using quickbooks to record restricted transactions

advertisement

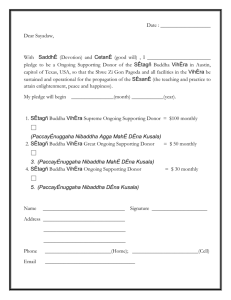

USING QUICKBOOKS TO RECORD RESTRICTED TRANSACTIONS Recording Pledges Pledges are unconditional promises that a donor gives to your organization, which could include a promise for money over a period of time, a one-time gift or in-kind donations. When a pledge is recorded, contributions income is also recorded at the same time. In the accounting rules, once an unconditional promise is made, the pledge should be recorded as of the date the promise is made. For example, if a donor sends you a letter that declares that s/he is going to give you $5,000 for your next year’s operations, you need to record it as a pledge when the promise is made, NOT when it is received in the next year. QuickBooks tracks every “Customer” as a “Job”. That means you can code any revenue or expense item to a Customer and later produce a report for just that “Job”. This is useful if you have a particular grant, within a program (which is coded as a specific “Class”), that needs to be accounted for separately. The restriction can be satisfied by either the passage of time or by expending the funds for their restricted purpose. For example, pledge receivables are, by default, time restricted because you have not received the funds yet. If there are no other program restrictions on the pledge, when you receive the funds, the time restriction is released because the collection has been made. See section Recording Temporarily Restricted Activity for more information on how to record and release pledge transactions. To record a pledge receivable: o Home Screen / Customers/Donors Create Invoices (make sure it is under the correct Pledge template) Enter the Customer name, class, date of the pledge, item, any other description and amount, then “Save & Close” To record receipt of the pledge: o Home Screen / Customers/Donors Receive Payments (make sure the correct Pledge Receivable account is in the A/R Account section) Enter the Customer name, amount, date of receipt, pmt. Method, and any other memo or reference you need, then “Save & Close” If the payment is less than the total amount owed, a screen will show that asks if the underpayment should be left as is or if you want to write off the extra amount. Usually you will leave it as an underpayment until the full pledge has been paid. At any point in time, you can run a report for all receivables by: o Reports / Customers & Receivables / A/R Aging Summary ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) 1 If a pledge is promised to be received over several future years, a discount may need to be recorded. Recording Temporarily Restricted Activity One of the largest areas of confusion in small nonprofit organizations is how to account for restricted contributions. The accounting rules require that restricted contributions be recorded in the period in which the contribution is unconditionally promised – even if the funds are to be received and used in a future period. This is confusing for most organizations – why would you record a contribution before you receive it? The rules state that these sorts of contributions must be separated from your normal contributions in a section called “Temporarily Restricted” contributions. Then, when the time has come to use those funds for their purpose, they are “Released” from the restriction and pulled into your ordinary operations. There are basically two types of temporarily restricted contributions: those promised (see above) and those that have been received in advance that are intended to be used for a future restricted purpose. The donation income is treated the same way in either case. If you have set up your QuickBooks chart of accounts as suggested in the Example Chart of Account Listing, you will notice the 70000 section on Temporarily Restricted Activity. On the next page are instructions on how to record the various transactions and releases. Color key: Original transaction Journal entry done after transaction ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) Month end journal entry 2 Transactions related to temporarily restricted donations: 1 To record a new pledge When to make entry Type When pledge is made Create I nv oice Date 07/01/2011 Num 1 Name Memo Donor 1 To record new pledge Donor 1 To record new pledge Account Class 12510 · Contribution Receiv able Program: Shelter 70100 ·Contributions for Future Period Program: Shelter Debit 50,000.00 50,000.00 50,000.00 Month end General Journal 07/31/2011 1a Donor 1 To record all new pledges Donor 1 To record all new pledges 31000 · Unrestricted Net Assets Program: Shelter 31300 · Temp. Restricted Net Assets Program: Shelter When receiv ed Date Receiv e Payments 07/01/2011 Num 2 Name Memo Donor 1 To record receipt of pledge Donor 1 To record receipt of pledge Account 10100 · Operating Checking 12510 · Contribution Receiv able Class Program: Shelter Program: Shelter 50,000.00 Debit 2a Donor 1 To record receipt of pledge Donor 1 To record receipt of pledge 70200 · Restricted