TELECOMMUNICATION ACCOUNTS & FINANCE MANUAL

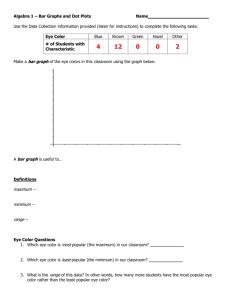

advertisement