best idea update: short yelp

advertisement

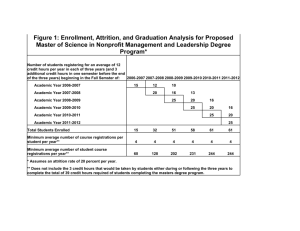

BEST IDEA UPDATE: SHORT YELP INTERNET & MEDIA FEBRUARY 2015 LEGAL DISCLAIMER Hedgeye Risk Management is a registered investment advisor, registered with the State of Connecticut. Hedgeye Risk Management is not a broker dealer and does not provide investment advice for individuals. This research does not constitute an offer to sell, or a solicitation of an offer to buy any security. This research is presented without regard to individual investment preferences or risk parameters; it is general information and does not constitute specific investment advice. This presentation is based on information from sources believed to be reliable. Hedgeye Risk Management is not responsible for errors, inaccuracies or omissions of information. The opinions and conclusions contained in this report are those of Hedgeye Risk Management, and are intended solely for the use of Hedgeye Risk Management’s clients and subscribers. In reaching these opinions and conclusions, Hedgeye Risk Management and its employees have relied upon research conducted by Hedgeye Risk Management’s employees, which is based upon sources considered credible and reliable within the industry. Hedgeye Risk Management is not responsible for the validity or authenticity of the information upon which it has relied. TERMS OF USE This report is intended solely for the use of its recipient. Re-distribution or republication of this report and its contents are prohibited. For more detail please refer to the appropriate sections of the Hedgeye Services Agreement and the Terms of Use at www.hedgeye.com HEDGEYE 2 FOR MORE INFORMATION CONTACT: SALES@HEDGEYE.COM 203.562.6500 HEDGEYE 3 BIGGER DATA = BETTER THESIS TRADITIONAL SELL-SIDE Evidence (Little Data) HEDGEYE INTERNET & MEDIA EVIDENCE (BIG DATA) Weak Argument Assumptions (Anecdotal) Strong Argument Assumptions (Anecdotal) WE LET THE DATA TELL THE STORY The data drives the thesis, that is our edge. We avoid saying anything unless we have the data to back it up, and if we do, we don’t confuse theory, opinion, or assumption with fact. HEDGEYE 4 YELP BUSINESS OVERVIEW • Local Advertising (85% of 2014 Revenue) – Product: native ads within search results – Revenue Source: mostly local businesses • Brand Advertising (9% of 2014 Revenue) – Product: Display ads on YELP’s site – Revenue Source: Primarily regional and national companies • Other Services (6% of 2014 Revenue) – Product: Tools to facilitate transactions, Deals & Gift Certificates – Revenue Source: Partnership Agreements, Local Businesses LOCAL ADVERTISING IS THE MAIN DRIVER Historically, the largest source of both revenues and growth. This will be the focus of this presentation. SOURCE: COMPANY FILINGS HEDGEYE 5 YELP THESIS SUMMARY YELP: DEATH OF A BUSINESS MODEL 1. Business Model: Hire enough new sales reps to drive new account growth in excess of its rampant attrition. 2. Conclusion: YELP’s Business Model is only sustainable if its TAM is large enough to support it; it’s not. 3. Outlook: Attrition will exert a greater impact on its model moving forward. YELP’s financials suggest that this has already started. RAMPANT ATTRITION + LIMITED TAM = DEATH OF A BUSINESS MODEL YELP’s attrition risk will always grow with its account base. The burden of new account growth will become more challenging against a limited TAM, leading to a precipitous slowdown in growth, and eventually declines. HEDGEYE 7 YELP SHORT: THESIS SUMMARY 1 ABSURD ATTRITION TO GET WORSE 2 TAM IS A FRACTION OF WHAT’S ADVERTISED 3 We estimate that YELP is losing the majority of its local advertising customers on an annual basis. Baring a seismic shift in its business model, the risk will increase each year. Estimates vary for YELP’s total addressable US market, YELP has estimated as high as 27M….In reality, we believe peak quarterly penetration will not exceed 170K. Further, YP.com’s 600K