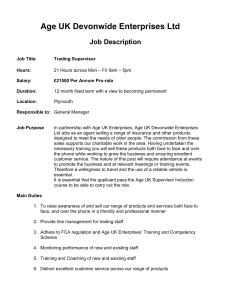

Document

advertisement

^ iSsA5 L OOLLtC O r Ir uLAND WHAT IS TRADE FOR IRISH TAX PURPOSES -AN EXAMINATION OF CASE LAW Catherine Hennessy (H3A) “ Try as you will, the word 4 trade’ is one o f those common English words which do not lend themselves readily to definition but which all o f us think we understand well enough”. Lord Denning CONTENTS INTRODUCTION L THE IRISH TAX SYSTEM 1.1 Administration o f the tax system 1.2 Tax Law 1.3 Case Law 1.301 Law and Fact 2. TRADES 2.1 What is Trade 2.2 Badges of Trade 2.3 Trading or Investing 3. TAXING OF TRADE PROFITS 3.1 Residence and Domicile 3.2 Self-assessment 3.3 Allowable Deductions when Computing Taxable Trading Profits 3.3.1 Profit Received as Compensation 3.3.2 Payment Received for the Restriction o f Trade 4. LOSS RELIEF 4.1 Section 307 Loss Relief 4.2 Section 309 Loss Relief 4.3 Terminal Loss Relief for a Trading Individual 4.4 Section 16(2) Loss Relief 4.5 Section 16(1) Loss Relief 4.6 Terminal Loss Relief for a Trading Company 4.7 Finance Act 1992 Section 55 2 5. TRADING EXPENDITURE 5.1 Expenses Incurred Wholly and Exclusively for the Purpose o f Trade 5.2 Pre-Trading Expenses 5.3 Repairs 5.4 5.5 Entertainment Expenses Bad Debts 6. CAPITAL EXPENDITURE 6.1 Capital Allowances 6.2 Plant and Machinery 6.3 Industrial Buildings 6.4 Motor Vehicles 7. 7.1 Clubs 7.2 Charities 8. 8.1 EXEMPT ACTIVITIES TRADE AND TAX EVASION Substance over Form o f Self-cancelling Transactions and Circular Contracts 8.2 True Motive 8.3 Fiscal Nullity 3 INTRODUCTION Income tax was first introduced by William Pit in 1799 as a temporary measure to raise revenue. It was subsequently never abolished. Until the passing of the Corporation Tax Act, 1976 Irish income tax was levied on the world-wide profits o f both individuals and companies, resident in this country. This Corporation Tax Act provides for the taxing o f profits of resident companies, while the Income Tax Act, 1967 provides for the taxing of resident individuals. Both these Acts were consolidated under The Taxes Consolidated Act. This Act and the Annual Finance Acts contain the legislation upon which income and corporation tax law is now based. In addition, regulations issued by the Revenue Commissioners, under powers conferred by the above legislation, set out certain detailed tax rules relating to this legislation. Individuals and companies can make profits, from various commercial activities. One of these activities is ‘trading’. Trading profits made by an individual, partnership or trust is assessed for income tax, while those o f a company are assessed for corporation tax. However, before the issue o f tax arises, it must be established whether the profits being assessed are genuinely as a result of ‘trading5, as their treatment for tax purposes can be significantly affected. The tax legislation passed regarding ‘trade’ seems, in parts, very inadequate and is challenged continuously in the courts. Because o f this, the courts and case law play a very significant role in the definition o f trade and it’s treatment for tax purposes. However, like all case law, tax case law is dynamic and only remains part of tax law until it is overruled by the judgem ent o f a higher court or by legislation. Although the Irish Courts adopt English case law fairly readily there have been exceptions. These exceptions may be a sign o f the Irish judiciary’s increasing reluctance to act as legislators rather than its reluctance to adopt the judgements of it’s English Counterparts. 4 In this paper I have attempted to look at the treatment o f 'trade' by legislation, some o f the areas o f ‘trade’ which have been challenged in the courts and the contribution of tax case law to Irish tax law. 5 THE TAX SYSTEM 1.1 Administration of the Tax System Responsibility for the general administration o f the Irish tax system and the collection of its taxes lies with the Revenue Commissioners. The Board o f Commissioners is appointed by An Taoiseach and consists o f three commissioners who are subject to the control o f the Minister of Finance. Inspectors o f Taxes, who are appointed by the Revenue Commissioners, run the tax system on a day-to-day basis. The State is divided into districts with an Inspector responsible for each district. The Inspectors o f Taxes charge taxes by way o f assessment. However, Tax Inspectors are not in charge o f the actual collecting of the tax. This falls to the Collector General. 1.2 Tax Law The levying of taxes, in Ireland, is governed by what are collectively known as “The Tax Acts”. “The Tax Acts” include The Income Tax Acts, The Corporation Tax Acts and The Capital Gains Tax Acts. These Acts are brought into law in the same way as all other statutes. Each year the Tax Acts are amended by the Finance Act o f that year, which is the bringing into law o f the Government’s budgetary proposals. The Tax Acts provide for the charging of taxes, by way o f assessm ent, by the Inspectors of Taxes. If a taxpayer disputes an assessment, ITA 1967 s 416(1) entitles them to appeal the same to the relevant Tax Inspector. If a taxpayer wants to appeal an assessment certain procedures must be followed and conditions fulfilled. It is by no means a ready strategy for the delaying o f tax payment. If the dispute persists the case can be listed for hearing before the Appeal Commissioner. The determination o f the Appeal Commissioner is final and conclusive unless either party is dissatisfied by the decision. Then the case 6 may be reheard by the Circuit Court and pursued further through the Law Courts if necessary. It is important to realise that the Circuit Court hearing is not an appeal but a complete rehearing of the case originally taken before the Appeal Commissioner. If the Circuit Court’s judgem ent is unsatisfactory to either party, the judge can be asked to have the case stated to the High Court on a point o f law. However, the case may only be stated before the High Court and appealed further to the Supreme Court, on a point o f law and not on a question of fact. The decision of the Appeal Commissioner and the Circuit Court are final with regard to questions of fact, and may not be upset by a higher court. The decision o f the Supreme Court is final on all legal matters, tax included. Tax decisions of the Supreme Court become part o f tax case law. 1.3 Case Law In order to apply and enforce law, its legal meaning must be understood fully. The essential rule when interpreting law is that words should generally be given the meaning which the normal speaker o f the English language would understand them to bear, in the context in which they are used. The interpreter has two vital duties. Firstly, to arrive at the legal meaning o f the law. This may not necessarily be the grammatical meaning. Secondly, the court is not entitled, on the principle - non-liquet (it is not clear) -to decline the duty of determining the legal meaning o f a relevant enactment. The rules governing the interpretation and application o f statutes are laid down in The Interpretation Act, 1937 and 1993. However, the extent o f the charge o f a law, or the facts o f a case may be difficult to decide upon, even with the aid o f these Acts. Tax case law has its purpose in aiding the interpretation o f the tax statues and the explaining o f difficult points o f law. Decisions on a point in any act become part o f tax law, on that point o f law, until it is either overruled by a higher court or changed by the introduction o f a subsequent tax act. 7 Irish and English tax law is similar for the most part. Decisions held in English courts have been used here in the Irish courts to aid statutory interpretation. However, the Irish courts have refused to implement certain principles, which have long since been accepted by the English courts. The effect of European law, in the form o f regulations and directives, is increasingly been felt here in the Irish courts. In addition, any judgements carried down by the European court o f Justice automatically become part o f Irish case law. 1.3.1 Law and Fact