31295002156791

advertisement

A STUDY OF THE AUDITOR'S CONTEMPORARY

LEGAL HAZARDS AND.REMEDIAL ACTION

by

JAMES EDWARD SAMSON, B.B.A.

A THESIS

IN

ACCOUNTING

Submitted to the Graduate Faculty

of Texas Tech University in

Partial Fulfillment of

the Requirements for

the Degree of

MASTER OF SCIENCE

IN

ACCOUNTING

Approved

May, 1970

rs /Jô.í^

ACKNOWLEDGMENTS

I am deeply indebted to Professor Doyle Z. Williams

for his direction of this thesis and to the other members

of my committee, Professors Bill J. Bishop and Arthur T.

Roberts, for their helpful criticism.

11

TABLE OF CONTENTS

ACKNOWLEDGMENTS

ii

TABLE

31

I.

INTRODUCTION

.

1

The Increasing Scope of the Auditor's

Liability

1

Statement of Purpose and Scope

3

Statement of Purpose

3

Statement of Scope

3

Limitations of Study

....

3

Definition of Terms

4

An Overview of the Study

II.

6

HISTORICAL PERSPECTIVES OF THE AUDITOR'S

LEGAL LIABILITY

8

Auditor's Liability to the Client

8.

Craig v. Anyon

9

National Surety Corporation v. Lybrand

.

11

Auditor's Liability to Third Parties

by Common Law

Landell v. Lybrand

12

: . . . .

13

Ultramares Corp. v. Touche

14

State Street Trust Co. v. Ernst

15

0 'Connor v. Ludlam

17

Gammel v. Ernst and Ernst

19

Auditor's Liability to Third Parties

by Statute

111

20

IV

The Federal Securities Act of 1933 . . . .

20

The Federal Securities Exchange

Act of 1934

22

Summary

III.

25

SELECTED RECENT CASES CONCERNING THE AUDITOR'S

LIABILITY

27

Escott V. BarChris

Facts Surrounding the BarChris Case

28

...

28

Materiality

30

Due Diligence Defense

32

Review of Subsequent Events

33

Inquiry Procedures

34

Due Professional Care

36

Qualifications of the Public Accountant

.

U.S. V. Simon

38

38

Facts Pertaining to the Case

39

Issues Pertaining to the Case

41

Fischer v. Kletz

47

Annual Report Liability

49

Interim Statement Liability

51

Investment Corporation of Florida v.

Buchman

52

Rusch Factors, Inc. v. Levin

54

Facts of the Case

IV.

THE AUDITOR'S LEGAL LIABILITY IN THE FUTURE

Should the Accountant be Liable for

Negligence?

55

. .

60

60

Reasons for Not Extending the Auditors'

Liability

61

Objections to Extending the Accountants'

Liability

64

Benefits that Would Accrue to the Auditor

V.

SOLUTIONS TO THE LIABILITY PROBLEM

66

72

Reports

73

Working Papers

76

Pronouncements by the Profession

VI.

.

. . . .

78

Professional Competence

80

Statutory Relief

81

Agreements

82

Clients

82

Education

83

Resistance

83

Insurance'

83

SUMMARY AND CONCLUSIONS

86

Summary

86

Craig v. Anyon

National Surety Corporation v. Lybrand

86

.

87

Landell v. Lybrand

88

Ultramares Corp. v. Touche

88

State Street Trust Co. v. Ernst

89

0 'Connor v. Ludlam

89

Gammel v. Ernst and Ernst

89

BarChris

90

VI

Continental Vending

91

Yale Express

91

Investment Corp. of Florida v. Buchman

Rusch Factors v. Levin

Conclusions

.

92

92

92

Advantages to Extending the Accountant's

Liability

93

Steps the Accountant Can Take to

Mitigate This Increased Liability . . . .

94

SELECTED BIBLIOGRAPHY

97

CHAPTER I

INTRODUCTION

Since the turn of the century the growth of American

business has been phenomenal.

Because of the dramatic in-

crease in the complexity of business enterprises, it has

become increasingly difficult for the accountant to attest

to the fairness of financial statements.

The Increasing Scope of the Auditor's Liability

Independent Certified Public Accountants, employed by

directors or stockholders, have the responsibility to determine if the financial statements portray fairly the operations of the business.

During the early part of this century

the public accountant's liability for negligence or fraud

in performing the attest function was limited mainly to the

client.

This responsibility has been established by several

court decisions over the years. Within the last ten years

the courts have expanded the auditor's liability for gross

negligence to include third parties.

Because of these recent

landmark decisions the liability of the public accountant to

third parties has attained new dimensions.

If the present

trend in court decisions continues, the auditor's legal lia-.

bility to third parties will likely be expanded to include

ordinary negligence,-

With the trend of court decisions has come an increased

number of liability suits against the public accountant.

In

19 66 it was estimated that there were approximately one hundred suits litigated.

These suits have caused several prob-

lems to the public accountant and his profession.

First,

even if the accountant is acquitted, his reputation suffers

heavily as well as the reputation of his firm.

Secondly,

these suits are causing a loss of confidence in the accounting profession, and unless the profession remedies this situation, its usefulness to society will be limited.

There are several reasons, for the flood of suits, which

are described aptly in the following quotation:

(1) The hope of banks and other financial institutions to make accounting firms a source of salvage

when credit losses occur; (2) the general growth of

the American economy and the related increase in

loss potential in the event of a business failure;

and (3) the publicity accompanying the six million

dollar law suit against Peat, Marwick, Mitchell &

Co., the nation's largest public accounting firm,

brought by the two largest banks in the United

States, the Bank of America and the Chase Manhattan

Bank.2

To summarize these causes, it can be said that third parties

are trying to find a source for relief from losses they have

suffered, and lately this source has been the public accountant.

Constantine N. Katsoris, "Accountants' Third Party Liability—How Far Do We Go?" Fordham Law Review, XXXVI (December, 1967), 191.

p

"Potential Liability of Accountants to Third Parties

for Negligence," St. John's Law Review, XXXXI (1967), 597.

Statement of Purpose and Scope

Statement of Purpose

The chief objective of this study is to analyze court

decisions relating to the auditor's liability for the purpose

of determining the impact of these decisions upon the traditional concepts of the auditor's liability to third parties.

An additional objective is to provide steps the auditôr can

take to mitigate his exposure to liability claims resulting

from the recently expanded concepts of liability.

Statement of Scope

The scope of this study will include an examination of

several recent cases which have defined the auditor's liability to third parties and some ramifications of these cases.

Second, this study will include an analysis of the reasons

for the accountant's liability and suggest some remedies

which may assist in protecting the public accountant from

liable suits.

This investigation will also include a review

of literature and official pronouncements of the American

Institute of Certified Public Accountants (AICPA) and other

bodies as appropriate.

Limitations of Study

The scope of this study will be limited to the legal

responsibilities of the public accountant for financial statements.

This study will not include a discussion of the

accountant's liability for taxation matters.

Second, this

investigation will be limited to rulings by United States

courts.

Third, this investigation will concentrate on recent

developments which have affected the auditor's legal liability.

Fourth, this study will include cases which pertain

directly to the public accountant and not decisions pertaining to other professions.

Finally, the investigation will

be limited to cases which are of significant impact to the

accounting profession to clearly establish precedent.

Definition of Terms

For this study selected relevant terms and phrases will

be used in accordance with the following definitions:

Auditor, accountant, pub1ic accountant, and Certified

Public Accountant as used in this paper will refer to a

Certified Public Accountant in public practice.

