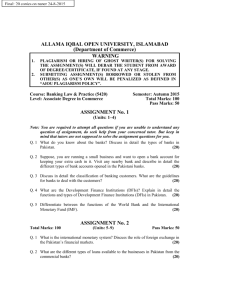

SME, Micro Finance & Agriculture Finance

advertisement

SME, Micro Finance & Agriculture Finance. Capsule Statement Over the last few years Pakistan witnessed phenomenal growth in different types of banking types along with regular conventional banking. These different types mainly include SME, Micro Financing, Consumer, Islamic and Agricultural banking. This categorization is mainly to identify specific area of the businesses and then financing accordingly keeping in view the needs and regulations. The objective of this course is to develop a deeper understanding of the newly formed branches of the banking industry. The main focus will be on the Prudential Regulations of State Bank of Pakistan regarding each category specifically, their implementation and financing analysis keeping in view the financing industry. SME itself hold major portion of financing amount of the commercial banks as it give boost to the middle line industry in the market. Banks are focusing it due to its size, entrepreneurship and government policies. Again Pakistan being agriculturist country always requires attention of all financing institutions in this field. Almost every listed commercial bank is feeding agricultural industry in its own way and managing it as an independent portfolio. The most recent form of modern banking is Micro Financing, which is to cater the below average class of the economy and to inject financing to strengthen and boost low level business. Learning Objectives The focus of the course shall be as follows: Development of practical insight amalgamated with analytical management skills on the students of SME, Micro Financing & agricultural banking. Since these types of banking are radically on the risk, therefore entrepreneurs already working in different organization shall stand to gain through it. Advancement of professional competence in the careers especially related to the areas of banking and commerce. Course Material Quarterly journals from Institute of Bankers of Pakistan. SBP’s Latest Prudential Regulations Handouts Publications/Journals © 2013; Department of Finance @ SBE, UMT, Lahore, Pakistan. Calendar of Activities – SME, Micro Finance & Agriculture Finance Session Topic State Bank of Pakistan 1-2 • History • Functions Banking Sector Reforms In Pakistan 1. Privatization of Nationalized Commercial Banks 2. Corporate governance. 3. Capital Strengthening. 4. Improving Asset quality. 5. Liberalization of foreign exchange regime 6. Consumer Financing 7. Mortgage Financing 8. Legal Reforms 9. Prudential Regulations 10. Micro financing 11. SME Financing 12. Taxation 13. Agriculture Credit 14. E-Banking 15. Human Resources 16. Credit Rating 17. Supervision and Regulatory Capacity 18. Payment Systems SME 2 HISTORY, DEFINITION AND REGIONAL CONCEPTS Of SMEs Concept of Small Business Characteristics of Small Business Typical Small Business Large vs. Small Business The SME’S in Pakistan The Government’s Effort towards SME Development Small & Medium Enterprise Development Authority (SMEDA) Definitions of SMEs in Pakistan 3 The Role Of Entrepreneurships In SMEs Imitating Entrepreneurs Characteristics of Entrepreneurs Qualities of an Entrepreneur Kinds of Entrepreneurs Role of SMEs in a Developing Economy Pakistan SME The Development Of SMEs In Pakistan GOVERNMENT’S EFFORT TOWARDS SME DEVELOPMENT Provincial Level Institutions Prudential Regulations for SMEs 4-5 Complete SBP Regulations along with Provisioning and Classification. © 2013; Department of Finance @ SBE, UMT, Lahore, Pakistan. o o o o o 6 7-8 Problems Faced By SMEs In Pakistan Why should banks promote SME Financing? Preferred sectors for SME financing Marketing for SME loans Eligibility and evaluation criteria for SME financing Elements of financing considerations Monitoring of SME loans • Relatively informal structure and organization of SMEs • General lack of financial and managerial expertise, record keeping and planning on the part of their owners • Danger / problem signs / signals, problem solving / trouble shooting, cautions & protections Micro Financing Microfinance Sector in Pakistan History and Evolution Types of MF Providers Microfinance Banks RSPs/NGOs Major highlights of the sector Comilla Model Prudential Regulations for Micro Financing 9-10 Complete SBP Regulations along with Provisioning and Classification. Micro Enterprise Financing 10-11 Establishing Microfinance Banks as per SBP Directives Category Of Microfinance Banks Ineligibility to become sponsors/directors of MBFs Minimum Capital Requirement Net worth of sponsor directors of MFBs NOC for incorporation with SECP Information/documents to be submitted with the application Structure of the MFB board Compliance with legal framework & prudential regulations for MFBs International Micro Enterprise Financing Institutions Agricultural Finance 12 Agriculture in Pakistan Background of Agricultural Sector of Pakistan Land use, farming systems and institutions Significance of the agricultural sector in the economy Overview of agricultural sector development Prudential Regulations for Agricultural Finance Agricultural Credit Department (ACD) 13-14 Short term / Long term financing Eligible For Agricultural Credit from the banks How can a person get agricultural loan from banks Purposes The Banks Provide Agricultural Credit Types Of Loans Provided To Farmers/Growers By Banks © 2013; Department of Finance @ SBE, UMT, Lahore, Pakistan. • • • Limit For Agriculture Financing Areas Covered Under The Agricultural Loans Scheme Consideration For Size Of Land Holdings Types Of Land Holdings In Four Provinces Types Of Sureties / Securities/Collaterals Are Acceptable To The Banks For Providing Agricultural Credit To Farmers/Growers Farm Credit – Production Purpose (Short-Term) Farm Credit – Development Purpose (Medium / Long Term) Non Farm Credit Classification & Provisioning in Agri-Financing / Agri-Business. Securities, Collaterals, Sureties CIB Report, Charge Creation procedure of Revenue office. Agricultural Credit Policy 15 • • • Role of State Bank of Pakistan in Agricultural financing Supervised Agricultural Credit Scheme 2001 “Revolving Credit Scheme” Prudential Regulations & Guidelines for Livestock & Fisheries Financing Purpose-wise & Province-wise Credit Targets PRESENTATIONS & PROJECT DISCUSSION. © 2013; Department of Finance @ SBE, UMT, Lahore, Pakistan.