W hether a transaction is o f a trading nature or not is a mixture o f law and fact. Legislation contains the definition o f “trade”. However, the facts o f a case must also be considered. The courts may only overturn the decision o f the Appeal Commissioners if they find that they misinterpret the word o f the law. If the courts decide that the evidence and law could be interpreted to show that either a trade had or had not been carried on, then, they can not interfere with the decision o f the Appeal Commissioners. In Edward's v Bair stow & Harrison [1956] 36 TC 207 Lord Radcliffe sought to clarify the position of the courts in such cases. Bairstow, a director o f a manufacturing company and Harrison, an employee o f a spinning firm jointly acquired a spinning machine, which they planned to sell as quickly as possible at a profit. However, they were forced to sell the machine in several separate components, which took 15 months. The Commissioners held that the transactions did not constitute trade. The High Court and the Court o f Appeal felt they could not overrule the decision o f the commissioners as the facts of the case showed that the taxpayers could equally have been carrying on a trade or investing when they bought the spinning machine. The High Court and the Court o f Appeal felt they could not overrule the commissioners, as it was a question o f fact. 8 decision o f the The Commissioners’ decision however, was overturned by the House o f Lords where Viscount Simonds stated it was a question o f law and not fact that showed the defendants to be involved in trade. He stated that the commissioners: “have misdirected themselves in law by a misunderstanding of the statutory language or otherwise their determination cannot stand.” He further stated that he could: “not find in the careful and indeed exhaustive statement of facts any item which points to the transaction not being an adventure in the nature o f trade Everything points the other way.” Lord Radcliffe, in upholding the decision stated: “If a party to a hearing before Commissioners expresses dissatisfaction with their determination and being erroneous in point of law, it is for them to state a case and in the body of it to set out the facts that they have found as well as their determination.” He went on to state that: “If the case contains anything which is bad law and which bears upon the determination, it is obviously erroneous in point o f law.” 9 TRADE 2.1 What Is Trade? According to ITA 1967 s 1(1) “Trade” includes” every trade, manufacture, adventure or concern in the nature o f trade”. According to ITA 1967 s 52(1) “Tax under schedule D shall be charged in respect o f the annual profits or gains arising or accruing to any person residing in the State from any trade, profession, or, employment exercised within the state” . Trade usually involves the entering into business in an organised, habitual and commercial manner in order to make a profit. However, an individual could be deemed to be carrying on a trade without the above being in evidence i.e. an individual may be found by the revenue to be carrying on a trade even though they are not making a profit. In Erichsen v W. K Last [1881] 8 QBD 414, 4 TC 422, 51 LJQB 86 Mr. Hermann Gustav Erichsen was the representative o f The Great Northern Telegraph Company of Copenhagen. The company was incorporated in Denmark and its head office was resident in Copenhagan. The company had two offices in the UK and three marine cables, which were in turn connected to telegraph cables under the control of the British Postmaster General. These cables assisted in the transmission o f messages to Europe. The Great Northern Telegraph Company of Copenhagan received an assessment o f £40,000 on the profits of its schedule D income arising in the UK Mr. Hermann Gustav Erichsen appealed against the assessment contending that no profit was made, by the company, through the use of the land lines in the UK The Surveyor of Taxes stated that the sender of the messages paid the company’s agency in London, for the transmission and was therefore liable to tax. The court held in 10 favour of the Surveyor of Taxes. The company appealed to the High Court. Their appeal was dismissed by the High Court. In its judgement the court maintained that the ownership o f the cables was irrelevant. The company, although a non-resident, was carrying on a trade in the UK with the intention of making a profit and therefore should be accordingly assessed for profit. In Erichsen v Last Cotton LJ recognised the difficulty in identifying certain activities as trading when he stated: “There are a multitude o f incidents which together make the carrying on of a trade, but I know o f no one distinguishing incident which makes one practice a carrying on o f trade and another practice not a carrying on o f a trade. If I may use the expression, it is a compound fact made up o f a variety o f incidents.” Over the years the courts provided, in their decisions, factors that could be attributed to activities which were considered to be o f a trading nature. These factors were to aid the courts in cases of doubt. In June 1955 in the UK, the Royal Commission on the Taxation o f Profits and Income included in their report “Six Badges of Trade” . These “Badges” were the factors considered by the courts to have an important bearing on whether a transaction was o f a trading nature or not. 2.1.1 Badges of Trade 1. Subject matter realised. Was the item, which was the cause o f the transaction, usually involved in transactions of a trading nature? E.g. the buying and selling o f stocks and shares is usually associated with transactions o f an investing nature 11 2. Length of period of ownership. The owner usually holds goods involved in trade for a relatively short period of time, while goods held for, say, investment purposes usually necessitate a longer holding period. 3. Frequency and number of transactions. An individual involved in trade normally carries out numerous transactions. An isolated transaction rarely constitutes trading. However, such was not the case in Rutledge v The Commissioners o f Inland Revenue, [1929] 14 TC 490. The taxpayer concerned had many business interests such as money lending, property dealing and various interests in the film industry. By chance he learned of a bankrupt firm, while abroad, and purchased a substantial amount o f toilet paper from the same. After shipping the toilet paper to England and selling it at a huge profit he was assessed to income tax under Schedule D, Case I for the profits on his transaction. The taxpayer appealed the General Commissioners decision to the High Court. The High Court upheld the decision o f the Special Commissioners stating that the purchase and resale of the toilet paper was an adventure in the nature o f trade, as the taxpayer had entered into his transaction like any other trader would do. 4. Supplementary Work on or in Connection with the Property Realised. Has the person realising the goods changed the goods, through processing or repair, or in an organised or commercial way sought buyers for the goods? In Taylor v Good (Inspector o f Taxes) [1973] 383 ChD, [1974] 148 CA. The taxpayer was not normally engaged in the trade o f land dealing. He purchased a piece of property with the view to it been possibly used as a residence. However, the same piece o f property was subsequently found to be unsuitable for residential purposes. On foot o f this, the taxpayer sought and obtained planning permission to develop the property. Upon sale o f the property, with planning permission,- the taxpayer realised a substantial profit. The Courts held that even though the planning permission did add substantially to the value o f the property and therefore to the profit realised, the planning permission to 12 develop the property did not constitute ‘supplementary work on or in connection with the property realised’. The transaction was held not to have been of a trading nature. 