What Every Payroll Manager Should Know About Travel

advertisement

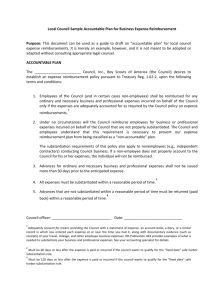

03-333-037 3/6/2007 10:25 AM Page 1 Don’t let travel reimbursements become taxable income Additional resources for expense management When you reimburse an employee for travel expenses, the last thing that employee expects is to owe taxes on the money. And you as an employer don’t want to be responsible for tracking and reporting it as income. IRS Publication 463, “Travel, Entertainment, Gift, and Car Expenses” Fortunately, employee travel reimbursements are usually exempt from taxation – provided you follow the guidelines we summarize here. For more detailed information, see the “Additional Resources” on the back panel of this brochure. When travel reimbursements do not meet the requirements for tax exemption When travel expense reimbursements do not meet the requirements for tax exemption, they become fully taxable for income and employment tax reporting and withholding. You should report them in Boxes 1, 3, and 5 on the employee’s Form W-2. Generally, no special Box 12 reporting is required, but you may elect to report them in Box 14. While this publication is addressed to the taxpayer, you’ll find it a valuable reference for determining which expenses are considered business-related by the IRS. Visit www.irs.gov and search for “Publication 463.” ADP’s Expense eXpert® automates your travel expense reimbursement process Automating expense management in conjunction with an online payroll service can reduce reporting and processing time and overall costs by as much as 70%* or more. ADP’s Expense eXpert® gives you efficient expense tracking, reporting, and management, all in one powerful on-demand service: • Employees use an Internet connection and any standard browser to create and submit expense reports from the office, home, or while on the road. • Standard templates and smart lists with prepopulated fields enhance expense tracking, as well as reporting speed and accuracy. • Expenditures using company-issued cards can be downloaded and imported into reports. What Every Payroll Manager Should Know About Travel Expense Reimbursements • Expense tracking reports are automatically routed to authorized parties for review and approval. • E-mail notifications alert your employees to report approval and payment status. For more information, contact your ADP Representative, or visit www.majoraccounts.ADP.com/expense. *American Express and PricewaterhouseCoopers Portions of this brochure are from an article by Nora Daly, CPP, a Senior Product Manager at Oracle Corp. The article originally appeared in the October 2006 issue of PAYTECH magazine, published by the American Payroll Association (APA). For a free sample issue of PAYTECH, call APA Membership Services at (210) 224-6406. Automatic Data Processing, Inc. One ADP Boulevard Roseland, NJ 07068-1728 The ADP Logo is a registered trademark of ADP of North America, Inc. Expense eXpert is a registered trademark of ADP, Inc. All other trademarks and service marks are the property of their respective owners. 03-333-037 2M Printed in USA © 2007 ADP, Inc. When must you report expense reimbursements as taxable income? How do the requirements differ for daily travel vs. overnight travel? Read on to find out… This guide is provided for informational purposes only. ADP is not engaged in the practice of law and does not render legal advice. If you require legal or other expert assistance, seek the services of a competent professional. 03-333-037 3/6/2007 10:25 AM Page 4 Requirements for nontaxable overnight travel expense reimbursements Reimbursements for overnight business travel can be excluded only if the expenses are incurred while the employee is temporarily away from home and on business for your company. Specifically: • The employee’s duties require him or her to be away from the general area of home substantially longer than an ordinary day’s work, and… • The employee needs to sleep or rest to meet the demands of work while away from home. Generally, a temporary assignment in a single location is one that is realistically expected to last for one year or less. In some cases, you may believe that an assignment will qualify as temporary, but later discover that the assignment will last longer than a year. When that happens, reimbursements for expenses incurred after it became clear that the assignment would last more than a year become fully taxable for income and employment tax reporting and withholding. Reimburse employees for substantiated overnight expenses… Employee expense reimbursements are generally taxfree and do not require reporting on the employee’s W-2 if the payments are made under an accountable plan. To qualify, the plan requires: • A business connection. • Substantiation, including the date, amount, business purpose, and place the expenses were incurred. Employees must provide receipts for all expenses of $75 or more and all lodging receipts, regardless of the amount. (Your company can set a lower limit, if it prefers.) • Return of any money advanced for unsubstantiated amounts within a reasonable time after the travel takes place. …or pay a fixed per diem rate Alternatively, you can pay for travel expenses using a per diem plan. Per diems require only that your employee substantiate the time, place, and business purpose of these expenses. The allowance you set will be deemed substantiated as long as it does not exceed IRS-established federal per diem rates for two categories: • Lodging – excluding lodging taxes which can be reimbursed as a miscellaneous expense. • Meals and Incidental Expenses (M&IE) – fees and tips, transportation between lodging or business and restaurants, postage for filing expense reports, and paying employer-provided credit card bills. The federal per diem rates for these two categories are listed in IRS Publication 1542. To download it, visit www.irs.gov and search for “Publication 1542.” Two methods for determining which per diem rate to apply A third option: combining per diem and reimbursement A third option is to reimburse lodging at the actual cost and pay a per diem for remaining expenses at the M&IE rate. You may do this only if one of the following applies: • You will reimburse the employee for their actual lodging expenses or directly pay the lodging provider. • You will actually provide the lodging. • You reasonably expect there will be no lodging expenses. • You calculate a separate lodging allowance on a basis similar to that used for calculating the employee’s wages or other compensation, such as hours worked or miles traveled. For more information, visit www.irs.gov and search for “per diem.” There are two approved methods for using the rates in IRS Publication 1542: Requirements for nontaxable daily travel expenses 1. High/low substantiation: Under this method, close to 40 localities in Publication 1542 qualify for a “high” 2007 per diem rate of $246. Any locality not listed as “high” is automatically considered “low cost” and qualifies for a per diem rate of $148. In 1999, the IRS ruled that reimbursements for an employee’s daily transportation expenses need not be included in the employee’s income if: 2. Locality of travel: Publication 1542 also lists per diem rates for hundreds of specific localities within the United States. With this method, you use the per diem rate for the individual location. For travel in 2007 to any location not listed, apply the standard rate of $99 ($60 for lodging, $39 for M&IE). You can use high/low per diem rates for one employee and locality of travel for another. But the two rates cannot be mixed when reimbursing the same employee within a given year. • The daily travel was between the employee’s residence and a temporary work location outside the metropolitan area where the employee lives and normally works. • The employee has one or more regular work locations away from home and the travel was between the employee’s residence and a temporary work location. • The employee’s home is his or her principal place of business and the travel was between the employee’s residence and another work location. Qualifying expenses include not only mileage, but incidental expenses such as parking fees and tolls.