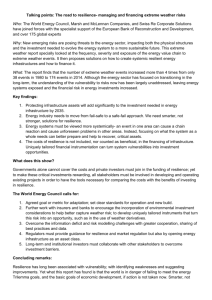

Market Systems for Resilience

advertisement