5. Circumstances Giving Rise to the Realisation of the Goods. Special circumstances may exist at the time o f a sale - a sale which would normally be regarded as of a trading nature, to cause that sale to be considered, for tax purposes, to be investing rather than trading. 6. Motive. Was the reason for buying the goods to resell them relatively quickly at a profit or to hold them as an investment? Usually a business being run with the motive o f making a profit is seen by the revenue commissioners to be a business o f a trading nature. However, in IRC v The Incorporated Council o f Law Reporting 3 TC 105 Coleridge CJ stated: “The definition of trade, although it is perfectly true that in 99 cases out of 100 does as a matter o f fact include the idea o f profit, yet the mere word ‘trade’ does not necessarily mean profit to be made by the seller.” The above badges should not be taken to give absolute answers in all cases and are not included in legislation. They are just guidelines intended to ease the making o f difficult decisions. It can happen that a transaction, which on all accounts appears to be o f a trading nature, is in fact o f an investing nature. The reverse is also true. 13 2.2 Trading or Investing Investing in something in order to receive a capital gain in the future is not trading. Selling an asset at a profit makes one liable for capital gains tax, not income tax as assessed under Schedule D case I. Part of the test of whether a transaction is o f a trading nature or o f an investing nature seems to depend on whether the party involved, decides to sell an item and simply makes a profit because o f the enhanced value o f that item, or they make a profit on sale because they speculatively bought that same item as part of the scheme of a business. The later is trade. So was the distinction explained in Californian Copper Syndicate VH arris [1904] ITC 159: " “It is quite a well settled principle in dealing with questions o f assessment of income tax, that where the owner o f an ordinary investment chooses to realise it, and obtains a greater price for it than he originally acquired it at, the enhanced price is not profit in the sense o f Schedule D assessable to income tax.” Even if an item is bought with the sole purpose o f returning an income over a period of years this does not constitute trading for tax purposes. This is generally the case with items associated with investments e.g. stock exchange securities, land etc. In Californian Copper Syndicate v Harris It was stated that: “each case must be considered according to its facts; the question to be determined being- is the sum o f gain that has been made a mere enhancement o f value by realising a security, or is it a gain made in an operation of business in carrying out a scheme.” However, this judgement did not hold consistent for Lewis Emanuel & Son Ltd in Lewis Emanuel & Son L td v White 42 TC 369 who were held to be carrying on a trade buying shares on the stock exchange even though their 14 company was incorporated for the purpose o f importing fresh produce. The Commissioners stated that the company was not involved in trading However, when the case was appealed to the Courts it was held that the facts of the case proved that Lewis Emanuel & Son Ltd were indeed carrying on a trade in buying and selling securities with the intention of making a profit. In Salt v chamberlain [1975] STC 750, the Special Commissioners found that the defendant was not involved in trade even though he had bought and sold several batches of shares, over a short period o f time, on the stock exchange. The taxpayer claimed he fulfilled all “badges o f Trade” except the one concerning subject matter. The same wanted to claim relief for a trading loss that he suffered the same year. The Special Commissioners however, held that the evidence available to them showed that the taxpayer was clearly investing and not involving himself in an adventure o f a trading nature when he bought and sold the subject matter in question. 2.3 Illegal Trading Until the passing of s. 19 FA 1983 income from illegal trading activities and from unknown sources was not chargeable to tax. In the Irish case, Hayes v Duggan 1 ITR 195 the income from the operation o f a sweepstakes was found not to be chargeable to tax as the activity was illegal. In the subsequent English case, Mann v Nash [1932] 1 KB 752, [1932] AER 956,16 TC 523 it was found that the only issue to be decided upon was whether a trade existed or not. The court held that a trade did in fact exist and should therefore be charged to tax accordingly. That the trade was illegal was found not be relevant. In the later Irish case Collins v Mulvey [1956] 31 TC 151, which involved the illegal operating o f slot machines in a public.place, the court disregarded the decision of the English court and decided in line with the earlier Irish case. Since the passing of FA 1983 the precedence set by the Supreme Court in Hayes v Duggan is nullified. 15 The taxing of income from an illegal manner o f carrying on a trade was never an issue. Such income has always fallen under the Tax Acts as regards to trading. The selling o f alcohol to the public without a valid licence is trading in an illegal manner, while selling illegal drugs is illegal trading. TAXING OF TRADE RECEIPTS Trade receipts are assessed for tax under schedule D case I for a trading company or individual and under schedule case II for a profession. Corporation tax is charged on the profits,of companies, resident in the state or operating through a branch or agency in the state. While income tax is charged on the trading profits of an individual. Profits o f a company constitute income and chargeable gains. Chargeable gains are capital gains which have been adjusted to allow for their inclusion, and charging for tax, in the normal corporation tax computation. The rate o f corporation tax, with effect from 1 January 1998, is 32%. The first £50,000 o f income (chargeable gains do not form part of income) is charged at the lower rate o f 25%. The standard rate o f income tax for a resident individual is 24% while the higher marginal rate is 46%. 3.1 Residence and domicile All companies, which are resident in this country, and non-resident companies, which operate through a branch or agency in this country, are charged with corporation tax. Residency is determined by the location o f central management and control, and not by the location o f incorporation. This “central management and control” test was adopted following De Beers Consolidated Mines v Howe [1905] 2 KB, 5 TC 198, 74 LJKB 934. In this case the taxpayers argued that a company’s residency is determined by where it is registered. De Beers was registered in South Africa but the directors 16 controlled the company through meetings held both there and in the UK. The courts held that a company resides where ultimate control is exercised .If a subsidiary has the final say in it’s own dealings, then it is possible that the subsidiary does not share the same residency o f that o f it’s parent. However, if the parent controls the functions and powers o f the board o f the subsidiary, then the subsidiary shares the same residency o f that o f the parent. In his judgement Lord Lorebum set precedence by stating that: “A company resides, for the purpose o f Income Tax, where it's real business is carried on, I regard that as the true rule, and the real business is carried on where the central management and control actually abides” A trading individual's residency is determined by the amount o f days they spend in the country each tax year. 3.2 Self -Assessment The Finance Act, 1988 introduced self-assessment as a method o f assessing and collecting income, capital gains and corporation tax. Self-assessment applies to income tax since the tax year 1988-89 onward and corporation tax for accounting periods ending on or after 1 Oct. 1989. In order to avoid the paying o f interest penalties or surcharges the following should be adhered to: (i) Preliminary tax must be paid on or before 1 November in the year o f assessment in respect to income tax. And no later than five months and 28 days