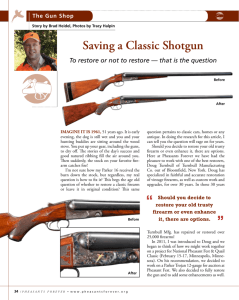

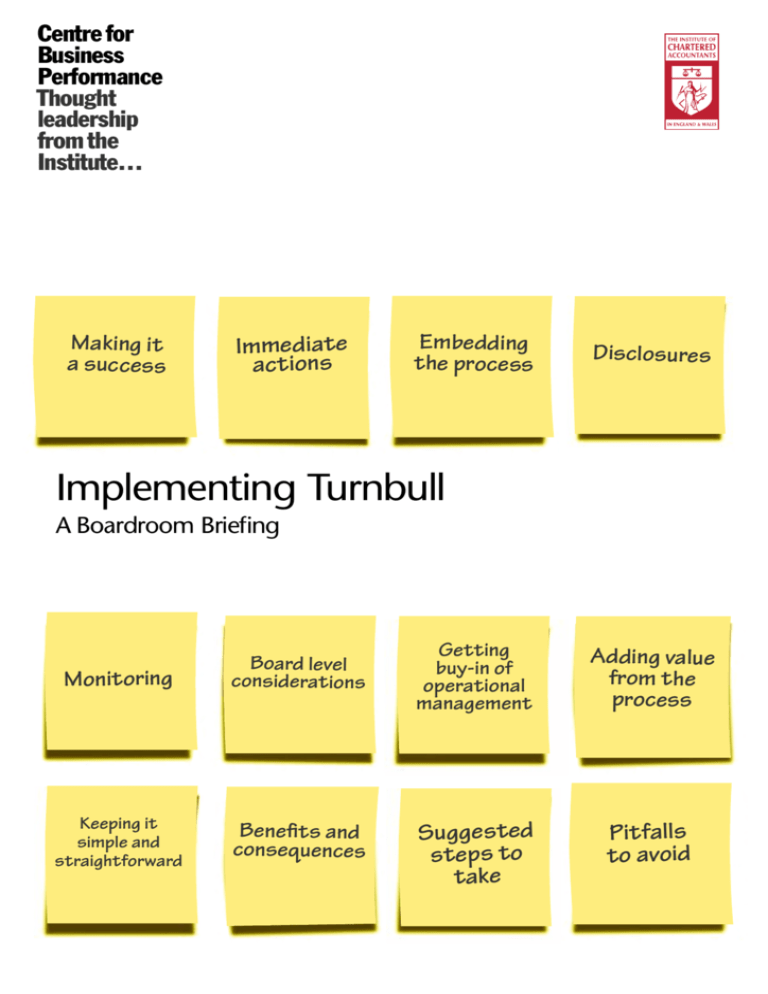

Implementing Turnbull

advertisement