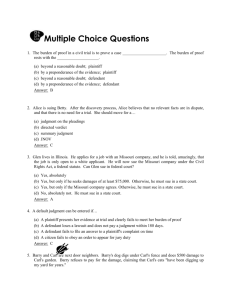

ACCT 350 casebook - University of Delaware

advertisement