The High-Performance

Manufacturing

Organization

The Boston Consulting Group (BCG) is a global

management consulting firm and the world’s

leading advisor on business strategy. We partner

with clients in all sectors and regions to identify

their highest-value opportunities, address their

most critical challenges, and transform their

businesses. Our customized approach combines

deep insight into the dynamics of companies

and markets with close collaboration at all levels

of the client organization. This ensures that our

clients achieve sustainable competitive advantage, build more capable organizations, and

secure lasting results. Founded in 1963, BCG is a

private company with 74 offices in 42 countries.

For more information, please visit www.bcg.com.

The High-Performance

Manufacturing

Organization

Frank Lesmeister, Daniel Spindelndreier, and Michael Zinser

June

AT A GLANCE

Performance improvement efforts tend to focus on the operational aspects of

manufacturing. But organizational issues—matrix structures with multiple interfaces, proliferating roles and responsibilities, a structure that is no longer aligned

with strategy—can also be a major obstacle to quality, flexibility, speed, cost

effectiveness, and competitive advantage.

S S

A company’s manufacturing strategy must be aligned with and support the overall

corporate strategy. These strategic considerations will drive decisions about how

best to set up manufacturing operations.

C R S

Companies must make design decisions at both the corporate and the plant levels.

Key considerations include whether to centralize control, whether to integrate

related functions, and what the roles and responsibilities of plants should be.

M T

Each organization design choice involves tradeoffs that can affect cost, product

quality, cycle times, and service levels. Many of these drawbacks can be offset.

T H-P M O

M

OST MANUFACTURERS HAVE COME to accept that change is a constant.

Increasingly global operations, evolving production networks, mergers and

acquisitions—all contribute to a growing complexity that can extract a high cost if it

is not actively managed. But improvement efforts tend to focus on the operational

aspects of manufacturing, such as production processes, the shop floor, and logistics. Oen overlooked is the high cost of organizational complexity: the matrix

structures with multiple interfaces, the proliferating roles and responsibilities, the

many management layers that have built up over the years, and an organization

structure that is no longer aligned with a company’s manufacturing strategy. These

issues are oen at the root of performance problems. Ignoring them can be a major

obstacle to quality, flexibility, speed, cost effectiveness, and competitive advantage.

No single solution will fit all manufacturing organizations. A company’s industry,

markets, customers, products, internal capabilities, competitive position, and overall

strategy will inform any decisions—and there will always be tradeoffs. But an

effective manufacturing organization requires three things: an optimal organization

structure; a skilled, engaged workforce; and supporting systems and governance.

(See the sidebar “The Importance of People and Governance.”)

This report focuses on organizational best practices and outlines three essential

steps for building a high-performance manufacturing organization: start with

strategy, choose the right structure, and manage the tradeoffs. It also offers guidelines for determining the best choices for a company’s manufacturing organization.

The Optimal Organization Design

Most companies wrestle with how best to organize their manufacturing operations

at both the corporate and the plant levels. Typical questions at the corporate level

include: Should we centralize manufacturing responsibility and decision making or

give regional and local plants greater autonomy? Should decisions that affect

product divisions be made globally or locally? How can we make sure that process

and technology standards are implemented across business units and globally? To

what extent should engineering, maintenance, quality, asset management, and

other functions be integrated into the manufacturing organization? How do we

minimize overhead among similar plants with similar products?

At the plant level, critical questions include: What responsibilities should be given

to plant managers? Which plant activities should be centrally coordinated? How

should plants be organized below the plant manager level?

T B C G

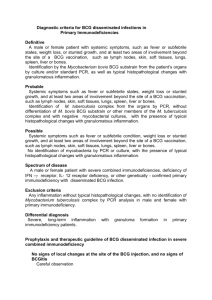

THE IMPORTANCE OF PEOPLE AND GOVERNANCE

Achieving a high level of manufacturing performance requires a skilled,

engaged workforce and governance

systems that drive and sustain

excellence.

