hall, accounting information systems

advertisement

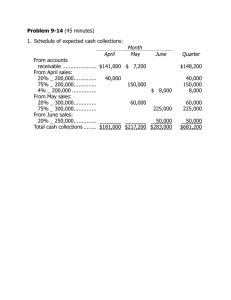

Accounting Information Systems, 6th edition James A. Hall COPYRIGHT © 2009 South-Western, a division of Cengage Learning. Cengage Learning and South-Western are trademarks used herein under license Objectives for Chapter 5 y Fundamental tasks performed during purchases and cash disbursement processes y Functional areas involved in purchases and cash disbursements and the flow of these transactions through the organization y Documents, journals, and accounts that provide audit trails, promote the maintenance of records, and support decision making and financial reporting y Risks associated with purchase and cash disbursements activities and the controls that reduce these risks y Operational features and the control implications of technology used in purchases and cash disbursement systems Purchase Requisition Purchasing 1 2 PROCUREMENT CYCLE (SUBSYSTEM) Receiving/ Inspection 3 Cash Disbursements 5 Accounts Payable 4 Goals of the Expenditure Cycle y The goal of providing needed resources to organization can be broken down into several objectives: y purchase from reliable vendors y purchase high quality items y obtain best possible price y purchase only items that are properly authorized y have resources available when they are needed y receive only those items ordered y ensure items are not lost, stolen, broken y pay for the items in a timely manner or DFD of Purchases System A Manual Purchases System y Begins in Inventory Control when inventory levels drop to reorder levels y A purchase requisition (PR) is prepared and copies to sent to Purchasing and Accounts Payable (A/P) y Purchasing prepares a purchase order (PO) for each vendor and sends copies to Inventory Control, A/P, and Receiving A Manual Purchases System y Upon receipt, Receiving counts and inspects the goods. y A blind copy of the PO is used to force workers to count the goods. y A receiving report is prepared and copies sent to the raw materials storeroom, Purchasing, Inventory Control, and A/P. A Manual Purchases System y A/P eventually receives copies of the PR, PO, receiving report, and the supplier’s invoice. y A/P reconciles these documents, posts to the purchases journal, and records the liability in the accounts payable subsidiary ledger. A Manual Purchases System y A/P periodically summarizes the entries in the purchases journal as a journal voucher which is sent to the General Ledger (G/L) department. Inv‐Control or Purchases Accts Payable‐Control DR CR y A/P also prepares a cash disbursements voucher and posts it in the voucher register. A Manual Purchases System yG/L department: y posts from the accounts payable journal voucher to the general ledger y reconciles the inventory amount with the account summary received from inventory control Manual Purchases Flowchart DFD of Cash Disbursements System Manual Cash Disbursements System y Periodically, A/P searches the open vouchers payable file for items with payments due: y A/P sends the voucher and supporting documents to Cash Disbursements y A/P updates the accounts payable subsidiary ledger Manual Cash Disbursements System y Cash Disbursements: y prepares the check y records the information in a check register (cash disbursements journal) y returns paid vouchers to accounts payable, mails the check to the supplier y sends a journal voucher to G/L: Accounts Payable DR Cash CR Manual Cash Disbursements System y G/L department receives: the journal voucher from cash disbursements y a summary of the accounts payable subsidiary ledger from A/P y y The journal voucher is used to update the general ledger. y The accounts payable control account is reconciled with the subsidiary summary. Cash Disbursements System Computer‐Based Accounting Systems y CBAS technology can be viewed as a continuum with two extremes: y automation ‐ use technology to improve efficiency and effectiveness y reengineering – use technology to restructure business processes and firm organization Levels of Automating and Reengineering Ordering y Computer generates PR y Purchases manually generates PO y Computer generates PO (no PR needed) y PO not sent until manually reviewed y Computer‐generated PO is automatically sent without manual review y Electronic Data Interchange (EDI) y Computer‐to‐computer communication without PO Expenditure Cycle Database y Master Files y supplier (vendor) master file y accounts payable master file y merchandise inventory master file y Transaction and Open Document Files y purchase order file open purchase order file y supplier’s invoice file y open vouchers file y cash disbursements file y • Other Files – supplier reference and history file – buyer file – accounts payable detail file Computer‐Based Purchases y A Data Processing dept. performs routine accounting tasks. y Purchasing ‐ a computer program identifies inventory requirements y The following methods are used for authorizing and ordering inventories: the system prepares POs and sends them to Purchases for review, signing, and distributing y the system distributes POs directly to the vendors and internal users, bypassing Purchases y the system uses electronic data