AP Macroeconomics Syllabus Spring 2014 Mrs. Merckens Teacher

advertisement

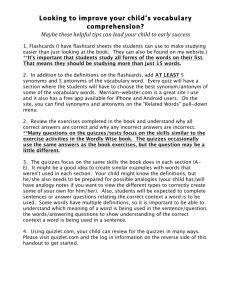

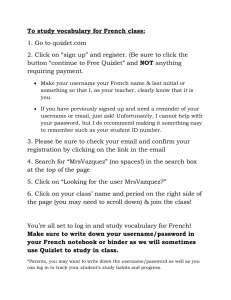

AP Macroeconomics Syllabus Spring 2014 Mrs. Merckens Teacher Contact Information Course Information Mrs. Heather Merckens 419-433-1234 x1206 hmerckens@huronhs.com Huron HS Semester Course: Fulfills Semester Economics Requirement; Potential College Credit per AP Test Score AP Macroeconomics Syllabus Course Description The purpose of the AP course in macroeconomics is to give students a thorough understanding of the principles of economics that apply to an economic system as a whole. The course places particular emphasis on the study of national income and price-level determination, and also develops students’ familiarity with economic performance measures, the financial sector, stabilization policies, economic growth, and international economics. (taken from the apcentral.collegeboard.com website) Why take this Course? The purpose of this Macroeconomics course is to give you, the student, a thorough understanding of the principles of economics that apply to an economic system as a whole. I believe in this course, because during this semester, you will develop an understanding of how economic forces influence the United States and other nations. This Advanced Placement course includes the seven topics from the College Board outline: I. Basic Economic Concepts; II. Measurement of Economic Performance; III. National Income and Price Determination; IV. Financial Sector; V. Stabilization Policies; VI. Economic Growth; and VII. Open Economy: International Trade and Finance. You will read and analyze significant amounts of material this semester. The class will also regularly practice graphing on the Smartboard and on small dry-erase boards that we will share and critique. Try to take chances and practice, practice, practice! We will all make mistakes, but we need to work through the details of this course together. You will also take multiple-choice tests to hone the skills necessary to achieve success on the AP Macroeconomics Exam you will take Thursday, May 15, 2014, at 8:00 am. A sufficient score can earn you three semester hours of credit so taking this course is already a smart economic choice as long as you try your best. This syllabus and course calendar will keep you organized. Keep track of them! Course Content Materials Text: Anderson, David and Margaret Ray. Macroeconomics for AP. New York: W.H. Freeman & Company, Education, Inc., 2011. Reader included in package: Anderson, David. Economics by Example. New York: Worth Publishers, 2007. With Occasional Articles from: The New York Times, The Economist, The Wall Street Journal, and other printed and MANY Internet sources (too many to list here) to update our texts and discussions on a daily and weekly basis. Course Requirements for Student Evaluation: 1. Neat & Organized 3-Ring Binder -to be collected on each Section Exam day 40 % of grade -- Separated and in this order: a. Notes from class (5%) b. Vocabulary Definitions for Each Module (10%) -With Clear Module Titles to Separate Vocabulary Terms and Definitions -And Creation of Quizlet Vocabulary Sets for Textbook Modules I will divide up our textbook modules and assign them to students. Students will visit Quizlet.com to create a set of flashcards (account under HuronMacro2014/password: allgeta5) with the terms/definitions for each assigned module. Students must complete each set online by the class period that falls one day before the Section Exam covering that module. You are already writing vocabulary definitions in your binders, so this won’t be hard. Plus, the entire class will benefit throughout the semester, and be able to review those vocabulary words before each exam AND again before the final AP Exam. c. Tackle the Test: Free Response Question 2 (for each Module) (10%) -Clearly labeled, with written and/or graphed answers for all parts d. Economics by Example Outlines (10%) -Each student will be reading and presenting an outline on just one of the Chapters in our reader, Economics by Example. So that our discussions can be more thorough and engaging, each of you MUST read and outline all chapters by the assigned date. This 10% of your grade will consist of all of the outlines you keep in your binder, as well as the one you will present to the class in PowerPoint, Presentation or Prezi style. Chapters are listed in the course outline; however, I will tell you exact deadlines and who will present these chapters based on final student enrollment. e. Accumulated papers to include practice tests and all handouts (5%) -to make sure you have all of your materials for study purposes. 