Costco Wholesale Corp. - University of Oregon Investment Group

advertisement

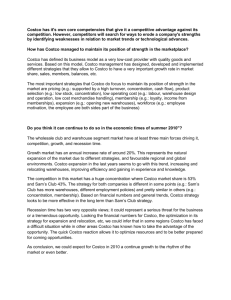

4/26/13 Industry: Variety Stores Sector: Retail Costco Wholesale Corp. Investment Thesis Key Statitisics 52 Week Price Range 81.98 50-Day Moving Average 104.26 Estimated Beta Costco is the second largest membership discount retailer in the U.S. Costco’s business segments comprised of Consumer Staples and Consumer Discretionary make its revenue more robust in a unstable economic environment Costco bolsters a significant portion of its income from membership dues, which it can increase a certain extent every year without significant loss in membership 109.75 0.68 Dividend Yield $ 0.28 Market Capitalization (In Millions) 3-Year Revenue CAGR 1.76% 47682 12% Trading Statistics Diluted Shares Outstanding (In Millions) Average Volume (3-Month) Institutional Ownership Five-Year Stock Chart 439.53 2.05 120.00 76.97% 45,000,000 40,000,000 100.00 Insider Ownership 1.01% EV/EBITDA (LTM) 12.12 35,000,000 80.00 30,000,000 25,000,000 Margins and Ratios 60.00 Gross Margin (LTM) 12.42% EBITDA Margin (LTM) 3.82% Net Margin (LTM) 1.72% 20,000,000 40.00 15,000,000 10,000,000 20.00 Debt to Enterprise Value 5,000,000 3.11% 2008-05-02 2009-05-01 2010-04-30 Adj Close Forecast Summary UOIG Projections Net Sales ($M) EBITDA ($M) Basic EPS ($) Consensus Estimates Net Sales ($M) EBTIDA ($M) Basic EPS ($) 2011-04-28 50-Day Ave 2012-04-26 200-Day Avg 0.00 2013-04-29 0 Volume 2012A $99,137.00 $3,667.00 $4.02 11/30/2012A $23,715.00 $852.00 $0.96 02/28/2013A $24,871.00 $955.00 $1.26 05/31/2013E $23,989.30 $899.60 $0.95 08/31/2013E $34,401.08 $1,376.04 $1.66 2013E $106,976.38 $4,082.64 $4.82 $99,137.00 $3,667.00 $2.03 $23,715.00 $852.00 $0.08 $24,871.00 $955.00 $0.94 $24,157.00 $936.00 $0.96 $32,945.00 $1,303.00 $1.12 $105,478.00 $4,089.00 $3.88 Covering Analyst: Tony Kim ddk@uoregon.edu 1 University of Oregon Investment Group University of Oregon Investment Group 4/26/2013 Business Overview Company History Founded by James Sinegal, and Jeffery H. Brotman, Costco first incorporated in California on Feb. 13, 1976. In October 1993, it reincorporated in Delaware as Price/Costco In, and in January 1997, it changed names to Costco Companies, Inc. In August 1999, it reincorporated in Washington as Costco Wholesaler Corporation. Business Analysis % Revenue Business Segments Sundries % Change Hardlines % Change Food % Change Softlines % Change Fresh Food % Change Ancillary and Other % Change 2009A 23 2011A 2012A 22 22 -4.35% 0.00% 17 16 -5.56% -5.88% 21 21 0.00% 0.00% 10 10 0.00% 0.00% 12 13 0.00% 8.33% 18 18 12.50% 0.00% Costco Wholesale Corporation (Costco) operates membership warehouses that offer low prices on limited selection of branded and private-label products with the goal of increasing sales volume and inventory turnover. By focusing on increasing turnover and increasing supply chain efficiency by prioritizing volume purchasing, minimal goods handling, and lean warehouses, Costco is able to operative profitably with lower margins than traditional retailers, wholesalers, and supercenters. Costco purchases its merchandise directly from manufactures, which is then routed to cross-docking hubs. Once the merchandise arrives at the docking stations, it is then routed to individual warehouses with minimal handing and delay. Number of Businesses Food Court and Hot Dog Stands % Change One-Hour Photo Centers % Change Optical Dispensing Centers % Change Pharmacies % Change Gas Stations % Change Hearing-Aid Centers % Change Print Shops and Copy Centers % Change Car Washes % Change 2009A 2010A 2011A 2012A 521 534 586 602 2.96% 2.50% 9.74% 2.73% 518 530 581 591 2.78% 2.32% 9.62% 1.72% 509 523 574 589 2.62% 2.75% 9.75% 2.61% 464 570 529 544 2.88% 22.84% -7.19% 2.84% 323 343 427 469 5.21% 6.19% 24.49% 9.84% 303 357 368 394 10.58% 17.82% 3.08% 7.07% 10 10 10 10 42.86% 0.00% 0.00% 0.00% 2 7 7 7 0.00% 250.00% 0.00% 0.00% It is normal for Costco to convert inventory to cash before it has to pay its vendors. Therefore, if inventory turnover increases, the amount of inventory that is financed through vendor payment terms increases. This is reflected in Costco’s negative working capital, and is described in further detail in the Discounted Cash Flow analysis section of this report. 2009 2010 2011 2012 As of the most recent reporting period of March 31, 2013, Costco operates 608 warehouses. 439 of those warehouses are in 40 states and Puerto Rico, 82 in Canada, 32 in Mexico, 22 in the U.K., 13 in Japan, 9 in Taiwan, 8 in Korea, and 3 in Australia. In addition to their warehouse operations, Costco operates an online business, and Costco Travel to complement their warehouse operations. As a part of its main operations, Costco current lines of business include Food Court and Hot Dog Stands, One-Hour Photo Centers, Optical Dispensing Centers, Pharmacies, Gas Stations, Hearing-Aid Centers, Print shops and copy centers, and Car Washes. Warehouse Count United States Operations Warehouses Canadian Operations Warehouses Other International Operations Warehouses Consolidated Operations Warehouses 19 21 10 12 15 2010A 23 0.00% 18 -5.26% 21 0.00% 10 0.00% 12 0.00% 16 6.67% 406 416 429 439 77 79 82 82 44 45 81 87 527 540 592 608 Costco has six merchandise segments, which are divided into sundries, hardlines, softlines, food, fresh food, and ancillary and other. Sundries include snack foods, tobacco and beverages. Hardlines include appliances and electronics; Softlines comprise merchandise such as apparel and home furnishings. Ancillary and other include gasoline, pharmaceuticals, and other miscellaneous merchandise that Costco sells. Business Growth Strategies Geographic Expansion Costco has continued to fuel its growth through expanding its geographic reach by acquiring subsidiaries and building a larger base of its discount warehouse locations. Costco expands its warehouse count by leasing or purchasing the warehouses. Management plans to continue building warehouses in the more mature markets of U.S., Canada, and U.K. However, there is more potential for UOIG 2 University of Oregon Investment Group 4/26/2013 growth in the International market, which includes Mexico, Australia, Taiwan, Japan, and Korea. According to management during the most recent earnings conference, Costco is targeting 25 warehouse locations in Japan and Korea. Costco is also targeting an entry into China through an online retail business model. Acquisitions Costco has expanded its business organically and through acquisitions and mergers. Costco has used acquisitions and mergers to expand its presence in the U.S., domestic, and international markets. However, acquisitions have declined in the U.S. and domestic