California Withholding Tax Table 2012

advertisement

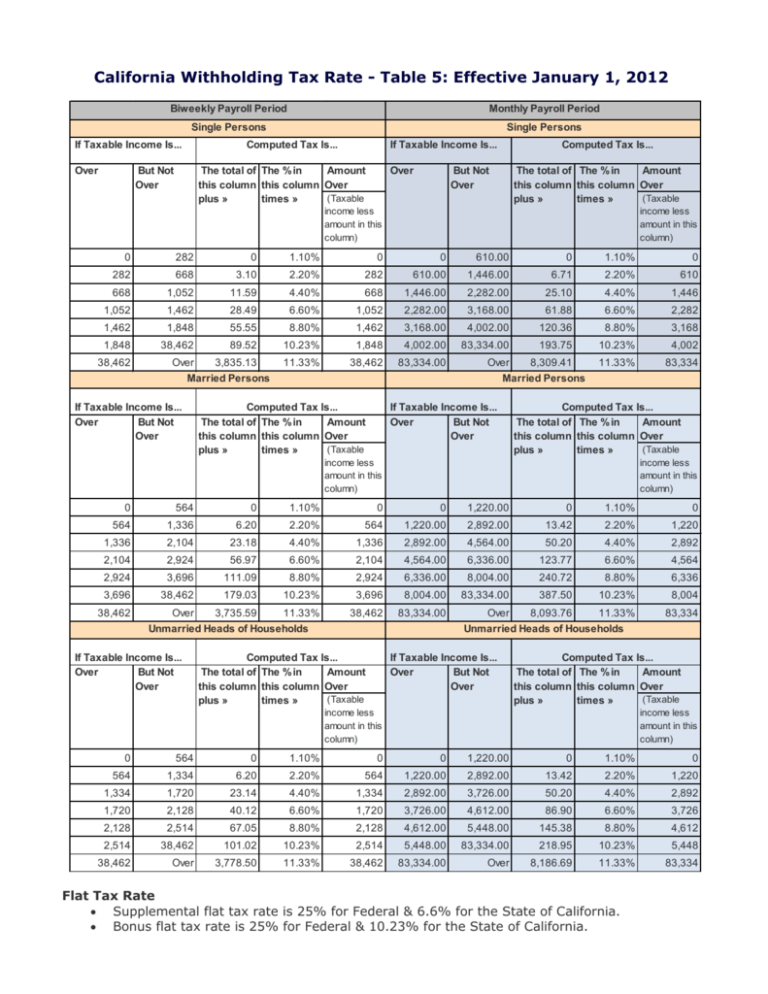

California Withholding Tax Rate - Table 5: Effective January 1, 2012 Biweekly Payroll Period Monthly Payroll Period Single Persons If Taxable Income Is... Over Single Persons Computed Tax Is... If Taxable Income Is... The total of The % in Amount this column this column Over (Taxable times » plus » But Not Over Over But Not Over Computed Tax Is... The total of The % in Amount this column this column Over (Taxable times » plus » income less amount in this column) income less amount in this column) 0 282 0 1.10% 0 0 610.00 0 1.10% 0 282 668 3.10 2.20% 282 610.00 1,446.00 6.71 2.20% 610 668 1,052 11.59 4.40% 668 1,446.00 2,282.00 25.10 4.40% 1,446 1,052 1,462 28.49 6.60% 1,052 2,282.00 3,168.00 61.88 6.60% 2,282 1,462 1,848 55.55 8.80% 1,462 3,168.00 4,002.00 120.36 8.80% 3,168 1,848 38,462 89.52 10.23% 1,848 4,002.00 83,334.00 193.75 10.23% 4,002 11.33% 38,462 83,334.00 11.33% 83,334 38,462 Over 3,835.13 Married Persons If Taxable Income Is... Over But Not Over Over 8,309.41 Married Persons If Taxable Income Is... Over But Not Over Computed Tax Is... The total of The % in Amount this column this column Over (Taxable plus » times » Computed Tax Is... The total of The % in Amount this column this column Over (Taxable plus » times » income less amount in this column) 0 564 0 1.10% 0 income less amount in this column) 0 1,220.00 0 1.10% 0 564 1,336 6.20 2.20% 564 1,220.00 2,892.00 13.42 2.20% 1,220 1,336 2,104 23.18 4.40% 1,336 2,892.00 4,564.00 50.20 4.40% 2,892 2,104 2,924 56.97 6.60% 2,104 4,564.00 6,336.00 123.77 6.60% 4,564 2,924 3,696 111.09 8.80% 2,924 6,336.00 8,004.00 240.72 8.80% 6,336 3,696 38,462 179.03 10.23% 3,696 8,004.00 83,334.00 387.50 10.23% 8,004 Over 3,735.59 11.33% Unmarried Heads of Households 38,462 83,334.00 Over 8,093.76 11.33% Unmarried Heads of Households 83,334 38,462 If Taxable Income Is... Over But Not Over Computed Tax Is... Amount The total of The % in this column this column Over (Taxable plus » times » If Taxable Income Is... Over But Not Over Computed Tax Is... Amount The total of The % in this column this column Over (Taxable plus » times » income less amount in this column) 0 564 0 1.10% 0 income less amount in this column) 0 1,220.00 0 1.10% 0 564 1,334 6.20 2.20% 564 1,220.00 2,892.00 13.42 2.20% 1,220 1,334 1,720 23.14 4.40% 1,334 2,892.00 3,726.00 50.20 4.40% 2,892 1,720 2,128 40.12 6.60% 1,720 3,726.00 4,612.00 86.90 6.60% 3,726 2,128 2,514 67.05 8.80% 2,128 4,612.00 5,448.00 145.38 8.80% 4,612 2,514 38,462 101.02 10.23% 2,514 5,448.00 83,334.00 218.95 10.23% 5,448 38,462 Over 3,778.50 11.33% 38,462 83,334.00 Over 8,186.69 11.33% 83,334 Flat Tax Rate • Supplemental flat tax rate is 25% for Federal & 6.6% for the State of California. • Bonus flat tax rate is 25% for Federal & 10.23% for the State of California. Table 1 - Low-Income Exemption Table Payroll Period Single Exemptions All Married 0 or 1 Biweekly Monthly Unmarried Heads of Household 2 or more All 482 482 964 964 1,044 1,044 2,088 2,088 Table 2 - Additional Itemized Deduction Allowance Table Number of Exemptions Payroll Period 1 2 3 4 5 6 7 8 9 10 Biweekly 38 77 115 154 192 231 269 308 346 385 Monthly 83 167 250 333 417 500 583 667 750 833 Table 3 - Standard Deduction Table Payroll Period Single Exemptions All Married 0 or 1 Unmarried Heads of Household 2 or more All Biweekly 145 145 290 290 Monthly 314 314 628 628 Table 4 - Personal Exemption