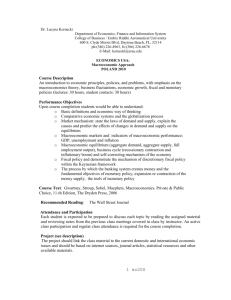

Monetary Policy and European Unemployment

advertisement