2.5.14 Class Notes

Homework

see handout

Bond Conversions

The Jolly Corporation has $400,000 of 6 percent bonds outstanding. There is $20,000 of unamortized discount remaining on these bonds after the July 1, 2011, semiannual interest payment. The bonds are convertible at the rate of 20 shares of $5 par value common stock for each $1,000 bond. On July 1, 2011, bondholders presented $300,000 of the bonds for conversion.

1. Is there a gain or loss on conversion, and if so, how much is it?

2. How many shares of common stock are issued in exchange for the bonds?

3. In dollar amounts, how does this transaction affect the total liabilities and the total stockholders' equity of the company? In your answer, show the effects on four accounts.

International Perspective

• The accounting disclosure requirements in non-U.S. countries and IFRS are not as comprehensive as those in the United

States, partially because the information needs of the major capital providers (i.e., banks) are satisfied in a relatively straightforward way—through personal contact and direct visits .

• A second way in which the heavy reliance on debt affects non-

U.S. accounting systems is that the required disclosures and regulations tend to be designed either to protect the creditor or to help in the assessment of solvency.

Economic Consequences of Reporting

Long-Term Liabilities

• Improved credit ratings can lead to lower borrowing costs

• Management has strong incentive to manage the balance sheet by using

“off-balance-sheet financing” i.e., operating leases

Stockholders Equity

BE12-2, E12-1, E12-3, E12-5, E12-6,

E12-13, E12-14, P 12-10

Chapter 12: Shareholders’ Equity

How to Finance the Corporation?

• Borrow

– Notes, Bonds, Leases

– The debt holders are legally entitled to repayment of their principal and interest claims

• Issue Equity

– Common and Preferred Stock

– The shareholders, as owners, have voting rights, limited liability, and a residual interest in the corporate assets

• Retained Earnings

Debt versus Equity

Debt

Formal legal contract

Fixed maturity date

Fixed periodic payments

Security in case of default

No voice in management

Interest expense deductible

Equity

No legal contract

No fixed maturity date

Discretionary dividends

Residual asset interest

Voting rights - common

Dividends not deductible

Double taxation

Distinctions between Debt and Equity

Interested Party

Investors /

Creditors

Management

Accountants/

Auditors

Debt

Lower investment risk

Fixed cash receipts

Contractual future cash payments

Effects on credit rating

Interest is tax deductible

Liabilities section of the balance sheet

Income statement effects from debt

Equity

Higher investment risk

Variable cash receipts

Dividends are discretionary

Effects of dilution/ takeover

Dividends are not tax deductible

Shareholders’ equity of the balance sheet

No income statement effects from equity

Preferred Stock vs Common Stock

Preferred Stock Common Stock

Advantages Preference over common in liquidation

Stated dividend

Preference over common in dividend payout

Disadvantages Subordinate to debt in liquidation

Stated dividend can be skipped

Debt or Equity?

No voting rights (versus common)

Components of both

Usually classified as equity

Voting Rights

Rights to residual profits

(after preferred)

Last in liquidation

No guaranteed return

E12-3 Authorizing and Issuing Stock

Prepare entries for each event:

1. Authorized to issue: (a) 100,000 shares of $100 par value , 8% preferred stock (b) 150,000 shares of no-par, $5 preferred stock; and (c) 250,000 shares of $5 par value common stock.

2. Issued 10,000 shares of $5 par value common stock for $30 per share.

E12-3 Authorizing and Issuing Stock

Prepare entries for each event:

3. Issued 25,000 shares of the $100 par value preferred stock for $150 per share.

4. Issued 50,000 shares of no-par preferred stock for $50 each.

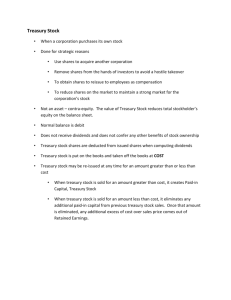

Treasury Stock

• Created when a company buys back shares of its own common stock.