Management leadership and visibility

help to create a culture of trust,

cooperation, learning, and continuous

improvement. Having the right people

in the right roles at the right time is

also critical. Given the global shortages of skilled labor, this requires

strategic workforce planning—a type

of planning that involves defining

needed jobs and skills, estimating

likely hiring and attrition rates, and

addressing any gaps that must be

filled. Companies should also make

an ongoing commitment to recruitment and training, and define roles to

clarify individual and shared responsibilities. (See the exhibit “Companies

Should Define Individual and Shared

Responsibilities.”)

Oen, manufacturing organizations

have too many of the wrong types of

skills or people. But when it comes to

trimming the organization, most

companies focus more on reducing

their workforce than on streamlining

their management ranks. “Delayering” these organizations can help

flatten the reporting pyramid and

increase spans of control, which

lowers costs and improves efficiency

and effectiveness. Delayering is more

than just a restructuring or costcutting exercise. It also leads to

improved management performance

and accountability, more efficient

decision making, and greater job

satisfaction. Knowledge, cultural

changes, and corporate values also

spread throughout the organization

To answer these questions, The Boston Consulting Group analyzed organization

structures in a wide range of industries. Our goal was to determine which factors

drive manufacturing performance and to identify overall best practices in organization design. Our analysis revealed the optimal setup for specific industries based on

strategic business drivers, and we created organizational guidelines to point companies in the right direction.

Start with Strategy

A company’s manufacturing strategy must be aligned with and support the overall

corporate strategy. These strategic considerations will drive decisions about how

best to set up manufacturing operations. (See Exhibit 1.) To this end, we believe the

manufacturing strategy must consider the following three factors: economics,

markets and customers, and technologies and skills.

•

Economics. How critical are scale, scope, efficiency, utilization rates, complexity,

labor, and other cost drivers that affect overall manufacturing economics? The

importance of these factors will vary by industry and company. For instance,

scale is typically integral to companies in the automotive, chemical, metal, and

fast-moving consumer-goods industries. The chemical and metal industries also

T H-P M O

THE IMPORTANCE OF PEOPLE AND GOVERNANCE

CONTINUED

more quickly and easily because there

are fewer layers of management.

Finally, the right incentives are

important to encourage the right

behavior. In addition to cost or quality

performance, for instance, plant

managers could be rewarded for such

factors as service levels, the health

and safety of their people, sharing of

best practices, and compliance with

production standards.

Companies Should Define Individual and Shared Responsibilities

Example: site manager and line manager

Site manager

Line manager

Organizational parameters

Direct or dotted-line

reporting; plant ownership

and structure

Manufacturing team

structures; task

allocation

Leadership behavior

“Go Gemba!” Kaizen

initiatives; collaboration

among manufacturingrelated functions and

headquarters; best-practice

sharing across plants

and business units

“Go Gemba!” Kaizen

initiatives; cross-line

collaboration; guidance

and development of

foremen and teams on

shop floor

Accountabilities

Individual: improve overall

financials by lowering costs

and reducing working

capital; improve quality,

service levels, staff engagement and capabilities,

health and safety

Individual: line performance; sustainable

implementation of

standards; crosstraining and competence development of

staff; engagement and

satisfaction of line staff

Shared: secure, reliable

product delivery for

customers and component

supply

Shared: timely product

delivery

Metrics and targets

First-pass yield; on-time

delivery; cycle/throughput

time; accident levels; COG;1

working capital/inventory;

direct/indirect costs; CAPEX

Overall equipment

effectiveness;

changeover times;

quality; direct/indirect

costs

Decision rights

Owns: execution of manufacturing strategy at plant;

personnel decisions;

improvement initiatives;

high-level planning (e.g.,

Kanban, segmentation);

inventory levels

Owns: optimization of

operating processes;

enforcement of

standards; leanmanufacturing tools;

line stoppages;

personnel decisions

on shop floor

Can veto: investments

Influences: manufacturing

strategy; supplier selection

Can veto: line

personnel decisions

Influences: investments;

inventory levels

Sources: BCG approach; BCG project experience.

1

COG refers to manufacturing costs only (costs of marketing and sales are not included).

