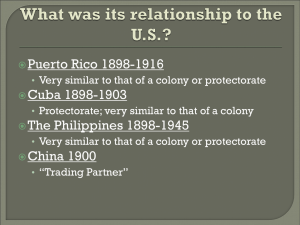

Foraker Act Taxation

advertisement