markets as Costco’s presence has become more established. Currently, acquisitions are more common in the international markets, which include Mexico, U.K., Japan, Korea, Taiwan, and Australia. Costco has a history of acquiring or partnering with retailers in a target market or region that it wants to capture. The below section is a list of significant acquisitions and partnerships Costco made during its lifetime. “In 1991, Co. formed a 50% joint venture with Controladora Comercial Mexicana, S.A. de C.V. On Oct. 21, 1993, the shareholders of both Price and Costco approved the mergers of Price and Costco into subsidiaries of PriceCostco. Pursuant to the Merger, Price and Costco became subsidiaries of PriceCostco. Shareholders of Price received 2.13 shares of PriceCostco common stock for each share of Price common stock and shareholders of Costco received one share of PriceCostco common stock for each share of Costco. On July 28, 1994 Co. entered into an Agreement of Transfer and Plan of Exchange with Price Enterprises, Inc. Price Enterprises is an indirect whollyowned subsidiary of Co., formed in July 1994. On May 4, 1998, Co. formed a joint venture in the Republic of Korea with Shinsegae Department Store Co., Ltd. (Shinsegae) to acquire the membership warehouse club operation from Shinsegae. The joint venture operation became effective on June 1, 1998. Initial capitalization of the joint venture totaled approximately $100,000, with the company being a 93.75% owner and Shinsegae being a 6.25% owner. Approximately $80,000 of the initial investment will be used for land and building acquisitions, and the remaining approximately $20,000 will be used to purchase merchandise inventories and other assets, and for working capital purposes. On May 26, 2000, Co. acquired from The Littlewoods Organisation PLC its 20% equity interest in Costco Wholesale UK Limited, increasing Co.'s ownership in Costco Wholesale UK Limited to 80%. The acquisition was funded with cash and cash equivalents on hand. On Oct. 3, 2003, Co. acquired from Carrefour Nederland B.V. its 20% equity interest in Costco Wholesale UK Limited for cash of approx. $95,000. On June 30, 2005, Co. acquired the remaining 4% equity interest in CWC Travel Inc. for cash of $3,961,000, bringing Co.'s ownership in this entity to 100%. On July 10, 2012, Co. acquired from its former joint venture partner the remaining 50% equity interest of Costco Mexico (Mexico) for $789,000,000.” UOIG 3 University of Oregon Investment Group 4/26/2013 Industry Overview In the retail sector, Costco competes in the Warehouse Clubs and Supercenters Industry. As of 2013, the Warehouse Clubs and Supercenters industry is one of the fastest growing industries in retail. Industry revenues are forecasted to increase by 6.7%, which is in connection to increasing disposable income. (Ibis World) Growth in the industry trends with economic growth, growth of disposable income, and employment. Because Costco sells a large amount of consumer stables, it is protected to a degree from fluctuations in disposable income. In addition, the Warehouse Clubs and Supercenters industry was one of the industries that saw growth during the 2008 recession as customers started to seek lower prices for goods. With the expected GDP growth of Costco’s international markets generally higher than the U.S., the outlook is positive for Costco’s international market. The international market is less saturated than the U.S. market, and while by no means uncompetitive, Costco’s business model has more headroom to grow in these markets. There are many factors that affect growth potential of each different business segment that Costco operates, but generally have similar effects on each segment. The Warehouse Clubs and Supercenters industry is a very capital intensive industry. New players need to make significant investments in capital to compete with warehouse locations, and there are significant economies of scale in the industry that makes the current players’ competitive position very stable. Capital structure varies for each company and within the industry. Costco has a low debt to equity ratio of .029, compared to Walmart’s .18. Costco’s management does not see this figure changing significantly, and it maintains that Costco’s debt financing will continue to have intermediate terms of less than 20 years. Currently, Costco’s longest maturity bonds mature in 2019. Costco and its international competitors face exchange rate fluctuations. Because Costco supplies a mix of foreign and national merchandise at its warehouse locations, exchange rate fluctuations can affect price of goods respective to different markets. In addition, it can have gains and losses due to currency conversion. Macro factors Economic growth such as GDP trends closely with revenue. This is because economic growth underpins many of the factors that influence the growth of sales for companies like Costco. As mentioned before, these factors include the level of disposable income and employment rates on the consumer side. On the supplier side, the price of gasoline and other commodities affect prices. Environmental factors can have a significant effect on Costco’s operations, and the operations of its suppliers. Adverse weather can affect the availability and prices of the goods Costco sells. Because Costco carries a large and diverse number of products, it can be indirectly affected my nearly any macro factors. UOIG 4 University of Oregon Investment Group 4/26/2013 Competition The industry is highly competitive, and competes in terms of pricing and volume. There are about 1200 discount warehouses in operation in the U.S. Supply chain efficiency is a huge part that determines how competitive a player is in the industry. The supply chain structure is what allows Costco and Walmart to execute its business strategy of passing down lower costs to consumers. Supply chain decisions include carrying a low number of branded products and reducing product handling to reduce overhead costs. As a company that deals largely with consumer staples, future innovations are not expected to affect Costco from an operation perspective. However, leverage of information technology and new developments in the area has and will continue to prove to be a significant area of competitive advantage. Especially regarding flow of inventory and supply chain activities, leverage of increasingly sophisticated ERP systems and inventory management systems may provide significant cost saving and economies of scale, which will continue to strengthen Costco’s position as one of the market leaders in the retail sector. Management and Employee Relations Year Salary Bonus Other Annual Compensation/Fees Stock Awards