T B C G

E | Strategic Drivers Affect Organizational Choices

Strategic drivers

High economies

of scale

Organization design

• Global setup

Economics

High economies

of scope

High significance

of asset utilization

• Global setup

Markets and

customers

Plant roles and

responsibilities

• Standardized production system

with integrated industrial

engineering

• Lead plants or centers of

excellence; if one product

per plant, independent plants

• Standardized production system

with integrated industrial

engineering

• Lead plants or centers of

excellence

• Integrated planning and scheduling • Lead plants or centers of

to balance demand volatility and

excellence

control global volumes

• Standardized production system

with integrated industrial

engineering and management of

assets and maintenance

High impact of

personnel costs

Technologies

and skills

Organizational choices

Degree of

functional integration

• High level of standardization

with integrated industrial

engineering

• Lead plants

• Standardized production

system with integrated

industrial engineering and

standardized assets with

asset management

• Lead plants

High degree of

complexity

• Global setup

High importance

of proximity to

customer

High number of

region-specific

products

• Regional or local setup

• Independent plants close

to customer

• Regional or local setup

• Independent plants

High number of

customer-specific

products

• Customer-oriented setup

on global or regional/

local level

• Lead plants or centers of

excellence

• Centers of excellence

Highly skilled

engineering and

production

workforce required

High importance

of production

know-how

• Global setup

• Standardized production

system with integrated

industrial engineering

• Lead plants or centers of

excellence

Source: BCG analysis.

tend to seek economies of scope, so that multiple products can share common

premanufacturing steps. Standardized processes are critical to companies

seeking scale and scope. For companies in asset-intensive industries such as the

automotive, pharmaceutical, and building materials industries, asset utilization

is a key consideration. When high asset utilization and economies of scale are

required, manufacturing is best set up as a centralized corporate function.

•

Markets and Customers. How important is it to be close to end-user markets and

to have products that are customized for specific regions or customers? For

instance, automotive suppliers, as well as companies making engineered products or specialized chemicals and metals, all offer a large number of customized

products. For companies in the building materials industry, proximity to custom-

T H-P M O

ers is critical. A regional or local manufacturing organization tends to be more

effective than a global one for these types of companies.

•

Technologies and Skills. How important are specialized engineering skills, technologies, or production capabilities? Companies that make customized products, such

as those companies noted above, require specialized processes and technologies

that are oen specific to individual plants. As a result, centralized control and

sharing of best practices is less important to their manufacturing operations.

Choose the Right Structure

To help determine the best setup for your company, look at how different industries

typically organize their manufacturing operations. As shown in Exhibit 2, certain

factors are more important in some industries than in others and lead to different

organization setups.

The key strategic drivers that we discussed above—economics, markets and customers, and technologies and skills—affect structural choices in three critical areas:

organization design, degree of functional integration, and plant roles and responsibilities. Let’s look at each of these areas more closely.

Organization Design. Companies must decide whether manufacturing decisions—

such as product allocations or capital outlays—should be made on a global, regional, or local level, and whether manufacturing should be set up as a centralized

corporate function or as a part of each business unit. (For illustrations of decisions

that should be made at the corporate level and at the plant level, see Exhibits 3

E | Industry Characteristics Drive Manufacturing Decisions

Consumer goods

Automotive

Organization

design Centralized Decentralized

Functional

integration Low

High

Plant roles

Organization

design Centralized Decentralized

Functional

integration Low

High

Plant roles

Standalone

Durables

Building materials

Network

FMCG

Chemicals/pharmaceuticals

Organization

design Centralized Decentralized

Functional

integration Low

High

Plant roles

Plant roles

Standalone

OEM

Network

Pharmaceuticals

Network

Standalone

Engineered products

Organization

design Centralized Decentralized

Functional

integration Low

High

Metals and mining

Organization

design Centralized Decentralized

Functional

integration Low

High

Plant roles

Standalone

Chemicals

Network

Standalone

Metals

Source: BCG analysis.

Note: FMCG = fast-moving consumer goods; OEM = original equipment manufacturer.

T B C G

Network

Supplier

Plant roles

Standalone

Organization

design Centralized Decentralized

Functional

integration Low

High

Mining

Network

and 4.) As a general rule of thumb, a global organization makes sense if scale or

standardization are major cost drivers, specialized production capabilities are

needed, or the manufacturing strategy has a major impact on the overall business

strategy.

