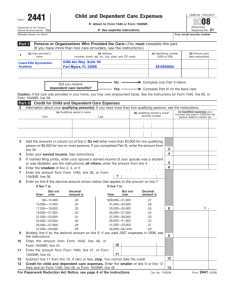

2004 Publication 503

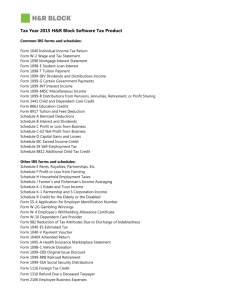

advertisement