the fiscal balance of stateless nations

advertisement

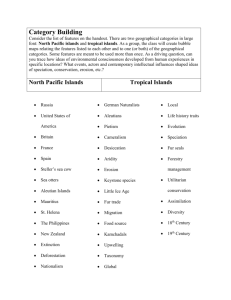

Jaume Garau Taberner Félix Pablo Pindado THE FISCAL BALANCE OF STATELESS NATIONS WITH THE EUROPEAN UNION The cases of Aragon, Scotland, the Basque Country, Flanders, Galicia, Wales and Catalonia, Valencia and the Balearic Islands Brussels CMC PAPERS | 2014 | 1 THE FISCAL BALANCE OF STATELESS NATIONS WITH THE EUROPEAN UNION The cases of Aragon, Scotland, the Basque Country, Flanders, Galicia, Wales and Catalonia, Valencia and the Balearic Islands Jaume Garau Taberner Félix Pablo Pindado Centre Maurice Coppieters CMC papers I 2014 I 1 summary Prologue 5 Introduction 7 1. Contributions and transfers from Member States to the EU budgets 9 2. The regionalisation of these items 11 3. Results and comparisons between regions 14 An example of how to calculate the fiscal balance of a region with the EU 17 Conclusions 19 Bibliography 23 The Emili Darder Foundation 25 Centre Maurits Coppieters 29 Members of the CMC 32 Colophon 34 This publication is financed with the support of the European Parliament (EP). The EP is not responsible for any use made of the content of this publication. The editor of the publication is the sole person liable. 3 PROLOGUE One of the major targets set by the European Union was to combat inequality among different regions by means of the Cohesion Policies. Significant advances have been made in this regard thanks to the large amounts of resources invested. Unfortunately, these resources have not always produced the best results because of the regional redistribution carried out by the Member States, which at times apply discretional criteria and assign the resources to their neediest regions. The observation of these practices is what lies behind this study, which by way of sampling shows that the States thereby pervert the Union’s philosophy, distorting the principles of the above-mentioned Cohesion Policies. The delicate economic situation that is shaking up countries in the Union, among other circumstances, is causing the disaffection of many people towards the EU institutions, which are perceived as excessively distant and bureaucratic. If in addition to this they are not particularly careful or transparent in public spending, popular disaffection will grow. We should therefore clearly define the political targets being pursued and check that they are correctly applied. The Emili Darder Foundation’s intention with this study is not limited to exposing these facts, but rather proposes the opening of a process of reflection within the European Union so that stricter and more objective criteria may be applied in the redistribution of resources, and at the same time so that there is a follow-up on the application thereof. Pere Sampol i Mas, Director of the Emili Darder Foundation Antoni Marimón, President of the Emili Darder Foundation 5 introduction The social and economic situation of the 270 regions making up the European Union is very unequal. London, Luxembourg and Brussels are the areas with the highest wealth index per capita. At the other end of the scale, the regions of Severozapaden and Severen Tsentralen – both in Bulgaria – and the North-East of Romania have the lowest wealth indices in the entire EU. In other words: a resident of London’s income is 13 times higher than that of a resident of Severozapaden. There are some cases of regions which have the same per capita income and the same population, however, they receive over three times more European Funds investments than others. In this case, the European Regional Policy does not help to harmonise the differences, but rather increase them. In order to reduce these significant regional differences, the EU set up the so-called Cohesion Policy, the flagship instrument of its projects. The European Commission’s intention is to drive more harmonious economic growth among the different regions in Europe. The purpose of this study is to analyse what a series of regions receive in European Funds and what they contribute – in tax – to the European Union budget. The end target is to come up with a new tool to better evaluate the European Regional Policy and its effects. In this way regions can access European financing depending on the “category” of the region in question. Areas whose GDP per capita is less than 75% of the EU average are the main priority of the policy and they receive the majority of resources. By way of contrast, zones whose GDP per capita is over 90% of the average receive less EU financing. In order to carry out this research, first of all we shall analyse what a series of European regions receive in European Funds. In order to do this, we have examined the transfers received by said zones from different kinds of existing funds. Even though the distribution mechanisms of European Funds are established by Brussels, state governments have plenty of leeway to decide how much of the European aid is in the end assigned to each region within the state. In other words, the governments in Madrid and London, for example, enjoy significant capacity to decide how much of the European Funds goes to each region within the State. This capacity held by the governments of Member States can – at times – distort the initial purpose of the Cohesion Policy. The lack of transparency and clear criteria and targets about how European Funds are assigned among the regions within a State often leads to tension concerning the final sharing out of EU aid among regions: paradoxes occur 6 in which areas with very similar per capita income and populations receive very different levels of European financing. We then calculated the contributions that these same regions make to the EU budget. All regions in the EU contribute resources to Brussels. Value Added Tax (VAT) is one of the best-known contributions, but there are others too. Finally, we assessed the difference between what these regions contribute – in tax – and what they receive – in European Funds. The idea is to see if certain regions contribute more tax to the EU than what they receive in public investment, and whether this might affect the initial purpose of reducing income differences in the regions of Europe. The research is focused on the cases of 26 European regions, which form part of three Member States: Belgium, Spain and the United Kingdom. In these States there are regions 7 with their own powerful economic, social and cultural characteristics, and this often leads to political tension with the governments in the capitals of said States. Our purpose in this exercise is to determine whether these political situations might have affected the discretion of the governments when it comes to assigning European financing to these politically differentiated regions. Table 1 shows which regions come under analysis. Finally, we would like to point out that the results obtained are the fruit of our own meth- odology, which has certain limitations: part of the calculations carried out imply adopting criteria to territorialise what is contributed and what is received. The criteria adopted – which are explained and justified – are always subject to opinions and interpretation. In short: this publication is a first approach to try and calculate the fiscal balances of European regions with the EU. We will then have a new instrument to assess the European Regional Policy and its effects. Table 1 regions in spain regions in the united kingdom Andalusia aragon Asturias baleaRic islands Canary islands Cantabria Castille and leon Castille la mancha catalonia valencian communitiy Extremadura galicia Madrid (region) Murcia (region) navarre basque country Rioja Ceuta Melilla wales scotland northern ireland England regions in belgium flanders Wallonia Brussels NB: Regions considered “Stateless Nations” or whose political and cultural identity is quite different from that of the majority in the State they belong to are shown in bold and italics. 1. contributions and transfers from member states to the eu budgets The resources that Member States contribute to the EU are basically divided up into 3 main items (cf. Las relaciones financieras entre España y la Unión Europea, 2012): • Traditional Own Resources (TOR) Seen as the “real” European tax, the consequence of applying common policies throughout the EU. TOR is made up of: - Taxes, fees, supplementary or compensatory amounts and additional elements, common customs duties and other rights set by EU institutions for trade with third countries. - Contributions and other rights set forth with in the framework of the common organisation of markets in the sugar sector. • Value Added Tax Obtained by applying the tax uniformly to all Member States. Part of what is collected by each State under this tax is transferred to the EU. • Gross National Income The more economic production a country has, the more it contributes to the EU budget. Given that EU budgets cannot have a deficit when they are approved, the total amount to pay for GNI is variable: once the total EU expense and the total income from Traditional Own Resources and VAT have been calculated, each State has to make a further contribution depending on its Gross National Income. Table 2 - Contributions of each State to the EU budget (2011) Belgium Bulgaria Czech Republic Denmkark Germany Estonia Ireland Greece Spain France Italy Cyprus Latvia Lithuania Luxemburg Hungary Malta Netherlends Austria Poland Portugal Romania Slovenia Slovakia Finland Sweden United Kindom Total Member States Traditional VAT GNI CONTRIBUTION CONTRIBUTION TO THE TOTAL own rescources TO THE UKNETHERLANDS AND SWEDEN 1.581,00 516,52.627,30 177,5 24,2 4.926,50 49,1 51,2274,1 18,4 2,4 395,2 220,6 207,7 1.170,30 74,6 9,3 1.682,50 327,6 291,31.701,20 112,1 16,1 2.448,30 3.456,00 1.671,5017.610,40 218,3 170,9 23.127,10 21,9 22,9106,8 6 1 158,6 199,8 193,5884,4 52,7 8,3 1.338,70 141 278,61.376,10 93,1 14,2 1.903,00 1.170,20 1.964,407.355,00 487,7 69 11.046,30 1.566,30 2.917,6014.035,00 965,9 133 19.617,80 1.741,70 1.811,8011.703,30 717,9 103,1 16.077,80 24,6 27123,5 8,5 1,2 184,8 22,6 15,9133,6 9 1,2 182,3 44,6 27,9213,7 14 1,8 302 14,3 46,7215 15 2,1 293,1 101 116,6666,4 47 6,4 937,4 10,1 9,543,6 2,9 0,4 66,5 1.935,60 290,34.217,20 50,7 -625 5.868,80 189,5 306,12.150,00 24 19,1 2.688,70 352,6 5272.494,60 182,7 23,5 3.580,40 135 299,31.207,70 81,6 10,8 1.734,40 109,9 138,8902,1 66,9 8,2 1.225,90 74,2 54,7251,9 17,9 2,4 401,1 117,4 60474,9 36,9 4,5 693,7 152,4 266,91.436,20 87 12,6 1.955,10 466,9 173,12.798,90 33 -138,3 3.333,60 2.551,80 2.512,10 12.241,00 -3.595,90 116,2 13.825,20 16.777,70 14.798,90 88.414,20 5,4 -1,4 119.994,80 Source: Eurostat 8 9 This means that if, for example, the income obtained by the EU from TOR and VAT is lower than planned, governments will have to pay more according to their Gross National Income. This means that the EU budget is balanced. Finally, each State makes an “extra” contribution to the United Kingdom, the Netherlands and Sweden. There is a political agreement to correct any budgetary imbalance these countries may have: they were net contributors to the EU budget and by means of these exceptional and temporary clauses, this state of imbalance is reduced. Altogether, the contributions from the 27 Member States to the EU budget for 2011 amounted to 119,000 million Euros. The country that contributed most was Germany (it is the main economic power and has the highest population): it contributed over 23,000 million Euros, 19% of the whole EU budget. At the other end of the scale, Malta (the least populated country in the EU), contributed 67 million Euros to Union accounts. Table 2 shows the contribution of each State to the EU in accordance with the different budgetary items. As far as income is concerned, the transfers that each State receives from the EU come, in general terms, from the following six items: • European Agricultural