issued the administrative authorization following significant changes made to the Act in 1981, which increased income inclusions for employer-supplied automobiles. The authorization provided that the standby charge would be 2 percent of the average cost (inclusive of sales tax) of all cars in the product evaluation program. The operating expense benefit was one-half of the amount so determined (that is, 50 percent business, 50 percent personal). GM relied on this authorization to determine its standby charge and operating expense benefit for ensuing years for its employees, including the taxpayer. Standby Charge and Operating Expense Benefit There are two income inclusions for employer-supplied automobiles: (1) a standby charge for the supply of a car, and (2) an operating expense benefit for the payment of operating costs. The standby charge is generally calculated as 2 percent monthly of the cost of the automobile inclusion, subject to reduction if the vehicle is used primarily for employment and the employee’s personal use is limited (less than 1,667 kilometres per month) under paragraph 6(1)(e) and subsection 6(2). The operating expense benefit is $0.24 per kilometre for personal use if an employer pays all or part of the operating expenses of an automobile that is subject to a standby charge. Alternatively, if the car is used primarily for employment, the employee may designate the benefit as one-half the standby charge, but the employee must notify the employer before the end of the year. GM’s Product Evaluation Program During the relevant period, GM required its executives and senior managers (including the taxpayer) to participate in a program designed to evaluate and promote their fleet of automobiles in the product evaluation program. An employee would select a car and use it for travel to and from work and for short-term business travel. The employee would report on any deficiencies and would be encouraged to promote the car to his or her network of family and friends. The program required the employee to use a new car every 5,000 kilometres or every three months, whichever was earlier. The taxpayer drove four different cars in each year under appeal. The CRA’s Audit of GM The CRA conducted its first major audit of GM in 2010, about 28 years after the authorization was issued. Approximately 350 employees were potentially affected. Following the audit, the CRA concluded that the authorization was no longer valid because of changed circumstances, and it issued assessments to the taxpayer and others for the 2008 and 2009 tax year. The taxpayer was the first of the reassessed employees to appeal to the TCC. GM and the taxpayer sought relief at the FC, where they argued in separate applications that the CRA was estopped from assessing contrary to the authorization. Both applications were dismissed (2013 FC 1219) for lack of jurisdiction; the TCC had exclusive jurisdiction. Appeals to the FCA were placed in abeyance pending the outcome of this decision. CRA Not Bound by the Authorization The TCC concluded that the CRA was not bound to follow the authorization because there had been material changes in both the underlying law and the facts since the time of the authorization. However, the court said that the CRA would have been bound to follow the authorization unless the approval was not clearly supportable by law. The court highlighted two major changes to the circumstances that invalidated the authorization: paragraph 6(1)(k) was enacted in 1993 to provide a specific rule for calculating the operating expense benefit at $0.24 per kilometre for non-employment use, and GM changed its policy on the frequency with which cars were to be exchanged from every 5,000 kilometres to every 12,000 kilometres or every three months, whichever was earlier. These changes were material, and the agreement was set aside as unsupportable by law. Due to a technical error in the minister’s pleading, the taxpayer’s appeal with respect to the standby charge was allowed. (The same circumstance is very unlikely to arise for other taxpayers.) Conclusion It should be noted that Szymczyk v. The Queen was decided under the informal procedure and does not carry precedential value. Nevertheless, the case raises many questions about when the CRA may renege on an agreement with a taxpayer. If the agreement is reflected in an advance income tax ruling, the CRA agrees to be bound by it even though, strictly speaking, the law does not bind the CRA. However, for administrative reasons the CRA may agree with taxpayers on a range of administrative matters not reflected in an advance ruling. What is the taxpayer’s position if the CRA decides to change its mind with respect to such agreements? Szymczyk highlights the fact that the CRA will not be bound by any agreement that is not supportable by law. Thus, as was the case here, if the law changes at a date after the effective date of the agreement, the CRA may assess contrary to the terms of the agreement. The same result would apparently follow if the facts on which the agreement is based have changed. It seems that the CRA is not required as a matter of fairness to notify the taxpayer that it no longer feels bound by an agreement. In Szymczyk, the reassessments were retroactive to years prior to the year in which the CRA first decided to disregard the agreement. Although general fairness principles might suggest that the CRA ought not to have reneged retroactively, it seems clear that in law the CRA was entitled to act in the way it did. Taxpayers that are operating under an administrative agreement with the CRA should consider the possible effect of this case on their agreements. Two obvious questions arise: (1) What qualifies as a material change in the facts? (2) Does each of the parties have an obligation to inform the other of such a change? Bobby B. Solhi TaxChambers LLP, Toronto Tax for the Owner-Manager Volume 15, Number 2, April 2015 ©2015, Canadian Tax Foundation Comment: Comments Terms Of Use