Our research shows a trend across industries toward creating a global manufacturing organization with centralized decision making for products, technologies, and

processes. Beyond the potential scale effects, this approach makes it easier to share

best practices and speeds up performance improvements—critical benefits in

today’s fast-changing, fiercely competitive global economy. But this solution isn’t

always the right choice. For instance, companies that must create different products

for different markets will usually find that a regional or local organization allows

them to better focus on—and respond more quickly to—the needs and requirements of local customers.

Degree of Functional Integration. Decisions about whether to integrate related

functions—such as production control, planning and scheduling, IT, quality, maintenance, engineering, and asset management—within the manufacturing organization

can have a major impact on operations. Integration can lead to fewer interfaces,

better communication, faster decision making, and greater synergy. Companies in

asset-intensive industries, for instance, can achieve higher levels of utilization by

E | Three Types of Organizational Decisions Should Be Made at the Corporate Level

Functional

Organization

design

Hybrid

Board

Board

Mfg.

Mfg. BU A BU B BU C

BU A BU B BU C

Mfg.

Planning and

scheduling

Degree of

functional

integration

Production

controlling

Divisional

Board

Procurement

Maintenance

management

Independent plants

Mfg.

BU A

BU B

BU C

Mfg.

Mfg.

Mfg.

Mfg.

Logistics

(in- and outbound)

Industrial

engineering

Asset

management

Quality

IT

Plant network

Products

Processes

Lead plants

Plant roles and

responsibilities

Source: BCG analysis.

Note: Mfg. = manufacturing; BU = business unit.

T H-P M O

E | Two Types of Organizational Decisions Should Be Made at the Plant Level

Value stream—process bundling

Organization

design

Workshops—activity bundling

Mfg.

Mfg.

WS 1

VS 1

WS 2

WS 3

VS 2

Production controlling

Degree of

functional

integration

Maintenance

Planning and scheduling

Quality

IT

Source: BCG analysis.

Note: Mfg. = manufacturing; VS = value stream; WS = workshop.

integrating maintenance, asset management, planning, and scheduling. As a result,

manufacturing operations have less downtime, greater asset productivity, more

balanced utilization across the plant network, and fewer bottlenecks along the supply

chain. Similarly, an integrated engineering unit can identify new performance levers,

promote production standards, and encourage the sharing of best practices. Integrating quality functions is usually more effective at the plant level, where total quality

management (TQM) can engage workers in continuous improvement efforts. Lean

initiatives—with their total-productive-maintenance (TPM) approach—also show the

power of integrating maintenance activities at the plant level.

Plant Roles and Responsibilities. Decisions about how to set up plants and

allocate production are also critical to overall manufacturing performance. When

cross-plant material flows are absent—such as when the product portfolio is varied

or highly customized to specific regions—there will be limited cross-plant synergies.

In these cases, plants can be run independently, steered by centrally defined

performance metrics. But when materials flow across plants and knowledge and

standards are shared, a plant network with dedicated roles for each plant is the

optimal setup. For instance, if specific production skills are critical, make certain

plants lead plants or centers of excellence for particular processes or capabilities in

order to concentrate this knowledge, set standards, and share best practices.

Manufacturers can also get more from their production networks by matching asset

characteristics with the needs of specific products and customers. For instance,

some plants are designed to produce a small number of products at high volume

for greater economies of scale. Others are designed for flexibility, with short changeover and ramp-up times that are best suited for products with volatile or unpredictable demand. By defining plant roles, consolidating products with similar character-

T B C G

WS 4

istics, and exploring ways to reallocate products across the network, companies can

achieve greater cost savings, flexibility, and efficiency.

Managing the Tradeoffs

Each design choice involves tradeoffs that can affect cost, product quality, cycle

times, and service levels. Companies with a decentralized or divisional manufacturing organization, for instance, typically have a harder time sharing best practices

and can lose synergies. A centralized coordinating function can offset these drawbacks by sharing best practices across the company and creating consistent standards and metrics. In this way, a divisional setup with concentrated knowledge of

certain products or regions can coexist with unified standards and a high degree of

sharing best practices across the company. A divisional manufacturing setup can

also greatly complicate interactions with a centralized R&D unit and hamper

design-to-cost efforts. Companies can offset these drawbacks—and sharply reduce

production costs over time—by defining manufacturing requirements early in the

manufacturing process through better communication.

