1 johdanto

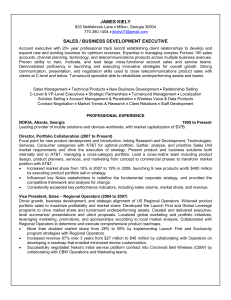

advertisement