Option Awards 2012 356,731 198,820 2011 350,000 198,400 2010 350,000 190,400 N/A N/A N/A 3,870,300 N/A 3,120,030 N/A 2,896,030 N/A Change in Pension Value & 30,483 Non-Qualified Deferred Comp. 5,076 N/A All Other Compensation Total Compensation 82,637 4,538,971 83,083 3,756,589 88,948 3,525,378 Year Salary Bonus Other Annual Compensation/Fees Stock Awards Option Awards 2012 662,500 168,233 2011 649,999 99,200 2010 635,000 95,200 N/A N/A N/A 3,870,300 N/A 2,496,024 N/A 1,448,015 N/A Change in Pension Value & 21,226 Non-Qualified Deferred Comp. 811 N/A All Other Compensation Total Compensation 88,514 4,810,773 89,831 3,335,865 85,844 2,264,059 Year Salary Bonus Other Annual Compensation/Fees Stock Awards Option Awards 2012 664,922 79,222 2011 644,995 79,360 2010 600,000 76,160 N/A N/A N/A 1,935,150 N/A 1,560,015 N/A 1,448,015 N/A Change in Pension Value & 49,801 Non-Qualified Deferred Comp. 2,066 N/A All Other Compensation Total Compensation 96,605 2,825,700 103,575 2,390,011 108,327 2,232,502 Year Salary Bonus Stock Awards Option Awards 2007 499,029 33,323 361958 824,861 Jeffery Brotman, Chairman Jeffrey H. Brotman, is the current Chairman of the Board of Costco Wholesale Corporation. Mr. Brotman is the co-founder of Costco Wholesale Corporation, and has been Chairman of the Board ever since Costco Wholesale Corporation’s inception excluding the period from October 1993 to December 1994, when he acted as a Vice Chairman. W. Craig Jelinek, Director and President W. Craig Jelinek, is the current Director and President of Costco Wholesale Corporation, a role he served since February 2010. In January 1, 2012, he started his role as Chief Executive Officer. Previously, Mr. Jelinek was President and Chief Operating Officer from February 2010 until January 2012, and was Executive Vice President in charge of merchandising, which was a role he served since 2004. Richard A. Galanti, Executive Vice President, CFO Richard A. Galanti, served as a Director of Costco Wholesale Corporation since January 1995. Since October 1993, he has served as an Executive Vice President and Chief Financial Officer of Costco Wholesale Corporation. Paul G. Moulton, Executive Vice President, Info. Sys. Paul G. Moulton, is the Executive Vice President, Information Systems of Costco Wholesale Corporation. Mr. Moulton served as the Executive Vice President of Real Estate Development from 2001 to March 2010. Change in Pension Value & 97147 Non-Qualified Deferred Comp. All Other Compensation Total Compensation 398,501 2,214,819 UOIG 5 University of Oregon Investment Group 4/26/2013 Management Guidance Costco’s management often provides fair estimates regarding their guidance. The management team shows a historical trend of being close to actual results and analyst estimates. Generally, Managements’ EPS guidance does not deviate more than $.05 above or below estimates Recent News April 29, 2013 – “Costco set to open in Queensland in 2014 following government approval” American bulk-goods chain Costco has received the green light to go ahead with the opening of its first Queensland store, as the company prepares for further expansion around Australia. (Smartcompany) March 26, 2013 - “Customers Flee Wal-Mart Empty Shelves for Target, Costco” It’s not as though the merchandise isn’t there. It’s piling up in aisles and in the back of stores because Wal-Mart doesn’t have enough bodies to restock the shelves, according to interviews with store workers. In the past five years, the world’s largest retailer added 455 U.S. Wal-Mart stores, a 13 percent increase, according to filings and the company’s website. In the same period, its total U.S. workforce, which includes Sam’s Club employees, dropped by about 20,000, or 1.4 percent. (Reuters) March 13, 2013 – “Costco gains market share; profit tops Street view” Costco Wholesale Corp. lured shoppers with low prices on everything from produce to gasoline in the latest quarter, gaining market share at a time when other retailers saw shoppers pull back due to higher taxes and rising fuel prices. (Bloomberg) Catalysts Upside Strengthening economic data will positively influence Costco’s stock price Efforts to increase presence in China and successful foray into the Chinese market will increase growth potential Downside Negative supply price fluctuation Devaluation of U.S. currency relative to foreign currency Increase in commodity prices that affect large suppliers UOIG 6 University of Oregon Investment Group 4/26/2013 Comparable Analysis 30% Multiple EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) P/E Price Target Current Price Overvalued Implied Price Weight 194.41 0.00% 97.57 0.00% 91.69 0.00% 87.94 100.00% 99.43 0.00% 73.23 0.00% $87.94 109.27 (19.52%) Comparable companies include Target, Wal-Mart. Price smart, Dollar General, and Fred’s. These companies were chosen because of their similarity in terms of operations and business. In addition, I screened for growth rates. However, the growth rates for the comparable companies do not match well. Costco is projected to have moderate growth going forward. Its growth is higher than Target and Wal-Mart. The other comparable companies PSMT, FRED, DG have a smaller market capitalization than Costco, and generally higher growth expectations. Target and Wal-Mart are most similar to Costco yet they have lower projected growth rates. Smaller competitors have higher projected growth rates, and trade at higher multiples than Costco. Costco has already gone through this high growth phase. Therefore it would not be reflective of future growth to include these smaller companies in the comparable analysis other than to increase the multiples. Because of a lack of good comparable companies, the comparable analysis is weighed less relative the discounted cash flow model. Target 50% “Target Corporation (Target) operates in three segments: U.S. Retail, U.S. Credit Card and Canadian. As a component of the U.S. Retail Segment, its online presence is designed to enable guests to purchase products either online or by locating them in one of its stores with the aid of online research and location tools. The Company merchandise at discounted prices… It operated 37 distribution centers at January 28, 2012. At January 28, 2012, it had 1,763 stores in 49 states and the District of Columbia.” I chose Target Corporation because it has a similar market capitalization with Costco, and because it shares similarities in terms of supply chain and physical store footprints. The growth estimates for Target are lower for 2013 while higher for 2014 compared to Costco. Walmart 50% “Wal-Mart Stores, Inc. (Walmart) operates retail stores in various formats around globally… The Company’s operates in three business segments: