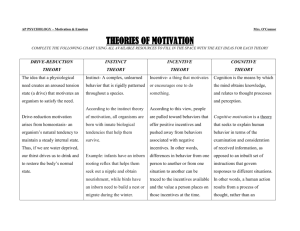

An overview of incentives theory and practice

advertisement