Aggregate Expenditure or Keynesian Model

advertisement

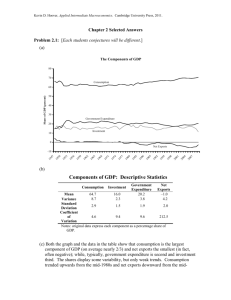

Aggregate Expenditure or Keynesian Model ECO 120: Global Macroeconomics 1 1.1 Goals Goals of this chapter • Specific Goals: 1. Understand how spending plans are determined when the price is fixed in the short run. 2. Understand the expenditure multiplier. 3. Understand how recessions and expansions begin. 4. Learn how to pronounce Keynes. It’s like candy canes. • Learning Objectives: 1. LO5: Use the model of aggregate demand and supply to evaluate the short-run and long-run impacts of fiscal and monetary policy on production, employment, and the price level. 2. GELO2: Students will be able to construct and use models to analyze, explain, or predict phenomena. 1.2 Reading Reading Chapter 11. 2 Expenditure Plans 2.1 Background Keynesian model background • Prices are assumed to be fixed → short run. • Quantities firms sell only depend on aggregate demand. • Aggregate demand determines real GDP. 1 • Aggregate expenditure: consumer spending + government spending + spending on investment + net exports • Real GDP: equal to aggregate expenditure in equilibrium. – An increase in aggregate expenditure leads to an increase in real GDP. – Since real GDP influences consumption and imports, an increase in real GDP leads to an increase in aggregate expenditure. 2.2 Expenditure Components Consumption and savings • Consumption is primarily determined by four components 1. Real interest rate 2. Disposable income 3. Wealth 4. Expected future income. • Consumption function: shows how much people consume (y-axis) based on level of disposable income. • What does the slope of the consumption function look like? sloping, slope is less than one. Consumption and savings functions 2 Upward Marginal propensity to consume • Marginal propensity to consume (MPC): fraction of an increase in disposable income that is consumed. MPC = ∆C ∆Yd • The slope of the consumption function = MPC. • Marginal propensity to save (MPS): fraction of an increase in disposable income that is saved. MPS = 1 − MPC • The slope of the savings function = MPS. MPC and MPS 3 • What does the straight line indicate? MPC and MPS are both constant. Do not change as disposable income changes. Shifts in the consumption function Changes in other things besides disposable income that affect consumption shift the consumption function. 1. A change in the interest rate. 2. A change in wealth. 3. A change in expected future income. Import function • Imports come from two sources: 1. Consumers import products → imports depend on disposable income. 2. Producers import factors of production, intermediate goods → imports depend on real GDP. • Imports increase as real GDP increases. • Marginal propensity to import (MPM): the fraction of an increase in real GDP that is spent on imports. • MPM increases as the global economy becomes more integrated. Aggregate expenditure curve • Consumption depends on disposable income, and therefore real GDP. • Investment demand does not depend on current real GDP (only expectations of future final goods demand). 4 • Government spending is exogenous. • Export demand does not depend on domestic real GDP (depends on demand from foreign countries). • Recall: imports depend on disposable income, and therefore real GDP. • Aggregate expenditure function: shows what aggregate spending plans will be for different levels of real GDP. Aggregate expenditure curve 2.3 Equilibrium Equilibrium • Real GDP is determined in equilibrium. • Equilibrium occurs where aggregate expenditure is equal to real GDP. 5 3 Expenditure multiplier Expenditure multiplier • An exogenous increase in AE leads to an increase in real GDP greater than the initial increase in AE. • Two ways to think about it: 1. ↑ AE → ↑ real GDP → ↑ C → ↑ AE → ↑ real GDP ... 2. Suppose government buys more bombs. → Defense contractors sales go up. → Salaries and profits for defense contractor workers increases. → They spend higher salaries and profits on consumption. → The consumption lead to higher sales for other businesses. → Workers at those businesses in turn consume more... 3.1 Expenditure Multiplier Expenditure Multiplier • Suppose there is an increase in government spending. • GDP will increase by the ↑ G plus the ↑ C minus the ↑ M . ∆Y = ∆C + ∆G − ∆M ∆C = MPC ∆Y ∆M = MPM ∆Y ∆Y = MPC ∆Y + ∆G − MPM ∆Y • Solve for the change in real GDP (∆Y ): ∆G ∆G (1-MPC+MPM)∆Y = ∆G ∆Y = 1-MPC+MPM ∆Y = MPS+MPM Expenditure Multiplier • The expenditure multiplier is given by, me = 1 MPS+MPM • MPS + MPM = fraction of income not spent in the United States (saved or spent abroad). • If economy is closed, or imports do not depend on income, then M P M = 0. • Let ∆AE denote any single change in aggregate expenditure • The impact on real GDP is, ∆Y = me ∆AE 6 3.2 Graphical interpretation Graphical interpretation • Increase in investment shifts AE upward. • Real GDP increases by more than the increase in investment. 4 Recessions and expansions 4.1 Recession Process Recessions and expansions • Recessions and expansions occur because of the expenditure multiplier. • Small negative shocks to autonomous expenditure cause larger decreases to real GDP. • Recession process: 1. Negative shock to AE. 2. Real GDP exceeds planned expenditure. 3. Business inventories increase due to lower sales volume. 4. Businesses cut production (lay off workers) to reduce inventories. 5. Real GDP decreases. 6. Decrease in real GDP reduces consumption... 4.2 Full Employment GDP Full employment GDP • Full employment GDP or Potential GDP: Level of GDP when all factors of production are used efficiently. 7 – Implies cyclical unemployment is equal to zero. Frictional and structural unemployment will still be positive. • Recessionary gap: when real GDP is below potential GDP. • Inflationary gap: when real GDP is above potential GDP. 8