the Walmart U.S. segment, the Walmart International segment, and the Sam’s Club segment. During the fiscal year ended January 31, 2012 (fiscal 2012), its Walmart U.S. segment accounted for approximately 60% of its net sales and operates retail stores in various formats in all 50 states in the United States and Puerto Rico, as well as Walmart’s online retail operations, walmart.com. Its Walmart International segment consists of retail operations in 26 countries. Its Sam’s Club segment consists of membership warehouse clubs operated in 47 states in the United States and Puerto Rico, as well as the segment’s online retail operations, samsclub.com. During 2012, Sam’s Club accounted for approximately 12% of its net sales.” I chose Walmart as a comparable company due to it being the closest competitor in the Warehouse Clubs and Supercenters industry. With about 60% of the market share, compared to Costco’s 18% share, Walmart is the biggest player in the industry. Walmart shares a very similar supply chain strategy as Costco. In addition, Walmart has the most comparable growth rate with Costco, with a growth rate of 5.1% and 5.0% in 2013 and 2014 respectively. UOIG 7 University of Oregon Investment Group 4/26/2013 Discounted Cash Flow Analysis 70% Discounted Free Cash Flow Assumptions Tax Rate 35.00% Terminal Growth Rate Risk Free Rate 1.70% Terminal Value Beta 0.68 PV of Terminal Value Market Risk Premium 7.00% Sum of PV Free Cash Flows % Equity 97.20% Firm Value % Debt 2.80% Total Debt Cost of Debt 5.70% Cash & Cash Equivalents CAPM 6.44% Market Capitalization WACC 6.36% Fully Diluted Shares Implied Price 120.78 Current Price 109.27 Undervalued 2.50% 62,258 44,342 10,126 54,467 1,382 4,854 53,085 440 10.53% Considerations Avg. Industry Debt / Equity Avg. Industry Tax Rate Current Reinvestment Rate Reinvestment Rate in Year 2018E Implied Return on Capital in Perpetuity Terminal Value as a % of Total Implied 2014E EBITDA Multiple Implied Multiple in Year 2018E Free Cash Flow Growth Rate in Year 2018E 13.10% 22.58% 46.24% 5.94% 42.07% 81.4% 12.6x 9.2x 3% The percentage of revenue method is used to calculate the items in the Revenue model, working capital model, and the discounted cash flow model. However, when appropriate, some line items are projected as a function of a factor they are dependent to. These items are specified by name, and the function discussed in more specific detail in the subsections of the Discounted Cash Flow Analysis. Revenue model Costco’s revenue model is broken down into its current geographic reporting segments. These segments are Costco’s U.S. Canada, and International operations. The U.S. segment includes all of Costco’s 448 stores in 40 states, and Puerto Rico. The Canadian segment in includes 85 warehouses in the provinces of Canada. The international segment includes 32 stores in Mexico, 23 stores in the U.K., 3 stores in Australia, 13 stores in Japan, 10 stores in Korea, and 8 stores in Taiwan. In each geographic segment, the revenue model projects warehouse count, revenue, total square footage, revenue per square footage, and average square footage. Warehouse count is projected based on management guidance, which is used to predict total square footage. Total square footage for the consolidated business segment is a function of number of stores. Total square footage is calculated by taking the product of the historical average warehouse size of 149000 square feet and the number of warehouses. Total square footage for each individual business segment is calculated by taking the weighing of the change in total square footage for the consolidated business segments by number of stores opened in the region over total stores opened. Revenue is projected using a mixture of management guidance, analyst estimates, and as a trend with warehouse openings. Revenue was projected in a way that each additional warehouse would provide slightly lower revenue due to the effect of cannibalization of sales among warehouses. Revenue per square footage is calculated by dividing revenue by total square footage for each geographic business segments. Average total square footage is the square footage divided by number of warehouses. The total square footage is a function of the warehouse count and an estimate of historical average square footage of a typical warehouse. Therefore, the change in average square footage from the actual years to projected years is minimal. Beta The Beta calculation includes the weighted average of the 1 year and 3 year betas regressed against the S&P500. 1 year and 3 year Betas are chosen to capture the period of transition from a weak economy to a more stable and less uncertain economy. COGS The working capital model projects COGS as percent of revenue. COGS for Costco historically trended flat and ranged between 86.21% and 86.66%. For the year 2013, management predicts COGS to remain flat. COGS is projected based on the percentage of revenue. Any event that increases COGS will negatively affect Costco’s bottom line and ultimately valuation of the company. Because UOIG 8 University of Oregon Investment Group 4/26/2013 COGS is such a significant portion of revenue, even a slight increase of COGS as a percentage of revenue will have a negative effect on bottom line. SG&A The working capital model projects SG&A as percent of revenue. SG&A for Costco historically trended flat and ranged between 9.64% and 10.11%. For the year 2013, management predicts SG&A to remain at historical levels. SG&A trends slightly higher as a percentage of revenue. This is to take into account of sales cannibalization with increasing warehouse locations. Revenue per square footage is projected to decrease, due to revenue per additional store declining in certain locations due to cannibalization of sales. However, each warehouse will be staffed in similar levels, increasing SG&A relative to sales. Even with careful management of staffing levels, as Costco increases its warehouse footprint and increases overlap of warehouse service area, SG&A will become a larger portion of Costco’s revenue. Due to the increasing saturation of the U.S., Canada, and some international markets, this has a greater chance of becoming reality. Unless Costco penetrates new markets without cannibalizing sales from other warehouse locations, diminishing returns for each warehouse that overlaps service area is inevitable. Depreciation & Amortization Costco depreciates its assets on a straight-line basis. Depreciable assets include buildings, equipment, and other capital assets. Depreciation base ranges from 530 years. Depreciation is calculated as a percentage of revenue with consideration given to capital expenditures. It is projected to increase as a percentage