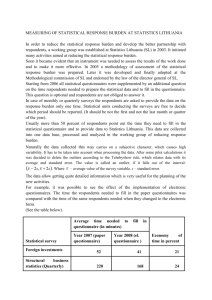

preliminary analysis on the finnish market– case study 7

advertisement