Financial statements refer to the income statement and

balance sheet as well as any other statements, certified by

the auditor, that are included in the annual report.

Auditor's report is a written statement by the auditor

expressing the nature and scope of his examination and his

opinion concerning the fairness of the financial statements.

Auditing standards as used herein refer to the auditor's

professional qualities and "the judgment exercised by him in

the performance of his examination and in his report."

Negligence is "the failure of an auditor to perform, or

report upon, a professional engagement with the care a reasonable prudent man would exercise in the circumstances."

Gross negligence is "a reckless or extreme departure

from the standard of care a reasonable, prudent auditor would

exercise under the circumstances."

Fraud is a deliberate deception by the auditor when

g

rendering an opinion on financial statements.

Privity of contract means "a mutual or successive relationship to the same rights of property legalized by contract."^

Third parties as used herein refers to any investors who

rely on the financial statements and any creditors of the

business entity.

3

American Institute of Certified Public Accountants,

"Auditing Standards and Procedures," Statements on Auditing

Procedure No. 33 (New York: American Institute of Certified

Public Accountants, 1963), p. 15.

Robert M. Trueblood, "Legal Liability--A View From the

States," Accountancy (Eng.), LXXVII (September, 19 67), 580.

c

Samuel Thurston Montgomery, "Accountants' Liability to

Third Parties" (unpublished Master's thesis, Texas Tech University, 19 69), p. 6.

R. F. Salmonson, "A Prophetic Analogy," The Accounting

Review, XXXVII (July, 1962), 502.

•7

Funk and Wagnalls Encyclopedic College Dictionary (New

York: Funk & Wagnalls, 1968), p. 1073.

6

Common law is the law developed by the courts which is

q

not covered by written law or the Constitution.

Statutory law includes written law, such as the Consti9

tution and laws passed by legislative bodies.

An Overview of the Study

In order to obtain a historical perspective, the study

will first examine several selected cases which have established the auditor's legal liability in previous years. This

examination will not include all cases which have been decided, but rather cases in which the courts have clearly

established the auditor's responsibility by a so-called landmark decision.

The second chapter will also contain a brief

discussion of the Securities Acts of 1933 and 1934 as they

have established the auditor's responsibility by statute.

The next section of the study, chapter three, will examine selected cases decided in the 1960's which in many

instances have redefined the auditor's liability.

There will

be a detailed review of these cases because of their extreme

importance in understanding the auditor's liability at

present.

Chapter four will include a discussion of the

^Essel R. Dillavau, et al., Principles of Business Law

(Englewood Cliffs, N.J.: Prentice-Hall, I n c , 1964), p. 105.

^lbid., p. 106.

^

implications of the recent court decisions and their effect

upon the accounting profession.

It will also include an

analysis of the benefits to be gained by an increased liability to both clients and third parties.

Based upon the foregoing analysis, the fifth chapter

will seek to distill the criteria for mitigating the auditor's

liability.

The last chapter will summarize the important court

decisions reached in this decade and review the future implications of these decisions.

In conclusion, the study will

present the steps the Certified Public Accountant may take

to minimize the risk associated with performing work of an

auditing nature.

CHAPTER II

HISTORICAL PERSPECTIVES OF THE AUDITOR'S

LEGAL LIABILITY

Historically, auditors have been held liable to clients

and third parties by both common and statutory law.

The

common or court decided law has evolved for several centuries.

This chapter will be concerned with United States cases from

the turn of the century to 19 60.

f

The common law liability

of the auditor has been divided into two categories, liability to clients and liability to third parties.

This division

has been made because of the significant difference in the

responsibility the accountant has to these parties.

The third section of this chapter consists of the auditor's liability to third parties by statute.

The examinatiop/'

has been limited to the sections of the Securities Acts of

19 33 and 19 34 which pertain to the auditor's liability and

does not contain a discussion of any cases based on the

Securities Laws.

Because of their recent origin, cases in-

volving the Securities Laws will be investigated in the next

chapter.

Auditor's Liability tothe Client

/

V

The auditor's liability to his client is founded on a

contractual relationship which may be written or oral.

8

This

contract does not assure the client that the audit will uncover defalcations, but rather that the audit will be performed with reasonable care and diligence.

The accountant

is liable to his client "for negligence, bad faith or dishonesty, but not for losses consequent upon mere errors of

judgment."

A review of several cases as decided by the

courts may be helpful in understanding more fully the CPA's

responsibility to his client.

Craig v. Anyon

In this case the plaintiffs were members of a firm of

brokers in stocks and commodities.

The defendants were en-

gaged to audit the company's books quarterly from 1913 to

1917.

In May 1917 it was discovered that an employee in

charge of their commodities department had swindled over one

million dollars.

The plaintiffs alleged that the auditor was

negligent and had he not been, the fraud would have been

discovered.

The auditor was found guilty of negligence and assessed

a fine of $2,000, the amount paid as compensation for the

accountant's services.

The principal issue to be decided

was whether the accountant's negligence was the cause of the

"^^illiam L. Prosser, Prosser or Torts (St. Paul:

Publishing Co., 1941), p. 673.

West

•'•-'•Craig v. Anyon, 212 App. Div. 55, 208 N.Y. Supp. 259

(1926).

10

loss or whether the client was responsible because of contributory negligence.

To answer this question the court

considered the auditor's examination.

The auditor had not

confirmed the accounts receivable nor had he made any attempt

to determine the status of the open accounts.

In considering the client's negligence the court found

that the books for the commodities department were maintained

by the head of the department, Mr. Moore.

This procedure

was objected to by the auditor because of the lack of internal control.

In reaching a decision the court stated the

following:

We think the damages cannot be said to flow naturally and directly from defendants' negligence or

breach of contract. Plaintiffs should not be allowed to recover for losses which they could have

avoided by the exercise of reasonable care. . . .

The plaintiffs in effect contend that defendants

are chargeable with negligence because of failure

to detect Moore's wrongdoing, wholly overlooking

the fact that, although they were closely affiliated with Moore, who was constantly under their

supervision, they were negligent in failing properly to supervise his acts or to learn the true

condition of their own business and to detect his

wrongdoing.1^

The court also said that public accountants are expected

to use "such skill in the performance of their agreements as

reasonably prudent, skillful accountants would use under the

„13

circumstances.

Ibid., p. 57.

13

Ibid., p. 58.

11

In conclusion, the court followed the theory that the

auditor was liable to the extent of compensation he received.

The client is liable for any loss in excess of the auditor's

fee because of his own negligence.

However, this theory is

not always applied as demonstrated in the National Surety

Corporation case which follows.

National Surety Corporation v. Lybrand

The plaintiff in this case was a surety company which

had refunded Hable and Streglitz, a brokerage firm, for

losses sustained through thefts by the cashier in the main

office.

The defendants were three different public account-

ing firms who had audited the brokerage firm from 19 28 to

1933.

The plaintiff charged that the accountants were guilty

of "negligence in the conduct of their audit and fraud in the

alleged misrepresentation of material facts in their reports."

In the trial court's decision the judge dismissed the

case on the grounds that "the Court is unable to discover

anything in the testimony indicating a violation of the obligations of an expert accountant" and that "the principle laid

16

down in Craig v. Anyon is the one to be applied here."

•^"^National Surety Corporation v. Lybrand, 256 App. Div.

226, 9 N.Y. S. 2d 554 (1939).