of revenue over time to capture the effect of decreasing marginal revenue for each additional store location. Net Working Capital The net working capital for Costco is negative, and is projected to be negative going forward. It is important to note that the working capital situation does not reflect Costco’s inability to pay its vendors. Costco does not have a cash shortage, and it has not taken out debt to cover its short cash position. Costco turns over inventory frequently, which allows the company to converts inventory into cash before it is required to pay back its suppliers and vendors. Net working capital includes Accounts Receivable, Inventory for current assets, and Accounts Payable, Income Tax Payable, and Other Liabilities. The working capital model excludes Cash, Short-Term Investments, Short-Term Debt, and Current Maturation of Long-Term Debt. The rational for calculating working capital excluding these items is because Net Working Capital reflects the investment required to maintain operations of the business. Inventory, receivables, payables, is the capital needed to maintain operations. Payables reflect the liability incurred to fund inventory, and receivables reflect the payment terms given to customers. Net working capital essentially shows the minimum amount of cash a company needs have tied up in assets to fund a business cycle, in most cases a year. Cash and liabilities associated with financial instruments are not included in the calculation of Net working capital because they are not required to maintain Costco’s immediate operations. Respectively, debt should be excluded if cash is also going to be excluded. UOIG 9 University of Oregon Investment Group 4/26/2013 The working capital model keeps the working capital flat with only minor deviation as a percent of revenue. This is done to minimize the potential negative and positive cash flow effects of an increase and decrease, respectively, in net working capital. The implication for projecting a flat working capital relative to percentage of revenues is that Costco will continue to be able to convert receivables into cash before it is required to pay of its payables to its suppliers and vendors. Ideally, if operating cash was known, it would have been added back into the net working capital model. Capital Expenditure Capital expenditure is projected while considering the increases in warehouse numbers. The rational for projecting capital expenditures using this method rather than taking a percentage of revenue is that capital expenditures are broken down into property purchases and other capital assets needed for operations. Due to the two components of capital expenditure, it would not well reflect capital expenditures on building and property if projecting capital expenditures as a percentage of revenue. An increase is warehouse building greater than the projected number will increase capital expenditure as a percentage of revenue over current projection numbers. Historically, management has been accurate with estimating warehouse openings. Tax Rate Corp. Tax Rates By Countries United States Canada Mexico United Kingdom Japan Korea, Republic of Taiwan Australia 2009 40 33 28 28 40.69 24.2 25 30 2010 40 31 30 28 40.69 24.2 17 30 2011 40 28 30 26 40.69 22 17 30 2012 40 26 30 24 38.01 24.2 17 30 2013 40 26 30 23 38.01 24.2 17 30 The tax rate to be 35% based on historical and projected tax rates. In addition I also considered shifting revenue mix as a potential to change tax rates. Historically, tax rates in the U.S. have been 40%, Canada 26%, Mexico 30%, U.K. 23%, Japan 38.01%, Korea 24.2%, Taiwan 17%, and Australia 30%. There is a slight trend in the tax rate towards the weighted international tax rate as revenue mix slightly shifts to the international markets. However, because the U.S. and Canada markets currently make up 87.95% of revenues, the shift of tax rates towards the international market tax rates is minimal as a percentage and nominal figure. Therefore, I projected the tax rate to be 35% going forward. Recommendation I recommend a Hold for the Tall Firs and Svigals’ portfolio. Based on DCF and Comparable analysis, Costco is fairly valued. I primarily covered Costco because its growth rates were higher than its competitors. However, it appears as if the market has priced in the higher expected growth. I am not pitching Costco as a defensive play on the market because Walmart has a lower Beta, and has a higher dividend yield of 2.42% as opposed to Costco’s 1.10%. In addition, Costco has not outperformed its competitor Wal-Mart during the 2008 recession. Therefore, even as a defensive play, I believe that Costco as an investment leaves more to be desired. There is little doubt that Costco is a good company with a very strong customer base. However, I believe that the market has fairly priced the company, and there are other companies that provide a better dividend yield with lower implied risk. UOIG 10 University of Oregon Investment Group 4/26/2013 Appendix 1 – Comparable Analysis Comparables Analysis ($ in millions) Stock Characteristics Current Price Beta Max $109.27 1.15 Min $14.22 0.36 Median Weight Avg. $70.52 $74.78 0.48 0.42 COST PSMT TGT WMT FRED Costco Price Smart, Inc Target Walmart Fred's, Inc $109.27 0.68 0.00% $89.23 1.15 50.00% $70.52 0.48 50.00% $79.04 0.36 0.00% $14.22 1.15 DG Dollar General Corp. 0.00% $52.83 0.37 Size Short-Term Debt Long-Term Debt Cash and Cash Equivalent Non-Controlling Interest Preferred Stock Diluted Basic Shares Market Capitalization Enterprise Value 12,719.00 41,417.00 7,781.00 3,289.83 260,028.24 306,383.24 12.24 8.13 30.19 521.96 527.33 1.26 2,771.34 145.09 327.21 17,286.61 19,913.74 6,359.50 28,035.50 4,282.50 1,965.61 152,629.43 184,238.93 1.00 1,381.00 4,854.00 439.53 47,898.31 44,426.31 7.24 71.42 92.49 30.19 2,693.68 2,679.85 14,654.00 784.00 641.39 45,230.61 62,094.61 12,719.00 41,417.00 7,781.00 3,289.83 260,028.24 306,383.24 1.26 12.24 8.13 36.71 521.96 527.33 0.89 2,771.34 145.09 327.21 17,286.61 19,913.74 Growth Expectations % Revenue Growth 2013E % Revenue Growth 2014E % EBITDA Growth 2013E % EBITDA Growth 2014E % EPS Growth 2013E % EPS Growth 2014E 12.90% 15.20% 16.10% 14.00% 25.00% 19.90% 0.90% 2.90% 0.60% 5.80% 0.80% 9.41% 5.10% 5.85% 10.10% 10.60% 6.50% 16.10% 3.80% 5.85% 3.00% 8.20% 5.80% 14.90% 7.91% 5.69% 11.33% 6.07% 16.60% 9.41% 12.90% 15.20% 16.10% 14.00% 25.00% 16.10% 2.50% 6.70% 0.60% 10.60% 5.10% 19.90% 5.10% 5.00% 5.40% 5.80% 6.50% 9.90% 0.90% 2.90% 13.40% 10.30% 0.80% 16.80% 10.40% 9.9.