Credit Table Pay Period Number of Exemptions Marital Status 0 Biweekly All 0 4.32 Monthly All 0 9.35 1 2 3 4 5 6 7 8 9 10 8.63 12.95 17.26 21.58 25.89 30.21 34.52 38.84 43.15 18.70 28.05 37.40 46.75 56.10 65.45 74.80 84.15 93.50 To calculate the personal exemption tax credit when more than 10 allowances are claimed, multiply the amount shown for one additional allowance by the number claimed. For example, a married employee paid monthly claiming 16 allowances (for the personal exemption credit) would have a tax credit of $149.60 (16 x $9.35). Tax Table - California Instructions How to Calculate California Withholding for 2012 Steps to calculate California withholding taxes are shown in the example below. You may also calculate your withholding tax by going to At Your Service Online (http://blink.ucsd.edu/HR/benefits/AYSO/ ). Example: An employee is paid $1,930.00 each biweekly pay period. The employee has a biweekly tax deferral of $200. The employee claims married status with three regular allowances and four additional allowances on the W-4 form. Calculation of California 2011 Withholding Tax First, determine if earnings are greater than amounts listed in "Table 1 - Low Income Exemption Table"; if so, income tax can be calculated following the instructions. If not, no taxes are calculated. Step 1: Determine taxable gross. A. Gross Earnings 1930.00 B. Less tax-deferred deductions* -200.00 C. Taxable Gross Step 2: Determine wages subject to withholding. 1730.00 D. Determine the number of each additional allowance (as listed on W-4, Section II, Line 3). If there are no additional allowances, go to Step 3. In this example, there are four additional allowances E. Determine the value of the additional allowance. (See "Table 2 - Itemized Deduction Allowance Table" in Tax Table - California State Income Tax.) F. Subtract the value of the additional allowances from Taxable Earnings -154.00 1576.00 Step 3: Determine taxable income. G. Subtract standard deduction based on payroll period and marital status. (See "Table 3 Standard Deduction Table" in Tax Table - California State Income Tax.) Step 4: Calculate withholding taxes before personal exemption credit. Tax Computation: Use "Table 5 - Tax Rate Table" in Tax Table - California State Income Tax H. Adjusted Taxable Income (income subject to withholding) -290.00 1286.00 I. Determine Payroll Period: Biweekly J. Determine W-4 marital Status: Married K. Determine appropriate tax table section: Biweekly Payroll Period/Married L. Find the appropriate range by comparing your adjusted taxable income (Step 3) to the ranges of the tax table section (K). For this example: The income of 1,294.00 is between the range of "548 not over 1,300" M. List the income subject to withholding (H) 1286.00 N. Subtract the lower value of the appropriate range (L). This is called the marginal income 564.00 O. Difference 722.00 P. List tax rate for the range (K) 2.20% Q. Multiply O by P R. Add the tax listed on the table of marginal income. In this example, the tax amount on $564.00 is ... S. Total California tax withholding before credit (add Q and R) Step 5: Apply personal exemption credit. 15.88 6.20 22.08 T. Determine the number of personal allowances. This is based on the allowances listed on the W-4 as regular allowances. In this example, there are three allowances U. Determine the value of the allowances by applying the information from Table 4 and subtract from S V. Total California Tax Withholding -12.95 9.13