following the end of the accounting period for corporation tax. Interest is charged at the rate o f 1% per month on the amount o f preliminary tax outstanding until it is paid. 17 (ii) With regard to income tax, the preliminary tax due should be the lower of: 90% of the amount o f tax due in the current year o f assessment or 100% o f the tax liability of the immediately preceding year o f assessment, and 90% o f the total tax due in the current accounting period for corporation tax (iii) A full and true return of income must be filed with the appropriate inspector on or before 31 January in the year following the year o f assessment, with respect to income tax and not later than nine months after the end o f the accounting being assessed in respect to corporation tax. If a return o f income is not filed by the due date a surcharge is imposed on the taxpayer. If the return is up to two months late the surcharge payable is 5%, subject to a maximum o f £10,000, of the amount of tax due for that assessment. If the return is over two months late the surcharge is 10% o f the tax due, subject to a maximum surcharge of £50,000. (iv) The balance of tax due must be paid on or before 30 April in the year following the year of assessment. 1% interest is charged each month on any outstanding unpaid tax until it is paid. Surcharges and interest penalties are only effective when dealing with profitable companies and individuals, as penalties are a percentage o f tax due. Individuals and firms, which incur a loss, have no tax liability in the lossmaking period and therefore, no incentive to submit a return o f income form on the due date. Loss relief is restricted for companies who fail to file a CTI form on time (see 4.7). There are no similar restrictions o f loss relief for individuals who fail to submit a timely return o f income. 3.3 Trading Receipts—Capital or Revenue The Income Tax Acts do not provide a definition o f ‘income’ nor o f ‘capital’. This poses problems as only income, received in the process o f trading, o f a revenue nature is included in the computation o f an individual’s liability to income tax or a company’s liability to corporation tax. These receipts must be 18 distinguished from receipts of a capital nature. If a person or company, who is trading in cars, sells a typewriter, the proceeds from that sale would not be assessable to tax under Schedule D case I. On the other hand, if that same individual or company were running a business selling office equipment the proceeds from the typewriter would form part o f the trading profits o f the business and be taxed accordingly. The question o f whether a trading receipt is one o f a revenue nature or of a capital nature is one o f fact. A common sense approach must be adopted when deciding. When the matter is in dispute before the courts, the facts of the case are examined and a decision is reached according to those facts. In Regent Oil Co. Ltd v Strick 43 TC 1 Lord Cave stated: “...the determination of what is capital expenditure and what is revenue expenditure must depend rather on common sense than on the strict application as any single legal principle.” This concept loses its simplicity when the payment received is in the form o f compensation, a grant or payment for abiding by terms o f an agreement. As Lord McDermot stated in Harry Ferguson (Motors) Ltd v IRC 33 TC 15: “There is so far as we are aware no single infallible test for settling thevexed question whether a receipt is o f an income or a capital nature. Each case must depend upon its particular facts and what may have weight in one set o f circumstances may have little weight in another. Thus the use o f the words ‘income’ and ‘capital’ is not necessarily conclusive. What is paid out of profit may not always be income and what is paid as consideration for a capital asset may on occasion be received as income. One has to look to all the relevant circumstances and reach a conclusion according to their general tenor and combined effect.” 19 3.3.1 Payment Received as Compensation Compensation received by a trader, for the loss o f income, which had it been received would have been liable to tax, has been deemed by the courts to be assessable as income as if derived from trading. Such payments are held by the courts to be o f a revenue rather than a capital nature. The courts have taken the stance that the function of the compensation payment is the deciding factor. They have held that compensation receipts for loss o f income should be charged to trading profits while compensation receipts for the loss o f the means or apparatus of making income should be charged as a capital gain. In White v G & M Davis [1979] STC 415 a farmer received an EC grant for changing from dairy to beef farming. Under the conditions o f the grant the farmer had to refrain from supplying milk or milk products for four years while at the same time maintaining the number o f his livestock at the same level. Upon receiving the first instalment o f his grant the farmer claimed that the money was not assessable to income tax as it was o f a capital nature. The courts found that the money received was indeed assessable to income tax as it compensated the loss of money, which if received, would have constituted profits o f his trade. In Alliance & Dublin Consumers’ Gas Co. v McWilliams H/C [1927] 1 ITC 199; [1928] IR, 1 compensation received from the UK government for the detention o f their ships during a coal strike was held to be trading profits and taxed accordingly. In O ’Dwyer (Inspector o f taxes) v Irish Exporters and Importers Ltd H/C [1942] 2 ITC 251, [1943] IR 176. The defendants were importers and exporters of cattle and motor cars. They were also wholesalers and retailers o f food. The defendant entered into several contracts with the Minister for Agriculture .One o f these contracts bound the M inister to pay Irish Exporters and Importers Ltd damages in the event than the M inister terminated his agreement to supply cattle for a specified four-year period. The Minister did default on the contract and paid compensation as agreed. The amount received by Irish Exporters and Importers Ltd was assessed as trading receipts for tax 20 purposes. The company appealed the assessment. The Special Commissioners found that the money received was not trading receipts. Upon appeal to the Court the decision o f the Special Commissions was upheld. The Court examined the facts of the case and decided likewise. However, the Court did state that in certain circumstances money received, by way o f compensation, could be treated as trading receipts. 3.3.2 Payment Received for the Restriction of a Trade If restrictions are placed on how a trade is to be operated and payment is given in lue o f these restrictions the courts hold such payments to be o f a capital rather than of a revenue nature. In Arthur Guinness Son & Co. Ltd v Morris (Inspector o f Taxes) [1923] Court o f Appeal, the appellants were brewers. They did not deal in barley but held stocks o f it for use in brewing. By order o f the government the taxpayer had to refrain from using their stocks o f barley for brewing, which was requisitioned by the government at this time, and told to store it in such a way that its quality was maintained. For providing this service they received payment to cover rent and insurance. Subsequently they were ordered to sell the stocks to millers at a fixed price set by the authorities. In allowing the appeal, O ’Connor held that once the barley had been requisitioned it no longer belonged to the taxpayer. Any profits made in any subsequent sale were not attributable to the brewery and therefore, should not be assessed as profits arising from trade. The court o f appeal held this decision in a majority, following the UK case Glenboig Union Fireclay Co. Ltd v CIR H/L 1922, 12 TC 427. 21 LOSS RELIEF It is possible that a person or a company carrying on a trade sustains a loss rather than a profit for one or more accounting periods. Relief is available for these trading losses. ITA 1976 provides for loss relief for a company carrying on a trade, while ITA 1967 provides for loss relief for persons carrying on a trade. 