accounts is not the low-hanging fruit, it’s a pipe dream. THE MODEL IS ALREADY BREAKING DOWN YELP’s business model isn’t sustainable, and we’re already seeing signs that it’s breaking down. The sell-side refuses to acknowledge YELP’s attrition issues, so they don’t understand the burden of new account growth necessary to hit their 2015/2016 revenue estimates. HEDGEYE 8 YELP SHORT: THESIS SUMMARY 1 ABSURD ATTRITION TO GET WORSE 2 TAM IS A FRACTION OF WHAT’S ADVERTISED 3 2 We estimate that YELP is losing the majority of its local advertising customers on an annual basis. Baring a seismic shift in its business model, the risk will increase each year. Estimates vary for YELP’s total addressable US market, YELP has estimated as high as 27M….In reality, we believe peak quarterly penetration will not exceed 170K. Further, YP.com’s 600K accounts is not the low-hanging fruit, it’s a pipe dream. THE MODEL IS ALREADY BREAKING DOWN YELP’s business model isn’t sustainable, and we’re already seeing signs that it’s breaking down. The sell-side refuses to acknowledge YELP’s attrition issues, so they don’t understand the burden of new account growth necessary to hit their 2015/2016 revenue estimates. HEDGEYE 9 “Will retention become a bigger focus for us in the future? Certainly although, we're still in such early days that acquisition is going to be the primary focus of our efforts for probably some long time to come now” – Geoff Donaker – YELP COO ATTRITION EXPLAINED CUSTOMER REPEAT RATE EXPLAINED “Our customer repeat rate, defined as a percentage of current customers who advertised with us in the past twelve months” Prior Quarter: 9 accounts Current Quarter: 10 accounts DATA SOURCE: COMPANY TRANSCRIPTS, HEDGEYE ESTIMATES Repeat Rate: 70% 7 repeating + 3 new 10 accounts Attrition: 7 repeating - 9 prior -2 accounts HEDGEYE 11 ATTRITION EXAMPLE 4Q14 EXAMPLE (unadjusted) 1. YELP had 86K customers in 3Q14 2. YELP had 94K customers in 4Q14 3. 4Q14 Customer Repeat Rate was 75% 1. 4Q14 Repeating Customers: 70K (94K x 75%) 2. 4Q14 New Customers: 23K (94K x 25%) 4. YELP had 86K customers in 3Q14, but only 70K repeating customers in 4Q14, so it lost ~16K customers (70K-86K) , or 18.5% of its customers from 3Q14. THE CUSTOMER REPEAT RATE IS A MEASURE OF MIX, NOT RETENTION Any time YELP’s Repeating Customers (calculated using its stated Repeat Rate) are less than its Active Customers from the prior quarter, it lost customers. DATA SOURCE: COMPANY REPORTS & HEDGEYE ESTIMATES HEDGEYE 12 ATTRITION IS A RECURRING THEME LOSES A SIGNIFICANT PORTION EACH QUARTER Every quarter since the company has gone public, it has lost a significant portion of its members on quarterly basis. YELP’s is losing almost 20% of its total customers every quarter since 1Q12. DATA SOURCE: COMPANY REPORTS & HEDGEYE ESTIMATES HEDGEYE 13 ANNUAL ATTRITION IS ABSURD Lost/Starting Customers: 90% New/Ending Customers: 95% Lost/Starting Customers: 85% New/Ending Customers: 88% YELP LOSING ALMOST ALL ITS CUSTOMERS ANNUALLY Since most of YELP’s contracts are on annual terms, it is losing the majority of its customers annually, while its ending customer base is comprised almost entirely of new accounts signed during the course of the year. DATA SOURCE: COMPANY REPORTS, HEDGEYE HEDGEYE 14 WHY IS ATTRITION SO HIGH? NOT GETTING ENOUGH BUSINESS? Digital Advertising Industry Notes 1. Lead Rates: only 25% of leads are legitimate 2. Conversion Rates: 79% of marketing leads never convert to sales Sources: Gleanster Research, MarketingSherpa ADS MAY NOT YIELD ENOUGH TRANSACTIONS… This table is a scenario analysis of the number of YELP-driven sales transactions, based on varying lead and conversion rates. The data output suggests a wide range of transactions on 500 impressions. SOURCES: GLEANSTER RESEARCH, MARKETINGSHERPA HEDGEYE 16 COST OF CONVERSION TOO HIGH? Digital Advertising Industry Notes 1. Lead Rates: only 25% of leads are legitimate 2. Conversion