Guarantee Fund (EAGF) Finances returns for the exportation of agricultural products to third parties, interventions to restore agricultural mar- kets, direct payments to farmers, etc. • European Agricultural Fund for Rural Development (EAFRD) Finances rural development and support programmes for farmers in European regions. • European Fisheries Fund (EFF) Finances projects related to all fishing and aquaculture sectors. • European Social Fund (ESF) Finances human resources training: the unemployed, the working population and disadvantaged groups. • European Regional Development Fund (ERDF) Finances projects and investment for structural development and adaptation for regional economies. The ERDF intervenes by means of projects in research, the information society, transport infrastructures, culture, tourism, etc. • Cohesion Funds Finances projects in the fields of the environment and trans-European transport networks. Not all the States have access to the same investment: for example, those which are more developed do not enjoy access to Cohesion Funds. Moreover, we should bear in mind that the major part of these payments is made through only three programmes - ERDF, ESF and EAFRD. 2. the regionalisation of these items Once the contributions and transfers from the Member States to the EU budget are known, these items are territorialised. In other words, each region is assigned a figure for what it is estimated to have contributed via the different taxes and for what it has received through the different European investment programmes. In the case of contributions to the EU budget, two different criteria were used for regionalisation, depending on the kind of item in question. In order to estimate the contributions made by a region in accordance with Traditional Own Resources and VAT, we used home consumption data for each region. Hence we assume that if, for example, homes in the region of England (United Kingdom) show a high level of consumption, they will contrib- ANDALUSIA15,46% ARAGON2,98% ASTURIAS 2,35% BALEACIC ISLANDS 3,58% CANARY ISLANDS 5,11% CANTABRIA1,32% CASTILLE AND LEON 5,34% CASTILLE LA MANCHA 3,87% CATALONIA17,21% VALENCIAN COMMUNITIY 10,13% EXTREMADURA1,93% GALICIA5,65% MADRID (REGION) 14,98% MURCIA (REGION) 2,63% NAVARRE 1,48% BASQUE COUNTRY 5,06% RIOJA 0,69% CEUTA 0,13% MELILLA 0,11% Total Consumption expenditure of households in Spain 610.535.000 The transfers received from European funds in the three States we have analysed for this study (Belgium, Spain and the United Kingdom) are shown in Table 3 for the period 2007-2013. 2007-2013 period Per year Belgium1.831,3261,6 Spain 44.401,96.343,1 United Kingdom14.019,8 2.002,8 10 NB: Corresponds to the European Commission’s financial commitments to these regions under the ERDF, ESF and EAFRD programmes. Even so, it would have been better to take into account the different rates of VAT (for each product) and the specific taxes on imported products. Nevertheless, as we used the same criteria in all 27 regions studied, we understand that it is an acceptable approach1. Secondly, State contributions have been regionalised in accordance with Gross National Income. In order to do this we used the Gross Domestic Product for each region. In Table 4 - Home consumption by region compared to the total for the State it belongs to (2011) Table 3 - Resources received within the framework of the ERDF, ESF and EAFRD programmes (2007-2013) Source: Drawn up in house based on financial figures published on the European Commission web site. ute more VAT to the EU budget. On the other hand, if homes in the region of Extremadura (Spain) show a low level of consumption, this region will contribute less to EU accounts under this concept. In other words, to estimate what regions contribute according to VAT and products purchased abroad, we used what families consume. This seemed to be the best method for regionalising this item (Table 4). FLANDERS35,3% WALLONIA33,1% BRUXELLES31,6% Total Consumption expenditure of households in Belgium n.a. WALES4,1% SCOTLAND8,4% NORTHERN IRELAND 2,9% ENGLAND84,6% Total Consumption expenditure of households in UK 12.304.098 Source: Drawn up in house based on data from “Statistics Belgium”, the “Instituto Nacional de Estadística” and the “Office for National Statistics”. NB: In the case of Spain, VAT has been reweighted on a regional basis in accordance with information from the INE (National Statistics Institute). Furthermore, in Spain there was an additional distribution that combines the VAT regionalisation indicators published by the INE for regions that do not have a local Inland Revenue and the Canary Islands, and the actual expense structure in final home consumption. 1 11 Once the regionalisation of payments made has been taken into account, we can estimate 169,9 184,3 174,3 186,3 196,3 188,5 196,6 213,7 202,7 219,4 214,2 226,0 223,0 235,2 231,0 261,7 238,3 262,8 283,7 274,1 297,7 295,1 1.054,3 374,6 Graph 1 shows contributions to the EU budget per inhabitant, according to the region they live in. Regions with a higher GDP per capita contribute more: Brussels, Flanders, the Basque Country, Madrid, etc. Even so, we could highlight the fact that there are regions with income rates under the European average that make additional contributions to the EU budget, such as Wallonia and the Balearic Islands. Graph 1 - Contribution to the EU budget per inhabitant and by region (2011) 303,5 In this case we applied regional GDP distribution structure data (SEC 95), which is the same for countries and regions. Table 5 shows the GDP for each region as a proportion in each State. what each region contributes to the budget of the European Institutions. Table 6 shows all these payments. 