Salion, Inc.: A Software Product Line Case Study

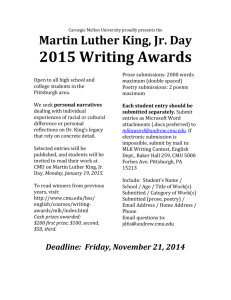

advertisement