Updates to 1040 Express Answers, 2014

advertisement

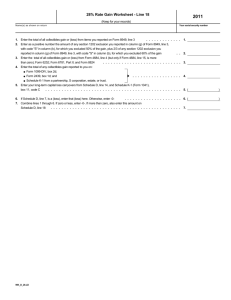

Updates to 1040 Express Answers, 2014 Tab 1: Form 1040 2013 Forms. The final Form 1040 and instructions for the 2013 tax year are now available. The information discussed in Tab 1 and the draft worksheets accurately reflect the information of the final Form 1040 and instructions. Filing Details The IRS has announced it will open the 2014 filing season on January 31, 2014. The new opening date for individuals to file their 2013 tax returns will allow the IRS adequate time to program and test its tax processing systems; the annual process for updating IRS systems saw significant delays in October 2013 following the 16-day federal government closure. The IRS will not process any tax returns before January 31, so there is no advantage to filing a paper return before the opening date. The April 15 tax deadline is set by statute and will not change (IRS News Release IR-2013-100). Tab 2: Schedules A and B Schedule A: Itemized Deductions Gifts to Charity, Lines 16-19 Line 16, Gifts by Cash or Check Philippine Typhoon Relief. Taxpayers who make qualifying cash charitable contributions after March 25, 2014, and before April 15, 2014, for relief of victims in areas affected by Typhoon Haiyan, which occurred in the Philippines on November 8, 2013, may treat the contributions as having been made on December 31, 2013. Thus, calendar-year taxpayers may claim a deduction for a qualified Typhoon Haiyan relief contribution on their 2013 returns. For donations by text message, the recordkeeping requirements can be met by a telephone bill showing the name of the donee organization, the date of the contribution and the contribution amount (H.R. 3771, §2). If the donation is $250 or more, the taxpayer must still get a contemporaneous written acknowledgment of the contribution from the donee organization. Tab 3: Schedules C, F and SE 2013 Forms. The final Schedule C, Schedule F, and Schedule SE of Form 1040 for the 2013 tax year are now available. The information discussed in Tab 3 accurately reflects the sections, lines, boxes, etc., of the final Schedules C, F, and SE. Tab 4: Sales & Exchanges; Net Investment Tax 2013 Forms. The final version of Schedule D (Form 1040), Form 8949, Form 4797, Form 6252, and Form 6781 for the 2013 tax year are now available. The information discussed in Tab 4 generally reflects the sections, lines, boxes, etc., of the final Schedule and Forms. Sale or Exchange of Property Reporting Gains and Losses Form 8949 must be completed before lines 1b, 2, 3, 8b, 9, or 10 of Schedule D of Form 1040. The combined totals from all Forms 8949 completed are reported on Schedule D. Form 8949 Sales and Other Dispositions of Capital Assets A taxpayer has the option to report short term and long term transactions directly on the Schedule D of Form 1040 rather than Form 8949. The option only applies if the taxpayer receives a Form 1099-B (or substitute statement): (1) that shows basis was reported to the IRS and does not show a nondeductible wash sale loss in box 5; and (2) the taxpayer does not have to make any adjustments to basis, or type of gain or loss reported on Form 1099-B. A taxpayer reports eligible transactions on either line 1a (short-term transactions) or line 8a (long-term transactions). Line 1(a) or 3(a), Description of Property Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, a description of property is reported on line 1(a) of Part II, rather than line 3(a). Line 1(b) or 3(b), Date Acquired Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the date property is acquired is reported on line 1(b) of Part II, rather than line 3(b). Line 1(c) or 3(c), Date Sold Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the date property is sold is reported on line 1(c) of Part II, rather than line 3(c). Line 1(d) or 3(d), Sales Price Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the sales price of property is reported on line 1(d) of Part II, rather than line 3(d). Line 1(e) or 3(e), Costs of Other Basis Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the cost or other basis of property is reported on line 1(e) of Part II, rather than line 3(e). Line 1(f) and 3(f), Code Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the code for any adjustment to gain or loss is reported on line 1(f) of Part II, rather than line 3(f). Line 1(g) and 3(g), Adjustments to Gain or Loss Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the adjustments to gain or loss is reported on line 1(g) of Part II, rather than line 3(g). Line 1(h) and 3(h), Gain or Loss Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, gain or loss is reported on line 1(h) of Part II, rather than line 3(h). Line 2 or 4, Totals Part II of the 2013 version of Form 8949 restarts line numbers for long-term transactions. Thus, the total for long-term transactions is reported on line 2 of Part II, rather than line 