•'•^lbid. , p. 228.

•'•^lbid. , p. 229.

12

The principle the judge referred to is "that the loss incurred could not be said to flow naturally and directly from

the defendants' negligence" because of the contributory negligence of the brokerage firm.

This decision was appealed and reversed and a new trial

ordered.

On reaching the decision to reverse the trial court

decision, the appellate court considered the question of contributory negligence at length.

The appellate court had the

following to say concerning contributory negligence:

Accountants, as we know, are commonly employed for

the very purpose of detecting defalcations which

the employer's negligence has made possible. Accordingly, we see no reason to hold that the accountant is not liable to his employer in such cases.

Negligence of the employer is a defense only when it

has contributed to the accountant's failure to perform his contract and to report the truth.-^^

Thus, it can be said that the accountant will be held

responsible to his employer in most cases.

Only in extreme

circumstances where the contributory negligence of the employer has led directly to misrepresentations by the accountant, will the accountant be released of his liability.

Auditor's Liability to Third Parties

*^

by Common Law

The accountant's liability to third parties has been

limited mainly to fraud because of the lack of a contractual.

•^'^lbid. , p. 230.

^^lbid., p. 233.

13

relationship.

However, in some cases where the auditor has

known in advance that a third party would rely upon his

opinion the court has held him responsible for negligence.

In order to understand more fully the accountant's liability

to third parties several cases will be discussed.

19

Landell v. Lybrand

This case is concerned with a suit brought against a

certified public accounting firm by a third party which had

relied on the financial statements.

The plaintiff alleged

that the financial statements were misleading and that he

relied on them when making his investment.

He also charged

that the auditors were negligent in the perfonnance of their

duties and consequently liable for the loss he sustained.

The courts found for the accountants stating the following:

There were no contractual relations between the

plaintiff and defendants, and, if there is any

liability from them to him, it must arise out of

some breach of duty, for there is no averment that

they made the report with intent to deceive him.

The averment in the statement of claim is that the

defendants were careless and negligent in making

their report; but the plaintiff was a stranger to

them and to it, and, as no duty rested upon them

to him, they cannot be quilty of any negligence of

which he can complain.20

19Landell v. Lybrand, 264 Pa. 406, 107 A. 783, 8 A.L.R.'

461 (1919).

^^John H. Myers, Auditing Cases (Chicago, Illinois:

Northwestern University Press, 1964), p. 15.

14

Ultramares Corp. v. Touche^-*In this case the Certified Public Accountants audited

the books of Fred Stern and Company and prepared thirty-two

copies of the balance sheet.

The auditors were aware that

the certified balance sheet was to be presented to several

banks and other creditors.

The plaintiff claimed that he

had relied on the balance sheet and had loaned substantial

amounts of money to Fred Stern and Company.

The plaintiff's

case was based on the failure of the auditor to discover an

overstatement of the accounts receivable by $950,000 and an

understatement of accounts payable by $300,000. Because the

auditor had failed to discover these mistakes the plaintiff

charged that he was guilty of fraud and negligence.

The Court of Appeals found that the accountant was

guilty of negligence,' but because of the lack of a specific

contract between the plaintiff and the defendant there did

not exist any liability on the accountant's part.

The court

stated the following in its opinion:

If liability for negligence exists, a thoughtless

slip or blunder, the failure to detect a theft or

forgery beneath the cover of deceptive entries,

may expose accountants to a liability in an indeterminate amount for an indeterminate time to an

indeterminate class. The hazards of a business

conducted on these terms are so extreme as to

21

Ultramares Corporation v. Touche, 255 N.Y. 170, 174

N.E. 441 (1931).

15

enkindle doubt whether a flaw may not exist in

the implication of a duty that exposes to these

consequences.22

However, the court went on to discuss how the act of

fraud might be inferred from a negligence act:

Our holding does not emancipate accountants from

the consequences of fraud. It does not relieve

them if their audit has been so negligent as to

justify a finding that they had no genuine belief

in its adequacy, for this again is fraud. It

does no more than say that, if less than this is

proved, if there has been neither reckless misstatement nor insincere profession of an opinion,

but only honest blunder, the ensuing liability

/

for negligence is one that is bounded by the con-tract, and is to be enforced between the parties

by whom the contract has been m.ade. We doubt

whether the average business man receiving a

certificate without paying for it, and receiving

it merely as one among a multitude of possible

investors, v/ould look for anything more.23

From the Ultramares Case several conclusions can be

drawn:

(1) that ordinary negligence on the part of the ac-

countant will not result in a liability to third parties,

and (2) that gross negligence (reckless misstatement or insincere profession of an opinion) can be inferred as fraud

and hence the accountant would be liable.

^24

State Street Trust Co. v. Ernst

In this case the accountant had audited the PelzGreenstein Company for 1928.

Pelz-Greenstein was engaged in

^^lbid., p. 444.

^^lbid., p. 445.

24State Street Trust Co. v. Ernst, 278 N.Y. 104, 15

N.E. 2d 416 (1938).

16

the factoring business and their working capital was supplied

by seventeen banks to whom an amount of $4,275,000 was owed

on December 31, 1928.

The plaintiff in this case was one of

the banks and claimed that he had relied on the financial

statements prepared by the accountant when making the loan

to Pelz-Greenstein.

He further claimed that the auditor was

grossly negligent in the performance of his audit because of

an inadequate review of the allowance for doubtful accounts.

The facts surrounding the case are as follows:

1.

The accountant prepared eleven copies of the PelzGreenstein financial statements of which ten copies

were to be used to obtain credit.

The standard

short form report was attached to each.

2.

Thirty days later the accountants issued a long form

report which was submitted to only the client.

3.

The plaintiff alleged that the long form report contained material information which should have been

revealed to the creditors.

4.

The accountants had accepted the client's word that

the provision for bad debts was sufficient and had

not investigated the account.

The actual loss on

doubtful accounts amounted to $215,000.

In deciding this case the Courts of Appeals cited the

Ultramares decision:

We have held that in the absence of a contractual

relationship or its equivalent, accountants cannot

17

be held liable for ordinary negligence in preparing a certified balance sheet even though they are

aware that the balance sheet will be used to obtain credit (Ultramares Corp. v. Touche, 255 N.Y.

170). Accountants, however, may be liable to third

parties, even where there is lacking deliberate or

active fraud. A representation certified as true

to the knowledge of the accountant when knowledge

there is none, a reckless misstatement, or an opinion based on grounds so flimsy as to lead to the

conclusion that there was no genuine belief in its

truth, are all sufficient upon which to base liability. A refusal to see the obvious, a failure •

to investigate the doubtful, if sufficiently gross,

may furnish evidence leading to an inference of

fraud so as to impose liability for losses suffered

by those who rely on the balance sheet.25

^^

The court further stated that because the accountant failed

to inform the creditors of the long form report and failed

to investigate the doubtful accounts, he was guilty of gross

negligence.

26

O'Connor v. Ludlam

This case was brought by a group of stockholders who

had purchased the preferred stock of G. L. Miller and Company.

The plaintiff purchased the stock during 1925 and 1926 and

the corporation was adjudicated bankrupt in 1926.

This suit

did not come to trial until 1934, following the final decision in the Ultramares case.

The plaintiff brought suit

against the accountant for fraud instead of negligence because

25State Street TrustCo. v. Ernst, op. cit., p. 111.