% 10.10% 11.30% 12.50% 15.60% Profitability Margins Gross Margin EBIT Margin EBITDA Margin Net Margin 144.9% 101.8% 12.3% 72.7% 13.5% 2.0% 3.8% 1.5% 31.0% 7.3% 7.6% 4.1% 28.0% 6.7% 8.9% 3.9% 13.5% 3.0% 3.8% 2.0% 144.9% 101.8% 6.4% 72.7% 31.0% 7.3% 10.2% 4.1% 25.0% 6.0% 7.6% 3.8% 26.9% 2.0% 4.0% 1.5% 31.7% 10.4% 12.3% 5.9% 2,064.00 0.24 1.95 142.95 0.55 0.03 0.17 9.32 204.99 0.14 1.41 16.55 1,435.00 0.21 1.77 12.94 93.00 0.03 0.34 43.90 3.93 0.03 0.57 35.37 806.00 0.24 1.95 9.32 2,064.00 0.18 1.58 16.55 0.55 0.03 0.17 142.95 204.99 0.14 1.41 9.58 446,950.00 111,823.00 26,720.00 34,160.00 16,999.00 13,510.00 1,955.00 526.80 39.08 78.62 29.63 48.02 16,022.00 5,085.00 2,198.00 1,964.00 1,570.00 2,988.00 260,125.50 67,278.00 16,045.50 20,836.50 9,999.00 8,393.50 106,976.38 14,406.70 3,198.53 4,082.64 2,118.93 1,354.90 2,160.00 3,130.00 2,198.00 139.00 1,570.00 2,988.00 73,301.00 22,733.00 5,371.00 7,513.00 2,999.00 3,277.00 446,950.00 111,823.00 26,720.00 34,160.00 16,999.00 13,510.00 1,955.00 526.80 39.08 78.62 29.63 48.02 Credit Metrics Interest Expense Debt/EV Leverage Ratio Interest Coverage Ratio Operating Results Revenue Gross Profit EBIT EBITDA Net Income Capital Expenditures Multiples EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) P/E 1.24x 3.92x 13.89x 19.28x 17.23x 22.60x 0.27x 0.86x 1.22x 6.71x (0.94x) 1.72x 0.85x 2.73x 11.56x 8.97x 14.66x 15.30x 0.77x 2.74x 11.51x 8.62x 14.75x 15.19x 0.42x 3.08x 13.89x 10.88x 16.29x 22.60x 1.24x 0.86x 1.22x 19.28x (0.94x) 1.72x 0.85x 2.73x 11.56x 8.26x 14.66x 15.08x 0.69x 2.74x 11.47x 8.97x 14.84x 15.30x 0.27x 1.00x 13.49x 6.71x 17.23x 17.62x 16,022.00 5,085.00 1,660.90 1,964.00 952.70 149.36 1 1.24x 3.92x 11.99x 10.14x 10.97x 18.14x UOIG 11 University of Oregon Investment Group 4/26/2013 Appendix 2 – Discounted Cash Flows Analysis Discounted Cash Flow Analysis ($ in millions) Total Revenue % YoY Growth COGS % Revenue Gross Profit Gross Margin Selling General and Administrative Expense % Revenue Depreciation and Amortization % Revenue Earnings Before Interest & Taxes % Revenue Interest Expense % Revenue Non-operating expense (income) % Revenue Earnings Before Taxes % Revenue Less Taxes (Benefits) Tax Rate Net Income Net Margin Add Back: Depreciation and Amortization Add Back: Interest Expense*(1-Tax Rate) Operating Cash Flow % Revenue Current Assets % Revenue Current Liabilities % Revenue Net Working Capital % Revenue Change in Working Capital Capital Expenditures % Revenue Acquisitions % Revenue Unlevered Free Cash Flow Discounted Free Cash Flow 2009A 71422 -1.46% 61607 86.26% 9815 13.74% 7218 10.11% 728 1.02% 1819.00 2.55% 108 0.15% -65 -0.09% 1776 2.49% 628 35.36% 1148.00 1.61% 728 70 1945.81 2.72% 6239 8.74% 9281 12.99% -3042 -4.26% 1250 1.75% 0 0.00% 696 2010A 77946 9.13% 67200 86.21% 10746 13.79% 7840 10.06% 795 1.02% 2077.00 2.66% 111 0.14% -88 -0.11% 2054 2.64% 731 35.59% 1323.00 1.70% 795 71 2189.50 2.81% 6522 8.37% 10063 12.91% -3541 -4.54% -499 1055 1.35% 0 0.00% 1633 2011A 88915 14.07% 76884 86.47% 12031 13.53% 8682 9.76% 855 0.96% 2448.00 2.75% 116 0.13% -60 -0.07% 2392 2.69% 841 35.16% 1471.00 1.65% 855 75 2401.22 2.70% 7603 8.55% 12050 13.55% -4447 -5.00% -906 1290 1.45% 0 0.00% 2017 Q1 Q2 Q3 Q4 2012A 11/30/2012A 02/28/2013A 05/31/2013E 08/31/2013E 99137 23715 24871 23989 34401 11.50% 9.65% 8.29% 7.46% 6.78% 85915 20513 21549 20751 29757 86.66% 86.50% 86.64% 86.50% 86.50% 13222 3202 3322 3239 4644 13.34% 13.50% 13.36% 13.50% 13.50% 9555 2332 2367 2339 3268 9.64% 9.83% 9.52% 9.75% 9.50% 908 213 217 227 227 0.92% 0.90% 0.87% 0.95% 0.66% 2759.00 639.00 738.00 672.56 1148.97 2.78% 2.69% 2.97% 2.80% 3.34% 95 13 25 31 29 0.10% 0.05% 0.10% 0.00% 0.00% -103 -20 -25 0 0 -0.10% -0.08% -0.10% 0.00% 0.00% 2767 646 738 641 1120 2.79% 2.72% 2.97% 2.67% 3.26% 999 225 185 225 392 36.10% 34.83% 25.07% 35.00% 35.00% 1768.00 421.00 553.00 416.95 727.98 1.78% 1.78% 2.22% 1.74% 2.12% 908 213 217 227 227 61 8 19 20 19 2736.70 642.47 788.73 664.20 973.90 2.76% 2.71% 3.17% 2.77% 2.83% 8122 9327 8882 8696 8635 8.19% 39.33% 35.71% 0.00% 0.00% 12260 14231 13230 13002 13004 12.37% 60.01% 53.19% 54.20% 37.80% -4138 -4904 -4348 -4306 -4369 -4.17% -20.68% -17.48% -17.95% -12.70% 309 -766 556 42 -63 1480 488 455 240 172 1.49% 2.06% 1.83% 1.00% 0.50% 0 0 0 0 0 0.00% 0.00% 0.00% 0.00% 0.00% 948 920 -222 382 865 920 -222 377 838 Q1 Q2 Q3 Q4 2013E 11/30/2013E 02/28/2014E 05/31/2014E 08/31/2014E 106976 25247 26318 25257 36241 7.91% 8.00% 8.00% 7.75% 7.50% 92570 21839 22765 21847 31348 86.53% 86.50% 86.50% 86.50% 86.50% 14407 3408 3553 3410 4893 13.47% 13.50% 13.50% 13.50% 13.50% 10306 2462 2566 2463 3443 9.63% 9.75% 9.75% 9.75% 9.50% 884 230 231 232 233 0.83% 0.91% 0.88% 0.92% 0.64% 3198.53 716.45 755.50 715.37 1216.42 2.99% 2.84% 2.87% 2.83% 3.36% 98 0 0 0 0 0.09% 0.00% 0.00% 0.00% 0.00% -45 0 0 0 0 -0.04% 0.00% 0.00% 0.00% 0.00% 3145 716 755 715 1216 2.94% 2.78% 3.03% 2.73% 3.32% 1027 251 264 250 426 32.63% 35.00% 35.00% 35.00% 35.00% 2118.93 465.69 491.07 464.99 790.67 1.98% 1.84% 1.87% 1.84% 2.18% 884 230 231 232 233 66 0 0 0 0 3069.13 696.02 722.49 696.76 1023.89 2.87% 2.76% 2.75% 2.76% 2.83% 8635 9215 9343 9219 9531 8.07% 0.00% 0.00% 0.00% 0.00% 13004 13482 13764 13816 14061 12.16% 53.40% 52.30% 54.70% 38.80% -4369 -4267 -4421 -4597 -4530 -4.08% -16.90% -16.80% -18.20% -12.50% -231 102 -155 -175 67 1355 252 263 253 362 1.27% 1.00% 1.00% 1.00% 1.00% 0 0 0 0 0 0.00% 0.00% 0.00% 0.00% 0.00% 1945 341 614 620 595 326 577 574 542 2014E 113063 5.69% 97800 86.50% 15264 13.50% 10933 9.67% 927 0.82% 3403.74 3.01% 0 0.00% 0 0.00% 3404 3.01% 1191 35.00% 2212.43 1.96% 927 0 3139.16 2.78% 9531 8.43% 14061 12.44% -4530 -4.01% -161 1131 1.00% 0 0.00% 2170 2170 2015E 118502 7.00% 102504 86.50% 15998 13.50% 11495 9.70% 947 0.80% 3556.22 3.00% 0 0.00% 0 0.00% 3556 3.00% 1245 35.00% 2311.55 1.95% 947 0 3258.39 2.75% 10132 0.00% 14896 12.57% -4764 -4.02% -234 1185 1.00% 0 0.00% 2307 1977 2016E 123197 6.00% 106565 86.50% 16632 13.50% 12012 9.75% 964 0.78% 3655.78 2.97% 0 0.00% 0 0.00% 3656 2.97% 1280 35.00% 2376.26 1.93% 964 0 3340.35 2.71% 10533 0.00% 15547 12.62% -5014 -4.07% -250 1232 1.00% 0 0.00% 2359 1901 2017E 127908 5.00% 110641 86.50% 17268 13.50% 12535 9.80% 981 0.77% 3751.28 2.93% 0 0.00% 0 0.00% 3751 2.93% 1313 35.00% 2438.33 1.91% 981 0 3419.66 2.67% 11000 0.00% 16142 12.62% -5142 -4.02% -128 1279 1.00% 0 0.00% 2268 1718 2018E 132429 4.00% 114551 86.50% 17878 13.50% 13044 9.85% 994 0.75% 3839.39 2.90% 0 0.00% 0 0.00% 3839 2.90% 1344 35.00% 2495.60 1.88% 994 0 3489.86 2.64% 11389 0.00% 16713 12.62% -5324 -4.02% -182 1324 1.00% 0 0.00% 2347 1672 UOIG 12 University of Oregon Investment Group 4/26/2013 Appendix 3 – Revenue Model Revenue Model (Geographic) ($ in millions) United States Operations Warehouses % Growth Average Store Square Footage % Growth Total Square Footage % Growth Revenue / Square Foot % Growth Revenue % of Total Revenue % Growth Canadian Operations Warehouses % Growth Average Store Square