interchange (EDI) and electronically places the order without POs y Computer‐Based Purchases y Other tasks performed automatically by the computer: y updates the inventory subsidiary file from the receiving report y calculates batch totals for general ledger update y closes the corresponding records in the open PO file to the closed PO file y validates the voucher records against valid vendor files Computer‐Based Cash Disbursements yTasks performed automatically by the computer: y the system scans for vouchers currently due y prints checks for these vouchers y records these checks in the check register y batch totals are prepared for the general ledger update procedure Automated Batch Purchases Automated Batch Purchases Advantages of Real‐Time Data Input & Processing Over Batch Processing y Shortens the time‐lag in record‐keeping; hence, records are more current y Eliminates much of the routine manual procedures, such as transcribing information onto paper documents y Eliminates much of the storage and shuffling of paper documents y Reduces data entry correction procedures Reengineered Purchases/Cash Disbursements Summary of Internal Controls General Internal Controls y Organization controls y segregation of duties y Documentation y Asset Accountability Controls y Management Practices y Data Center Operations Controls y Authorization Controls y Access Controls Manual Authorization Controls y Purchases of inventory should be authorized by the Inventory Control department, not by purchasing agents y Accounts Payable authorizes the payments of bills, not the cash disbursements clerk, who writes the checks How do these controls change in a CBAS? Computer‐Based Authorization Controls y Authorizations are automated. y programmed decision rules must be debugged y Automating inventory in EDI and JIT y faulty inventory model can lead to over‐purchasing or under‐purchasing y Cash disbursements may automate check printing and signing. y programming logic must be flawless y automated signing only below a dollar threshold Traditional Segregation of Duties y Warehouse (stores) y Inventory control y Accounts payable y General ledger y Requisitioning y Purchases y Purchases returns and allowances y Cash disbursements Manual Segregation of Functions y Custody of the asset, inventory, by the Warehouse must be separate from recordkeeping for the assets by the Inventory Control. y Custody of the asset, cash, by Cash Disbursements must be kept separate from recordkeeping for the asset by A/P. How do these controls change in a CBAS? Computer‐Based Segregation of Functions y Extensive consolidation by the computer of tasks traditionally segregated y computer programs authorize and process purchase orders y computer programs authorize and issue checks to vendors Manual Supervision y Within the expenditure cycle, supervision is of highest importance in the Receiving department, where the inventory arrives and is logged in by a receiving clerk. Need to minimize: y failures to properly inspect the assets y theft of the assets How do these controls change in a CBAS? Computer‐Based Supervision y Automation often leads to a collapsing of the traditional segregation of duties. y requires greater supervision y Supervision takes on new aspects as technology advances. y electronic monitoring y Supervision because more difficult as the workplace becomes more sophisticated. y employees may have advanced IT training Manual Accounting Records y Must maintain adequate records for: y accounts payable y vouchers payable y checks y general ledger y subsidiary ledgers How do these controls change in a CBAS? Computer‐Based Accounting Records y Accounting records rest on the reliability and security of stored digitalized data. Accountants should be skeptical about the accuracy of hard‐copy printouts. y Backups ‐ the system needs to ensure that backups of all files are continuously kept y y Most automated systems still have a lot of paper documents. This is good for audit trail purposes but is often inefficient. y As the system becomes increasing paperless, maintaining an audit trail becomes more difficult. y Manual Access Controls yAccess to: y inventories (direct) y cash (direct) y accounting records (indirect) How do these controls change in a CBAS? Computer‐Based Access Controls y Magnetic records are vulnerable to both authorized and unauthorized exposure and should be protected y must have limited file accessibility y programs must be safeguarded and monitored Manual Independent Verification y A/Payable dept. verifies much of the work done within the expenditure cycle. y PR, PO, receiving reports, and suppliers’ invoices must be checked and verified by A/P. y G/Ledger dept. verifies: the total obligations recorded equal the total inventories received y the total reductions in accounts payable equal the total disbursements of cash y How do these controls change in a CBAS? Computer‐Based Independent Verification y Automating the accounting function reduces the need for verification by reducing the chances of fraud and error in the expenditure cycle. y However, the need for verification shifts to the computer program and the programmers where fraud and error may still be present.