2. Vocabulary Quizzes for Textbook Modules -- 10% of grade There will be announced and unannounced vocabulary quizzes to make certain you are completing your readings and vocabulary definitions on time. 3. Section Exams – 50% of grade Your final AP Government Test will include 60 multiple-choice questions you must answer in 70 minutes and 3 free response questions you must answer within 60 minutes. As regular assessments and in preparation for that final exam, you will take 7 Section Exams during the semester made up of both Multiple Choice and Free Response questions. Please see the calendar for the specific dates. Course & Instructor Policies Make-up exams, tests and homework must be completed according to school policy (in as many days as the student was absent). Students are responsible for their own make-up work. Extra credit opportunities are offered infrequently, so students should take advantage of them if and when they arise. Academic Dishonesty All school rules apply in this class and it should go without saying that academic dishonesty will not be tolerated in this class. There will be disciplinary action against any student suspected of dishonesty. All offenders will be subject to disciplinary action through Huron HS Student Handbook. From the Huron HS Student Handbook Rule #4: Cheating A student shall not engage in any act of academic dishonesty which are defined but not limited to: plagiarism (defined as “To use the ideas or writings of another as your own, or to appropriate passages or ideas from another and use them as your own”), looking at someone else’s test or other materials, copying work from another when the work is not intended to be collaborative, obtaining a copy of tests or scoring devices, unauthorized use of materials not permitted during a test, copyright infringement, allowing another to copy your work, putting your name on another’s work and talking during a test. A teacher and/or administrator will determine if cheating has occurred. 1st offense by class------------Parent contacted, Zero (0) points on work and TWO detentions 2nd offense by class ------------Failure for semester AP Macroeconomics Course Outline--Merckens Krugman’s Text Section & Module Titles, % of Final AP Exam applicable, and Quizlet Vocabulary Deadlines/Student Assignments Section 1: Basic Economic Concepts (8-­‐12%) Module 1: The Study of Economics Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 2: Introduction to Macroeconomics (business cycle, unemployment, inflation, growth) Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 3: The Production Possibilities Curve Model Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 4: Comparative Advantage and Trade Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Section 2: Supply and Demand Module 5: Supply & Demand Intro Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 6: Supply and Demand: Supply & Equilibrium Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 7: Supply and Demand: Changes in Equilibrium Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 8: Supply and Demand: Price Controls (Ceilings & Floors) Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Module 9: Supply and Demand: Quality Controls Online Quizlet Vocabulary Due by _______________ on Thurs., Jan. 30 Section 1 Appendix: Graphs in Economics Dates of Coverage, Reader Outline Deadlines /Student Assignments, and Exam Dates Sections 1-­‐2 Begin: Tuesday, Jan. 21 Economics by Example: Chapter 1, What’s to Love About Economics? Virtues of the Economic Way of Thinking Everyone’s Outlines due on ____________and Presentation by ___________________ Economics by Example: Chapter 2, Why did the Cashier Let Biff Henderson East All the Free Mints? An Introduction to the Power of Incentives Everyone’s Outlines due on ____________and Presentation by ___________________ Economics by Example: Chapter 3, The Coffee Market’s Hot, Why Are Bean Prices Not? Insights into Supply and Demand Everyone’s Outlines due on ____________and Presentation by ___________________ With Section 1-­‐2 Exam over Modules 1-­‐9 on: