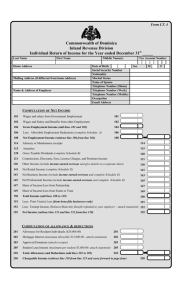

Malaysian Individual Tax Computation Example 2009

advertisement

INDIVIDUAL TAX COMPUTATION OF BE FORM Year of Assessment 2009 LHDNM-R/008/10 Together We Develop The Nation Under Self Assessment System, individual is required to compute his own tax Example : Married individual Mr. B and his wife are both employed by G Sdn. Bhd. and their income in the year 2009 are as follows: Example: Single individual. Mr. A, working in XY Sdn. Bhd. Income for 2009 : Employment Income Salary Bonus Commision Monthly Tax Deduction (MTD) Income from letting out a house Rental received Expenses: Assessment *Penalty for late payment of assessment Bank Loan (including interest (RM2,136)) Repairs of roof Mr. A claims the following expenses: EPF Medical insurance premium Approved Donation Books and Magazines Zakat RM 54,000 4,500 9,000 1,200 7,200 320 32 10,620 500 6,435 2,640 1,000 560 1,575 Employment: Salary Bonus Commision Gross Employment Nora Caw Jalan Duta Employment Income Rental Aggregate Income Less : Donation Total Income Less : Individual & dependent relative Books and magazines EPF (Restricted) Medical insurance premium Chargeable Income Mr. A Tax Liability Tax on first 50,000 Tax on the balance 3,544 @ 19% Tax charged Less: Zakat Tax Payable Monthly Tax Deduction (MTD) Balance of Tax Payable www.hasil.gov.my 1-300-88-3010 RM 67,200 6,000 Wife Salary Dividend (Gross) 25,200 3,000 Additional Infomation: (a) Mr. B and his wife have four (4) unmarried children - First child studying in local university - Second child studying in a university abroad - Third and forth children are schooling The wife claimed relief for the third and forth child (b) Mr. B and his wife claimed the following expenses: EPF Parent medical expenses Full medical examination School books and magazines Life insurance premium Education insurance premium Mr. B Wife 7,392 5,320 280 770 2,480 2,400 2,772 350 330 1,260 Tax Computation Mr. B and his wife (Separate Assessment) Mr. B Employment Dividend (Gross) Total Income Tax Computation Mr. A Rental Income: Gross Rental Less: Assessment Loan interest Repairs of roof Adjusted Rental Income *Disallowable expenses Mr. B Salary Dividend (Gross) 54,000 4,500 9,000 67,500 7,200 320 2,136 500 2,956 4,244 8,000 560 6,000 2,640 3,325.00 673.36 3,398.36 1,575.00 2,423.36 1,200.00 1,223.36 67,500 4,244 71,744 1,000 70,744 17,200 53,544 Less : Individual & dependent relative Parent medical bill (restricted) Medical check-up Books and magazines Children (4,000 x 2) EPF & Life Insurance premium (restricted) Education insurance premium Chargeable Income Tax on first 35,000 Tax on next 7,750 @ 12% Income Tax Charge Less: Tax deducted at source from dividend (25% x 6,000) Tax Payable Wife Employment Dividend (Gross) Total Income Less : Relief Individual and dependent relative Medical check-up Books and magazines Children (1,000 x 2) EPF & Life Insurance Premium Chargeable Income Tax on first 10,000 Tax on next 3,488 @ 3% Income Tax Charged Less : Rebate (restricted) Tax Payable Less : Tax deducted at source from dividend (25% x 3000) Tax Repayable 67,200 6,000 73,200 8,000 5,000 280 770 8,000 6,000 2,400 30,450 42,750 1,525.00 930.00 2,455.00 1,500.00 955.00 25,200 3,000 28,200 8,000 350 330 2,000 4,032 14,712 13,488 175.00 104.64 279.64 279.64 Nil 750.00 750.00 Disclaimer Disclaimer Thisleaflet leafletisisissued issuedforfor general information It does not contain final or advice or complete information pertaining a particular topic andused should not reference This general information only.only. It does not contain final advice complete information pertaining to a particulartotopic and should not be as legal be used as legal reference.