Rates: 79% of marketing leads never convert to sales Sources: Gleanster Research, MarketingSherpa ADS DON’T MAKE SENSE FOR ALL BUSINESSES This is the same table, but measuring the advertising cost to acquire those transactions. YELP ads do not make sense unless the business has an Average Gross Profit/Transaction > Cost Per Conversion. SOURCES: GLEANSTER RESEARCH, MARKETINGSHERPA HEDGEYE 17 BCG STUDY SHOWS VARYING YIELD… Note: BCG’s Incremental Revenue Analysis for YELP businesses compares Advertising Businesses (green bars) and Businesses with Claimed Pages (blue bars) vs. businesses that do not have a YELP presence REVENUE BENEFITS VARY BY BUSINESS TYPES These metrics compare incremental revenues for businesses that either advertise or have claimed pages vs. those without a YELP presence at all. Note that YELP helped finance the study. DATA SOURCE: BCG STUDY HEDGEYE 18 INCREMENTAL IS WHAT MATTERS YELP Average Local Ad ARPU Note: What the study should have compared is the advertiser ROI vs. a business that has claimed a page, not vs. a business that doesn’t have a YELP presence. WE NEED TO COMPARE THE GREEN AND BLUE BARS AFTER AD COSTS What matters is the incremental revenue an Advertising Business gets over a Claimed Business. After considering advertising costs, the yield for some is limited and/or negative. DATA SOURCE: BCG STUDY, YELP OFFICIAL BLOG HEDGEYE 19 INCREMENTAL SALES MIXED, BUT… THESE ARE REVENUES, NOT PROFITS We aggregated the BCG data and sorted the results based on YELP’s revenue concentration. Outside of Restaurants and Beauty & Fitness, the results look favorable, but these are revenues, not profits…. DATA SOURCE: BCG STUDY, YELP OFFICIAL BLOG HEDGEYE 20 …PROFITS TELL A DIFFERENT STORY INCREMENTAL GROSS PROFIT MAY NOT JUSTIFY COST YELP’s core market is local businesses; many lack economies of scale and inherently have lower profit margins. The BCG study suggests the ROI from YELP Local Advertising would be negative in many cases. DATA SOURCE: BCG STUDY, YELP OFFICIAL BLOG HEDGEYE 21 CAN’T TRUST THE CPC ROI METRIC Not Mutually Exclusive Events CLAIMS OF +500% CPC ROI LIKELY BASED ON SAME MATH This is a snapshot of YELP’s business dashboard for its customers. The tool grossly exaggerates revenues because it is not calculated off of conversions, but rather leads that are NOT mutually exclusive events. DATA SOURCE: YELP HEDGEYE 22 WHY ATTRITION WILL GET WORSE BECAUSE IT HAS MORE CUSTOMERS (IT’S THAT SIMPLE) Since 1Q12, YELP’s attrition rate has averaged 18.7% with a standard deviation of 60bps. Barring a seismic shift in retention, YELP will lose more customers simply because its customer base is larger. DATA SOURCE: COMPANY REPORTS & HEDGEYE ESTIMATES HEDGEYE 23 YELP SHORT: THESIS SUMMARY 1 ABSURD ATTRITION TO GET WORSE 2 TAM IS A FRACTION OF WHAT’S ADVERTISED 3 2 We estimate that YELP is losing the majority of its local advertising customers on an annual basis. Baring a seismic shift in its business model, the risk will increase each year. Estimates vary for YELP’s total addressable US market, YELP has estimated as high as 27M….In reality, we believe peak quarterly penetration will not exceed 170K. Further, YP.com’s 600K accounts is not the low-hanging fruit, it’s a pipe dream. THE MODEL IS ALREADY BREAKING DOWN YELP’s business model isn’t sustainable, and we’re already seeing signs that it’s breaking down. The sell-side refuses to acknowledge YELP’s attrition issues, so they don’t understand the burden of new account growth necessary to hit their 2015/2016 revenue estimates. HEDGEYE 24 YELP’S ADDRESSABLE US MARKET… Criteria for Advertising with YELP 1. Affordability: Minimum cost $3,600 annually 2. Retail: vs. B2B YELP Estimate for US Local Business Opportunity Composition of US Market (27M Total Businesses) 1. Affordability: 75% earn < $100K in annual revenue 2. Retail: 47% are primarily B2B companies NOT ALL BUSINESSES ARE APPLICABLE YELP’s audience is primarily retail (our survey suggests 70% use exclusively for restaurants); B2B companies aren’t likely to advertise. Most earn less than 100K, so YELP’s smallest ad program would be prohibitive. DATA SOURCE: CENSUS, COMPANY REPORTS (27 TAM ESTIMATE FROM YELP MAY 2012 INVESTOR CONFERENCE PRESENTATION) HEDGEYE 25 TAM MUCH SMALLER THAN IMPLIED ? 