Friday, Jan. 31 (This in-­‐text appendix will help explain how graphs work, how to determine the slope of linear and non-­‐ linear curves, and prepare you for upcoming graphs throughout the semester.) Section 3: Measurement of Economic Performance (12–16%) National Income Accounts: Module 10: The Circular Flow and GDP Online Quizlet Vocabulary Due by _______________ on Monday, Feb. 10 Module 11: Interpreting Real GDP Online Quizlet Vocabulary Due by _______________ on Monday, Feb. 10 Module 12: The Meaning & Calculation of Unemployment Online Quizlet Vocabulary Due by _______________ on Monday, Feb. 10 Module 13: The Causes and Categories of Unemployment Online Quizlet Vocabulary Due by _______________ on Monday, Feb. 10 Module 14: Inflation: An Overview Online Quizlet Vocabulary Due by _______________ on Monday, Feb. 10 Module 15: The Measurement and Calculation of Inflation Online Quizlet Vocabulary Due by _______________ on Monday, Feb. 10 Section 4: National Income and Price Level Determination (10-­‐15%) Module 16: Income and Expenditure Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 17: Aggregate Demand: Introduction and Determinants Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 18: Aggregate Supply: Introduction and Determinants Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 19: Equilibrium in the Aggregate Demand-­‐ Aggregate Supply Model Online Quizlet Vocabulary Due by _______________ Section 3 Begins: Friday, Jan. 13 Economics by Example Chapter 6, Is Adam Smith Rolling Over in His Grave? Perfect Competition, Efficiency, and the Father of Modern Economics Everyone’s Outlines due on ____________and Presentation by ___________________ Economics by Example Chapter 11, Why Not Split the Check? A Briefing on Market Failure Everyone’s Outlines due on ____________and Presentation by ___________________ Economics by Example Chapter 21, Why Do We Neglect Leisure and Cheer for Divorce? The Divergence of Gross Domestic Product and Measures of Well-­‐Being Everyone’s Outlines due on ____________and Presentation by ___________________ With Section 3 Exam over Modules 10-­‐15 on: Tuesday, Feb. 11 Section 4 Begins: Wednesday, Feb. 12 Economics by Example Chapter 25, How Much Debt is Too Much? Expenditure Smoothing, Ricardian Equivalence, Crowding Out, and Investments for the Future Everyone’s Outlines due on ____________and Presentation by ___________________ With Section 4 Exam Over Modules 16-­‐21 on: Wednesday, Feb. 26 Section 4: National Income and Price Level Determination (10-­‐15%) Module 16: Income and Expenditure Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 17: Aggregate Demand: Introduction and Determinants Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 18: Aggregate Supply: Introduction and Determinants Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 19: Equilibrium in the Aggregate Demand-­‐ Aggregate Supply Model Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 20: Economic Policy and the Aggregate Demand-­‐Aggregate Supply Model Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Module 21: Fiscal Policy & the Multiplier Online Quizlet Vocabulary Due by _______________ on Tuesday, Feb. 25 Section 5: The Financial Sector (15–20%) Module 22: Saving, Investment, and the Financial System (Markets) Online Quizlet Vocabulary Due by _______________ on Thursday, March 3 Module 23: The Definition and Measurement of Money Online Quizlet Vocabulary Due by _______________ on Thursday, March 3 Module 24: The Time Value of Money Online Quizlet Vocabulary Due by _______________ on Thursday, March 3 Module 25: Banking and Money Creation Online Quizlet Vocabulary Due by _______________ on Thursday, March 3 Module 28: The Money Market Online Quizlet Vocabulary Due by _______________ on Thursday, March 3 Module 29: The Market for Loanable Funds Online Quizlet Vocabulary Due by _______________ on Thursday, March 3 Section 4 Begins: Wednesday, Feb. 12 Economics by Example Chapter 25, How Much Debt is Too Much? Expenditure Smoothing, Ricardian Equivalence, Crowding Out, and Investments for the Future Everyone’s Outlines due on ____________and Presentation by ___________________ With Section 4 Exam Over Modules 16-­‐21 on: Wednesday, Feb. 26 Section 5 Begins: Thursday, Feb. 17 Economics by Example Chapter 22, Does the Money Supply Matter? Money, the Fed, and the Debate over Optimal Monetary Policy Everyone’s