• Reasons for buyback?

• The debit balance account called “Treasury Stock” is reported in shareholders’ equity as a contra account to SE.

– Note: Treasury Stock is not an asset.

• The stock remains issued, but is no longer outstanding.

– does not have voting rights

– cannot receive cash dividends

• May be reissued (to the market or to employees) or retired.

• No gains or losses are ever recognized from these equity transactions.

E12-5 Treasury Stock

Company was incorporated on 4.1.12 and was authorized to issue 100,000 shares of $5 par value common stock and 10,000 shares of $8, no-par preferred stock. a. T accounts:

1.

Issued 25,000 shares of common stock in exchange for $500,000 cash.

2.

3.

4.

5.

Issued 5,000 shares of preferred stock in exchange for $60,000 cash.

Purchased 3,000 common shares for $15 per share and held them in the treasury.

Sold 1,000 treasury shares for $18 per share.

Issued 1,000 treasury shares to executives who exercised stock options for a reduced price of $5 per share.

b. Assume company generated $500,000 in net income in 2012 and did not declare any dividends.

Prepare the stockholders’ equity section of the balance sheet as of

12.31.2012.

E12-6 Treasury Stock

12.31.2011 Shareholders’ section

Common stock

Additional paid-in capital

Retained earnings

Total shareholders’ equity

$80,000

10,000

60,000

$150,000

During 2012, the company entered into the following transactions:

1.

Purchased 1,000 shares of treasury stock for $60 per share.

2.

As part of a compensation package, reissued half of the treasury shares to executives who exercised stock options for $20 per share.

3.

Reissued the remainder of the treasury stock on the open market for $66 per share.

a.

Prepare the shareholders’ equity section of the balance sheet as of

12.31.2012. Company generated

$20,000 in net income and did not declare dividends during 2012.

E12-6 Treasury Stock

12.31.2011 Shareholders’ section

Common stock

Additional paid-in capital

Retained earnings

$80,000

10,000

60,000

Total shareholders’ equity $150,000 b. What portion of the additional paid-in capital account is attributed to treasury stock transactions?

E12-9 Inferring Transactions from SHE

2012 2011

Preferred stock (no par)

Common stock ($1 par value)

Additional paid-in capital:

Common stock

Treasury stock

Less Treasury stock

Provide the journal entries for the following: a. Issuance of preferred stock during 2012.

$ 700

1,000

40

10

130

$ 400

900

20

---

150 b. Issuance of common stock during 2012.

c. Sale of treasury stock during

2012.

Cash Dividends and Stock Dividends: 3 Dates

BE12-2 Stock Splits and Market Value

When Tandy (Radio Shack) Corporation announced a 2:1 stock split, it had 97 million shares outstanding, trading at

$100 per share.

a. Estimate the number of shares outstanding and market price per share immediately after the split.

b. Estimate the company’s overall market value, and explain whether you expect the company’s overall market value to change due to the split.

E12-1 SHE Transactions

For each transaction indicate which

SHE accounts are affected, whether these accounts increase or decrease, and the transaction’s effect on total

SHE.

1.

Issue common stock above par for cash.

2.

Declare a 3-for-1 stock split.

3.

Repurchase 10,000 shares of own stock for cash.

4.

Declare and issue a stock dividend.

Market>Par

5.

Reissue 1,000 treasury shares for

$75. Treasury stock had been previously acquired for $60.

6.

Pay cash dividend that had been previously declared.

7.

Generate net income of $250,000.

E12-13 Dividends in Arrears

The company paid the following total cash dividends since 2008:

2008:$0; 2009:$30,000;

2010:$80,000; 2011:$15,000; and

2012:$40,000.

• Preferred stock-10,000 shares authorized, 5,000 issued, cumulative, nonparticipating,

$5, $10 par.

• Common stock-500,000 shares authorized, 200,000 shares issued, 50,000 held in treasury, no par.

a. Compute the dividends paid to the preferred and common shareholders for each year since

2008. b. Compute the balance of dividends in arrears at yearend. c. Should dividends in arrears be considered a liability?

