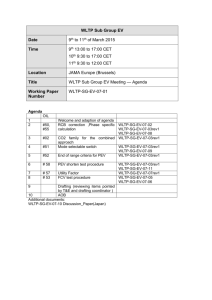

Assessment of Plug-in Electric Vehicle Integration with ISO/RTO

advertisement