27 MILLION…OR A QUESTIONABLE 3 MILLION We pulled the Census data where YELP is getting its TAM estimate, and we filtered it by companies with more than 100K in revenue and those that cater to YELP’s audience. 3.4 million is still optimistic. DATA SOURCE: CENSUS.GOV HEDGEYE 26 BUT HOW MUCH CAN IT PENETRATE? Note: 2011 New/Lost Account metrics are estimates ATTRITION WILL ALWAYS DRAG ON PENETRATION Given YELP’s attrition problems, which will only intensify as its business grows, we can’t see how it could ever penetrate more than its peak historical rate of 5%, or 170K peak quarterly accounts. DATA SOURCE: COMPANY REPORTS HEDGEYE 27 YP.COM IS A PIPE DREAM YELP YP.com DXM FEWER PRODUCTS – B2B EXPOSURE + HIGHER PRICE = SMALLER TAM YELP has implied that YP’s account base is the low-hanging fruit. Yet, the breadth of YELP’s offering is far more limited, and often more expensive; meaning its TAM is considerably smaller. DATA SOURCE: YELP FILINGS, COMPANY WEBSITES HEDGEYE 28 YELP SHORT: THESIS SUMMARY 1 ABSURD ATTRITION TO GET WORSE 2 TAM IS A FRACTION OF WHAT’S ADVERTISED 3 2 We estimate that YELP is losing the majority of its local advertising customers on an annual basis. Baring a seismic shift in its business model, the risk will increase each year. Estimates vary for YELP’s total addressable US market, YELP has estimated as high as 27M….In reality, we believe peak quarterly penetration will not exceed 170K. Further, YP.com’s 600K accounts is not the low-hanging fruit, it’s a pipe dream. THE MODEL IS ALREADY BREAKING DOWN YELP’s business model isn’t sustainable, and we’re already seeing signs that it’s breaking down. The sell-side refuses to acknowledge YELP’s attrition issues, so they don’t understand the burden of new account growth necessary to hit their 2015/2016 revenue estimates. HEDGEYE 29 YELP’S KEY FUNDAMENTAL DRIVERS Key Drivers 1. New Accounts 2. Lost Accounts The spread between the two = YELP’s Q/Q Account Growth EVERYTHING ELSE IS JUST NOISE YELP’s attrition issues have gone unnoticed because new account growth has been exceeding losses. But with increasing base of advertising accounts to lose, and highly penetrated TAM, things are going to get ugly. DATA SOURCE: COMPANY REPORTS & HEDGEYE ESTIMATES HEDGEYE 30 NEW ACCOUNTS MUST ACCELERATE THE ATTRITION RISK GROWS EACH YEAR As the starting customer base grows, the attrition risk grows with it. To compensate, new account growth needs to accelerate in absolute terms, but in 2015 specifically, the growth rate needs to accelerate too. BUT… DATA SOURCE: COMPANY REPORTS & HEDGEYE ESTIMATES HEDGEYE 31 THE DEATH OF A BUSINESS MODEL SALESFORCE OUTGROWING THEIR PRODUCTIVITY YELP’s attrition issues have gone unnoticed because its aggressive salesforce increases have driven enough new account growth to compensate. That story is over, which means the model is broken… HEDGEYE 32 ALREADY AT PEAK COVERAGE? CALL VOLUME IS NOT AN INVESTABLE THESIS Two perspectives: First is all potential YELP businesses (see TAM slide 28), Second is YELP’s claimed business pages. This could be why YELP’s salesforce productivity has been on the decline lately. HEDGEYE 33 2015 ESTIMATES ARE INSANE 2014 Averages • New Account Growth (y/y): 38%* • Quarterly Attrition Rate: 18.5%** * The 2014 average excludes the 2.2K accounts migrated from Qype in 4Q13, actual 2014 new account growth was 32%. New account growth in 4Q14 was 30% (16% ex Qype). ** YELP’s historical quarterly attrition average (1Q12-4Q14) is 18.7% with a standard deviation of 0.6%, and a range of 17.8% to 19.4%. Note: We have raised our estimates by $37M to account for the