Outlines due on ____________and Presentation by ___________________ With Exam over Modules 22-­‐29 on: Friday, March 4 Section 6: Inflation, Unemployment, and Stabilization Policies (20–30%) Module 31: Monetary Policy and the Interest Rate Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Module 32: Money, Output, and Prices in the Long Run Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Module 33: Types of Inflation, Disinflation, and Deflation Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Module 30: Long Run Implications of Fiscal Policy: Deficits and Debt Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Module 34: Inflation and Unemployment: The Phillips Curve Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Module 35: History and Alternative Views of Macroeconomics Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Module 36: The Modern Macroeconomic Consensus Online Quizlet Vocabulary Due by _______________ on Monday, April 14 Section 7: Economic Growth and Productivity (5– 10%) Module 37: Long-­‐run Economic Growth Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 38: Productivity and Growth Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 39: Growth Policy: Why Economic Growth Section 6 Begins: Monday, March 17 Economics by Example Chapter 19, Will Technology Put Us All Out of Work? Unemployment, Creative Destruction, and Quality of Life Everyone’s Outlines due on ____________and Presentation by ___________________ With Exam over Modules 30-­‐36 on: Tuesday, April 15 Section 7 Begins: Wednesday, April 16 Economics by Example Chapter 28, Why Are Some Nations Rich and Other Poor? Growth Models, Miracles, and the Determinants of Economic Development Everyone’s Outlines due on ____________and Presentation by ___________________ Section 7: Economic Growth and Productivity (5– 10%) Module 37: Long-­‐run Economic Growth Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 38: Productivity and Growth Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 39: Growth Policy: Why Economic Growth Rates Differ Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 40: Economic Growth in Macroeconomic Models Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Section 8: Open Economy: International Trade and Finance (10–15%) Module 41: Capital Flows and the Balance of Payments Online Quizlet Vocabulary Due by _______________ on Monday, May 5 Module 42: The Foreign Exchange Market Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 43: Exchange Rate Policy Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 44: Exchange Rates and Macroeconomic Policy Online Quizlet Vocabulary Due by _______________ on Tuesday, April 23 Module 45: Putting It All Together Section 7 Begins: Wednesday, April 16 Economics by Example Chapter 28, Why Are Some Nations Rich and Other Poor? Growth Models, Miracles, and the Determinants of Economic Development Everyone’s Outlines due on ____________and Presentation by ___________________ With Exam over Modules 37-­‐40 on: Thursday, April 24 Section 8 Begins: Friday, April 25 Economics by Example Chapter 27, Is Globalization a Bad Word? Comparative Advantage, Culture Clashes, and Organizations meant to Make the Most of Global markets Everyone’s Outlines due on ____________and Presentation by ___________________ With Exam over Modules 41-­‐44 on: Tuesday, May 6 A way for you to assess your content and level of preparation: Check below/Keep Track: Questions? Confident? Essential Skills and Concepts in italics; Significant Graphs in Bold & Underlined Section 1-­‐2 Materials 1. Define the science of economics. 2. Distinguish between opportunity cost, scarcity, and tradeoffs. A. Scarcity: What is it? Why is it so important to economic thought? B. Opportunity Cost: Define and compute it. Why can it never be avoided? How is it related to marginal analysis? 3. Distinguish between macroeconomics and microeconomics. 4. List the three basic economic questions. 6. Use a production possibilities curve to demonstrate opportunity cost and growth. C. Production Possibilities: Construct and interpret production possibilities schedules, and graphs; relate production possibilities curves to the issues of scarcity, choice and cost. Why are most PPCs bowed out? Production Possibility Curve Graphing A. Efficiency B. Inefficiency C. Attainable versus unattainable combinations D. Growth 5. Define comparative advantage and specialization and benefits of exchange. D. Specialization and Comparative Advantage: Define and calculate absolute and comparative advantages for production exchange. E. Functions of Any Economic System 1. Answering the questions: What to produce? How to produce? For whom to produce? 