384,0 other words, we assumed that the region with the highest total production would contribute the most to European budgets. This is the same criteria applied to States when calculating their contribution to Brussels, hence it is considered to be the best criteria for regionalisation. We then calculated the transfers received by Source: Drawn up in house based on calculations explained above (Tables 3 and 4) Table 5 - GDP for each region, compared to the total for each State (2011) Table 6 - Payments made by each region to the EU (TOR+VAT+GNI) FLANDERS212.354 WALLONIA86.767 BRUXELLES69.895 Belgium369.259 ANDALUSIA141.603 ARAGON33.307 ASTURIAS 22.472 BALEACIC ISLANDS 25.968 CANARY ISLANDS 40.718 CANTABRIA12.754 CASTILLE AND LEON 55.331 CASTILLE LA MANCHA 37.113 CATALONIA194.285 VALENCIAN COMMUNITIY 99.372 EXTREMADURA16.954 GALICIA55.940 MADRID (REGION) 188.445 MURCIA (REGION) 27.177 NAVARRE 18.144 BASQUE COUNTRY 64.857 RIOJA 7.986 CEUTA 1.499 MELILLA 1.338 Spain1.046.327 WALES60.428 SCOTLAND137.864 NORTHERN IRELAND 37.813 ENGLAND1.376.256 United Kingdom 1.612.361 FLANDERS2.369,3 VALONIA1.358,7 BRUXELLES1.198,5 Belgium 4.926,5 Source: Drawn up in house based on Eurostat data. NB: The sum of the regional GDPs is not exactly the same as that for each State, as we should take the “Extra-Regional” GDP into account, generated outside the State. 12 ANDALUSIA1.556,3 ARAGON345,5 ASTURIAS 243,9 BALEACIC ISLANDS 308,8 CANARY ISLANDS 468,4 CANTABRIA137,9 CASTILLE AND LEON 586,1 CASTILLE LA MANCHA 402,4 CATALONIA2.010,0 VALENCIAN COMMUNITIY 1.069,7 EXTREMADURA188,8 GALICIA600,4 MADRID (REGION) 1.895,8 MURCIA (REGION) 288,2 NAVARRE 183,6 BASQUE COUNTRY 649,6 RIOJA 81,9 CEUTA 15,4 MELILLA 13,7 Spain 11.046,3 WALES511,5 SCOTLAND1.122,0 NORTHERN IRELAND 335,9 ENGLAND11.855,7 United Kingdom 13.825,1 Source: Drawn up in house based on calculations explained above (Tables 4 and 5) each region under the different programmes in the European Regional Policy. As explained above, most Community Funds come in the form of ERDF, ESF and EAFRD. Most regions analysed do not have access to EFF or Cohesion Funds. EAGF is a very specific fund derived from the Common Agricultural Policy and which we decided not to territorialise: EAGF is not an investment for the economic development of a region, but rather consists of interventions to regularise agricultural markets and make direct payments to farmers, set up within the field of the CAP. Consequently, we respected the territorial assignation of each commitment to credit set up by the European Commission in the 3 ERDF, ESF and EAFRD funds. The amounts received by the 26 regions under study are shown in Table 7. Graph 2 shows which regions receive most European financing per capita. Once we had estimated what each region contributes to and receives from the European budgets, it is important to point out that the calculations of income and expenses are asymmetrical: while regionalisation for Table 7 - European Commission commitments to the regions analysed (ERDF, ESF and EAFRD funds) (2011) FLANDERS127,76 VALONIA68,09 BRUXELLES65,77 ANDALUSIA1.572,3 ARAGON91,7 ASTURIAS 118,7 BALEACIC ISLANDS 28,0 CANARY ISLANDS 187,6 CANTABRIA27,5 CASTILLE AND LEON 239,0 CASTILLE LA MANCHA 372,2 CATALONIA181,4 VALENCIAN COMMUNITIY 245,7 EXTREMADURA407,9 GALICIA563,9 MADRID (REGION) 95,1 MURCIA (REGION) 118,3 NAVARRE 25,6 BASQUE COUNTRY 62,3 RIOJA 14,1 CEUTA 8,0 MELILLA 7,3 WALES360,61 SCOTLAND213,75 NORTHERN IRELAND 48,11 ENGLAND1.380,36 Source: Drawn up in house based on data from the European Commission. 13 Graph 3 - Fiscal balance with the EU, in relation to GDP EXTREMADURA GALICIA 0,01% ANDALUSIA CASTILLE LA MANCHA -0,07% WALES -0,08% MELILA -0,25% CEUTA MURCIA -0,47% CASTILLE AND LEON -0,63% ASTURIAS SCOTLAND -0,63% -0,49% CANARY ISLANDS -0,66% -0,56% ENGLAND VALENCIAN COMMUNITY -0,69% RIOJA -0,83% NORTHERN IRELAND CANTABRIA -0,85% -0,70% NAVARRE -0,87% ARAGON BASQUE COUNTRY -0,87% -0,76% CATALONIA -0,91% -0,76% MADRID (REGION) -0,94% FLANDERS -0,96% BALEARIC ISLANDS -1,06% WALLONIA BRUXELLES -1,08% -1,49% -1,62% 19,2 14,9 24,7 20,2 26,3 25,7 26,7 40,8 29,1 41,2 47,6 44,9 57,9 49,1 80,5 69,8 95,9 89,3 105,1 98,7 119,8 112,5 190,4 181,8 206,0 376,5 1,29% Graph 2 - EU financing per inhabitant Source: Drawn up in house Source: Drawn up in house based on calculations explained above (Tables 3 and 4) expenses was complete, in income part of the European investment could not be regionalised. The reason is that not all European investment is assigned to a specific region: there are numerous “multiregional” programmes, i.e. programmes that are applied to different regions at the same time. In such cases it is not easy to determine what is actually invested in each region. Even so, it did prove possible to regionalise most European investment: for example, in the case of Spain, 75% of European investment made in the state is specifically assigned to regions. In any case, it is important to remember that European investment in regions is not shown in its entirety. This could lead to bias in the calculation of fiscal balances: all payments made to the EU are shown but not all European investment received is. However, given that the same situation is applicable to all the regions studied, we understand that the data obtained is comparable. 