Footage % Growth Total Square Footage % Growth Revenue / Square Foot % Growth Revenue % of Total Revenue % Growth Other International Operations Warehouses % Growth Average Store Square Footage % Growth Total Square Footage % Growth Revenue / Square Foot % Growth Revenue % of Total Revenue % Growth Consolidated Operations Warehouses % Growth Average Store Square Footage % Growth Total Square Footage % Growth Revenue / Square Foot % Growth Revenue % Growth 2009A 2010A 2011A Q1 11/30/2012A 2012A Q2 02/28/2013A Q3 05/31/2013E Q4 08/31/2013E Q1 11/30/2013E 2013E Q2 02/28/2014E Q3 05/31/2014E Q4 08/31/2014E 2014E 2015E 2016E 2017E 2018E 406 2.01% 0.14 0.43% 58.60 2.45% 964.98 -3.00% 56548 79.17% -0.62% 416 2.46% 0.14 0.26% 60.20 2.73% 990.43 2.64% 59624 76.49% 5.44% 429 3.13% 0.14 0.03% 62.10 3.16% 1045.15 5.52% 64904 73.00% 8.86% 439 2.33% 0.15 0.24% 63.70 2.58% 1126.78 7.81% 71776 72.40% 10.59% 447 3.23% 0.15 0.22% 64.91 3.46% 260.65 4.73% 16918 71.34% 8.35% 448 3.46% 0.15 0.22% 65.05 3.69% 273.53 3.31% 17794 71.55% 7.12% 450 3.45% 0.15 0.18% 65.35 3.63% 264.05 2.77% 17256 71.93% 6.50% 452 2.96% 0.15 0.10% 65.65 3.06% 376.99 2.85% 24749 71.94% 6.00% 452 2.96% 0.15 0.10% 65.65 3.06% 1168.59 209.98% 76717 71.71% 6.88% 460 3.00% 0.15 0.07% 66.90 3.07% 266.78 -77.17% 17848 70.69% 5.50% 461 3.00% 0.15 0.08% 67.06 3.08% 278.63 4.44% 18684 70.99% 5.00% 461 2.50% 0.15 0.06% 67.03 2.56% 269.03 -3.44% 18033 71.40% 4.50% 463 2.50% 0.15 0.06% 67.33 2.56% 385.94 43.45% 25986 71.70% 5.00% 463 2.50% 0.15 0.06% 67.33 2.56% 1196.31 209.98% 80551 71.24% 5.00% 475 2.50% 0.15 0.08% 69.06 3.22% 1218.90 1.89% 84176 71.03% 4.50% 486 2.25% 0.15 0.13% 70.65 5.36% 1233.14 1.17% 87122 70.72% 3.50% 495 2.00% 0.15 0.17% 72.10 7.56% 1250.68 1.42% 90171 70.50% 3.50% 505 2.00% 0.15 0.21% 73.57 9.27% 1265.18 1.16% 93084 70.29% 3.23% 77 2.67% 0.14 0.27% 10.50 2.94% 927.3 -10.16% 9737 13.63% -7.51% 79 2.60% 0.14 0.25% 10.80 2.86% 1115.8 20.33% 12051 15.46% 23.77% 82 3.80% 0.14 -0.09% 11.20 3.70% 1251.8 12.18% 14020 15.77% 16.34% 82 85 3.66% 0.14 0.0 11.64 3.94% 343.8 8.09% 4002 16.09% 12.35% 85 3.66% 0.14 0.0 11.64 3.94% 486.1 3.90% 5659 16.45% 8.00% 85 3.66% 0.14 0.0 11.64 3.94% 1492.2 6.33% 17372 16.24% 10.53% 85 2.41% 0.14 0.0 11.64 2.56% 360.8 5.30% 4200 16.64% 8.00% 86 1.18% 0.14 0.0 11.79 1.28% 363.2 5.65% 4282 16.27% 7.00% 86 1.18% 0.14 0.0 11.79 1.28% 343.5 4.66% 4051 16.04% 6.00% 87 2.35% 0.14 0.0 11.94 2.56% 497.7 2.38% 5942 16.40% 5.00% 88 3.53% 0.14 88 2.33% 0.14 89 3.49% 0.14 89 2.30% 0.14 11.94 2.56% 1547.4 3.70% 18475 16.34% 6.35% 12.09 3.84% 1597.1 342.67% 19306 16.29% 4.50% 12.09 2.53% 1660.9 357.34% 20079 16.30% 4.00% 12.24 3.79% 1698.1 394.30% 20781 16.25% 3.50% 12.24 2.50% 1753.3 252.30% 21457 16.20% 3.25% 44 12.82% 0.14 2.02% 6.10 15.09% 842.1 -11.65% 5137 7.19% 1.68% 45 2.27% 0.14 0.98% 6.30 3.28% 995.4 18.20% 6271 8.05% 22.08% 81 80.00% 0.14 -2.12% 11.10 76.19% 900.1 -9.57% 9991 11.24% 59.32% 87 7.41% 0.14 0.65% 12.00 8.11% 970.3 7.80% 11644 11.75% 16.54% 87 7.41% 0.14 0.65% 12.00 8.11% 242.3 4.54% 2908 12.26% 13.02% 89 7.23% 0.14 0.55% 12.29 7.81% 250.2 2.08% 3075 12.36% 10.06% 85 3.66% 0.14 0.0 11.64 3.94% 328.2 5.83% 3821 15.93% 10.00% 2 91 7.06% 0.14 0.50% 12.59 7.60% 231.3 2.23% 2912 12.14% 10.00% 87 2.35% 0.14 1403.3 12.10% 15717 15.85% 12.10% 83 1.22% 0.14 0.0 11.35 1.35% 342.6 11.52% 3889 16.40% 13.02% 91 4.60% 0.14 0.30% 12.59 4.91% 317.2 4.86% 3993 11.61% 10.00% 91 4.60% 0.14 0.30% 12.59 4.91% 1023.7 5.50% 12888 12.05% 10.68% 92 5.75% 0.14 0.38% 12.74 6.15% 251.1 3.63% 3199 12.67% 10.00% 93 4.49% 0.14 0.34% 12.89 4.85% 260.1 3.96% 3352 12.74% 9.00% 94 3.30% 0.14 0.25% 13.04 3.55% 243.5 5.26% 3174 12.57% 9.00% 95 4.40% 0.14 0.32% 13.18 4.73% 327.1 3.12% 4312 11.90% 8.00% 95 4.40% 0.14 0.32% 13.18 4.73% 1064.6 3.99% 14037 12.41% 8.92% 99 7.61% 0.14 0.54% 13.78 8.19% 1089.9 333.99% 15019 12.67% 7.00% 103 10.75% 0.14 0.73% 14.38 11.56% 1112.6 327.77% 15996 12.98% 6.50% 107 13.83% 0.14 0.90% 14.97 14.86% 1132.4 365.12% 16955 13.26% 6.00% 110 15.79% 0.14 1.00% 15.42 16.95% 1160.1 254.67% 17888 13.51% 5.50% 527 2.93% 0.14 0.49% 75.20 3.44% 949.8 -4.74% 71422 -1.46% 540 2.47% 0.14 0.32% 77.30 2.79% 1008.4 6.17% 77946 9.13% 592 9.63% 0.14 -0.41% 84.40 9.18% 1053.5 4.48% 88915 14.07% 608 2.70% 0.14 0.25% 86.90 2.96% 1140.8 8.29% 99137 11.50% 617 3.52% 0.14 0.08% 88.26 1.56% 268.7 5.65% 23715 9.65% 622 4.01% 0.14 0.01% 88.99 0.82% 279.5 3.85% 24871 8.29% 626 3.99% 0.14 0.03% 89.58 0.67% 267.8 3.11% 23989 7.46% 628 3.29% 0.14 0.01% 89.88 0.33% 382.7 3.24% 34401 6.78% 628 637 1.50% 0.14 0.06% 91.28 1.56% 276.6 2.94% 25247 6.46% 640 0.48% 0.14 0.02% 91.73 0.49% 286.9 2.65% 26318 5.82% 641 0.13% 0.14 0.01% 91.85 0.13% 275.0 2.68% 25257 5.29% 645 0.63% 0.14 0.03% 92.46 0.66% 392.0 2.41% 36241 5.35% 645 662 2.57% 0.14 0.10% 94.93 2.67% 1248.3 2.08% 118502 4.81% 677 2.22% 0.14 0.08% 97.12 2.30% 1268.5 1.62% 123197 3.96% 691 2.17% 0.14 0.08% 99.31 2.26% 1288.0 1.53% 127908 3.82% 704 1.87% 0.14 0.07% 101.23 1.94% 1308.2 1.57% 132429 3.53% 0.14 11.20 0.14 89.88 1190.2 210.97% 106976 7.91% 0.14 92.46 1222.9 211.98% 113063 5.69% UOIG 13 University of Oregon Investment Group 4/26/2013 Appendix 4 – Working Capital Mode Working Capital Model ($ in millions) Total Revenue Current Assets Accounts Receivable Days Sales Outstanding A/R % of Revenue Inventory Days Inventory Outstanding % of Revenue Total Current Assets % of Revenue Long Term Assets Net PP&E Beginning Capital Expenditures Acquisitions Depreciation and Amortization Net PP&E Ending Total Current Assets & Net PP&E % of Revenue Current Liabilities Accounts Payable Days Payable Outstanding % of Revenue Short Term Debt Days Charges Outstanding % of Revenue Income Taxes Payable Days Taxes Outstanding % of Revenue Accrued Payroll % of Revenue Current Portion of Long Term Debt % of Revenue Other Liabilities % of Revenue Total Current Liabilities % of Revenue 2009A 2010A 2011A 2012A Q1 Q2 Q3 Q4 11/30/2012A 02/28/2013A 05/31/2013E 08/31/2013E 2013E Q1 Q2 Q3 Q4 11/30/2013E 02/28/2014E 05/31/2014E 08/31/2014E 2014E 2015E 2016E 2017E 2018E $71,422.00 $77,946.00 $88,915.00 $99,137.00 $23,715.00 $24,871.00 $23,989.30 $34,401.08 $106,976.38 $25,247.41 $26,317.59 $25,257.16 $36,240.92 $113,063.08 $118,501.84 $123,196.52 $127,908.29 $132,428.77 834.00 4.26 1.17% 5405.00 32.02 7.57% 6239.00 9% 884.00 4.14 1.13% 5638.00 30.62 7.23% 6522.00 8% 965.00 3.96 1.09% 6638.00 31.51 7.47% 7603.00 9% 1026.00 3.79 1.03% 7096.00 30.23 7.16% 8122.00 8% 1175.00 4.51 4.95% 8152.00 36.16 34.37% 9327.00 39% 1300.00 4.70 5.23% 7582.00 31.67 30.49% 8882.00 36% 1259.44 4.83 5.25% 7436.68 32.97 31.00% 8696.12 36% 1066.43 2.85 3.10% 7568.24 23.40 22.00% 8634.67 25% 1066.43 3.64 1.00% 7568.24 29.84 7.07% 8634.67 8% 1136.13 4.10 4.50% 8079.17 36.89 