and its subsidiaries

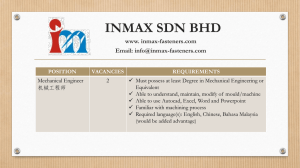

advertisement