4.1 Section 307 loss relief Under s307 ITA 1967 the trading loss o f an individual can be set off against other income, regardless o f source, o f the same year. Gains on development land are an exemption. Non-development land losses cannot be set off against development land gains. The loss is deducted from gross income before the deduction of charges or personal allowances. Section 307 relief is not compulsory but the Inspector of tax must be notified in writing, not later than two years after the end of the year o f assessment in which the loss is incurred, if the relief is been availed o f A section 307 loss must be utilised in full. It is not possible that it can be used partially in such a way that enough income remains to cover charges and personal allowances, or to avoid been taxed at a higher rate. The unused proportion of a section 307 loss may be carried forward as a section 309 loss. Availing o f s.307 loss relief reduces total income. This could affect such things as permanent health insurance relief Relief for contributions to permanent health insurance is restricted to the lower of; the amount o f the contribution or 10% of total income. 22 When loss relief under section 307 is availed of, the taxpayer has the option o f increasing his tax loss by the amount o f his capital allowances for that year o f assessment. Alternatively, he can create a loss by deducting his capital allowances from his taxable, profits, if his profits are less than his capital allowances. 4.2 Section 309 Loss Relief Under s309 a trading loss sustained in a particular year o f assessment may be carried forward, to subsequent years and set off against assessable profits, after the deduction o f capital allowances, o f the same trade or profession. The loss must, as far as possible, be set off against the trading profits, o f the earliest possible subsequent year. Losses may be carried forward indefinitely providing the same trade or profession is been undertaken. In the Irish case HA O ’Loan (Inspector o f Taxes) v Messrs M J Noone & Co. [1948] 2 ITC 430 The defendants, a partnership, operated a trade in fruit wholesale until September 1939. Due to the difficulty o f acquiring fruit during the war their trade gradually changed over to that o f fuel merchants. They maintained the same staff, number o f lorries and used the same premises as their headquarters. In addition they purchased mining plant and Equipment, and acquired interests in several mines. The partnership carried forward losses incurred in the last accounting period o f their operating as fruit wholesalers into the first accounting period o f their operating as fuel merchants. The Special Commissioners decided that the partnership had commenced a new trade and that such loss relief was not available to them. Upon rehearing by the Circuit Court the opposite was found. However, the High Court held that the Circuit Court had been erroneous in law and that when the facts of the case were considered they showed that a new trade indeed had commenced. 23 If an individual is carrying on more than one trade simultaneously, a loss in one of these trades may not be carried forward and set off against a profit in another. 4.3 Terminal Loss Relief for a Trading Individual If a loss is incurred in the last twelve months o f trading, under s311 (1) ITA 1967 terminal loss relief may be claimed. This loss may be carried back and set off against income from the same trade in the three years preceding those last twelve months. Terminal loss relief will be given only where all other claims for loss relief have been made. Terminal loss relief may also be claimed if the trade is deemed to have permanently discontinued due to a change o f ownership. When claiming terminal loss relief the loss must be set off against the net Schedule D Case I or Case II income of the most recent o f the three preceding years up to the full amount of that income. Then, the same must be done in the next most recent year until finally, if possible against that in the earliest o f the three preceding years. A trade is deemed to be permanently discontinued when there is a change of ownership. Therefore in such circumstances terminal loss relief can be avail of. 4.4 Section 16(2) Loss Relief Section 16(2) CTA, 1976 allows companies to set o ff trading losses, incurred in an accounting period, against other profits, before charges, in the same accounting period. However, like trading individuals, non- development land losses cannot be set off against development gains. S16 (2) also allows such 24 losses to be carried back and set against profits o f a preceding accounting period o f the same length. Both o f these claims must be made within two years from the end o f the accounting period in which the loss was incurred. In order to be able to carry loss forward under section 16(2) the same trade must still be in operation. In Bolands Ltd v Davis (Inspector o f Taxes) [1925] the taxpayers incorporated a company to carry on the business o f milling, baking and dealing in com. The company also owned several restaurants. The mills and bakeries were on separate premises. The various activities were controlled form one headquarters although separate accounts o f the income and expenditure o f the milling operations were kept Overhead expenditure was not apportioned to the different activities. In August 1922 the company ceased milling and purchased the flour needed by the bakeries. In April 1923 they resumed their own milling. The company set its milling loss off against its other business’ profits The Special Commissioners found that the company had carried on only one trade and that this trade had not discontinued in August 1922. They disallowed the taxpayers claim to set off their milling loss. The decision was appealed to the High Court where it was upheld. Since capital allowances o f companies are treated as trade expenses, unlike individuals carrying on a trade, they cannot be used to increase a loss. 4.5 Section 16(1) Loss Relief Section 16(1) CTA, 1976 allows companies to carry forward trading losses of subsequent accounting periods providing; the loss is set off against income of the same trade, that relief has not been claimed for an earlier period and that the company is still carrying on the same trade. The loss can be carried forward indefinitely and there is no time limit for claiming the relief. 25 4.6 Terminal Loss Relief for a Company Trading companies can avail o f terminal loss relief similar to that availed o f by trading individual. Under s i 8 CTA 1976 a company can carry back a trading loss, suffered in its final year o f trading, and set it against income from the same trade, in the three preceding year o f its operation. 4.7 Finance Act 1992 Section 55 Any company which is late in submitting it’s return o f income i.e. CT1 form, or does not submit it’s return o f income for a chargeable period, will have it’s claim to loss relief restricted. Loss relief claimed under section 16(2) CTA, 1976 is reduced to 50% if the return o f income is filed within two months after the due date, subject to a maximum reduction o f £50,000. FA 1995 s 66 amends FA 1992 s 55 for returns relating to accounting periods ending on or after 6 April 1995. Under this amendment the restriction of relief is reduced from 50% to 25%. For returns submitted more than two months after the due date the reduction of relief is 50%. The amendment has maintained the same percentage of restriction i.e. 50% but this is now subject to a maximum reduction o f £123,000. 26 ALLOWABLE DEDUCTIONS Certain trade-related items are allowed to be deducted when calculating the tax adjusted profit of a trading company or individual. The majority of these allowable deductions are expenses. Only trade expenses o f a revenue and not of a capital nature are permissible. In addition to the deduction of trade related expenditure a trading individual is allowed deductions such as, married allowance etc. in computing their ultimate income tax liability. 