Yacine Francis - Investment Policy Hub

WORKSHOP ON INTERNATIONAL INVESTMENT POLICIES,

INVESTMENT PROMOTION STRATEGIES AND SUSTAINABLE

DEVELOPMENT

Casablanca, Morocco, November 2012

Definition of investment, admission and establishment

Yacine Francis, Senior Associate, Allen & Overy, Dubai

© Allen & Overy 2012 1

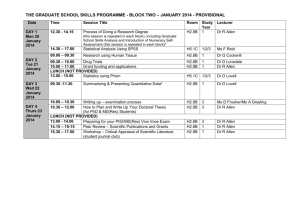

Plan

1. Definition of “investment”

2. Definition of “investor”

3. Temporal scope of application

4. What is admission and establishment

5. Two main IIA approaches

6. Exceptions to pre-establishment

7. “In accordance with local law” requirement

8. Case study

© Allen & Overy 2012 2

2

Introduction

– IIA expose States to international legal proceedings and financial liabilities

– Traditional BITs of the 1990s - overly broad and investororiented

– Treaty text is paramount

– The role of disputes and arbitral decisions

– Capacity-building is essential

© Allen & Overy 2012 3

3

Definition of “investment”

– Economic definition: Investment – expenditure of capital in the expectation of future economic benefit

– Treaty defines “protected”/“covered” investment

– Traditional chapeau :

“ The term “investment” means every kind of asset invested by investors of one Party in accordance with the laws and regulations of the other Party in the territory of the latter, and particularly, though not exclusively, includes: […] ”

© Allen & Overy 2012 4

4

Typical illustrative list of assets

– movable and immovable property and any other property rights

– shares in companies and debt instruments

– claims to money or to any performance under contract having a financial value

– certain intellectual property rights

– business concessions, e.g. to exploit natural resources

© Allen & Overy 2012 5

5

Closed-list definition

– “ Investment means the following assets invested in the territory of a Contracting Party in accordance with its laws and regulations:

[list assets covered]

But investment does not mean:

[list assets excluded]

© Allen & Overy 2012 6

6

Examples of assets that could be excluded

– Portfolio investment

– Claims to money under certain commercial contracts such as ordinary one-off sales and services contracts

– Government bonds

– Short-term loans and debt securities

© Allen & Overy 2012 7

7

Other issues

– Reinvestments – covered or not?

– Change in the form of investment – covered or not?

© Allen & Overy 2012 8

8

Definition of “investor”

– Natural persons

– Legal entities

© Allen & Overy 2012 9

9

Natural persons

– Typical definition: “ physical persons who, according to the law of that Contracting Party, are considered to be its nationals ”

– Citizenship criterion

– Status of permanent residents and dual nationals? Possible solutions

© Allen & Overy 2012 10

10

Legal entities

– Typical definition: “ any entity constituted or organized under the law of the Contracting Party ”

– Advantages: easy to apply and permanent

– Disadvantages: possibly no real economic link to the country of incorporation, opportunities for “treaty shopping”

© Allen & Overy 2012 11

11

Treaty shopping

– Investment by an investor from a non-Contracting Party through an intermediate company established in the

Contracting Party

– Investment by an investor from the host State through an intermediate company established in the Contracting Party

– Possible solutions:

– Requirement of “seat” and/or “real economic activities”

– Denial-of-benefits clauses

© Allen & Overy 2012 12

12

Denial-of-benefits clauses

– “ A Party may deny the benefits of this Treaty to an investor of the other Party that is an enterprise of such other Party and to investments of that investor if the enterprise has no substantial business activities in the territory of the other

Party and persons of a non-Party, or of the denying

Party, own or control the enterprise.

”

– Two elements of the test:

– substantial business activities

– where does the company’s owner/controller come from?

© Allen & Overy 2012 13

13

Temporal scope of application

– Protection of investments made only after the treaty’s entry into force

– Protection of investments made both prior to and after the entry into force. But then a limitation:

– “ This Agreement applies to investments made before or after its entry into force, but not to claims or disputes arising out of events which occurred prior to that date .”

– Protection after termination (“survival clause” – 10-20 years)

© Allen & Overy 2012 14

14

What is A & E

– Admission and establishment = market access

– General international law – entry of aliens is in the discretion of States

– Entry regulations for FDI are common:

– Closing certain sectors for foreigners completely

– Restrictions for foreign ownership in certain industries

– Restricted admission to privatization

– Screening/authorization of foreign investments

– Minimum capital requirements, etc

© Allen & Overy 2012 15

15

Two main IIA models

– Post-establishment

– Pre-establishment

© Allen & Overy 2012 16

16

Post-establishment

– Most European BITs

– Typical formulation: “ Each Contracting Party shall admit investments by investors of the other Contracting Party in accordance with its laws and regulations.

”

© Allen & Overy 2012 17

17

Pre-establishment

– IIAs of Canada, Japan, United States

– How? Prohibition of discrimination vis-à-vis domestic investors (National Treatment) and other foreign investors

(MFN)

© Allen & Overy 2012 18

18

Pre-establishment – treaty example

Canada-Peru FTA of 2009:

– Article 803: National Treatment

– Each Party shall accord to investors of the other Party treatment no less favourable than that it accords, in like circumstances, to its own investors with respect to the establishment, acquisition, expansion , management, conduct, operation and sale or other disposition of investments in its territory

© Allen & Overy 2012 19

19

Pre-establishment – treaty example (Cont’d)

– Each Party shall accord to covered investments treatment no less favourable than that it accords, in like circumstances, to investments of its own investors with respect to the establishment, acquisition, expansion , management, conduct, operation and sale or other disposition of investments in its territory

© Allen & Overy 2012 20

20

Exceptions to pre-establishment

Usually two types of exceptions:

– exclude certain sectors or sub-sectors

– exclude existing non-conforming measures

Difference – the first type provides more flexibility for the future

Negative list vs. positive list

© Allen & Overy 2012 21

21

“In accordance with local law” requirement

– Illegal investment are deprived of treaty protection.

Examples:

– Fraport v. The Philippines (2007) – circumvention of local law requirements

– Plama v. Bulgaria (2008) – fraud

– World Duty Free v. Kenya – corruption

© Allen & Overy 2012 22

22

Corruption and Investment Treaty Claims

– Investors claims may be inadmissible as bribery is against transnational public policy; contracts procured by bribes are void ( World Duty Free v Kenya )

– Denial of treaty based protections ( Plama v Bulgaria )

– Enforcement of arbitral award.

© Allen & Overy 2012 23

23

Questions?

These are presentation slides only. The information within these slides does not constitute definitive advice and should not be used as the basis for giving definitive advice without checking the primary sources.

Allen & Overy means Allen & Overy LLP and/or its affiliated undertakings. The term partner is used to refer to a member of Allen & Overy LLP or an employee or consultant with equivalent standing and qualifications or an individual with equivalent status in one of Allen & Overy LLP’s affiliated undertakings.

© Allen & Overy 2012

DB-#5566554-v1-Investment_Presentation.PPT

24