^^O'Connor v. Ludlam, 92 F. 2d 50 (2d Cir.), certiorari

denied, 302 U.S. 758 (1937).

18

of the Ultramares decision.

The Circuit Court of Appeals

upheld the trial court decision in finding for the defendant

and certiorari was denied by the Supreme Court of the United

States.

The prominent issues on which the plaintiff based his

case were:

1.

2.

3.

4.

The audit and balance sheet were claimed to be

"intentionally fraudulent in not adequately disclosing the amount of cash held in trust."

Payments made by Miller & Company to complete

the construction of mortgaged buildings were

falsely shown in the balance sheet to be

"Secured."

Miller & Company itself guaranteed to bondholders

the completion of buildings under construction,

and the balance sheet made no mention of such contingent liabilities.

The defendants made a false certificate as to the

earnings of Miller & Company.27

In commenting on the definition of fraud when applied to the

accountant the Circuit Court stated the following:

. . . fraud may be established by showing that.a

false representation has been made, either knowingly, or without belief in its truth, or in reckless disregard of whether it be true or false; and

that the issue was whether the defendants had an

honest belief that the statements made by them were

true. "If they did have that honest belief, whether

reasonably or unreasonably, they are not liable. If

they did not have an honest belief in the truth of

their statements, then they are liable, so far as

this third element [scienter] is concerned."28

Saul Levy, Accountant's Legal Responsibility (New York:

American Institute of Accountants, 1954), p. 41.

28O'Connor v. Ludlam, op. cit., p. 53.

19

The Circuit Court concluded that the jury had been properly

instructed and that the verdict for the accountant should

not be reversed.

Gammel v. Ernst and Ernst

The plaintiff in this case, President of Midway Creamery

Corporation, entered into agreement with Sanitary Farm Dairy

to merge the two corporations.

437 shares of common stock.

The plaintiff was to receive

The newly formed corporation

was to pay the plaintiff a sum equal to "twelve times the

net earnings per share of said common stock for the preceding

30

twelve months."

In the event the parties could not agree

on the net earnings per share, an independent auditor was to

be hired to determine the earnings.

In June of 19 4 6 the auditors completed their review and

determined that the reported earnings for 1944 were

$180,602.90 before taxes. On August 6, 1946, the plaintiff

filed suit against the auditors "for bias, gross mistake,

31

and fraud."

The court found that the audit by Ernst and

Ernst contained fraud and the actual earnings for 1944 were

$227,475.15.

In reaching a decision the court stated that

the accountant could not be classified as a quasi arbitrator

29 Gammel v. Ernst and Ernst, 54 ALR 2d 316 (1955).

-^^lbid., p. 319.

^•'•Ibid., p. 320.

20

immune from liability.

The court went on to say that the

standards of reasonable care which apply to lawyers, doctors,

architects, and engineers in furnishing skilled services for

compensation apply to the public accountant.

Auditor's Liability to Third Parties by Statute

In addition to liability by common law, the auditor has

a civil and criminal liability to third parties by statutory

law.

The auditor's liability to third parties by statute is

derived mainly from the Federal Securities Act of 1933 and

the Federal Securities Exchange Act of 1934. The passage of

these Acts was brought about primarily by the stock market

crash of 1929.

Many of the listed companies had written up

their assets and distorted earnings in an effort to present

a favorable financial picture.

The Securities Acts were passed with the intention of

providing the general public with reliable financial information.

To enforce these Acts the Securities Exchange Commis-

sion was established to review the financial information

published by publicly listed companies.

32

The Federal Securities Act of 1933

The primary purpose of the Federal Securities Act of

1933 was to provide full and fair disclosure of securities

^^Federal Securities Act of 1933, 48 Stat. 74 (1933), as

amended, 15 U.S.C. ## 77a-77aa (1964).

21

issued to the public by companies in interstate and foreign

commerce.

To achieve this purpose the Securities and Ex-

change Commission (SEC) requires the filing of a Registration

Statement with the issuance of securities.

The Registration

Statement contains both historical and financial inform.ation

about the corporation.

Any material fact concerning the

corporation must be disclosed within the Registration Statement or the accountant can be held liable to the public.

The concept of materiality is defined as follows by the SEC:

"The information required to those matters as to which an

average prudent investor ought reasonably to be informed

33

before purchasing the security."

The Securities Act of 1933 creates a responsibility for

the auditor to the investing public, but does not provide

the creditors of the company protection.

Section 11(a)

establishes the auditor's liability to the public as follows:

In case any part of the registration statement,

when such part became effective, contained an

untrue statement of a material fact or (which has)

omitted to state a material fact required to be

stated therein or necessary to make the statements therein not misleading, any person acquiring such security . . . may, either at law or in

equitv, in any court of competent jurisdiction,

sue.^^

^•^Louis H. Rappaport, SEC Accounting Practice and Procedure, Revised Printing (New York: The Ronald Press Company, 1959), p. 212.

^"^Federal Securities Act of 1933, op. cit., 82 #77K(a).

22

The auditor, as a defense, must prove that he had reasonable

grounds to believe that the financial statements were true

and that there were no omissions of material facts which

would have affected the investor's judgment.

The Securities Act of 1933 has significantly expanded

the auditor's liability to third parties and in so doing

has negated the common law decisions which have protected

the accountant.

Secondly, the burden of proof has been

placed upon the auditor rather than the plaintiff.

Thirdly,

the accountant must prove that the loss sustained by the

plaintiff was not caused by the omission of material facts

within the financial statements.

Under common law the

plaintiff is required to show that he relied upon the financial statements and that they were the proximate cause of

his loss.

Finally, the public accountant is liable "not

only as of the date of the financial statements, but beyond

that, as of the time when the Registration Statement becomes

effective."^^

The Federal Securities Exchange

Act of 1934^^

The Securities Act of 1934 was passed to extend the

coverage of the 1933 Act.

The 1934 Act provides for the

Levy, op. cit., p. 47.

^^Federal Securities Exchange Act of 1934, 48 Stat. 881

(1934) as amended, 15 U.S.C. ##78a-78bb (1964).

23

regulation of the national exchanges and over-the-counter

markets.

It requires companies listed on the national ex-

changes to file annual reports with the SEC.

Prior to the

passage of the Securities Exchange Act of 1934 the Federal

Trade Commission enforced the Securities Act of 19 33.

The

19 34 Securities Act established the Securities and Exchange

Commission for the purpose of enforcing the provisions of

the 1933 and 1934 Securities Acts.

Section 18 of the 1934 Act protects the public from

misleading statements certified by the auditor.

The section

states that:

Any person who shall make or cause to be made any

statement in any application, report, or document

filed pursuant to this chapter or any rule or regulation thereunder . . . which statement was at the

time and in the light of the circumstances under

which it was made false or misleading with respect

to any material f'act, shall be liable to any person (not knowing that such statement was false or

misleading) who, in reliance upon such statement,

shall have purchased or sold a security at a price

which was affected by such statement, for damages

caused by such reliance, unless the person sued

shall prove that he acted in good faith and had no

knowledge that such statement was false or misleading.^'

There are several significant differences between the

1933 Act and the 1934 Act.

First, the 1933 Act protects

only the buyer of the securities, whereas the 1934 Act

^"^Federal Securities Exchange Act of 1934, 48 Stat. 881

(1934), as amended, 15 U.S.C. ##78a-78hh (1934), pp. 897-98,

78r(a) .

24

protects both the buyer and the seller.