Funds Released Program: Shelter 44900 · Restricted Funds Released Program: Shelter General Journal 07/31/2011 2b Donor 1 To record all releases Donor 1 To record all releases 31300 · Temp. Restricted Net Assets Program: Shelter 31000 · Unrestricted Net Assets Program: Shelter When donation receiv ed Donations 07/01/2011 Num 3 Name Memo Account Class Donor 2 To record temp restricted contribution Donor 2 To record temp restricted contribution 70100 ·Contributions for Future Period Program: Shelter 10100 · Operating Checking Program: Shelter 30,000.00 General Journal 07/31/2011 3a Donor 2 To record all temp restricted contributions Donor 2 To record all temp restricted contributions 31300 · Temp. Restricted Net Assets Program: Shelter 31000 · Unrestricted Net Assets Program: Shelter 4 To release temporarily restricted funds related to expenses paid for restricted purpose When to make entry Type Date Num Name When bill is receiv ed Enter Bills 07/01/2011 4 Memo Donor 2 Expenses paid for restricted purpose Donor 2 Expenses paid for restricted purpose Donor 2 Expenses paid for restricted purpose Account Class 63560 · Medical and Diagnostic Program: Shelter 63590 · General and Other Supplies Program: Shelter 10100 · Operating Checking Program: Shelter 30,000.00 Debit 4a Donor 2 Release for expenses paid for program Donor 2 Release for expenses paid for program 70200 · Restricted Funds Released Program: Shelter 44900 · Restricted Funds Released Program: Shelter General Journal 07/31/2011 4b Donor 2 Release for expenses paid for program Donor 2 Release for expenses paid for program 31300 · Temp. Restricted Net Assets Program: Shelter 31000 · Unrestricted Net Assets Program: Shelter 5,000.00 5,000.00 5,000.00 5,000.00 5,000.00 Debit Credit 2,000.00 3,000.00 5,000.00 5,000.00 5,000.00 5,000.00 5,000.00 5,000.00 5,000.00 5,000.00 ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) Credit 5,000.00 5,000.00 Month end 30,000.00 5,000.00 5,000.00 JE right after transactionGeneral Journal 07/01/2011 30,000.00 30,000.00 5,000.00 Month end 30,000.00 30,000.00 30,000.00 3 To record a temporarily restricted contribution When to make entry Type Date Credit 30,000.00 30,000.00 Month end 50,000.00 30,000.00 30,000.00 JE right after transactionGeneral Journal 07/01/2011 50,000.00 50,000.00 50,000.00 2 To record receipt on the pledge When to make entry Type Credit 5,000.00 3 5.16 Endowments Endowments are contributions that a donor or Board of Directors has stipulated must be held forever. Generally the investment income or other revenue stream from the corpus of the endowment can be used for general operations or a program, according to the donor’s wishes, but the core of the donation must be held and managed forever. There are two types of endowments – those stipulated by a donor and those set aside by the Board of Directors. If the endowment is stipulated by a donor, it must be segregated in the financial statements as a “Permanently Restricted Net Asset” in the equity section of the Balance Sheet. Board of Director designated endowments are considered “Unrestricted Net Assets” on the Balance Sheet because the Board may change their minds at a future period. There are no special rules in general accounting for Board designated endowments. In this section we will discuss how to treat the permanently restricted (donor) endowment, which is a bit more complicated. Because the core of the donation must be kept forever, how the organization manages these funds is important. Most states have adopted the Uniform Prudent Management of Institutional Funds Act (UPMIFA) which requires the organization to preserve the fair value of the original gifts in permanently restricted endowment funds. The investment income is placed in temporarily restricted net assets until the Board of Directors approves using them. In general, the entries for recording donor restricted endowments should follow these guidelines: ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) 4 Transactions related to permanently restricted endowment donations and investment income: 6 To record a permanently restricted gift: When to make entry Type When receiv ed Sales Reciept Date 07/01/2011 Num 6 Name Donor 3 Donor 3 Memo To record new endow ment gift To record new endow ment gift Account Class 10100 · Operating Checking Program:Clinic 70100 ·Contributions for Future PeriodProgram:Clinic Debit 100,000.00 100,000.00 Month end General Journal 07/31/2011 7 To record interest income on endowment: When to make entry Type Date When bank statement receiv ed General Journal 07/01/2011 6a Num Donor 3 Donor 3 Name 7 To record new endow ment gift To record new endow ment gift Memo 31000 · Unrestricted Net Assets 31500 · Perm Restricted Net Assets Account To record interest income on endow ment 10100 · Operating Checking To record interest income on endow ment 49100 · I nv estment I ncome Program:Clinic Program:Clinic Class Program:Clinic Program:Clinic General Journal 07/31/2011 7a To record interest income on endow ment 31000 · Unrestricted Net Assets To record interest