3. results and comparisons between regions Table 8 - Fiscal balance of regions with the EU FLANDERS-2.241,6 VALONIA-1.290,6 BRUXELLES-1.132,7 ANDALUSIA15,9 ARAGON-253,8 ASTURIAS -125,1 BALEACIC ISLANDS -280,8 CANARY ISLANDS -280,8 CANTABRIA-110,4 CASTILLE AND LEON -347,0 CASTILLE LA MANCHA -30,2 CATALONIA-1.828,6 VALENCIAN COMMUNITIY -823,9 EXTREMADURA219,0 GALICIA-36,5 MADRID (REGION) -1.800,8 MURCIA (REGION) -170,0 NAVARRE -158,0 BASQUE COUNTRY -587,2 RIOJA -67,9 CEUTA -7,4 MELILLA -6,3 WALES-150,9 SCOTLAND-908,3 NORTHERN IRELAND -287,8 ENGLAND-10.475,3 Source: Drawn up in house Once the payments and investment for each region in the study had been analysed, we were able to calculate the fiscal balance with the EU for a given region: payments made by a region to the EU budget were subtracted from the amount received. Table 8 shows the results. Of all the regions studied, Brussels, Wallonia 14 and the Balearic Islands have the worst fiscal balance in relation to their GDP (Graph 3). Extremadura and Andalusia are the regions with the most positive fiscal balance with the EU. The residents who contribute most and receive least from the EU are those who live in the regions of Brussels, Wallonia and Flanders (Graph 4). At the other end of the scale, inhabitants of Extremadura and Andalusia are those who pay least and receive most. If we analyse the GDP per capita in each of these regions, and what they receive in European Funds (Graph 5), it becomes clear that there is a certain relationship between the GDP per capita figures in a region and the amount of European investment received by that region: the higher the per capita income in a region, the less European funds it receives. Despite this general trend, certain significant anomalies come to light: there are regions that receive much more or much less European investment than would be expected from their wealth per capita. We can see on this graph that there are four kinds of region, according to the amount of European investment received: • Regions that receive European financing in relation to their wealth per capita: Flanders, Navarre, the Basque Country, Scotland, Aragon, Castilla y León, Ceuta, Asturias, Wales, Madrid, La Rioja, the Canary Islands, Melilla and Murcia (the latter could also be placed in the following group). These regions are shown on the graph on the diagonal dividing line. • Regions that receive much less European financing than would be expected from their per capita income (in this order): Northern Ireland, Wallonia, Valencia, the Balearic Islands, Cantabria and Catalonia. These regions are shown on the graph under the diagonal dividing line (in the lower left corner). • Regions that receive much more European financing than would be expected from their per capita income: Galicia, Castilla-La 15 GALICIA EXTREMADURA ANDALUSIA 1,9 202,2 CASTILLE LA MANCHA -13,4 WALES -14,8 MELILLA -50,1 CEUTA -85,6 MURCIA -97,6 ASTURIAS -115,8 NORTHERN IRELAND CANARY ISLANDS VALENCIAN COMMUNITY -159,6 -118,5 SCOTLAND -164,6 CASTILLE AND LEON CANTABRIA -173,4 -133,7 ARAGON -190,7 -139,3 ENGLAND CATALONIA -193,0 NAVARRE -249,3 RIOJA BALEARIC ISLANDS -253,9 -199,7 BASQUE COUNTRY -258,0 -216,8 MADRID (REGION) -274,4 FLANDERS -282,7 WALLONIA -354,4 BRUXELLES -996,4 -364,8 Graph 4 - Fiscal balance with the EU per inhabitant Mancha and Andalusia. These regions are shown on the graph above the diagonal dividing line (in the upper right corner). • Regions that receive an extraordinarily higher level of European financing than would be expected from their per capita income: Extremadura and Brussels. Even so, the region of Brussels is a special case: it has the highest GDP per capita. Even though it has the most negative fiscal balance in the EU, this means that it still receives a “high” amount of European funds. This is due to its extraordinarily high income level. These regions are shown on the graph well above the diagonal dividing line (above the upper right corner). A second reading of the graph shows how regions with similar wealth levels receive very dissimilar European financing. Northern Ireland and Galicia enjoy a similar degree of economic development, but the European financing they receive is completely different: the former receives much less European investment. The GDP per capita in the Balearic Islands and Valencia is lower than in Aragon, but the latter’s European financing per inhabitant is significantly higher. Source: Drawn up in house Graph 5 - Fiscal balance with the EU per inhabitant (The vertical axis shows European investment per inhabitant, the horizontal axis shows GDP per inhabitant) An example of how to calculate the fiscal balance of a region with the EU If we take the Balearic Islands as an example, we can see how we have calculated the fiscal balance of a region with the EU Institutions. First of all, we took the region’s income from European programmes (Table 6): 27.96 million Euros altogether per year. As far as the region’s payments to the EU are concerned, we regionalised two items: what they have to pay under VAT and Own Resources and what they pay for their economic business activity (Contribution for Gross National Income). Source: Drawn up in house NB 1: Data for Extremadura and Brussels has not been included on the graph, as these results – explained above in the text – would distort the depiction. NB 2: In order to draw up the graph, we used a scale of 1 to 100 for all data. The axis show- 16 ing European investment per inhabitant goes from 0 to 100. The region that receives most investment (Extremadura; 3,765 €) is given a value of 100 on this axis. The axis showing the GDP per inhabitant also goes from 0 to 100. The region with the highest per capita income (Brussels; 61,485 €) is given a value of 100. In order to regionalise the former component, it will be seen that the proportional consumption in the Balearic Islands in relation to Spain is 3.58%, i.e. 21,854,622 Euros. The contribution for Gross National Income was regionalised in accordance with the pro- portion of the Balearic GDP in relation to Spain: 25,968 million Euros. When these two components are added together, we obtain the sum of payments this region is estimated to make to the EU: 308.8 million Euros. If we subtract what the Balearic Islands contribute to the EU from what the EU invests in the archipelago, the result is a negative balance of 280.8 million Euros for 2011. This negative balance accounts for 1.08% of the region’s GDP: one of the highest in all the regions studied. Each inhabitant on the Islands contributes 283 Euros to the EU budget while the EU invests 26 Euros per inhabitant. 