5.1 Expenses Incurred Wholly and Exclusively for the Purpose of Trade In order that an expense be allowed as a deduction when computing tax adjusted profits it must be incurred “wholly and exclusively for the purposes of trade”. Whether an expense adheres to this criterion is a matter o f fact. Expenses “Wholly” for the purposes of trade, means that the total amount of the expenditure was for the purpose o f the trade. Therefore, if a building is only partly used for a business and partly used for residential purposes, the expenses of that building must be apportioned between the two uses. Only that amount which, applies to the business section may be deducted when arriving at the tax adjusted profits of the business. 27 In Cope man v William Flood & Sons 24 TC 53 the taxpayers children were paid an inordinate salary for their duties in the business as a telephonist and as a buyer. The Court ruled that only the amount o f their salaries that genuinely represented the duties they performed for the company could be charged against the profit for tax purposes. “Exclusively” for the purpose o f trade is a more difficult concept to understand. In Mallalieu v Drummond [1983] STC 665 it was held that the cost of replacing and laundering the compulsory black and white clothing o f barristers, was not an allowable expense for tax purposes, for barristers. The court held that the clothing was not worn for the exclusive purpose o f the defendant's profession but had a dual purpose in its function. The clothing had to be worn in order that the defendant be allowed to practise at the bar but it also provided the function o f clothing the person as a human being. 5.2 Pre- Trading Expenses Finance Act, 1997 provides that any expense, which is incurred in the three years prior to the commencement o f a trade is allowed to be deducted for tax purposes, providing they would have been trading expenses, if the trade had already commenced. If pre-trading expenses create a loss by exceeding income, relief for that loss may only be claimed under section 309 for a trading individual and under section 16(1) for a trading company i.e. the loss may be carried forward but not set off against other income o f the same year. 5.4 Repairs Expenditure on repairs to, and replacement of, trade related assets is allowed as a deduction when arriving at the tax adjusted profit o f an individual or company carrying on a trade. Reserves for repairs or expenditure on the enhancement of assets are not allowed as deductions. If the repair o f an asset 28 results in the renewal or replacement o f any part o f that asset, the proportion o f expenditure which represents the renewal, must be added back to the tax adjusted figure, if the expenditure was charged to the profit and loss account and not capitalised in the normal accounts. Buckley, LJ distinguished between the meaning o f renewal and repair in L urcottv Wakely and Wheeler [1911] 1 KB 905: “Repair is restoration by renewal or replacement o f subsidiary parts o f the whole. Renewal, as distinguished from repair, is reconstruction of the entirety, meaning by the entirety not necessarily the whole but substantially the whole subject matter under discussion.” Decisions in many subsequent cases have been based on this distinction. If replacement expenditure is to be allowed the replacement asset must be near identical to the original one. In Samuel Jones & Co. (Devondale) Ltd v IRC 32 TC 513 expenditure on a factory chimney, which was identical to the one, which it replaced, was found to be deductible. However, in a similar case, Bullcroft Main Collieries Ltd v O ' Grady 17 TC 93 the expenditure on a replacement factory chimney was found not to be deductible as the replacement was much larger than the original. 5.3 Entertainment Expenses Finance Act 1982, section 20 prohibits the allowance o f tax relief for expenditure incurred on business entertainment on or after 26 March 1982. However, expenditure incurred by a trader on staff entertainment is still permitted, as a deduction providing the entertainment is not incidental to the entertaining o f any third parties who are not staff. 29 ‘ 5.4 Bad Debts Bad debts, to the extent that they are irrecoverable and related to trade, are allowable as a trade expense. Conversely, recovered debts, which were previously treated as bad, are subject to tax as trade receipts. Provisions for specific bad debts are allowable deductions while general provisions for bad debts are not allowable. 5.5 Charges Certain trade related payments, although not o f a capital nature and incurred wholly and exclusively for the purpose o f trade, are not allowed to be deducted when calculating the taxable profits o f a trade. These payments are known as charges. They are annual payments which are subject to the deduction o f tax at source i.e. the taxpayer deduct and withholds tax, at the standard rate, from such payments and is accountable for its payment to the revenue. Relief for a charge is allowed as a deduction, o f the gross amount, from the total income o f a trader. The principle trading charge is patent royalties. 30 CAPITAL EXPENDITURE When computing tax adjusted profits expenditure o f a capital nature nor depreciation on the capital assets purchased allowed as a deduction. R elief for capital consumed by a trading business is given through a system o f capital allowances. The types of assets, regardless o f whether they are new or second­ hand, on which capital allowances may be. claimed are: (i) Plant and Machinery (ji) Industrial Buildings (iii) Scientific Research (iv) Mining Development (v) Patents (vi) Dredging (vii) Farm Buildings (viii) Ships In certain cases, capital allowances on capital expenditure are allowed on the following (i) Hotels (ii) Holiday Cottages (iii) Urban Renewal Buildings (iv) Renewal and improvement o f certain Resort Areas 6.1 Capital Allowances Capital allowances are deducted from tax adjusted profits. The assets for which capital allowances are claimed must be owned by the taxpayer and in use in the business at the end o f the relevant period o f assessment, wholly and exclusively for the business. Annual wear and tear allowances for plant and machinery are the most commonly claimed capital allowances. Computer software is specifically included as plant by statute; s 24 FA 1994. Before the passing of this act, intangible assets such as computer software, which can constitute a huge out lay of funds, did not qualify for capital allowances. Prior to s 24 FA 1994 There was little incentive to modernise businesses or improve efficiency through the introduction and updating o f technology. 6.2 Plant and Machinery The Tax Acts do not contain a definition o f plant and machinery. Recognising if an asset falls under the definition o f machinery does not, understandably, pose a problem. However, defining plant poses many problems. Therefore, case law must be examined in order to establish whether an item qualifies or not as plant for tax purposes. In the non-tax case, Yarmouth v France [1888] 19 Q/B 647 1888, Lindley, LJ gave the definition of plant upon which all subsequent definitions are based: “in its ordinary sense it includes whatever apparatus is used by a businessman for carrying on his business - not his stock in trade which he buys or makes for sale; but all goods and chattels, fixed or moveable, live or dead, which he keeps for permanent employment.” Plant are assets which are employed in a business and are FUNCTIONAL to it’s operation. They do not form part o f the SETTING o f the business. When deciding whether or not a capital asset is plant, the courts have often applied 32 the ‘Functional Test’, which has its origins in Benson (Inspector o f Taxes) v Yard Arm Club L td , STD 266 1979. In this case the taxpayer acquired a ship which it converted into a floating restaurant. The taxpayer claimed that the expenditure in doing so was plant and so claimed capital allowances. It was held that the ship was not plant as it played no function in the carrying on o