E12-14 Stock Dividends and Stock Splits

SHE as of 12.31.2012:

Common stock (10,000 shares issued @$6 par)

Additional paid in capital-common stock

Retained earnings

Less: Treasury stock (2,000 @ $12)

Total shareholders’ equity

$ 60,000

100,000

60,000

(24,000)

$196,000

Prepare journal entries for the following independent transactions: a. Declare and distribute a 2% stock dividend when the market price of the stock was $70.

b. Declare a 3:2 stock split.

c.

Declare a 10% stock dividend when the market price of the stock was $80.

d. Declare a 2:1 stock split.

P12-10 Inferring Transactions from BS

Preferred stock (9%, $100 par value)

Common stock ($10 par value, 750,000 authorized,

90,000 issued, and 5,000 held in treasury

Additional paid in capital-preferred

Additional paid in capital-common

Retained earnings

Less: Treasury stock

Total shareholders’ equity

2012

$200,000

900,000

150,000

465,000

575,000

(110,000)

$2,180,000

2011

$110,000

750,000

35,000

298,000

495,000

$1,688,000 a.

How many shares of preferred stock were issued during 2012? What was the average issue price?

b.

How many shares of common stock were issued during 2012? What was the average issue price?

c.

Prepare the entry to record the repurchase of the company’s own stock during

2012? What was the average repurchase price?

Sample Co. Shareholders’ Equity

Common stock, $1 par value, 500,000 shares authorized, 80,000 shares issued, and

75,000 shares outstanding

Common stock dividends distributable

Preferred stock, $100 par value, 1,000 shares authorized, 100 shares issued and outstanding

Paid in capital on common

Paid in capital on preferred

$ 20,000

3,000

Paid in capital on treasury stock 2,000

Retained earnings:

Unappropriated

Appropriated

$18,000

4,000

Less: Treasury stock, 5,000 shares (at cost)

Less: Other comprehensive income items

(unrealized loss on AFS securities)

Total Shareholders’ Equity

$ 80,000

2,000

10,000

25,000

22,000

(6,000)

(2,000)

$131,000

Retained Earnings

We will be expanding the basic retained earnings formula in this chapter. Now the Statement of Retained Earnings will include the following:

RE, beginning (unadjusted)

Add/Subtract: Prior period adjustment

RE, beginning (restated)

Add: net income

Less dividends:

Cash dividends-common

Cash dividends - preferred

Stock dividends

Property dividends

Less: Adjustment for TS transactions

Appropriation of RE

RE, ending xx xx xx xx xx xx xx xx xx xx xx

Other Comprehensive Income

• “Other Comprehensive Income” includes certain direct equity adjustments that are not part of the current income statement, but which may have an eventual effect on income.

• We already discussed one of these direct equity adjustments when reviewing Available-

for-sale Investments. We found that any

unrealized gains/losses from revaluation to market are shown in SE (as “other comprehensive income”) rather than on the income statement.

Stock Option Basics v. Restricted Stock

• Granted to employees as part of their compensation.

• Generally not transferable and must either be exercised prior to expiration date or allowed to expire as worthless on expiration day. May have a vesting period.

• When granted, company expenses options for their fair value on grant date [may be a complicated calculation].

• Depending on the type of option granted, the employee may or may not be taxed when granted or exercised.

• Gives employees an incentive to behave in ways that will boost the company's stock price. If the company's stock market price rises above the exercise price stated in the option, the employee could exercise the option, pay the exercise price and would be issued ordinary shares in the company.

BUS512M

Session 10

Leases, and Enduring

Accounting

Wonders

Economic Consequences of Reporting

Long-Term Liabilities

• Improved credit ratings can lead to lower borrowing costs

• Management has strong incentive to manage the balance sheet by using

“off-balance-sheet financing” i.e., operating leases

Leases: operating or capital

• FASB issued SFAS No. 13, which requires certain leases to be recorded as capital leases.