17 Conclusions 2014 is a particularly important year for the European Regional Policy: one period of European Fund implementation is coming to an end (2007-2013) and a new investment period (2014-2020) is being prepared. Now, therefore, is a good time to reflect on and assess what has been done in the past in order to reach conclusions for the future. This study is a preliminary approach to try and calculate regions’ fiscal balances with the EU. The purpose is to come up with a new tool to better evaluate the Regional Policy, one of the European Commission’s major budget items. There are two significant limitations to this study. Firstly, in order to estimate what each region contributes to the EU budget, we territorialised these payments. This is unavoidably subject to different opinions and interpretations. Secondly, we were not able to territorialise all the EU investment items: funds such as the EAGF and the Multiregional Operating Programmes did not show all the expenses and investment that the EU carries out in a given region. Even so, we believe that the results obtained are sufficiently sound and that they enable us to make comparisons between States and regions. The results obtained show us how: • In general terms, regions with a high wealth index per capita are those that contribute most to the budgets. At the same time, regions with the lowest per capita income are those that receive most investment from the EU. 18 • Nevertheless, there are exceptions: Northern Ireland, Wallonia, Valencia, the Balearic Islands and Catalonia have particularly low European financing in relation to their income and their fiscal balances are especially negative, if we take the degree of their economic development into account. • There are regions that receive especially high levels of European financing, even in relation to their relative poverty level. Extremadura is the best example of this. • Regions with very similar degrees of development receive very different European financing. • Five of the six European regions with the lowest European financing in relation to their income correspond to exceptional political situations: the Catalan-speaking Countries (i.e. Catalonia, Valencia and the Balearic Islands) – with a different language and culture from the majority of inhabitants in the State - Northern Ireland and Wallonia. Nevertheless, we cannot speak of the existence of a clear relationship between the political status of a “Stateless Nation” and its financial relationship with the EU. At the same time as we establish financial relationships between Member States and the European Institutions, there are also economic and political criteria. The exception clauses for Great Britain, the Netherlands and Sweden are a clear example of a political decision. In these cases, the political decision is expressly stated. 19 On the other hand, the political criteria for distributing European funds among the regions within a State are not so clear. The situation is relevant if we bear in mind that there are anomalous situations: regions with very similar income levels receive very different amounts of European financing and have very dissimilar fiscal balances with the EU. In short, greater transparency is called for in the Commission and in the governments of Member States to make all the criteria for assigning European financing better known in European regions as a whole. We need greater clarity in public accounts, especially when there are signs that financial relationships between certain European regions and the EU might be leading to the opposite effect of the initial purpose of harmonising economic differences between regions. 20 21 Bibliography European Commission http://ec.europa.eu/ Dury, D., Eugène, B., Langenus, G., Van Cauter, K., Van Meensel, L. (2008) Interregional transfers and solidarity mechanisms via the government budget Economic Review - National Bank of Belgium Eurostat www.epp.eurostat.ec.europa.eu Instituto Nacional de Estadística www.ine.es Las relaciones financieras entre España y la Unión Europea (2011) Ministerio de Hacienda y Administraciones Públicas Office for National Statistics www.ons.gov.uk Statistics Belgium www.statbel.fgov.be 22 23 The emili darder foundation Since 1987, the Emili Darder Foundation has been disseminating the life and thought of the doctor and politician Emili Darder i Cànaves, the Republican and progressive Mayor of Palma, executed by the Fascists in 1937. Darder today is one of the main symbols of honesty, efficiency and commitment to the social progress and self-government of the Balearic Islands. He represents a clear avant-garde in progressive thought and the policies of public service, as he started up various initiatives that even today are still pioneer and surprisingly advanced for his time. For this reason, the Foundation promotes public talks, conferences and other events 24 to promote the person of Darder, and the values and ideals of political sovereignty, Mallorquinism, social justice and ecology. The Foundation aims to make a contribution to the development of the political, social and cultural thought of democratic nationalism in the Balearic Islands and to increase the training and knowledge of people in the Islands. As Emili Darder used to say, the fundamental aspect of humanity is citizens, and there is only one way to make citizens – through culture. If everybody contributes, we can keep working with the task started by Emili Darder and build up peoples who are freer, fairer, more sustainable and more solidaritybased. 