Since it was founded in 1963 in the town of Bredebro in

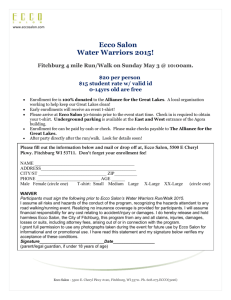

advertisement