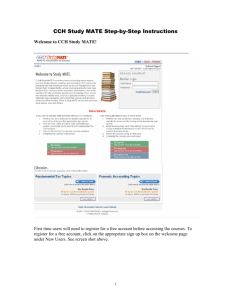

CCH OmniTax™ Library

advertisement

CCH® OmniTax™ Library Current Features and Journals: ® SM CCH Tax Tracker News : Gives you late-breaking tax news and primary source material daily, integrated with the federal and state tax materials in OmniTax. Customize the news to fit your needs, automatically run standing searches of particular interest to your clients each night. Select from over 80 customization topics ranging from emerging state business incentives to the most recent IRS rulings on tax compliance matters, and recent tax legislative activity. Links directly to detailed explanations, analysis and tax laws. At your option, receive tax headlines each day via e-mail. TAXES – The Tax Magazine: Current issue and two-year archive of TAXES—The Tax Magazine, featuring in-depth analysis of current issues in tax law by noted tax practitioners. Journal of Retirement Planning: Previous issue and two-year archive of this bimonthly journal, featuring in-depth analysis of current issues in retirement planning by noted practitioners. Federal Publications: Current Legislative Developments: Keep up to date with the latest breaking developments as they happen, with bill text, committee reports and analysis of legislative events in Congress. CCH Federal Tax Weekly Newsletter: A newsletter that offers timely insight on current federal tax developments. Includes commentary and analysis and other features such as "Compliance Calendar" and "Audit Watch" that summarizes and comments on new federal tax developments. Standard Federal Tax Reporter: The cornerstone of federal income tax research since 1913. This Reporter provides a complete and up-to-date picture of federal income tax law, including extensive coverage of international transactions. Organized by Internal Revenue Code section for quick and easy research, the CCH Standard Federal Tax Reporter also offers CCH's superior explanations, regulations, court decisions, opinions, other authoritative tax documents and more! Standard Federal Tax Reporter Archives: Historical information is included for in-depth research into past-year issues. The complete CCH Standard Federal Tax Reporteris archived from 1986 forward. The Internal Revenue Code is archived from 1954 forward. Federal Estate & Gift Tax Reporter: In-depth analysis related to federal estate, gift and generation-skipping tax law. Essential for planning federal transfer tax consequences. Code-based, it integrates the text of the Code, regulations and court decisions with CCH's superior explanations and other related authoritative tax documents. Federal Excise Tax Reporter: Detailed coverage of the excise tax provisions of the Internal Revenue Code. This Codebased Reporter is a great resource for determining a client's exposure to excise tax. It integrates the text of the Code, with related committee reports, regulations, court decisions, opinions as well as CCH's superior explanations. CCH Federal Tax Service: Detailed, topically arranged analyses written by expert tax practitioners on how the federal law has been applied in specific real-world situations - with numerous practical examples and sample calculations. Includes coverage of estate and gift provisions, as well as international transactions. Also suggests tax strategies fully supported by relevant authority. Tax Treaties Reporter: Full-text of treaties, protocols and other related documents on taxation agreements between the U.S. and Foreign governments - with CCH's superior explanations. Internal Revenue Code: The full-text of the current Internal Revenue Code - in addition to CCH's comprehensive Codeamendment notes to allow tracking of changes over time. Federal Tax Regulations: The full, official text of the Treasury Department interpretations of the Internal Revenue Code, including final, temporary and proposed regulations. Rulings and Other Documents: Full-text of federal administrative rulings and documents -including Revenue Rulings, Revenue Procedures, Treasury Decisions, IRS Announcements, and much more. Tax Cases: Full-text of all relevant tax cases that have been decided by federal courts - including specialized Tax Court and Board of Tax Appeals. Also includes CCH headnotes to help scan cases for relevance to your situation and strategy formulation. Legislative Documents, Treaties: Guidance on congressional intent in making tax law changes. Helps in interpreting the changes in the tax law. Includes official text of legislation, tax treaties and conventions, full-text committee reports, proposed changes, and more. IRS Publications: Narrative insight and guidance from the viewpoint of the IRS - as stated in over 150 publications. U.S. Master Tax Guide®: The best-selling, quick-answer handbook in