Each design choice

involves tradeoffs

that can affect cost,

product quality,

cycle times, and

service levels.

Some companies take more of an out-of-the-box approach to managing tradeoffs. A

microchip manufacturer with enormous cost pressures, for instance, had stringent

requirements for quality and process reliability. Moreover, because its business was

asset intensive, asset productivity and scale were critical. To meet these challenges,

the company made all its manufacturing plants identical, down to the smallest

detail, so that each one makes the same products in the same way—a rather

extreme approach to central governance. As a result, the company can diagnose

and fix problems quickly, and it can rapidly implement improvements. Its plant

network is also extremely flexible—production can be shied as needs, volume, or

economic conditions change, and any bottlenecks are short-lived.

Another example of an out-of-the-box approach to managing a tradeoff: An automobile manufacturer with a global production network wanted to avoid the excessive overhead and backlogs that can result from having headquarters steer the

plants and implement global standards inflexibly. The company decided to establish regional “mother plants” that support local projects, train staff, set up employee exchange programs, and manage five-year performance road maps. Headquarters can now focus on the bigger picture—developing major change programs that

the mother plants can implement.

Each company must decide which tradeoffs to make based on its individual situation,

markets, competitive environment, and industry benchmarks. Moreover, a company’s

organizational choices require the right people and skills to be truly powerful.

I

’ -, increasingly complex global environment, companies

must rethink not just their manufacturing operations but also their manufacturing organizations. The high-performance organization is lean, flexible, and strategically aligned. The right organization design, an engaged workforce, and effective

governance systems result in sustained manufacturing excellence—and a powerful

source of competitive advantage.

T H-P M O

About the Authors

Frank Lesmeister is a principal in the Düsseldorf office of The Boston Consulting Group and a

topic expert for manufacturing. You may contact him by e-mail at lesmeister.frank@bcg.com.

Daniel Spindelndreier is a partner and managing director in the firm’s Düsseldorf office and

coleader of BCG’s manufacturing topic. You may contact him by e-mail at spindelndreier.daniel@

bcg.com.

Michael Zinser is a partner and managing director in the firm’s Chicago office and coleader of

BCG’s manufacturing topic. You may contact him by e-mail at zinser.michael@bcg.com.

Acknowledgments

The authors would like to thank Katherine Andrews, Gary Callahan, Martha Craumer, Angela

DiBattista, and Pamela Gilfond for their contributions to the writing, editing, design, and production of this report.

For Further Contact

If you would like to discuss this report, please contact one of the authors.

T B C G

For a complete list of BCG publications and information about how to obtain copies, please visit our website at

www.bcg.com/publications.

To receive future publications in electronic form about this topic or others, please visit our subscription website at

www.bcg.com/subscribe.

© The Boston Consulting Group, Inc. 2011. All rights reserved.

6/11

Abu Dhabi

Amsterdam

Athens

Atlanta

Auckland

Bangkok

Barcelona

Beijing

Berlin

Boston

Brussels

Budapest

Buenos Aires

Canberra

Casablanca

Chicago

Cologne

Copenhagen

Dallas

Detroit

Dubai

Düsseldorf

Frankfurt

Geneva

Hamburg

Helsinki

Hong Kong

Houston

Istanbul

Jakarta

Johannesburg

Kiev

Kuala Lumpur

Lisbon

London

Los Angeles

Madrid

Melbourne

Mexico City

Miami

Milan

Minneapolis

Monterrey

Moscow

Mumbai

Munich

Nagoya

New Delhi

New Jersey

New York

Oslo

Paris

Perth

Philadelphia

Prague

Rio de Janeiro

Rome

San Francisco

Santiago

São Paulo

Seoul

Shanghai

Singapore

Stockholm

Stuttgart

Sydney

Taipei

Tel Aviv

Tokyo

Toronto

Vienna

Warsaw

Washington

Zurich

bcg.com