f the taxpayers business. The ship was the setting o f the business. The ship was therefore, not allowed to be regarded as plant based on the functional test. Many important cases have been decided by applying this functional test the following two been amongst them. In IRC v Scottish and Newcastle Breweries Ltd. [1982] STC 149, the taxpayer incurred expenditure on electric light fittings, decor and “murals” for its hotels and public houses. The decor consisted o f items which were either hung on or screwed to the wall and were removable. The items, for which the taxpayer was claiming capital allowances, had the ‘function’ o f creating atmosphere and contributing to the well-been o f the customer, the taxpayer claimed. The court up held this opinion. However, in giving his judgem ent Lord Lowery explained: “...the mural paintings and the wallpaper when executed or applied, are part o f the walls and not plant, whereas the “murals”, being apparatus are plant. The fact that two things perform the same function or role is not the point. One thing functions as part o f the premises, the other as part o f the plant.” In Wimpey International Ltd v Warland [1988] STC 149 the taxpayer owned and operated a chain o f fast food restaurants. The company made major changes to the premises installing, inter alia, shop fronts, light fittings and wiring, raised floors, floor and wall tiles, suspended ceilings, balustrading and stairs. The company claimed capital allowances for the items as plant. The Court, In deciding that the items were not plant, clarified the ‘functional test’ further: 33 “It is proper to consider the function o f the item in dispute. But the question is what does it function as? If it functions as part of the premises it is not plant. The fact that the building in which a business is carried on is, by its construction particularly well suited to the business, or indeed was specially built for that business, does not make it plant. Its suitability is simply the reason why the business is carried on there.” Fox LJ, held that the Special Commissioners decision should not be disturbed and supported the functional test even more: “There is a well established distinction, in general terms, between the premises in which the business is carried on and the plant with which the business is carried on. The premises are not plant.” The wear and tear allowance for plant and machinery is 15% o f the cost o f the asset for the first six years and 10% for the final seventh year. Acquisition and installation expenses can be included in the cost of plant and machinery for the purpose o f capital allowances. Including the interest on borrowings, to acquire an asset, in the cost of that asset, has been unsuccessfully tried in the English courts to date. In Ben-Odeco Ltd v Powlson STC 111 1978 the commitment fees and interest costs incurred in the construction o f an oil rig were held not to be part of the total cost of the rig for the purpose o f capital allowances. In his judgement Brightman, J contended that: “...a distinction is to be drawn in the context o f this present case between money spent on the provision o f finance by the use of which the machinery or plant is acquired and money spent on the provision o f such machinery or plant” . 34 This case was unsuccessfully appealed further to the House o f Lords. Under the Irish tax system such interest costs are allowed, in the main, as a deduction when computing the tax adjusted profits o f a trade. A full annual wear and tear allowance is granted in the year o f purchase o f the asset, regardless o f when in the year the asset was bought. None is granted in the year o f sale. However, the length of the basis period does affect the amount o f the allowance granted. If the basis period is less than 12 months the allowance is apportioned according to the actual length o f the basis period. E.g. if the basis period is 6 months only 50% o f the annual wear and tear allowance will be granted for qualifying assets. 6.3 Industrial Buildings Industrial buildings occupied for the purpose o f carrying on a trade are defined by s 255 1967 IT A to be structures which accommodate: (i) a trade carried on in a mill, factory or other similar premises. (ii) a dock undertaking. (iii) the growing o f fruit, vegetables or other produce in the course o f a trade of market gardening. (iv) the intensive production of cattle, sheep, poultry or eggs in the course o f a trade other than the trade o f farming. (v) the trade of hotel keeping. (vi) a laboratory whose main or sole activity is the analysis o f minerals in connection with the exploration for or extraction o f such minerals. The person operating the laboratory need not be the person who is involved in the exploration and extraction of the mineral. (vii) the operating or managing o f an airport used mainly or solely for aircraft which carry passengers or cargo for hire or reward. 35 (viii) the provision o f recreation o f employees by employers involved in any o f the above. Excluded buildings include: (I) a dwelling house (ii) a retail shop (iii) a showroom (iv) an office The above premises may qualify if they are part o f a larger structure which qualifies, and the cost o f the smaller structure does not exceed 10% o f the total cost of the complete structure excluding the site cost and including any grants received. The annual allowance for industrial buildings is normally 4% on a straight line basis. The rate for holiday cottages, hotels, market garden structures or structures used in the intensive production o f livestock is 15% for the first 6 years and 10% for the final seventh year. 6.4 M otor vehicles A motor vehicle is a vehicle used for the conveyance o f passengers or goods by road. The rate of annual wear and tear allowance for motor vehicle is 20% on a reducing balance basis. The allowable cost o f a vehicle is restricted to £15,500 for new vehicles with effect from 3 December 1997. New vehicles bought before this date have various different limits depending on the date o f purchase.The Finance Act 1994 introduced the raising o f the restrictions o f the allowable cost of new vehicles. For vehicle bought up to the 31 January 1992 no distinction is made in the restrictions between new and second-hand vehicles. 36 7. EXEMPTED ACTIVITIES Certain persons, groups of people and categories o f income are deemed exempt from been assessed to tax. Clubs and charities are two examples. 7.1 Clubs "Approved bodies of persons established for the sole purpose o f promoting athletics or amateur games or sports in respect o f all income that is or will be applied for such purposes", are exempt from income tax under the Income Tax Act 1967, Section 349. However, a club that provides it’s facilities to non-members at a fee is seen to be trading and is liable for income tax under Schedule D case 1 for the amount collected from non-members. This was found to be the case in Carlisle & Silloth G o lf Club v Smith 6 TC 198. The opposite was found to be the case in National Association o f Local Government Officers v Watkins 18 TC 499 where only the members availed o f the club’s facilities after paying subscriptions. This club was found to be exempt from income tax. In British Legion, Peterhead Branch v IRC 35 TC 509 the running o f dances was held to constitute trade for tax purposes as the dances were run on a regular and commercial basis. 