income on endow ment 31300 · Temp. Restricted Net Assets Program:Clinic Program:Clinic 100,000.00 100,000.00 100,000.00 Debit Credit 500.00 500.00 Name Memo To record authorized income use To record authorized income use Account Class 31300 · Temp. Restricted Net Assets 31000 · Unrestricted Net Assets Program:Clinic Program:Clinic 500.00 Debit 500.00 Credit 500.00 500.00 500.00 ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) 500.00 500.00 500.00 8 To release restricted investment income when Board authorizes: When to make entry Type Date Num When use is authorized by the Board of Directors General Journal 08/15/2011 8 100,000.00 100,000.00 500.00 Month end Credit 100,000.00 500.00 5 EXAMPLE CHART OF ACOUNTS Account Number Type 10100 Operating Checking Bank 10500 Petty cash Bank 11000 12000 Investments Accounts Receivable Savings Accounts Receivable 12010 Accounts Receivable Accounts Receivable 12020 12500 Allowance for Uncollectible Pledges Receivable Accounts Receivable Accounts Receivable 12510 Contribution Receivable Accounts Receivable 12520 Allowance for Uncollectible Accounts Receivable 12530 18000 Discount on multi-year pledges Inventory for Sale Accounts Receivable Other Current Asset 18100 Inventory for Use Other Current Asset 18500 Prepaid Insurance and Expenses Other Current Asset 15100 15200 Furniture and Equipment Real Property Fixed Asset Fixed Asset 15900 Accumulated Depreciation Fixed Asset 18700 Security Deposits Asset Other Asset 20000 22000 Accounts Payable Credit Card Accounts Payable Credit Card 24000 Payroll Liabilities Other Current Liability 25000 Accrued vacation Other Current Liability 26000 Debt Long Term Liability 27200 Other Long-Term Liabilities Long Term Liability 31000 Unrestricted Net Assets Equity 31100 Opening Balance Equity Equity 31300 Temp. Restricted Net Assets Equity 31500 Perm. Restricted Net Assets Equity ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) Subaccount of Description Main checking account used for operating and payroll activities Float cash for retail operations and small administrative charges Investments in stocks, bonds, mutual funds, certificates of deposit, etc. Header Accounts Receivable Amounts owed to you from program activities Contra-account to accounts receivable. It is the estimate of uncollectible accounts Accounts Receivable receivable Header Unconditional amounts promised to you from Pledges Receivable donors - to be collected in the future Contra-account to pledges receivable. It is Pledges Receivable the estimate of uncollectible pledges Contra-account to pledges receivable. Calculated at the time that the gift is Pledges Receivable promised Retail inventory stock Inventory of supplies to be used in the future Insurance and other costs paid in advance to be reversed when the period has expired Furniture and equipment with useful life exceeding one year Land, buildings and improvements Contra-account to fixed assets. Total amount of depreciation recorded for a fixed asset since its date of acquisition Deposits and other returnable funds held by other entities Amounts you owe to vendors for expenditures incurred To record credit card purchases Unpaid payroll liabilities. Amounts withheld or accrued, but not yet paid The obligation the organization has accumulated that would be paid to all eligible employees at any point in time Obligations, such as mortgages or lines of credit Liabilities other than payroll, accounts and grants payable, deferred revenue, loans, bonds, or mortgages Assets given to an organization by a donor with no specific stipulations Opening balances during setup post to this account. The balance of this account should be zero after completing your setup Assets given to an organization by a donor who stipulates that the assets must be spent for a specific purpose and/or over a specific timeframe Assets given to an organization by a donor who stipulates that the assets can never be spent 6 Number 43400 Account Type Income 43410 43420 Corporate Contributions Foundation Contributions Income Income Support Support 43430 Government Grants Income Support 43450 Individual Contributions Income Support 43460 Bequests Income Support 43470 Gifts in Kind Income Support 43500 Special events, net Income Support 44800 United Way, CFC Contributions Income Support 44900 47000 Restricted Funds Released Program Income Income Income Support 47200 47300 47400 47500 Program Income Shelter Fees Clinic Fees Adoption Fees Income Income Income Income Program Income Program Income Program Income Program Income 47600 Outreach Training Fees Income Program Income 47700 48000 48100 Government Contracts Retail Inventory Sales Program Income Retail Inventory Sales Income Income Income 48500 Cost of Retail Sales Income Retail Inventory Sales 49000 Miscellaneous Revenue Income 49100 61000 Investment Income Facilities and Equipment Income Expense 61100 Depreciation Expense 61200 Donated Facilities Expense 61300 Equip Rental and Maintenance Expense 61400 Property Insurance Expense 61500 Rent, Parking and Storage Expense 61600 62100 