Second, under the

19 34 Act the accountant is not obligated to extend his examination beyond the completion date of the audit.

The 19 34 Act requires that the Registration Statement

be accurate and not misleading "at the time and in the light

of the circumstances under which it was made."^^ Therefore,

the accountant cannot be held liable for events subsequent

to the signing of the Registration Statement.

Third, the 1934 Act provides that the plaintiff must

prove that he relied upon the financial statements and that

they were the proximate cause of his injury.

Under the 1933

Act the accountant had to prove that the loss by the plaintiff was not caused by the omission of material facts within

the financial statements.

Fourth, under the 19 34 Act the plaintiff does not have

to prove negligence or fraud by the auditor.

The auditor may

use as a defense the fact that he "acted in good faith and

had no knowledge that such statements were false or misleading."

Therefore, it would seem that the accountant would

not be liable for negligence provided he had acted in good

faith.

^^Spencer Gordon, "Liability of Accountants Under Securities Exchange Act of 1934," The Journal of Accountancy, LVIII

(October, 1934), 257.

Levy, op. cit., p. 50.

25

Summary

In summarizing the historical respects of the accountant's liability the following major points should be noted.

The auditor is responsible to his client to perform the

audit with the ordinary care a reasonable, prudent accountant

would use under the circumstances.

Should the auditor fail

to perform the audit in this manner he will be liable to the

client for negligence or fraud.

In cases where contributory

negligence by the client has led directly to misrepresentations by the accountant, the auditor will be responsible only

to the extent of the audit fee.

The auditor, because of the lack of a contractual relationship, will not be held liable to third parties for ordinary negligence.

Only in cases where the accountant has made

a reckless misstatemerit or an insincere profession of an

opinion will he be liable to third parties.

Thus, the ac-

countant will be responsible to third parties when.the negligences is sufficiently gross as to infer fraud.

As a defense

the auditors must prove that they "had an honest belief that

40

the statements made by them were true."

Also, it should

be noted that the auditor is subject to the same standards as

doctors, lawyers, architects, and engineers.

The Securities Act of 1933 places responsibility on the'

O'Connor v. Ludlam, op. cit., p. 53.

26

accountant for an untrue statement of a material fact or

omission of a material fact.

The 1933 Act also extends the

auditor's responsibility to the effective date of the Registration Statement.

Under the Securities Exchange Act of 1934 the accountant is liable to any person that relied upon his statements

when purchasing or selling securities.

As a defense the

auditor must prove that "he acted in good faith and had no

knowledge that such statements were false or misleading. "'^-'The 1934 Act also releases the auditor of liability subsequent to completion of his examination.

Federal Securities Exchange Act of 1934, op. cit.,

pp. 897-98, 78r(a).

CHAPTER III

SELECTED RECENT CASES CONCERNING

THE AUDITOR'S LIABILITY

Within the decade of the sixties the accountant's responsibility for financial statements was expanded in almost

every conceivable direction.

First, accountants were found

guilty of negligence under the Securities Act of 1933 and

the judge elaborated upon the concept of materiality.

Second,

accountants were convicted of fraud under the Securities Exchange Act of 1934 for preparing financial statments which

were false and misleading.

Third, the auditor's responsi-

bility may be expanded to include a perpetual liability for

the financial statements.

Another inroad was made on the

auditor's legal responsibility when a State Supreme Court

ruled that accountants can be liable to third parties that

they knew would rely upon the financial statements. This

decision was based on common law rather than statutory law

as in the preceding cases.

In another case the extent of

the auditor's liability to knov/n third parties was defined.^

The court stated that the accountant is liable for damages

which the third party suffered when relying on the financial

statements.

Thus, it is evident that a thorough investiga-

tion of these precedent setting cases is necessary to

27

28

ascertain the present extent of public accountants' liability for financial statements.

Escott V. BarChris"^^

The BarChris case was one of the most significant cases

ever tried under the Securities Act of 1933.

This case was

the first to be brought under Section 11 of the Securities

Act of 1933.

Judge McLean's opinion established new standards

for materiality, subsequent period events, qualifications of

the auditor, and extended the auditor's liability to include

negligence to third parties.

Facts Surrounding the BarChris Case

The BarChris Construction Company was primarily engaged

in the construction of bowling alleys and participated in the

bowling alley boom frôm 1956 to 1960. Sometime between 1961

and 19 62 the market became saturated and BarChris, because

of over-expansion, was forced to declare bankruptcy.

To finance construction of the bowling alleys, BarChris

accepted notes for the balance.

The notes were normally dis-

counted to a bank, thus becoming a contingent liability on

BarChris's balance sheet.

To help finance operations BarChris

made a public offering of common stock and later an offering

42 cott V. BarChris Construction Corporation, 283 F.

Es

Supp. 643 (1968)

29

of debentures.

In October 19 62 BarChris defaulted on the

interest payment to tlie debenture holders and on October 25,

19 62, the plaintiffs filed suit alleging:

. . . that the registration statement with respect

to these debentures filed with the Securities and

Exchange Commission, which became effective on

May 16, 19 61, contained material false statements

and material omissions.43

Judge McLean made an extensive review of the registration statement and concluded it contained false and misleading statements.

In reaching his decision the judge placed

particular emphasis on the matter in v/hich the proceeds of

the debentures were employed.

The net proceeds of the debentures which amounted to

$3,202,298.85 were deposited in a new account at the Irving

Trust Company.

The purpose of the sale of the debentures

was to finance the construction of a new plant and to develop a new equipment line.

Shortly after depositing the

proceeds, withdrawals totaling $1,379,000 were made.

The

purpose of the v/ithdrawals was to repay loans from the officers of the company and construction costs incurred in preceding months.

It v/as also discovered that as of May 19 61

BarChris had borrowed $600,00 0 and held up payments to creditors totaling $400,000.

These factors were not mentioned in

the prospectus, nor was the fact that approximately 60

^"^lbid., p. 644.

30

percent of the net proceeds from the debentures would be used

"in paying prior debts incurred as a result of alley construction already undertaken. "^"^ Because of these and other

factors, the judge concluded that the BarChris prospectus

was misleading.

However, for accountants to be held respon-

sible for negligence under the 19 33 Securities Act, the misstatements must be of a material amount.

Materiality

Judge McLean's decisions concerning materiality are of

importance because "they present difficult judgments on

actual dollar amounts and, more significantly, because the

judge expanded the criteria for determining materiality." 45

The judge considered each issue separately to determine

its significance.

Table 1 presents the relevant figures on

which Judge McLean based his decision.

In considering the question of materiality the court

relied.on a definition from an earlier case:

. . . a fact which if it had been correctly stated

or disclosed would have deterred or tended to deter the average prudent investor from purchasing

the securities in question.46

^"^lbid., p. 657.

^^Douglas R. Carmichael, "The Auditor's Statutory Liability to Third Parties," The Texas Certified Public Accountant, XXXVIII (October, 1968), 5.

"^^lbid., p. 8.

