Colgate People, Colgate Spirit

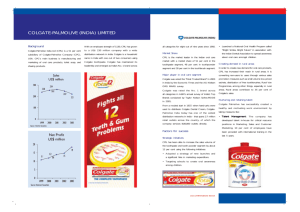

advertisement