4. Schedule D Capital Gains and Losses A taxpayer has the option to report short term and long term transactions directly on the Schedule D of Form 1040 rather than Form 8949. The option only applies if the taxpayer receives a Form 1099-B (or substitute statement): (1) that shows basis was reported to the IRS and does not show a nondeductible wash sale loss in box 5; and (2) the taxpayer does not have to make any adjustments to basis, or type of gain or loss reported on Form 1099-B. A taxpayer reports eligible transactions on either line 1a (short-term transactions) or line 8a (long-term transactions). Form 8949 must be completed before lines 1b, 2, 3, 8b, 9, or 10 of Schedule D of Form 1040. The combined totals from all Forms 8949 completed are reported on Schedule D. Short-Term Capital Gains and Losses, Lines 1-7 The final version of Capital Loss Carryover Worksheet for the 2013 tax year is now available in the Schedule D (Form 1040) instructions. The information discussed in Tab 4 accurately reflects the sections, lines, boxes, etc., of the final worksheet. Long-Term Capital Gains and Losses, Lines 8-15 The final version of Capital Loss Carryover Worksheet for the 2013 tax year is now available in the Schedule D (Form 1040) instructions. The information discussed in Tab 4 accurately reflects the sections, lines, boxes, etc., of the final worksheet. Line 18, Amount of 28% Rate Gain The final version of 28% Rate Gain Worksheet for the 2013 tax year is now available in the Schedule D (Form 1040) instructions. The information discussed in Tab 4 accurately reflects the sections, lines, boxes, etc., of the final worksheet. Line 19, Unrecaptured IRC §1250 Gain The final version of the Unrecaptured Section 1250 Gain Worksheet for the 2013 tax year is now available in the Schedule D (Form 1040) instructions. The information discussed in Tab 4 accurately reflects the sections, lines, boxes, etc., of the final worksheet. Net Investment Income Tax The IRS has issued final regulations that provide guidance on the general application of the net investment income (NII) tax and the computation of NII. In addition, the IRS has released draft instructions to Form 8960, based mostly on the final regulations. The IRS released a draft version of Form 8960 for reporting the NII tax in August 2013. The final regulations are generally effective for tax years beginning after 2013; however, taxpayers may rely on the final regulations for the 2013 tax year, or they may rely on the proposed regulations issued in 2012. Moreover, taxpayers do not have to tell the IRS which regulations they are using. The IRS expects to release the final Form 8960 and instructions for the 2013 tax year as soon as possible. Tab 5: Schedule E: PALS and At-Risk 2013 Form. The final Schedule E of Form 1040 for the 2013 tax year is now available. The information discussed in Tab 5 accurately reflects the sections, lines, boxes, etc., of the final Schedule E. Tab 7: Form 4562: Depreciation MACRS Depreciation (Part III, Lines 17-20) Line 18, Election to Group Assets The IRS has issued Reg. §1.168(i)-7 and Prop. Reg. §§1.168(i)-1, 1.168(i)-7, and 1.168(i)-8, which would provide rules for dispositions of property subject to depreciation under the Modified Accelerated Cost Recovery System (MACRS), including property in grouped in general asset accounts. The proposed regulations are intended to replace provisions of Temp. Reg. §§1.168(i)-1T, 1.168(i)-7T, and 1.168(i)-8T, which were issued as part of the temporary “repair” regulations (T.D. 9564) in 2011. Temp. Reg. §1.168(i)-7T has been withdrawn. (T.D. 9636; NPRM REG-110732-13). Amortization (Part VI, Lines 42-44) Line 42, Amortization of Costs for 2013 Tax Year The IRS has amended Reg. §§1.171-2 and 1.171-3 to provide guidance on the tax treatment of a debt instrument with a bond premium carryforward in the holder’s final accrual period (T.D. 9653). Tab 10: Tax Credits and the AMT 2013 Forms. The final Forms 1040, 2441, 1116, 8801, and 3800, and Schedule 8812 (Form 1040), for the 2013 tax year, are now available. The information discussed in Tab 10 accurately reflects the sections, lines, boxes, etc., of the final forms. Tab 11: Estimated Payments, Penalties, and Amended Returns 2013 Form. The IRS has released a revised version of Form 1040X, dated December 2013. The final form matches the draft version released by the IRS on October 29, 2013. Tab 13: Family and Education Children and Taxes Credits for Families with Children Adoption Credit. The Patient Protection and Affordable Health Care Act increased the adoption credit amount and made it a refundable credit (IRC §23). The adoption credit amount that may be claimed on Form 8839,Qualified Adoption Expenses, is $12,970 for qualified adoption expenses for each eligible child. The credit is phased out ratably for taxpayers with modified gross incomes between $194,580 and $234,580. The credit amount is then reported on line 53 of Form 1040.