1.5 Double Marginalization - Hu

advertisement

1.5. DOUBLE MARGINALIZATION

1

To be included in: Elmar Wolfstetter. Topics in Microeconomics: Industrial Organization, Auctions,

and Incentives. Cambridge University Press, new edition, forthcoming.

1.5

Double Marginalization

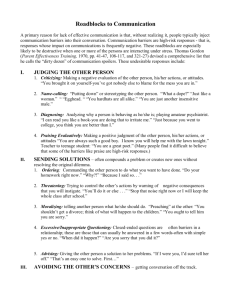

The distortion caused by a Cournot monopoly is further aggravated if there is a chain of several

vertical Cournot monopolies. The distortion caused by a chain of monopolies, measured by the

distance between price and marginal cost, is larger than the sum of individual distortions. This

important property is known as “double” (or better multiple) marginalization.

We now elaborate on two models of double marginalization.

1. In the first model an upstream monopoly is able to commit to a price and to perfectly

communicate its decision before the downstream monopoly chooses its price; there, vertical

monopolies play a sequential moves game.

2. In the second model upstream and downstream monopolies cannot commit to prices or

cannot observe each others’ prices and thus play a simultaneous moves game.

Both models are motivated by real life cases.

1.5.1

Access Pricing: the Sequential Moves Case

.........1

1.5.2

Extortion: the Simultaneous Moves Case

An interesting case of double marginalization as a simultaneous moves game is the extortion of

bribes by corrupt military officers along a highway. This model is based on Olken and Barron

(2009), who conducted a field study in the Aceh province in Indonesia, where the military extorted

bribes at roadblocks which were set up along two major highways during the war with separatist

guerillas.

As a stylized model suppose the military has set up n > 1 roadblocks, numbered from 1 (first) to n

(last), along a highway that is used by truck drivers to ship goods to a port. At each roadblock, k,

the corrupt staff requests a bribe bk , and denies passage if that bribe is not paid. The bribe charged

at one roadblock cannot be observed by the staff at the other roadblocks down the road. Therefore,

the staff of the roadblocks set bribes independently and under imperfect information, which gives

rise to a simultaneous moves bribe setting game. The active players of that game are officers that

staff the n roadblocks, and their strategies are the requested bribes bk .

Suppose truck drivers earn an unobservable profit per successful trip, denoted by the variable V ,

and zero profit for each not completed trip. Therefore, a truck driver will start a trip if and only

1 For

a detailed account of access pricing and other issues in the economics of telecom markets

see Laffont and Tirole (2000)

2

if V is at least as high as the expected total bribe per trip, V ≥ B, B := ∑nk=1 bk . The frequency

distribution of V determines a demand function, X(B), which is the number of trucks that travel the

highway as a function of the total bribe. Of course, X is a decreasing function of B since a bribe

crowds out trips of low profitability. For simplicity we assume

n

X(B) := 1 − B,

B :=

∑ bk .

(1.1)

k=1

As one can easily confirm, the simultaneous moves bribe setting game has a unique symmetric

equilibrium, b∗ , which satisfies the equilibrium condition

b∗ = arg max b 1 − (n − 1)b∗ − b .

(1.2)

b

And one finds the equilibrium bribes, denoted by (b∗ , B∗ ),

b∗ (n) =

1

,

n+1

B∗ (n) =

n

.

n+1

(1.3)

Evidently, the equilibrium total bribe per trip, B∗ , is an increasing function of the number of

roadblocks n, while the equilibrium bribe charged at each roadblock, b∗ , diminishes in n. Therefore,

as n is increased, the monopoly distortion goes up, gains from trade erode (since valuable trips are

not started), and total bribe income,

n

Π(B∗ (n)) := B∗ (n)(1 − B∗ (n)) =

(1.4)

(n + 1)2

diminishes.

It is also useful to compare the equilibrium bribes with the optimal bribes that would be set by

a “merger” of all roadblocks (or a centralized bribe setter who shares bribes equally among all

roadblocks). Denote that optimal bribe by B0 ,

B0 := arg max B(1 − B).

B

(1.5)

Evidently, the optimal bribe B0 = 12 is independent of n, and for all n > 1 one has B0 < B∗ , which

entails a smaller monopoly distortion. Nevertheless, the coalition earns higher bribe income,

Π(B0 (n)),

1

n

=: Π(B∗ (n)).

(1.6)

n > 1 ⇒ Π(B0 ) := B0 (1 − B0 ) = >

4 (n + 1)2

In other words, a strong military leadership that centralizes the bribe setting and shares bribes

equally among all roadblocks, generates a higher bribe income, sets a lower bribe, B, and thus is

Pareto superior since it benefits truck drivers, consumers, and corrupt officials. This is the essence

of double marginalization.

In line with these results, Olken and Barron (2009) find in their case study that military officials

acted just like in the above stylized model. When the number of checkpoints was reduced, after

the government had signed a peace plan with the separatist guerillas, the officials at the remaining

checkpoints seized the opportunity to extract more rent.2

You are invited to explore some variations of this problem in exercises 2 and 3 below.

2 Similar

cases of double marginalization have been reported from India, where the officials of

public utilities have been accused to extort bribes by threatening to disrupt service.

1.5. DOUBLE MARGINALIZATION

3

Exercises

Exercise 1 (Access Pricing). Consider the access pricing problem from Section 1.5.1. Generalize

by assuming that in order to reach its final destination, the phone call has to pass through a sequence

of n > 1 phone networks of independent phone companies.

Exercise 2 (Extortion I). Consider the extortion model of double marginalization from Section

1.5.2. Suppose roadblocks are weigh stations where officers can measure the weight, w, of the truck

load. And suppose the value of the truckload, v, is an increasing function of its weight. How can

corrupt officials use weight to engage in price discrimination? For simplicity assume w ∈ {w1 , w2 },

w2 > w1 . Assume that there is an equal number of trucks in each weight category, and assume ...

Compute the equilibrium bribes for each weight category.

Exercise 3 (Extortion II). Consider the extortion model of double marginalization from Section

1.5.2. Suppose, unlike in Section 1.5.2, that at each roadblock k the officials can observe the

bribes paid in the already passed roadblocks, j ∈ {1, 2, . . . , k − 1}, so that the bribe extortion game

becomes a sequential moves game (just like the access pricing problem in Section 1.5.1).

1. Compute the subgame perfect equilibrium bribes (b1 , b2 , . . . , bn ).

2. Now suppose that corrupt officials engage in Nash bargaining (rather than setting take-it-orleave-it bribes). Compute the subgame perfect equilibrium bribes (b1 , b2 , . . . , bn ).

3. In the above two models, examine whether the subgame perfect equilibrium bribes are

monotone increasing: k ∈ {1, n − 1} ⇒ bk+1 > bk .

4

Bibliography

Laffont, J.-J. and J. Tirole (2000). Competition in Telecommunications. Cambridge,

MA: MIT Press.

Olken, B. and P. Barron (2009). “The Simple Economics of Extortion: Evidence

from Trucking in Aceh”. Journal of Political Economy 117, pp. 417–452.

5