32.00% 9215.30 37% 1315.88 4.50 5.00% 8026.86 32.30 30.50% 9342.74 36% 1136.57 4.14 4.50% 8082.29 33.63 32.00% 9218.86 37% 1195.95 3.04 3.30% 8335.41 25.74 23.00% 9531.36 26% 1195.95 3.86 1.06% 8335.41 31.11 7.37% 9531.36 8% 1303.52 4.03 1.10% 8828.39 36.71 7.45% 10131.91 9% 1355.16 4.02 1.10% 9178.14 36.71 7.45% 10533.30 9% 1406.99 4.02 1.10% 9593.12 36.71 7.50% 11000.11 9% 1456.72 4.02 1.10% 9932.16 36.71 7.50% 11388.87 9% 10355.00 1250.00 0.00 728.00 10877.00 17116 15% 10900.00 1055.00 0.00 795.00 11160.00 17682 14% 11314.00 1290.00 0.00 855.00 11749.00 19352 13% 12432.00 1480.00 0.00 908.00 13004.00 21126 13% 12916.00 488.00 0.00 213.00 13191.00 22518 56% 13251.00 455.00 0.00 217.00 13489.00 22371 54% 13489.00 239.89 0.00 227.04 13501.85 22197.97252 56% 13501.85 172.01 0.00 227.07 13446.79 22081.4568 39% 12916.00 1354.90 0.00 884.11 13386.79 22021.4568 13% 13386.79 252.47 0.00 230.33 13408.93 22624.23748 53% 13408.93 263.18 0.00 231.41 13440.70 22783.44145 51% 13440.70 252.57 0.00 231.77 13461.50 22680.35898 53% 13461.50 362.41 0.00 233.22 13590.68 23122.04791 38% 13386.79 1130.63 0.00 926.73 13590.68 23122.04791 12% 13590.68 1185.02 0.00 946.85 13828.86 23960.76405 12% 13828.86 1231.97 0.00 964.09 14096.73 24630.03577 11% 14096.73 1279.08 0.00 981.33 14394.49 25394.59907 11% 14394.49 1324.29 0.00 994.26 14724.51 26113.38699 11% 5450.00 27.85 7.63% 16.00 0.08 0.02% 302.00 1.54 0.42% 1418.00 1.99% 81.00 0.11% 2014.00 2.82% 9281.00 13% 5947.00 27.85 7.63% 26.00 0.12 0.03% 322.00 1.51 0.41% 1571.00 2.02% 0.00 0.00% 2197.00 2.82% 10063.00 13% 6544.00 26.86 7.36% 0.00 0.00 0.00% 335.00 1.38 0.38% 1758.00 1.98% 900.00 1.01% 2513.00 2.83% 12050.00 14% 7303.00 26.96 7.37% 0.00 0.00 0.00% 397.00 1.47 0.40% 1832.00 1.85% 1.00 0.00% 2727.00 2.75% 12260.00 12% 8825.00 33.86 37.21% 12.00 0.05 0.05% 94.86 0.36 0.40% 1945.00 8.20% 1.00 0.00% 3353.00 14.14% 14230.86 60% 7441.00 26.93 29.92% 64.00 0.23 0.26% 185.00 0.67 0.80% 2077.00 8.35% 1.00 0.00% 3462.00 13.92% 13230.00 53% 7196.79 27.60 30.00% 0.00 0.00 0.00% 287.87 0.90 1.20% 1919.14 8.00% 0.00 0.00% 3598.39 15.00% 13002.20 54% 7740.24 20.70 22.50% 0.00 0.00 0.00% 447.21 1.20 1.30% 2064.06 6.00% 0.00 0.00% 2752.09 8.00% 13003.61 38% 7740.24 26.41 7.24% 0.00 0.00 0.00% 447.21 1.53 0.42% 2064.06 1.93% 0.00 0.00% 2752.09 2.57% 13003.61 12% 7826.70 28.21 31.00% 0.00 0.00 0.00% 100.99 0.36 0.40% 2019.79 8.00% 0.00 0.00% 3534.64 14.00% 13482.12 53% 7895.28 27.00 30.00% 0.00 0.00 0.00% 210.54 0.67 0.80% 2105.41 8.00% 0.00 0.00% 3552.87 13.50% 13764.10 52% 8082.29 29.44 32.00% 0.00 0.00 0.00% 303.09 0.90 1.20% 2020.57 8.00% 0.00 0.00% 3409.72 13.50% 13815.67 55% 8335.41 21.16 23.00% 0.00 0.00 0.00% 471.13 1.20 1.30% 2174.46 6.00% 0.00 0.00% 3080.48 8.50% 14061.48 39% 8335.41 26.91 7.37% 0.00 0.00 0.00% 471.13 1.52 0.42% 2174.46 1.92% 0.00 0.00% 3080.48 2.72% 14061.48 12% 8769.14 27.08 7.40% 0.00 0.00 0.00% 497.71 1.51 0.42% 2370.04 2.00% 0.00 0.00% 3258.80 2.75% 14895.68 13% 9116.54 27.01 7.40% 0.00 0.00 0.00% 517.43 1.52 0.42% 2463.93 2.00% 0.00 0.00% 3449.50 2.80% 15547.40 13% 9465.21 27.01 7.40% 0.00 0.00 0.00% 537.21 1.53 0.42% 2558.17 2.00% 0.00 0.00% 3581.43 2.80% 16142.03 13% 9799.73 27.01 7.40% 0.00 0.00 0.00% 556.20 1.53 0.42% 2648.58 2.00% 0.00 0.00% 3708.01 2.80% 16712.51 13% UOIG 14 University of Oregon Investment Group 4/26/2013 Appendix 5 – Discounted Cash Flows Analysis Assumptions 1 Year Daily 1 Year Daily Hamada Beta Company Beta Weighting SD Variance Price Smart, Inc 1.15 0% 0.125 Target 0.48 50% Walmart 0.36 Fred's, Inc 1.15 Dollar General Corp. Beta Beta SD Weighting Company Beta Weighting D/E Tax Rate Unlevered Beta 1 Year Daily 0.71 0.10 50.00% 1.57% Price Smart, Inc 1.15 0% 0.03 11.31% 1.12 3 Year Daily 0.64 0.05 50.00% 0.071 0.51% Target 0.48 50% 0.28 21.97% 0.39 Costco Beta 50% 0.070 0.50% Walmart 0.36 50% 0.18 20.50% 0.32 0% 0.119 1.42% Fred's, Inc 1.15 0% 0.03 36.15% 1.13 0.37 0% 0.118 1.40% Dollar General Corp. 0.37 0% 0.14 22.95% 0.34 Industry Costco 0.42 0.71 Variance 0.50% 1.04% Weight 67% 33% Vasicek Beta 0.51 Weight Avgerage Unlevered Beta 1.243820231 0.13212512 0.35 Costco 0.03 17.78% Levered Costco Beta 3 Year Daily 0.68 0.36 3 Year Daily Hamada Beta Company Beta Weighting SD Variance Company Beta Weighting Price Smart, Inc 1.15 0% 0.060 D/E Tax Rate Unlevered Beta 0.36% Price Smart, Inc 1.15 0% 0.03 11.31% Target 0.63 50% 1.12 0.033 0.11% Target 0.63 50% 0.28 21.97% Walmart 0.44 0.52 50% 0.027 0.07% Walmart 0.44 50% 0.18 20.50% Fred's, Inc 0.39 1.08 0% 0.049 0.24% Fred's, Inc 1.08 0% 0.03 36.15% Dollar General Corp. 1.06 0.47 0% 0.049 0.24% Dollar General Corp. 0.47 0% 0.14 22.95% 0.43 Industry Costco 0.54 0.64 0.03 17.78% Variance 0.09% 0.25% Weight 74% 26% Vasicek Beta 0.56 Beta Weight Avgerage Unlevered Beta Costco Levered Costco Beta Discounted Free Cash Flow Assumptions Tax Rate 35.00% Terminal Growth Rate Risk Free Rate 1.70% Terminal Value Beta 0.68 PV of Terminal Value Market Risk Premium 7.00% Sum of PV Free Cash Flows % Equity 97.20% Firm Value % Debt 2.80% Total Debt Cost of Debt 5.70% Cash & Cash Equivalents CAPM 6.44% Market Capitalization WACC 6.36% Fully Diluted Shares Implied Price 120.78 Current Price 109.27 Undervalued 0.45 0.46 Considerations 2.50% 62,258 44,342 10,126 54,467 1,382 4,854 53,085 440 Avg. Industry Debt / Equity Avg. Industry Tax Rate Current Reinvestment Rate Reinvestment Rate in Year 2018E Implied Return on Capital in Perpetuity Terminal Value as a % of Total Implied 2014E EBITDA Multiple Implied Multiple in Year 2018E Free Cash Flow Growth Rate in Year 2018E 13.10% 22.58% 46.24% 5.94% 42.07% 81.4% 12.6x 9.2x 3% Method Comparable DCF Price Target Current Price Undervalued Implied Price 87.94 120.78 110.93 109.27 1.52% Weight 30.00% 70.00% 10.53% UOIG 15 University of Oregon Investment Group 4/26/2013 WACC Adjusted Beta Appendix 6 –Sensitivity Analysis 121 0.78 0.73 0.68 0.63 0.58 121 7.36% 6.86% 6.36% 5.86% 5.36% 2.00% 93.70 100.69 108.78 118.24 129.45 Implied Price Terminal Growth Rate 2.25% 2.50% 97.76 102.27 105.45 110.77 114.42 120.78 125.00 132.71 137.67 147.19 2.0% 87.9 97.3 108.8 123.3 142.0 Implied Price Terminal Growth Rate 2.3% 2.5% 91.5 95.4 101.7 106.6 114.4 120.8 130.7 139.1 152.1 163.9 Undervalued/(Overvalued) Terminal Growth Rate 2.75% 107.30 116.77 128.02 141.60 158.34 3.00% 112.96 123.57 136.33 151.96 171.56 Undervalued/(Overvalued) Terminal Growth Rate 2.8% 99.7 112.1 128.0 149.0 178.0 3.0% 104.5 118.4 136.3 160.6 195.1 UOIG 16 University of Oregon Investment Group 4/26/2013 Appendix 7 – Sources SEC Filings Costco Wholesale Corporation Investor Relations Costco Presentations Earnings call transcripts IBIS World S&P Net Advantage S&P Capital IQ ONEsearch Mergent Online Factset Prospectuses Press releases UOIG 17