electronic format. Provides baseline answers for all income, estate and gift tax questions. Includes hot links to the Standard Federal Tax Reporter for further research, full-text and primary source documents, if needed. Internal Revenue Manual: Official text of the IRS publication, including procedural information on examination principals and audits of specific tax issues. Also covers administration, collection, taxpayer service, employee plans and exempt organizations, appeals criminal investigation, inspection and penalties. Letter Rulings & IRS Positions: Insights on the IRS interpretation of tax laws on a myriad of previous taxpayer situations. These documents give insight into how the IRS might respond in similar situations, as well as their approach to specific industries. Includes full text of every ISP and MSSP. Tax Archive Materials: Complete text of the Standard Federal Income Tax Reports as it existed at the end of each year from 1990 through the previous year, and complete text of the Internal Revenue Code at the end of each year from 1978 through 1989. Tax Rates and Tables: All the critical tax rates and amounts a practitioner needs, in one convenient publication. CCH Citator: Tracks the history of cases and rulings through the legal process. Use the CCH Citator to determine whether a case or ruling is still current, whether there are any other cases or rulings on the same point of law that should be considered, and whether the ruling in the case is still good. Tax Election Checklist: Comprehensive listing of the hundreds of elections available to minimize taxes, including who can make the election and how it’s made. CCH® Election and Compliance Toolkit™: This interactive tool enables you to create and print customized, filing-ready plan paper election and compliance statements to complete your compliance efforts. Includes links to relevant authority and filing requirements. IRS Actuarial Factors finding tool: Instantly finds or calculates the exact actuarial factor that you need. CCH® Client Letter Toolkit™: Allows you to quickly find and adapt appropriate client communications. Search by topic, type of client, or type of letter for maximum flexibility. State Publications: CCH 50 State Tax Reporters: The most comprehensive, authoritative, and up-to-date collection of full-text law, regulations, and court decisions covering the entire field of state and local taxation. CCH's expert legal editors tie together superior explanations, primary source materials and practical, how-to guidance for complete and definitive answers to your tax questions in every state. The Reporters contain everything you need to plan tax strategies and resolve tax issues. Includes all U.S. states plus New York City and the District of Columbia. Includes archives back to 1994. CCH State Tax Guide: The industry's number one source for quick answers to everyday tax issues. Includes concise tax charts and explanations covering all U.S. states and the District of Columbia, tax rates, due dates, business license fees, and more. CCH Multistate Corporate Income Tax Guide: Provides in-depth editorial explanation and relevant source material to help minimize tax liabilities of corporations. Coverage also includes discussions of key tax topics, quick answer charts, case annotations, laws, regulations and other source material related to corporate income taxes - plus Washington D.C. and New York City - are covered. CCH Multistate Sales Tax Guide: The most in-depth explanations and case annotations covering sales and use taxes levied by each state in the U.S. All aspects of sales and use taxation are covered, including new developments and hot issues arising in this fast changing field. Includes quick-answer charts, full text of sales tax laws, regulations, CCH explanations analysis, case annotations, sales tax rates, and more! CCH Multistate Property Tax Guide: Offers the most comprehensive information on how to get your property taxes under control and make cost-effective tax planning decisions. Whether you are researching the best locations to build your property in the United States, proven tax saving strategies, valuation trends, taxpayer remedies, or just brushing up on the latest property tax law changes, Multistate Property Guide puts it all at your finger tips. California and New York Tax Analysis: Provides real-world examples and tax planning strategies on how to minimize tax liabilities in California, New York State, and New York City. They are written by expert tax practitioners and provide illustrative examples, planning notes and supporting details including state tax laws, regulations and case citations. Forms: CCH perform plus III: Interactive federal and state tax forms and instructions delivered over the Internet.