Utilities Contract Services Expense Expense 62110 62140 Accounting Fees Legal Fees Expense Expense ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) Description Subaccount of Support Header Retail Inventory Sales Facilities and Equipment Facilities and Equipment Facilities and Equipment Facilities and Equipment Facilities and Equipment Facilities and Equipment Contract Services Contract Services Contributions from corporations, sponsorships Contributions from private foundations Contributions from local, state or federal governments Contributions from individuals, businesses, direct mail, telethons, including any portion of dues that is greater than the value of member benefits received Gifts from donors who have designated your organization as beneficiary Donated goods, services or facilities: noncash gifts and contributions, donated inventory Gross proceeds from special events, net of direct benefit costs (food, beverage, rent) Contributions received through federated fundraising agencies - United Way, CFC, etc. Funds that were restricted that are released to be used in the current years operations. Should agree to Account #70200 Header Program service fees, member dues and assessments Fees generated from the shelter program Fees generated from the clinic program Fees generated from adoption fees Fees generated from the training in the community Contracts from local, state or federal governments Header Sales of retail inventory Contra-income account. Costs related to the sales of inventory Revenue from occasional or non-material activities Revenue from investment, cash or savings accounts Header Depreciation and amortization for the period Donated use of facilities, utilities, rent, equipment Rental and maintenance of office, program, and other equipment Insurance on property (not investment) owned by the organization Office and parking space, storage Basic utilities Header Outside (non-employee) accounting, audit, bookkeeping, tax prep, payroll service, and related consulting Outside (non-employee) legal services 7 Account Number 62150 63000 63100 Outside Contract Services Operations Type Subaccount of Contract Services Advertising Expense Expense Expense 63150 Bank & Processing Fees Expense Operations 63200 Books, Subscriptions, Reference Expense Operations 63250 Business Registration Fees Expense Operations 63480 Events Expense Operations 63500 Insurance - Liability, D & O Expense Operations 63520 63550 63555 63560 63570 63580 63590 Postage, Mailing Service Printing and Copying Supplies Operations Operations Medical and Diagnostic Food for Animals Office Supplies General and Other Supplies Expense Expense Expense Expense Expense Expense Expense 63600 63650 63700 Staff Development & Education Staff Recruiting Interest Expense Expense Expense Expense Operations Operations Operations 63750 Telephone, Telecommunications Expense 63900 Travel Expense 63950 Volunteer expenses Expense 64000 65000 65100 65200 Other Costs Payroll Expenses Salaries and Wages Payroll Taxes Expense Expense Expense Expense 65300 70000 Employee Benefits Temporarily Restricted Activity Expense Other Income 70100 Contributions for Future Period Other Income 70200 Restricted Funds Released Other Income ©2011 Jones & Associates LLC, CPAs (www.judyjonescpa.com) Operations Operations:Supplies Operations:Supplies Operations:Supplies Operations:Supplies Description Outside contractors (non-employee) for projects, consulting, short-term assignments for internal organization activities Header Advertising and promotion Bank service charges, credit card and payroll processing fees Books, subscriptions, reference materials, periodicals for use Permits, registrations, licenses, moving, royalties, bank charges, credit card fees Cost for special events - that do not directly benefit the participants Non-employee or property insurance liability, malpractice, directors Postage, parcel delivery, local courier, trucking, freight, outside mailing services Printing, copying, duplicating, recording Header Medical and diagnostic supplies Food for animals Supplies for office related usage Other or general supplies Conducting, or sending staff to, programrelated meetings, conferences, conventions Costs for recruiting staff Interest paid on debt Telephone equipment and service, internet Operations access, fax, conference calls Expenses related to travel, meetings, Operations conferences Costs to recruit, support and reward Operations volunteers Miscellaneous, small, or non-recurring Operations expenses Header Payroll Expenses Salaries and wages paid to employees Payroll Expenses Company portion of payroll related taxes Benefit paid on behalf of each employee such as; vacation, sick-leave, insurance (health, vision, dental, life, long-term disability, Payroll Expenses unemployment), bonus, etc. Header Temporarily Restricted New contributions received or promised to be Activity used in a future period Funds that were restricted that are released Temporarily Restricted to be used in the current years operations. Activity Should agree to Account #44900 8