EatMe acquisition. BECAUSE THEY WON’T CONSIDER YELP’S ATTRITION ISSUES YELP would need to produce historically low Attrition Rates and accelerate its new account growth rate over 2014 levels to hit 2015 estimates, and this is based on Consensus 2014 Estimates, not Hedgeye’s. DATA SOURCE: BLOOMBERG & HEDGEYE ESTIMATES HEDGEYE 34 HEDGEYE VS. CONSENSUS BULL CASE = BEST CASE BEAR CASE ≠ WORST CASE The Model Drivers are in BLUE text. Both cases assume new account growth continues to accelerate in absolute terms, and annual attrition rates improve. Only way YELP beats estimates is via acquisition. DATA SOURCE: BLOOMBERG HEDGEYE 35 STOCK: $34-$37 BY YEAR END TRANSLATES TO ONLY 1.0X-1.5X TURNS ON OUR BASE CASE 2015 REVENUES YELP is well past the days of double-digit P/S multiples, but some may see these charts as a buying opportunity. Decide for yourself, but understand the setup. The first time YELP doesn’t raise guidance, the stock craters. HEDGEYE 36 YELP: DEATH OF A BUSINESS MODEL 1. Business Model: Hire enough new sales reps to drive new account growth in excess of its rampant attrition. 2. Conclusion: YELP’s Business Model is only sustainable if its TAM is large enough to support it; it’s not. 3. Outlook: Attrition will exert a greater impact on its model moving forward. YELP’s financials suggest this has already started. RAMPANT ATTRITION + LIMITED TAM = DEATH OF A BUSINESS MODEL YELP’s attrition risk will always grow with its account base. The burden of new account growth will become more challenging against a limited TAM, leading to a precipitous slowdown in growth, and eventually declines. HEDGEYE 37 SHORT RISK: HIDING THE BODIES • Developments: YELP acquired two international companies (10/28/14), then acquired Eat24 (2/10/15). • Near-Term Risk to the Short: If YELP chooses to juice its Local Advertising Revenue & Local Advertising Account metric with its acquired Eat24 service, which is a transactional business that YELP has historically categorized in Other Services segment. Same could have been said for SeatMe (see below). Also, YELP may have understated the expected contribution from Eat24 in its guidance raise (make the core business look better). • Precedent: 1. Shady Accounting: YELP acquired SeatMe (reservation service) in 3Q13. Beginning in 2014, it reclassified those accounts into its Active Local Business accounts, then stopped disclosing its SeatMe accounts in 2Q14… 2. Pulling Data: YELP will no longer provide its legacy account metric (Active Local Business Accounts) starting in 2015 in favor of a new one focusing only on accounts contributing to Local Advertising Revenues. There is no reason it can’t provide both, unless to buy itself some deniability. MASKING ATTRITION ISSUES WITH ACQUISITIONS & SHADY DISCLOSURE YELP has been saying anything it can to deny its attrition issues. Now, YELP is trying to manipulate the data itself. However, YELP can’t continue this buy-and-bury approach indefinitely, so this is only a near-term risk. HEDGEYE 38 QUESTIONS FOR YELP MANAGEMENT 1. Retention: What percentage of your current customers have been advertising with YELP for more than a year? (derivative of its “Customer Repeat Rate”) 2. Pulling Data?: Why is YELP pulling its legacy Active Local Business Account metric in favor of Local Advertising Account metric. Why not provide both? 3. Eat24 Accounts: What segment will Eat24 revenues be recognized, and will these businesses be included in Local Advertising Account metric? 4. SeatMe Accounts: How many paying SeatMe customers do you currently have, and why did you stop providing the metric in 2Q14? NOT ALLOWED TO PLEAD THE 5TH 1st question directly addresses its attrition issues, 2nd addresses how YELP plans to disguise them. 3rd and 4th are about transparency. There is no reason to dodge these questions unless something is terribly wrong… HEDGEYE 39 FOR MORE INFORMATION, CONTACT US AT: SALES@HEDGEYE.COM (203) 562-6500 HEDGEYE 40