– Capital leases record the leased asset as a capital asset, and reflect the present value of the related payment contract as a liability.

• Requirements of SFAS No. 13 - record as capital lease for the lessee if any one of the following is present in the lease:

– Title transfers at the end of the lease period,

– The lease contains a bargain purchase option,

– The lease life is at least 75% of the useful life of the asset, or

– The lessee pays for at least 90% of the fair market value of the lease.

Capital Lease

P11-14 Capital and Operating Leases

Company leased equipment on 1.1.11 for an annual lease payment of $30,000.

Assume the lease term is 5 years and the life of the equipment is also 5 years. If the lease is treated as a capital lease, the FMV of the equipment is $119,781. The straight line depreciation method is used to depreciate fixed assets. The effective interest rate on the lease is 8%.

a.

Compute rent expense for 2011-2015 if lease is treated as an operating lease.

b.

Compute the amounts that would complete the table:

Date BS Value Leasehold

Obligation

Interest

Expense

Depreciation

Expense

Total

Expense

1.1.2011

12.31.2011

12.31.2012

12.31.2013

12.31.2014

12.31.2015

c. Compare total expense over 5 years for the two methods and comment.

Annual Report Treasure Hunt-Find the 6 Key Numbers

• Revenue

• Income (Loss)

• Cash Flow from (used by) Operating Activities

• Assets

• Liabilities

• Stockholders’ Equity

Prove the Accounting Equation

Can you tell the type of business?

Service, Retail, Manufacturing

Cash Conversion Cycle

OPERATING ASSET MANAGEMENT : Ability to utilize current assets and liabilities in a way that supports growth in revenues with minimum investment.

• Measures the time it takes from cash invested in inventory to cash received from customers versus the time it takes to pay suppliers. (The time required to make or buy products, finance the products, and to sell & collect for them.)

Days Inventory

+ Days Receivables

Operating Cycle

- Days Payables

Cash Conversion Cycle

If Operating Cycle is > Days Payables then Financing Gap

If Operating Cycle is < Days Payables then able to Self-finance

Operating Cycle Ratios

Inventory:

Inventory Turnover = COGS/Average inventory

Average inventory = (Beginning + Ending)/2

Days Inventory on Hand = 365 days/Inventory turnover

Accounts Receivable:

A/R Turnover=Net Credit Sales/Average A/R

Average A/R= (Beginning + Ending)/2

Days Sales= 365/A/R Turnover

Operating Cycle= Days Inventory on Hand + Days Sales

Is there a Financing Gap?

Accounts Payable:

Accounts Payable Turnover = COGS/Average A/P

Average A/P = (Beginning + Ending)/2

Days Payables = 365 days/Accounts Payable Turnover

Financing Gap?

Operating Cycle - Days Payables= Financing Gap…

BORROW SHORT TERM

OR

Days Payables – Operating Cycle= No Gap…

Free Financing from Suppliers

The SEC mandated the use of XBRL for public company reporting and other reporting applications:

Public Company Reporting – all public companies must file in XBRL format; companies with worldwide public float greater than $5 billion to comply starting with period ending June

2009; all other large accelerated filers to comply starting with period ending June 2010; all other public companies comply with period ending June 2011.

Risk Return Summary Portion of Mutual Fund Prospectus – mutual funds must begin publishing the risk return summary portion of their prospectuses in XBRL format starting

January 1, 2011.

Credit Rating Agencies – must report ratings actions (initial rating, upgrades, downgrades, etc.) in XBRL format.

The SEC and XBRL US have resources available to help public company preparers get educated, identify tools and resources to tag their financials and create their own XBRLformatted financials.

http://xbrl.us/Learn/Pages/FactSheet.aspx

XBRL ( eXtensible Business Reporting Language ) is a freely available and global standard for exchanging business information.

XBRL is a technology language for the electronic communication of business and financial data and is being implemented worldwide. XBRL-formatted documents enable greater efficiency, improved accuracy and reliability as well as cost savings to those involved in supplying and using financial and business information data.