7.2 Charities 6 Charity ’ means any body o f persons or trust established for charitable purposes only. However, the term 4 charitable purposes 6 is not defined in the Tax Acts. Therefore, case law must be resorted to give it a definition. In Income Tax Special Purposes Commissioners v Pemse [1891] AC 531, [1891- 37 1894] AER 28, 3TC53, 61LJQB 265 Lord Mac Naghten grouped ‘charitable purposes’ into four categories: (i) The relief of poor (ii) The advancement of education (iii) The advancement of religion (iv) Other purposes of a charitable nature beneficial to the community, which do not fall within the other three categories. Lord Mac Naghten considered a trust only to be charitable if: (i) it is solely of a charitable character (ii) its effect is the promotion o f some public benefit Lord Mac .Naghten’s definition is well established in case law and often quoted in judgements 38 TRADING AND TAX EVASION Regardless of the amount o f legislation defining and clarifying tax issues, establishment of whether a person or company is liable to the payment o f taxes or not, as a result of commercial activity is often decided upon by the courts. Many assessments of tax are appealed to the Courts by the revenue commissioners as they believe that companies enter into transactions with the sole purpose o f deliberately creating losses. The companies then write these losses off against legitimate gains. Both the Irish and English courts have set precedence in trying to rectify this problem. The issues of the most significant cases dealing with trading and tax evasion are o f a fundamentally similar nature. These issues are; substance over form o f self-cancelling transactions and circular contracts, true motive and commercial value o f individual transactions in series o f transactions, construction o f existing legislation and the doctrine o f fiscal nullity. The English and Irish courts, have viewed these issues, for the most part, differently. 8.1 Substance over Form of Self-Cancelling Transactions and circular contracts. In the Irish case Patrick Me Grath, Seamus Me Grath A nd Joseph Me Grath v J.E. Me Dermott (Inspector O f Taxes) [1988] IR 258, statute construction and substance over form were the issued to be decided upon. The taxpayers realised gains on the disposal o f certain assets. In order to avoid paying tax on these gains the taxpayers entered into similar loss-making transactions. They purchased the issued preference shares in P Ltd. By applying s. 102 of the capital gains tax Act, 1975 the taxpayers were now in control o f P Ltd and “connected” for capital gains tax purposes. They then purchased the complete ordinary share capital o f G Ltd at £1 per share. Attached to the preference shares was an option for the holder to purchase the ordinary shares of G Ltd at £2 per share. The taxpayers sold their shareholding 39 in P ltd and G ltd for £900 and £100 respectively which was the market value. Since the deemed cost of the shares exceeded the sale proceeds the taxpayers wrote this loss off against their previous gain. Ultimately their capital gains tax liable was nil. The Inspector o f taxes refused to recognise the loss as no loss had actual been incurred. On appeal the Appeal Commissioner considered, not the transactions individually, but as a whole and upheld the decision o f the Inspector o f tax. They held that the overall purpose o f the series o f transactions was the avoidance of tax. The case was appealed to the High Court by way o f case stated, by the taxpayers. The appeal was allowed and the court held that the law must be construed in a manner that affords people their legal rights as meant by the law. A series of transactions must not necessarily be viewed and presented to the court as a single transaction, and it’s substance decided upon. Carroll, J stated that the new doctrine, ‘substance over form ’ which has already been accepted by the English Courts as a new approach to tax evasion, had not been accepted by the Irish Courts. Upon appeal, the Supreme Court argued that legislating for tax was the duty o f parliament and that it was not the function o f the Courts to intervene if parliament failed to legislate against schemes, whose primary purpose is to facilitate the avoidance o f paying tax. It was stated that: “the function of the courts in interpreting a statute is limited to ascertaining the true meaning of each statutory provision. The courts may not add to or delete from express statutory provisions so as to condemn tax avoidance schemes which are not prohibited by statute law. To do so would constitute an invasion o f the legislative powers o f the Oireachtas” . 40 8.2 True Motive According to the ‘Badges of Trade ‘ the motive o f a person involved in a business transaction can aid the deciding o f whether that person is involved in an adventure in the nature o f trade, or not, and liable to tax accordingly. In Me Grath v Me Dermott another aspect o f motive is examined. It was held that the individual steps of the series o f transactions had no commercial function and that the true motive of the transactions was to avoid tax. This concept led to the development of the doctrine 4 fiscal nullity \ 8.2 Fiscal Nullity Fiscal nullity is the examination o f a series o f transactions and distinguishing between the transactions o f commercial value and those o f no value, to arrive at the true purpose of the transactions. In Furniss (Inspector O f Taxes) V Dawson and Related Appeals [1984] 1 All ER 530, X Ltd and Y Ltd, two manufacturing companies had the taxpayers as their main shareholders. The taxpayers devised a scheme in order to avoid paying capital gains tax on the sale o f the two companies. Company G Ltd was incorporated in the Isle of Mann. This new company bought the taxpayers shares in X ltd and Y ltd for £152,000 by allotting shares in G Ltd to the taxpayers. Subsequently the shares in X Ltd and Y Ltd were sold further to a purchaser for £152,000. Although the taxpayers were now shareholders in a company whose only assets consisted o f £152,000 they were assessed for capital gains tax on the sale o f their shares in X Ltd and Y Ltd. The taxpayers’ appeal against the assessment was upheld by the Special Commissioners. However, the Crown appealed on the grounds that the true effect o f the transactions undertaken by the taxpayers was their sale o f shares in X Ltd and Y Ltd to the purchaser for the sum o f £152,000. The taxpayers argued that G Ltd had legally taken control o f the two manufacturing companies and so they, 41 the taxpayers, were not liable for capital gains tax until they disposed o f their v ►_____ shares in G Ltd. The appeal was dismissed as the judge held that although the transactions had no commercial significance they were not self-cancelling. He stated that G Ltd still existed and that any transaction it entered into had legal consequences. The Crown appealed to the House o f Lords. The House o f Lords held that the taxpayers were liable to capital gains tax. They held that where a series o f pre­ planned transactions are entered into, which have no commercial value but to aid in the avoidance or deferral o f tax, the series o f transactions must be viewed as a whole and not individually. The doctrines o f ‘substance over form ’ and ‘fiscal nullity5 have been adopted by the English Courts, which now forms part o f English case law. Although the Irish Courts usually follow English case law and use it to arrive at their judgements, this is not always the case. With regard to the issue o f tax avoidance the courts here in Ireland have formed the attitude that the letter of the law must be followed and their duty is to uphold that law in their judgements. They believe that the responsibility o f legislating is with the Oireachtas and that this separation o f powers, stated in the Constitution must be maintained. This friction between the powers o f the judiciary and the Oireachtas is also often evident in civil and criminal cases. 42 BIBLIOGRAPHY • Cooney, T., McLaughlin, J and Martyn, J (1998) Taxation Summary, The Institute of Taxation in Ireland • Appleby, T. and Carr, F.(1997) The Taxation o f Capital Gains, The Institute o f Taxation in Ireland • Judge, N. (1995) Irish Income Tax, Butterworths • Moore, Alan Tax Acts 1995-96; Butterworths. • Centre o f Accounting Studies (1998) Corporation Tax , Institute of Chartered Accountants • Centre of Accounting Studies (1998) Income Tax; Institute o f Chartered Accountants • Centre o f Accounting Studies (1998) Capital gains Tax; Institute o f Chartered Accountants • McAteer, W., Reddin, G., Deegan, G (1996) Income Tax ; The Institute of Taxation • All England Reports • Irish Tax Cases • Irish Law Reports • Scottish Tax Cases • Annual Law Review 43 .1 .