31

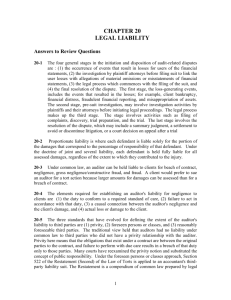

TABLE 1

RELEVANT FIGURES FROM BARCHRIS'S FINANCIAL STATEMENTS

BALANCE SHEET (19 60)

Current Assets

Current Liabilities

Current Ratio

INCOME STATEMENT (19 60)

Sales

Net Operating Income

Earnings Per Share

CORPORATIVE EARNINGS (19 59)

Sales

Net Operating Income

Earnings Per Share

Source:

REPORTED

ACTUAL

$4,524,021

2,413,867

1.9

$3,924,000

2,478,000

1.6

$9,165,320

1,742,801

75 cents

$8,511,420

1,496,196

65 cents

$3,320,121

441,103

33 cents

Douglas R. Carmichael, "The Auditor's Statutory

Liability to Third Parties," The Texas Certified

Public Accountant, XXXVIII (October, 1968), 5.

The judge realized that the definition was actually indeterminate.

Since no one knows what moves or does not move the

mythical "average prudent investor," it comes down

to a question of judgment, to be exercised by the

trier of the fact as best he can in the light of

all the circumstances.47

The court ruled that the misstatements within the income

statement were not misleading.

In so finding Judge McLean

reasoned as follows:

These debentures were rated "B" by the investment

rating services. They were thus characterized as

"^"^lbid.

32

speculative, as any prudent investor must have

realized. It would seem that anyone interested in

buying these convertible debentures v/ould have

been attracted primarily by the conversion feature,

by the growth potential of the stock. The growth

which the company enjoyed in 19 60 over prior years

was striking even on the corrected figures. It is

hard to see how a prospective purchaser of this

type of investment would have been deterred from

buying if he had been advised of these comparatively minor errors in reporting 19 60 sales and

earnings.48

However, the judge ruled that the over-statement of the current assets and the under-statement of the current liabilities was of a material amount even though the securities

were presumed to be growth oriented.

There are several significant features of Judge McLean's

decision concerning materiality.

1.

In determining the significance of a misstatement

the amount is not the only determinate factor.

2.

The court placed considerable weight on the purpose

for which the investor purchased the securities.

Due Diligence Defense

Under the Securities Act of 1933 the auditor is liable

for negligence provided he cannot establish his innocencé by

use of the due diligence defense.

To sustain this defense

the auditor must prove that he made a reasonable investigation and that there were no material omissions from the

Ibid.

33

registration statement.

In considering the auditor's defense

the court contemplated several technical auditing questions.

Review of Subsequent Events

The auditor is required by statutory law to make a review of events which have taken place between the date of

the financial statements and the effective date of the registration statement.

The purpose of this review is:

. . . to ascertain whether any material change has

occurred in the company's financial position which

should be disclosed in order to prevent the balance

sheet figures from being misleading. The scope of

such review, under generally accepted auditing standards, is limited. It does not amount to a complete audit.49

The court found that Peat, Marwick, Mitchell & Co.'s

(PMM) program conformed to generally accepted auditing standards and included the following:

1. Review minutes of stockholders, directors

and c o m m i t t e e s . . . .

2. Review latest interim financial statements

and compare with corresponding statements of preceding year. Inquire regarding significant variations and changes.

4. Review the more important financial records

and inquire regarding material transactions not in

the ordinary course of business and any other significant items.

' e'. 'lnquire as to changes in material contracts....

^^lbid., p. 9.

34

^^rnÍn;^-.^?'^''^^^ ^^ ^° ^""^ significant bad debts or

been Sade

^''^^''^^

^^^ ^^^^h provision has not

Kni^í- ^''^V^^^ as to . ; ; Aewly discôvêr^d'liabilities, direct or contingent. . . .50

Judge McLean concluded that the auditor had failed to carry

out the steps required by the S-1 review.

The accountants

had failed to read the prospectus, read any contract documents, read the minutes of executive committee meetings, or

éxamine financial records other than the trial balance.^^

The judge also stated that there were sufficient danger signals within the documents the auditor examined to require

further investigation.

Another auditing question which the

court considered at length was the inquiry procedures employed by the auditor.

Inquiry Procedures

The court criticized the auditor for being too easily

satisfied with the ansv/ers he received to questions regarding

the subsequent period events.

The judge stated:

He [the auditor] asked questions, he got answers

which he considered satisfactory, and he did

nothing to verify them.

. . . He was too easily satisfied with glib answers

to his inquiries.

It is not always sufficient merely to ask questions.52

50

p. 658. Escott V. BarChris Construction Company, op. cit..

51Carmichael, op. cit., p. 10.

Escott V. Barchris Construction Company, op. cit..

659.

35

An accountant is required by the third standard of

field work to obtain

. . . sufficient competent evidential matter

through inspection, observation, inquiries and

confirmations to afford reasonable basis for an

opinion regarding the financial statements under

examination.53

Judge McLean stated that for the public accountant to

merely ask questions is not sufficient.

The auditor must be

able to verify, or test the answer so as to have a basis for

an opinion.

There are several examples of insufficient verification

in the BarChris case.

One instance was when the auditor in-

quired about a certain Capital Lanes.

The auditor testified

that he was told that Capital Lanes was not yet in existence,

but was the site of a prospective location.

In actuality

Capital Lanes existed, but under the name of Heavenly Lanes.

The court stated that the accountant should have been aware

to this misstatement because of insurance payments which

were being made on Capital Lanes.

By this maneuver the offi-

cers of BarChris were able to include the sales and profits

of this alley in the income statement and not include the

liability on the balance sheet.

In reaching a conclusion concerning the accountant's

inquiry procedures, the court stated that "Accountants should

^^American Institute of Certified Public Accountants,

"Auditing Standards and Procedures," op« cit., p. 34.

36

not be held to a standard higher than that recognized in

their profession.

I do not do so here."^"^ The judge ruled

that the inquiry was inadequate and the accountant liable

for the misstatements.

Due Professional Care

The auditor, under generally accepted auditing standards

is required to exercise "due professional care . . . in the

performance of the examination and the preparation of the

report." 55 This standard requires the auditor to extend his

examination if his suspicions are aroused during his investigation.

In the BarChris case an example is given of the criteria

used to determine whether the auditor exercised due professional care.

A factoring institution made a temporary loan

in December 19 60 to BarChris to increase their cash balance

on the December 31, 19 60, financial statements. Although

extended auditing procedures by PMM would have revealed the

payment v/as conditional, the court held that "it would be

contrary to reason to require the auditor to examine all of

^"^Escott V. BarChris Construction Company, op. cit.,

p. 665.

^^American Institute of Certified Public Accountants,

"Auditing Standards and Procedures," op. cit., p. 15.

^

/

37

BarChris's correspondence files when he had no reason to

suspect any irregularity."^^

Due profession care by the auditor is required in the

^

preparation of the working papers as well as the performance

of the examination.

The work papers should contain sufficient

documentation to "support the auditor's opinion and his representation as to compliance with auditing standards."^^

When reviewing PMM's work papers Judge McLean found

several instances in which there was insufficient documentation to support an opinion by the accountant.

In one in-

stance the auditor testified that he had based his computation of BarChris's contingent liability on an agreement

between BarChris and the factor.

The court ruled that the

computation of the liability was incorrect and found no evidence of any agreement between the factor and BarChris

within the working papers.

This example displays vividly

the importance of complete and accurate working papers which

are necessary to limit the auditor's responsibilities to

third parties.

Escott V. BarChris Construction Company, op. cit..

p. 666.

57American Institute of Certified Public Accountants,

"Auditing Standards and Procedures," op. cit., p. 23.

