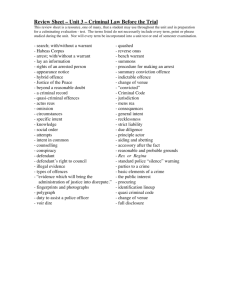

Criminal Proceeds Confiscation Act 2002

advertisement