25 The life of emili darder Born in Palma (Mallorca) in 1895 into the bosom of a well-to-do family, he obtained a degree in Medicine and Surgery from the University of Valencia and then his PhD in Clinical Analysis in Madrid. Darder was an outstanding and enthusiastic doctor who devoted his time to fighting infectious diseases, and in his awareness of the sanitary conditions of the population in Mallorca, he promoted social, preventive and didactic medicine. At the same time, his social, civic and cultural activism led him to take part in numerous popular initiatives: he promoted and chaired the Cultural Association of Mallorca and was one of the promoters of the Preliminary Project for the Self-Governing Statute of the Balearic Islands. As a politician, he was voted City Councillor of Palma for the Federal Republican Party of Mallorca (1931), and set in motion a project for building schools and the Municipal Sanitary Service Plan. In 1934 he inspired the foundation of the Balearic Republican Left, of 26 which he was one of the main leaders. In 1933, he was appointed Mayor of Palma, and was the driving force behind the water supply and sanitary sewers for the whole city, and the building of kindergartens and schools: over the six years of the Second Republic more schools were opened in Palma than in the first twenty years of the Franco dictatorship. He also kept working on the renovation and improvement of the sanitary services. When the Fascist military uprising took place (1936) he was arrested and locked up in the Castle of Bellver. He was court-martialled, condemned to death and shot by a firing quad in the cemetery of Palma on 24 February 1937, even though he was already seriously ill. He was 41 years old. In 1994, on the proposal of the Socialist Party of Mallorca, he was named an "Illustrious Son" of Mallorca, an official ceremony recognising his contribution to the city, by the City Council of Palma. 27 Centre Maurits Coppieters The European Parliament recognized the Centre Maurits Coppieters (CMC) as a Political Foundation at a European Level in 2007. Since then the CMC has developed political research focusing on European issues, also in the fields of multilevel governance, management of cultural and linguistic diversity in complex (multi-national) societies, decentralization, state and constitutional reform, succession of states, conflict resolution and protection of human rights. So far, every little step has been important to the steady consolidation and growth of the Centre, that’s why I’m especially proud of this publication. Indeed, it undoubtedly represents a crucial contribution to the current state of affairs and will certainly have a significant impact both in the Academia and among European decision makers in a broad sense, including European Institutions (like the European commission, European Parliament, Council and Committee of the Regions), other political actors, think tanks, research centers and contributors to the European integration process. On behalf of the Centre Maurits Coppieters and our partners I sincerely wish to thank the author of the report for his groundbreaking approach to the subject and his passionate, conceptually robust and well structured factual presentation. Finally I also wish to thank you (the reader) for your interest in our organization and for reviewing our modest contribution to a much wider European political debate in this area. Günther Dauwen Secretary of Centre Maurits Coppieters www.ideasforeurope.eu 28 29 Goals of the European Political Foundation CENTRE MAURITS COPPIETERS (CMC) Maurits Coppieters According to its general regulations, the Centre Maurits Coppieters asbl-vzw persues the following objectives and references: The Fleming Maurits Coppieters studied history and later became a Doctor of Laws and obtained a master’s degree in East European studies. During the Second World War, he refused to work for the German occupier. After many years as a teacher, he worked as a lawyer for a while. He was one of the people who re-established the Vlaamse Volksbeweging (Flemish People’s Movement), of which he was the President from 1957-1963. ww Observing, analysing and contributing to the debate on European public policy issues with a special focus on the role of nationalist and regionalist movements and the process of European integration; ww Serving as framework for national or regional think tanks, political foundations and academics to work together at European level; ww Gather and manage information for scientific purposes on all nationalist and regionalist movements, organisations, structures,… in all its appearances situated in a European context; ww Making available information to the public on the implementation of the principle of subsidiarity in a context of a Europe of the Regions; ww Promoting scientific research on the functioning and the history of all national and regional movements in the EU and making the results public to as many people as possible; 30 ww Developing actions to open information sources and historical information sources in a structured and controlled way with the aim to build a common data network on issues of Nationalism and Regionalism in Europe; ww Maintaining contacts with all organisations who are active in national movements and with the Institutions of the EU; The Centre Maurits Coppieters asbl-vzw takes all the necessary actions to promote and achieve the higher stated goals always observing the principles on which the European Union is founded, namely the principles of liberty, democracy, respect for human rights and fundamental freedoms, and the rule of law. Coppieters’ political career began when he became a member of the Flemish-nationalist party Volksunie (VU) which was formed in 1954. With the exception of two years, Coppieters was a town councillor between 1964 and 1983. He was also elected as a member of the Belgian Chamber (1965-1971) and Senate (1971-1979). At the same time, Coppieters became President of the newly formed ‘Cultuurraad voor de Nederlandstalige Cultuurgemeenschap’ (Cultural Council for the Dutchspeaking Community, from which later the Flemish Parliament emanated), when the VU formed part of the government. In 1979, Coppieters was moreover elected during the first direct elections for the European Parliament. As a regionalist, he became a member of the Group for Technical Coordination and Defence of Independent Groupings and Members in the European Parliament (TCDI). Among other things, he made a name for himself when he championed the