2007 Publication 503 - Savannah State University

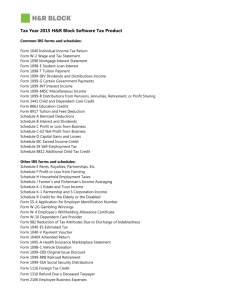

advertisement