What XBRL can do:

XBRL allows for the creation of interactive, intelligent data.

Each piece of business information has detailed descriptive and contextual information wrapped around it, so that the data becomes machine-readable and can be automatically processed and analyzed.

XBRL allows business reporting information to be reused and repurposed.

A financial or business report created once can be used to create many documents in different formats--HTML, ASCII text, Microsoft Word or Excel—with no loss of accuracy or integrity.

XBRL adds value to every step of an organization’s business information reporting.

The entire reporting chain of business information -- from data collection through internal reporting and external reporting -- will be made more efficient and accurate and will contain more useful data.

XBRL enhances the ability to compare information from one organization or entity to another , because XBRL lays out a common set of definitions by which all organizations tag their data.

XBRL allows for unique reporting situations , because it can be extended by a single reporting entity by adding special elements that may be needed to best represent that company.

Sustainability Reporting

• The Global Reporting Initiative (GRI) is a nonprofit organization that promotes economic sustainability. It produces one of the world's most prevalent standards for sustainability reporting — also known as ecological footprint reporting, environmental social governance

(ESG) reporting, triple bottom line (TBL) reporting, and corporate social responsibility

(CSR) reporting. GRI seeks to make sustainability reporting by all organizations as routine as, and comparable to, financial reporting.

• A sustainability report is an organizational report that gives information about economic, environmental, social and governance performance.

http://www.responsibility.ups.com/Sustainability

https://corporate.homedepot.com/CorporateRespo nsibility/Environment/Documents/Sustainability__

Brochure_pages.pdf

http://www.coca-colacompany.com/sustainability/performance-highlights

Evolution of Accounting

Telling the story of business by converting events into numbers

• Resources

• Unit of Measure

• Valuation

• Responsibilities

• Capital

• Cost-Benefits

• Exchange Transactions

• A=L+OE

• Rise of Corporations

• Going Concern & Business Entity

• Net Income, Contributed Capital,

Retained Earnings, & Dividends

• Depreciation, Amortization, & Depletion

• Financial reporting & Auditing

• Product & Service Costing

Accounting kept the books (locked the data up) and interpreted the data for others.

Financial Accounting Fundamentals

Assumptions

• Economic Entity

(identified and measured)

• Fiscal Period

(periodicity)

• Going Concern

(life indefinite)

• Stable Dollar

(across time)

Valuation

Input Market (purchase)-original, replacement

Output Market (sell)-present, fair market

Measurement Principles

• Objectivity

(Verifiable and documented)

• Matching and Revenue

Recognition

(costs & benefits)

• Consistency

(methods same across time)

• Two Exceptions

– Materiality –little to no effect on user decisions

– Conservatism -understate assets, overstate liabilities, accelerate losses, and delay gains (due to legal liability)

Financial Statements:

• Original (Historic) Cost: Land, LT Invt

– Lower of Cost or Market: Inventory

– Net Realizable Value: net AR

– Net Book Value: PP&E, Intang.

• Face: Cash, Current liabilities

• Fair Market Value (sales price): ST

Invt

• Present Value: LT NR & LTL

IFRS v. US GAAP

Principles based

Rules based

4 Criteria for Recognizing Revenue

1. The company has completed a significant portion of the production and sales efforts.

2. The amount of revenue can be objectively measured.

3. The company has incurred the majority of costs, and remaining costs can be reasonably estimated, and

4. Cash collection is reasonably assured.

Today and Tomorrow

Transformative Technologies

• Now data unlocked with 24/7 access to anyone via Internet & Cloud.

• Massive quantities of financial and nonfinancial data.

• Making sense of business to an audiencewhat info important?

• Point of view of who’s telling the storysingle entity or helicopter?

• Accountants still can be the storytellers by bringing meaning to data through the process of:

Understanding the Concepts first

Then applying the best Accounting Tools

To analyze and make Business Decisions

Resources-Events-Agents