38

Qualifications of the

Public Accountant

Generally accepted auditing standards require that the

audit "is to be performed by a person or persons having

adequate technical training and proficiency as an auditor."^^

In reviewing the auditor's qualifications Judge McLean

stated the following:

He was not yet a C.P.A. He had no previous experience with the bowling industry. This was his

first job as a senior accountant. He could hardly

have been given a more difficult assignment.59

Clearly, the court was less than satisfied with the qualifications of the senior accountant and the supervision displayed by the manager and partner.

In conclusion, it should be noted that where clear, concise auditing standards exist, the court will rely on them

in making a decision.

When no standards exist, or if they

lack clarity and contain ambiguity, the court will supplement these with standards it feels are required of a prudent

auditor.

60

U.S. V. Simon

Up to this point this study has concentrated on civil

^^lbid., p. 18.

^^Escott V. BarChris Construction Company, op. cit.,

p. 669.

U.S. V. Simon, U.S. Court of Appeals, Second Circuit

(1969), p. 3817.

39

suits involving the CPA.

The case of U.S. v. Simon concerns

the accountant's liability for criminal fraud.

To establish

criminal fraud the Government must prove that "the financial

statements were false or misleading in a material respect

and the defendants knew it to be and deliberately sought to

mislead."

The indictment was brought against three members pf a

prominent public accounting firm, Simon, Kaiser and Fishman,

for violations of the U.S.C. and the Securities Exchange Act

of 1934.

Section 32 of the 1934 Act "renders criminal the

willful and knowingly making of a statement in any required

report which was false or misleading with respect to any

material fact."

In June 19 68 the U.S. District Court found the defendants guilty of fraud'and fines were assessed to Simon for

$7,000 and Kaiser and Fishman $5,000 each.

The defendants

appealed the decision to the U.S. Court of Appeals.

The

Court of Appeals affirmed the District Court's decision on

November 12, 19 69.

Facts Pertaining to the Case

This case involves the published financial statements

of Continental Vending Machine Corporation (Continental)

^•^lbid., p. 3819.

^^lbid.

40

for 19 62 as well as events preceding and subsequent to this

date.

The accounting firm of Lybrand, Ross Brothers and

Montgomery began auditing Continental in 1956 and continued

until the corporation was declared bankrupt in February 1963.

Continental had as an affiliate the Valley Commercial

Corporation (Valley) which was engaged in lending money to

Continental and other companies in the vending machine. business.

The president of Continental was Harold Roth who also

had controlling interest in Valley.

Continental was in the

practice of issuing negotiable notes to Valley, who would in

turn discount these to a bank and transfer the proceeds to

Continental.

As of the 19 62 financial statements the payable

to Valley amounted to $1,029,4 75.

Another practice, which was common between these companies, was loans from Continental to Valley and then loans

from Valley to Roth.

Roth used the money to finance stock

market transactions from 19 57 to 19 62.

Because of these

transactions the Continental financial statements contained

both a Valley payable and a Valley receivable.

These amounts

could not be offset because the notes from Continental had

been discounted.

At the end of 19 62 the Valley receivable

amounted to $3.5 million, and by February 19 63 it had risen

to $3.9 million.

The majority of this receivable consisted

of loans to Roth to finance his stock market transactions.

In December 19 62 the auditors learned that Valley was not

41

able to repay the debt and required that collateral be posted.

To accomplish this Roth posted his equity in certain securities as collateral for his loan from Valley and hence secured

the loan from Valley to Continental.

The securities which

were posted consisted of approximately 80 percent Continental stock and convertible debentures.

In a footnote to the 19 62 Continental balance sheet the

auditors stated that the Valley receivable was secured by

certain marketable securities which as of February 15, 19 63,

exceeded the net receivable.

The Government had two objec-

tions to the footnote:

(1) A statement should have been made informing the

stockholders that the payable could not be netted

against the receivable.

(2) The nature of the collateral should have been disclosed.

The Government also contested the valuation of the marketable

securities.

They contended that the securities should have

been valued at $1,978,000 rather than $2,978,000 because of

liens against the securities.

Issues Pertaining to the Case

The prosecution's case was based on two central issues.

First, the financial statements failed to disclose that

loans made to Valley were of approximately the same amount

as the loans from Valley to Continental's president, Harold

42

Roth.

Second, the auditors failed to disclose that "a sub-

stantial part of the collateral securing the Valley receivable

consisted of common stock of Continental principally owned by

Roth."^^

In defense of these issues the auditors contended that

disclosure of this nature was not required by generally accepted auditing standards.

To prove their contention the

defendants called eight expert accountants to testify in

their behalf.

The expert testimony verified the auditors'

contentions except for the netting of the Valley receivable

against the Continental payable.

The expert witnesses testi-

fied that:

. . . neither generally accepted accounting principles nor generally accepted auditing standards

required disclosure of the make-up of the collateral or of the increase of the receivable after

the closing date of the balance sheet, although

three of the eight stated that in light of hindsight they would have preferred that the make-up

of the collateral be disclosed.64

The witnesses also testified that disclosure of the loan

from Valley to Roth was not required under generally accepted

auditing standards.

In justifying this view the witnesses

stated that to

. . . reveal what Valley had done v/ith the money

would be to put into the balance sheet things that

did not properly belong there; moreover, it would

^-^lbid. , p. 3826.

^"^lbid., p. 3832.

43

create a precedent which would imply that it was

the duty of an auditor to investigate each loan to

an affiliate to determine whether the money had

found its way into the pockets of an officer of

the company under audit, an investigation that

would ordinarily be unduly wasteful of time and

money."5

The Government called several accounting witnesses, including the SEC chief accountant.

Most all of these wit-

nesses took a contrary view and stated that for adequate

disclosure it would have been necessary for the auditors to

reveal the loans from Valley to Roth and the makeup of the

collateral.

In reaching a decision the judge stated that the

. . . critical test was whether the financial

statements as a whole fairly presented the financial position of Continental as of September 30,

19 62, and whether it accurately reported the operations for fiscal 1962. If they did not, the

basic issue became whether defendants acted in

good faith. Proof of compliance with generally

accepted standards was evidence which may be very

persuasive but not necessarily conclusive that he

acted in good faith, and that the facts as certified were not materially false or misleading.^^

Thus, it is evident that the court placed more weight on the

fairness of the financial statements rather than their compliance with generally accepted auditing standards.

The judge agreed with the defendants that advances by a

company to an affiliate do not impose a duty on the

^^lbid.

^^lbid., p. 3833.

44

accountant under ordinary circumstances.

But, the court

went on to state:

. . . it simply cannot be true that an accountant

is under no duty to disclose what he knows when

he has reason to believe that, to a material extent, a corporation is being operated not to carry

out its business in the interest of all the stock-^

holders but for the private benefit of its president.

For a court to say that all this is immaterial as

a matter of law if only such loans are thought to

be collectible would be to say that independent •

accountants have no responsibility to reveal known

dishonesty by a high corporate officer. If certification does not at least imply that the corporation has not been looted by insiders so far as the

accountants know, or, if it has been, that the

diversion has been made good beyond peradventure

(or adequately reserved against) and effective

steps taken to prevent a recurrence, it would mean

nothing, and the reliance placed on it by the public would be a snare and a delusion.^'

In evaluating the application of generally accepted

auditing standards to this instance the court said that the

accountant is to use these standards as guides in the usual

case.

If, as a result of his investigation, the accoun-

tant's suspicions are aroused, he is to make full disclosure

of all relevant facts.

Another issue the court considered was the failure of

the auditor to describe the collateral used to secure the

note from Roth to Valley.