cause of the Corsicans. In the meantime, Coppieters also played a pioneering role in the formation of the European Free Alliance, of which he became the Honorary President and in whose expansion he continued to play a role, even after he said farewell to active politics in 1981. In 1996, Coppieters joined forces with the president of the Flemish Parliament, Norbert De Batselier, to promote ‘Het Sienjaal’, a project with a view to achieve political revival beyond the party boundaries. Coppieters died on November 11, 2005. Among other things, Coppieters was the author of: ‘Het jaar van de Klaproos’; ‘Ik was een Europees Parlementslid’; ‘De Schone en het Beest’. He is Honorary member of the EFA. 31 CMC MEMBRES Arritti 5, Bd de Montera, 20200 BASTIA, Corsica Member since 2008 www.p-n-c.eu Fundación Alkartasuna Fundazioa Portuetxe 23, 1º, 20018, Donostia/ San Sebastian, Euskadi Member since 2008 www.alkartasunafundazioa.org Fundació Emili Darder Isidoro Antillon 9, Palma de Mallorca Iles Baleares Member since 2008 www.fundacioemilidarder.cat Fundació Josep Irla Calàbria 166, 08015 Barcelona, Catalunya Member since 2008 www.irla.cat Previous Centre Maurits Coppieters studies Fundación Galiza Sempre Av. Rodriguez de Viguri 16, Baixo 15702 Santiago de Compostela, Galicia Member since 2008 www.galizasempre.org Home of the Macedonian Culture Stefanou Dragoumi 11, P.O. BOX 51, 53100 Florina Member since 2008 Le Peuple Breton Brittany Member since 2013 www.peuplebreton.net Welsh Nationalism Foundation Wales Member since 2008 www.welshnationalismfoundation.eu Fundacion Aragonesista 29 de junio, Conde de Aranda 14-16, 1°, 50003 Zaragoza, Aragon Member since 2008 www.chunta.org/29j.php Centre International Escarré per les Minories Ètniques i les Nacions C/Rocafort, 242, bis 08029 Barcelona, Catalunya Member since 2011 www.ciemen.cat 32 CMC 2012 — The Ascent of Autonomous Nations 2nd edition The institutional advantages of being an EU member state, by Matthew Bumford In a joint effort with the Welsh Nationalism Foundation CMC 2012 — Variations autour du concept d’empreinte culturelle Définition du concept et metodes de Mesure, by Elna Roig Madorran et Jordi Baltà Potolés CMC 2011 — Approaches to a cultural footprint Proposal for the concept and ways to measure it, by Elna Roig Madorran and Jordi Baltà Potolés CMC 2010 — The Internal Enlargement of the European Union 3rd edition Analysis of the legal and political consequences in the event of secession or dissolution of a Member State, by Jordi Matas, Alfonso Gonzalez, Jordi Jaria and Laura Roman. In a joint effort with Fundació Josep Irla CMC 2009 — Electoral contestability and the representation of regionalist and nationalist parties in Europe, by Simon Toubeau CMC 2008 — A different kind of kinetics Establishing a network of heritage and research institutions for the (historical) study of national and regional movements in Europe, by Luc Boeva CMC 2013 | 2 — Globalism vs Internationalism By Josep Bargallón Isidor Marí and Santiago Castellà CMC 2013 | 1 — Law and Legitimacy: the denial of the Catalan voice By Huw Evans Associated members Transylvanian Monitor Str. J. Calvin 1, 410210 Oradea, Romania Member since 2009 www.emnt.org CMC 2012 — The Future of Europe An integrated youth approach Previous Centre Maurits Coppieters policy papers Kurdish Institute of Brussels Rue Bonneelsstraat 16, 1210 Brussels Member since 2010 www.kurdishinstitute.be CMC 2013 — An alternative economic governance for the European Union By Xavier Vence, Alberto Turnes and Alba Noguera CMC 2012 | 3 — Making ideas spread New Media, Social Networks, Political Communication, advocacy and campaigns, by Jorge Luis Salzedo Maldonado Istituto Camillo Bellieni Via Maddalena, 35 07100 Sassari Member since 2012 www.istituto-bellieni.it Free State of Rijeka Association Užarska 2/3 51000 Rijeka – Fiume Member since 2012 CMC 2012 | 2 — The size of states and Economic Performance in the European Union, by Albert Castellanos i Maduell, Elisenda Paluzie I Hernàndez and Daniel Tirado i Fabregat. In a joint effort with Fundació Josep Irla CMC 2012 | 1 — 2014-2020 Un autre cadre financier pluriannuel pour une nouvelle Europe: Pour une Europe des peuples, by Roccu Garoby. In a joint effort with Arritti CMC 2011 | 3 — From Nations to Member States, by Lieven Tack, Alan Sandry and Alfonso González CMC 2011 | 2 — Diversité linguistique un défi pour l’Europe CMC 2011 | 1 — Tourism and identity, by Marien André In a joint effort with Fundació Josep Irla CMC 2010 | 1 — Language Diversity a challenge for Europe 33 Colophon CMC paperS | 2014 | 1 Editorial Centre Maurits Coppieters (asbl-vzw), Boomkwekerijstraat 1, 1000 Brussels www.ideasforeurope.eu Publication date 2014 Publication series and number CMC PaperS | 2014 | 1 Authors Jaume Garau Taberner and Félix Pablo Pindado Coordination Ignasi Centelles Editorial board Xabier Macías Günther Dauwen José Miguel Marinez Tomey Alan Sandry Josep Vall Antonia Luciani Advisory Scientific Council Alan Sandry - Political Science adviser. (Advisory Scientific Council member since 2008) Luc Boeva - Archives and History of Nationalism adviser. (Advisory Scientific Council member since 2008) Rubén Lois - History and Geography adviser. (Advisory Scientific Council member since 2014) Carmen Gallego - Anthropology adviser. (Advisory Scientific Council member since 2012) Josep Huguet - Contemporary history and Public governance adviser. (Advisory Scientific Council member since 2012) Jaume Garau - Economic development adviser. (Advisory Scientific Council member since 2012) Daniel Turp - International law and Self-determination adviser(Advisory Scientific Council member since 2013) Graphics and Layout Wils&Peeters - Lier Translation Dobra Forma Printing Drukkerij De Bie - Duffel © CMC, Centre Maurits Coppieters - asbl, Brussels, April 2014 No items of this publication can in any way be copied or used without the explicit permission of the author or editor. 34