2. Define ways societies determine allocation, efficiency, and equity. 7. List the determinants of demand and supply. 8. Recognize which factors will cause demand curves or supply curves to shift. 9. Distinguish between changes in quantity demanded and a change in demand. 10. Distinguish between changes in quantity supplied and a change in supply A. Demand: Define and illustrate demand through schedules and graphs. 1. Distinguish between change(s) in quantity demanded and change(s) in demand. 2. Examine the inverse relationship existing between quantity demanded and price. Evaluate the Law of Demand. 3. Identify and explain the variables that cause a change in demand. 4. Illustrate graphically a change in demand versus a change in quantity demanded. B. Supply: Define and illustrate supply through schedules and graphs. 1. Distinguish between change(s) in quantity supplied and change(s) in supply. 2. Examine the direct relationship existing between quantity supplied and price. Evaluate the Law of Supply. 3. Identify and explain the variables that cause a change in supply. 4. Illustrate graphically a change in supply versus a change in quantity supplied. 11. Determine effects on price and quantity when equilibrium changes. C. Equilibrium Price and Quantity: Define and illustrate equilibrium through schedules and graphs. 1. Define and illustrate surpluses and shortages. 2. Define the effects of surpluses and shortages on prices and quantities. 3. Interpret the effects of a price floor and price ceiling on equilibrium price and quantity. 4. Introduction to market failures: lack of competition, externalities, and public goods. Demand and Supply Graphs A. Showing equilibrium B. Shifts in supply or demand curves and effects Section 3 Materials: Know the Circular Flow Model A. Simple model: household and business, resource and product market B. Simple model with government added C. Open-­‐economy macro model 12. Describe the macroeconomic performance of the United States and other countries—gross domestic product (GDP), inflation, unemployment, and other indicators. A. Measuring GDP, Four-­‐Sector Circular Flow Model, and Flow Versus Stock 13. Define GDP by expenditure and income approaches. 1. Expenditure approach [C+I+G+(X-­‐IM)] where C = Personal Consumption Expenditures I = Gross Private Investment G = Government Consumption Expenditures and Gross Investment X-­‐IM = Net Exports 2. Income approach (W+I+R+P) where W = Compensation of Employees I = Net Interest R = Rental Income of Persons P = Profits (Non-­‐income adjustments) 15. Explain the limitations of GDP measures. 3. Problems with calculating GDP: Nonmarket transactions, distribution, kind and quality of products. 14. Distinguish between nominal GDP and real GDP. 4. Changing Nominal GDP (NGDP) to real GDP (RGDP). How and why? 5. Other national accounts: net national product (NNP), national income (NI), personal income (PI), and disposable income (DI). A. The Roller Coaster: The four phases of the business cycle B. Total Spending and How It Affects the Business Cycle 16. Define unemployment; list sources and types. C. Unemployment: Defined D. Problems with the Unemployment Rate: Who is counted and who isn’t? 17. Define the labor-­‐force participation rate. E. Types of Unemployment 1. Seasonal, frictional, structural, cyclical 2. Which type(s) affect the unemployment rate? F. Full Employment: What is it? What are the implications if achieved? 18. Define the full-­‐employment level of GDP. G. The GDP Gap: Explaining lost potential; Okun’s Law 19. Distinguish between actual and potential GDP. 19. Distinguish between actual and potential GDP. A. The Meaning and Measurement of Inflation 20. Explain the calculation of price indices—GDP deflator, consumer price index (CPI), and producer price index (PPI). B. The Consumer Price Index (CPI) and How It Is Computed C. Problems with the CPI D. Other Indices: Ex: Producer Price Index 21. Use price indices to calculate real wages and real interest rates. 