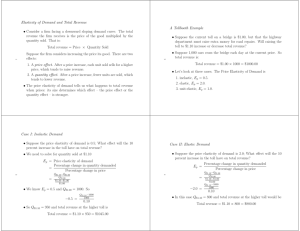

Endogenous Income

advertisement

Endogenous Income The consump0on-­‐leisure model Modifying consumer’s problem Assume that the consumer is endowed with an ini0al bundle of goods, ( x, y ) and she has no other income sources. If the consumer can trade at the market prices px and py, then her budget constraint is xp x + yp y ≤ x p x + yp y Budget constraint y xpx y+ py y x x+ yp y px x Changes in prices An increase in px y y x x Changes in prices An increase in py y y x x Changes in prices • The impact of price changes in the consumer’s budget set is now a bit more subtle: an increase of the price of a good may make the consumer “richer” if she has a large endowment of the good. • Since the ini0al endowment is always a feasible bundle (consumer can always consume her own endowment), changes in prices result in a rota0on of the budget line around her ini0al endowment. Consumer Demand Assume the u ( x , y ) is differen0able, and that the system xp x + yp y = x px + yp y px py yields an interior solu0on to the consumer’s problem ~x ( p x , p y ) , ~y ( p x , p y ) . Then MRS ( x, y ) = ~ x ( p x , p y ) = x * ( p x , p y , x p x + yp y ) ~ y ( p x , p y ) = y * ( p x , p y , x p x + yp y ) where the func0ons on the RHS are the ordinary demands. Consumer Demand: example u ( x , y ) = x y ; ( x , y ) = (2,1) Calculate ordinary demands: Hence, x * ( px , p y , I ) = 2I 3 px y * ( px , p y , I ) = I 3 py 2(2 p x + p y ) 4 2 p y ~ x ( px , p y ) = = + 3 px 3 3 px ~y ( p , p ) = 2 p x + p y = 1 + 2 p x x y 3 py 3 3 py Income and substitution effects • Study the effect of an increase in px for u0lity func0on u ( x , y ) and endowment ( x , y ) y C B A u2 u1 y x x Income and substitution effects • Subs0tu0on effect is nega0ve SE = xB − xA < 0 • Income effect is positve IE = xC − xB > 0 • In this case, income effect is larger than subs0tu0on effect, so the total effect is posi0ve: an increase in p x leads the consumer to increase its consump0on of both goods TE = SE + IE = xC − x A > 0 Income and substitution effects The sign of the income effect of a price increase (that is, whether a price increase makes the consumer poorer or richer) depends on whether the consumer is a net seller or a net buyer of the good whose price has increased: -­‐If the consumer is a net seller of the good, then the IE is nega0ve. -­‐If the consume is a net buyer of the good, then the IE is posi0ve. Formally: ∂x ∂x * ∂x * = |u=cte −(x − x) ∂px ∂px ∂I Income and substitution effects Exogenous income Endogenous income y y B B C C A A u1 u1 u0 x u2 x The consumption-leisure model Two goods: leisure (x-­‐axis) and consump0on (y-­‐axis) -­‐ Leisure, denoted by h and measured in hours. The wage per hour (or price of leisure) is denoted by w. -­‐ Consump0on, denoted by c and measured in euros. The price of c is therefore pc = 1). Ini0al endowment is (M,H), where: -­‐ M : ini0al exogenous wealth (or non-­‐labor income). -­‐ H : number of hours available for leisure and work. The consumption-leisure model Budget set (recall p c = 1 ) c + hw ≤ wH + M c + hw : market value on the consump0on-­‐leisure bundle. wH + M : market value of ini0al endowment. c wH + M slope = − w M H h The consumption-leisure model. Labor supply The consumer problem is: Maxc , h st u ( c, h ) c + hw ≤ wH + M 0≤h≤ H c≥0 The consumption-leisure model. Labor supply. Example Maxc , h c + 2 ln h st c + wh = 16w + 4 0 ≤ h ≤ 16 c≥0 Interior solution requires MRS (h, c) = w ⇔ And 2 2 = w ⇒ h( w) = h w 2 ≥ 0 ⇔ ∀w > 0 w 2 1 h( w) = ≤ 16 ⇔ w ≥ w 8 h( w) = The consumption-leisure model: An example Therefore, the consumer’s demands of leisure and consumptions are: 16 if w < 1 / 8 h(w) = 2 if w ≥ 1 / 8 w 4 if w < 1 / 8 c (w) = € 2 +16w if w ≥1/8 The consumption-leisure model: An example And her labor supply is l ( w) = H − h( w) = 1/8 0 if w < 1 / 8 2 16 − w if w ≥ 1 / 8 The consumption-leisure model: An example • Assume w' < w • For interior solu0ons, the consumer is a net supplier of leisure • Total income effect: if leisure is a normal good, ∂ h / ∂ I > 0 , TIE is posi0ve, leading the consumer to demand less leisure (or supply more labor) − ∂h (l − H ) > 0 ∂I >0 <0 • Subs0tu0on effect : is always non-­‐posi0ve. Since leisure is cheaper, this effect leads the consumer to demand more leisure (or supply less labor) • Total effect is ambiguous (it depends on the shape of the u0lity func0on) The consumption-leisure model: Changes in wages c wH + M w' H + M A B C M H h The consumption-leisure model. Labor supply. Effect of changes in wages c wH + M w' H + M A B C M H h The consumption-leisure model. Labor supply. Effect of changes in wages For w ∈ ( 0 , 10 ) , SE dominates (leisure is more expensive and consumer offers more labor) For w ∈ ( 10 , 20 ) , TIE dominates (consumer is richer and does not need to work as much as before) Application: a tax on labor income • Impose t ∈ [0,1] • The new budget constraint is c + (1 − t ) wh ≤ (1 − t ) wH + M • The tax is equivalent to a reduc0on of wage: its impact on leisure consump0on (or labor supply) is ambiguous • Its impact on welfare is unambiguous. Of course, tax policies have other objec0ves we are not considering here. Application: a tax on labor income c wH + M (1 − t ) wH + M c* M h* H h Application: a tax on labor income • Alterna0ve: a non-­‐labor income tax T • The new budget constraint is c + wh ≤ wH + ( M − T ) • If both goods are normal, then the introduc0on of T reduces their demands (increases labor supply, in par0cular) Application: a tax on labor income c wH + M wH + ( M − T ) M M −T h H Application: a tax on labor income Exercise: what if T=twh*? (Hint: is (c*,h*) op0mal for T?) c wH + M wH + ( M − T ) (1 − t ) wH + M A c* M B M −T h* h