As previously mentioned, the

auditors had required that collateral be posted to ensure

the collectibility of the Valley receivable.

^"^lbid.

The court

45

questioned the auditor's judgment when they accepted the Continental stock as security for the debt owed by Valley.

Since Continental itself was experiencing major financial

difficulties the auditors could hardly have been justified

in accepting this as collateral.

An issue that was questioned by the defense counsel was

the lack of motivation for the defendants to perpetrate such

fraud.

The court agreed that in most cases the motivation

was much clearer than in this case.

The defendants were not

guilty of accepting any bribes nor was the Continental account so large as to influence their judgment.

The Govern-

ment contended:

. . . that the defendants in the course of their

audits of Continental in the years preceding 19 62

also had had an obligation to inquire into the

affairs of Valley (and to disclose Roth's borrowings, which would have been revealed by such inquiry); and that their failure to make such inquiry

gave them a reason to falsify the 19 62 balance

sheet—namely, concealment of their earlier failure to inquire.68

In reaching a decision concerning the criminal intent

of the defendants, the judge stated:

Even if there were no satisfactory showing of motive, we think the Government produced sufficient

evidence of criminal intent. Its burden was not

to show that defendants were wicked men with designs on anyone's purse, which they obviously were

^^American Institute of Certified Public Accountants,

"The Continental Vending Case," The Journal of Accountancy,

CXXVI (November, 19 68), 55.

46

not, but rather that they had certified a statement knowing it to be false.69

The American Institute of Certified Public Accountants

(AICPA) filed a memorandum with the Court of Appeals in an

effort to obtain an acquittal for the defendants.

The ef-

fort was unsuccessful, but the memorandum contained several

statements relevant to this study.

The Institute found that

the Continental case was

. . . a unique case: the first in which an accountant has been charged with criminal responsibility

for financial statements alleged to be false and

misleading by reason of failure to make disclosure

asserted to be required by professional standards.70

The Institute also pointed out that the defendants were

charged with having knowledge of a professional standard

which "could be found in no places more accessible than the

71

minds of some accountants."

Because of the lack of gen-

eral support for the existence of auditing standards requiring disclosure of this nature the AICPA questioned the

validity of convicting the accountants by hindsight.

The

Institute stated the following:

The essential vice of allowing a finding of guilty

knowledge regarding a professional standard upon

a record as thin and doubtful as that presented

here is that it exposes a professional person to

the risk of criminal liability for the exercise of

69U.S. V. Simon, op. cit., p. 3840.

^^American Institute of Certified Public Accountants,

"The Continental Vending Case," op. cit., p. 57.

'^-^lbid., p. 60.

47

his honest professional judgment, for it allows

his judgment to be tested by the hindsight judgment

of other members of the profession without any real

assurance that he knew at the time what that other

judgment might be.72

An important conclusion which can be drawn from the

Continental case is that accountants are required by law to

disclose all pertinent information.

In areas where gener-

ally accepted auditing standards are lacking or lack clarity

concerning disclosure the accountant should place primary

interest upon the fair presentation of the facts.

Fischer v. Kletz'^'^

In this case the plaintiff sought action against the

defendant under Section lOb and lOb-5 of the Securities

Exchange Act.

The plaintiff alleged that the accounting

firm of Peat, Marwick, Mitchell & Co. (PMM) had certified

financial statements which were materially false and that

the accountant failed to disclose information acquired subsequent to the certification.

This case is significant

. . . both for its expansion of the traditional

duties of independent accountants to responsibility for non-disclosure and for its unique application of the federal securities anti-fraud provisions, incorporated in rule lOb-5, to a case

^.

"^^lbid.

"^-^Fischer v. Kletz, 266 F. Supp. 180 (S.D.N.Y. 1967).

48

involving neither a corporate insider, a brokerdealer, a corporate issuer nor a party to a

securities transaction.74

Early in 19 64 PMM undertook the annual audit of Yale

Express System (Yale).

The audit was completed and a certif-

icate was issued for the December 31, 1963, financial statements on March 31, 19 64.

On or about June 29, 19 64, the

annual report Form lOK was filed with the SEC.

In May 19 64 the auditors were engaged by Yale to conduct

a "special study of Yale's current income and expenses."^^

The study was concluded May 5, 19 65, at which time PMM disclosed its findings to Yale, the SEC, and the exchange on

which the securities were traded.

During the course of the special study the auditors

were informed by Yale of their intention to issue interim

statements.

The auditors advised Yale that the figures

derived from the special study could not be used for the

interim statements, and suggested that Yale use figures from

their own internal accounting records.

None of the interim

statements issued by Yale were certified or prepared by the

auditors.

As later discovered, the Form lOK, the annual

New York University School of Law, "Securities—Rule *

lOb-5," New York University Law Review, LXVII (March, 1968),

209.

75

Fischer v. Kletz, op. cit., p. 183.

49

report, and the interim statement "were materially false

76

and misleading."

The plaintiff asserted that PMM was liable because of

their failure to report conditions which they undercovered

during their special study.

In defense of their actions PMM

stated that when conducting the special study they were engaged not as independent public accountants, but rather as

dependent accountants and therefore were not required to disclose the findings of the study.

In ruling on this case the

judge separated his opinion into two sections:

annual report

liability and interim statement liability.

Annual Report Liability

The plaintiff's claim was based on the common law action of deceit citing the defendant for nondisclosure or

silence.

The court supported its position in the following

manner:

Plaintiffs' claim is grounded in the common law

action of deceit, albeit an unusual type in that

most cases of deceit involve an affirmative misrepresentation by the defendant. Here, however,

plaintiffs attack PMM's nondisclosure or silence.77

PMM contended that such a duty exists only to parties

of a business transaction and thus was not applicable to an

independent auditor.

^^lbid., p. 183.

"^"^lbid., p. 185.

In reply the judge stated:

50

One party to a business transaction is under a

duty to exercise reasonable care to disclose to

the other before the transaction is consummated.

Any subsequently acquired information which he

recognizes as making untrue or misleading a previous representation which v/hen made was true or

believed to be so.78

To answer the question of the defendant's intent the

court recognized the theory of continuing representation.

An explanation of the theory follows:

A representation is deemed repeated at each successive moment during the period in which it is

relied upon. Therefore, unless the representor

corrects or modifies the misrepresentation at

any time during such intervals, he is deemed to

intend the results which flow from such misrepresentation.79

The judge further stated that under common law a person

who makes a representation and later finds the representation

to be false is under a duty to correct the misrepresentation.

In conclusion the court was quick to realize some of the

potential problems inherent in such a decision.

How long, for instance, does the duty to disclose

after-acquired information last? To whom and how

should disclosure be made? Does liability exist

if the after-acquired knowledge is obtained from

a source other than the original supplier of information? Is there a duty to disclose if an associate or employee of the accounting firm discovers that the financial statements are false

but fails to report it to the firm members?^^

"^^lbid., p. 186.

^ New York University School of Law, "Securities—

Rule lOb-5," op. cit., p. 214.

^^Fischer v. Kletz, op. cit., p. 189.

51

In ruling on this portion of the case the court stated

the following:

Proper reconciliation of these interests or policy

considerations, however, can only be m.ade after

full development of the facts of this case during

the discovery process and at trial.81

Interim Statement Liability

The plaintiff alleged that the auditors aided and abetted

Yale "by remaining silent when it was known that the interim

statements were false and, second, by recommending the issuance of the reports."