44. Distinguish between nominal and real interest rates. E. Consequences of Inflation: Nominal v. Real Values; shrinking incomes, changes in wealth, effect on interest rates F. Demand–Pull and Cost–Push Inflation Section 4 Materials: 22. List the determinants of aggregate demand (AD). 23. Distinguish between changes in AD and a change in price level causing movement along the AD curve. 24. List reasons why the AD curve is down sloping. A. Aggregate Demand Curve: Reasons for Its Shape 1. Shifts of the Aggregate Consumption Function 2. Interest rate effect 3. Net export effect B. Non price-­‐Level Determinants of Aggregate Demand: Expectations 25. List the determinants of aggregate supply (AS). 26. Distinguish between changes in AS and a change in price level causing movement along the AS curve. 27. Explain and demonstrate the shape of the AS curve in the short run and long run; define and show the full-­‐employment level of output (Qf). C. Aggregate Supply Curve 1. Short-­‐run AS 2. Shifts of Short-­‐run AS Curve 3. Long-­‐run AS 4. From Short-­‐ to Long-­‐run 28. Determine the importance of the shape of the AS curve on the effects of change in the AD curve. 29. Determine equilibrium using an AD/AS graph and show the effects on price level and real GDP when equilibrium changes in both the long run and the short run. 30. Given data, determine the size of the spending multiplier and assess its impact on AD. The AD-­‐AS Model AD/AS GRAPHS During Recession and Inflation A. Equilibrium price level and output B. AS long run and short run C. Shifts in AD and AS curves (short run and long run) D. Effects of fiscal and monetary policy actions 31. Define fiscal policy—discretionary and nondiscretionary. 32. Define and measure the effect of built-­‐in stabilizers on the economy. 33. Using AD/AS analysis, show the effect on price level and real gross domestic product (RDGP) of changes in fiscal policy. A. Discretionary Fiscal Policy 1. Changes in government spending 2. Changes in tax rates 34. Define the balance budget multiplier. 3. Balanced-­‐budget multiplier B. Supply-­‐Side Policies 49. Consider issues surrounding the size and burden of the national debt. C. Government Size and Growth 1. Financing budgets 2. Government expenditure patterns and Multiplier Effect E. Types of Taxation 1. Progressive 2. Proportional 3. Regressive (G. Effects on the Phases of the Business Cycle: 1. Expansion, Peak, Contraction, Trough Review from earlier) 35. Distinguish between sticky price and sticky wage models and flexible price and flexible wage models; identify the effect of differences on the AS curve. Section 5 Materials: 37. Define money supply and other financial assets. A. Three Functions of Money B. What Stands Behind the U.S. Dollar? C. The Three Money Supply Definitions M1: most narrowly defined money supply M2: adding near monies to M1 M3: adding large time deposits to M2 D. Financial assets: Money, Stocks, Bonds 38. Demonstrate understanding of the time value of money. 1. Time value of money (present and future value) 39. Define a fractional banking system. 2. Banks and creation of money 36. Define and list factors influencing money demand. 3. Money demand 4. Money market Money Market Graph A. Equilibrium nominal rate of interest and quantity of money B. Shifts of supply of and demand for money C. Effect of shifts on equilibrium interest rate 5. Loanable Funds Loanable funds market Graph A. Equilibrium real rate of interest and quantity of money B. Shifts of supply of and demand for money C. Effect of shifts on equilibrium interest rate 40. Explain the role of the Federal Reserve System in the economy. E. The Federal Reserve System 1. Origins and organizational structure 2. Powers of the Fed 42. Describe the process of money creation and multiple-­‐deposit expansion. 48. Examine the economic effects of government deficit budgets, including “crowding out.” a. Control of the money supply b. Clearing checks c. Supervising and regulating the banks d. Loaning currency to banks e. Acting as the bank for the U.S. government 41. Identify and examine the tools of central bank policy and their impact on money supply and interest rates. 3. Monetary Policy Tools of the Fed/Central Bank Policy a. Open market operations b. Discount rate c. Reserve requirement 43. Given data, determine the size of the money multiplier and assess its impact on the money supply. 52. Speculate on the role of inflationary expectations on price level and output. 