Written Report - CFA Institute

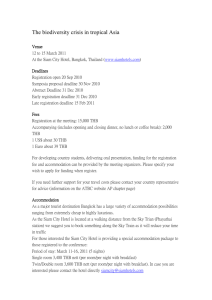

advertisement