4. The Money Multiplier Theory versus reality F. Monetary Policy Shortcomings 1. Money multiplier inaccuracies 2. Lags in policy effects G. Monetary Policy 1. The demand for money and how it may affect interest rates 2. How monetary policy affects prices, output, and employment Loanable Funds Market Graph & Monetary Policy & Equilibrium GDP Graphs 45. Define the quantity theory of money. Fed Funds Graphs-­‐Expansionary & Contractionary Section 6 Materials: A. Classical Model of Money and Prices; B. The Inflation Tax 50. Gain understanding of inflation-­‐unemployment tradeoffs using short-­‐run and long-­‐run Phillips curve analysis 51. Show the causes of inflation on an AD/AS model. Phillips Curve Graphs and Decrease in AS GRAPH: Cost-­‐Push Inflation 45. Define the quantity theory of money. 47. Gain understanding of how an economy responds to a short-­‐run shock and adjusts in the long run in the absence of any public policy actions. A. Shape in short run and long run B. Effects of AD shifts C. Effects of AS shifts D. Long-­‐run position at natural rate of unemployment C. A comparison of views: Monetarist, Keynesian and classical economists Section 7 Materials: A. Comparing Nations: GDP Per Capita 53. Define economic growth and list the factors that stimulate growth. 54. Assess the role of productivity of raising real output and standard of living. 55. Suggest how public policies stimulate economic growth. B. Sources of Long-­‐run Growth: Causes Progress and Productivity in Nations? Section 7 Materials: A. Comparing Nations: GDP Per Capita 53. Define economic growth and list the factors that stimulate growth. 54. Assess the role of productivity of raising real output and standard of living. 55. Suggest how public policies stimulate economic growth. B. Sources of Long-­‐run Growth: Causes Progress and Productivity in Nations? C. Capital, Technology, Policy & Growth Differences Among Nations Long & Short-­‐Run AS Graphs Section 8 Materials: 56. Using graphical and tabular analysis, show the benefit of employing comparative advantage. 57. Explain how the balance of payments accounts are recorded. A. Balance of payments accounts 1.Balance of trade 2. Current account 3.Financial account (formerly known as capital account) B. Foreign Exchange Markets 1. Supply and demand for foreign exchange 2.Current fluctuations a. Appreciation and depreciation b. Graphing currency changes 59. List the factors that influence equilibrium foreign exchange rates. 60. Using demand/supply analysis, show how market forces and public policy affect currency demand and currency supply. 61. Define currency appreciation and depreciation and relate both to graphical analysis. Foreign Exchange Currency Market Graphs Flexible Exchange Rates A. Equilibrium price of currency and quantity of currency (equilibrium exchange rate) B. Shifts of supply of and demand for currency C. Effect of shifts on price of currency 58. Explain the effect of trade restrictions. 62. State the effects of appreciation and depreciation on a country’s net exports. 63. Understand how changes in net exports and capital flows affect financial and goods markets. C. Imports, exports, and financial capital flows D. Relationships between international and domestic financial and goods markets Module 45: Pulling it All Together: Analyzing Graphs of Long-­‐run and Short –Run Macroeconomic Equilibrium -­‐with Recessionary & -­‐Inflationary Gap; Your final AP Macroeconomics Exam is on Thursday, May 15, 2014, at 8:00 am! We will prepare for the final AP exam in class and at home throughout the semester and after we have completed our text. However, you may want to get to work on these strategies right now! 1. We will go to the AP Collegeboard site to practice more released Multiple Choice and Free Response questions, and analyze answers and commentary that the website has available http://apcentral.collegeboard.com/apc 2. We will watch numerous videos on Youtube by Jason Welker and by other very talented and respected teachers. Watching these will help for intermediate review for individual Section Exams too! 3. The use of a study guide such as Strive for a 5, Prepared by Margaret Ray and David Mayer, may be helpful as a study guide as you complete the course and as an AP test preparation resource. The high school spent some big bucks on our textbook sets, and as of right now, it is your responsibility to buy a study guide if you choose to do so.