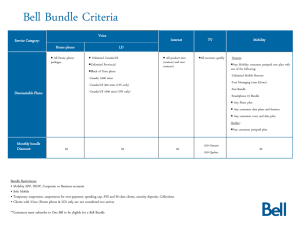

Triple play as a separate market?

advertisement

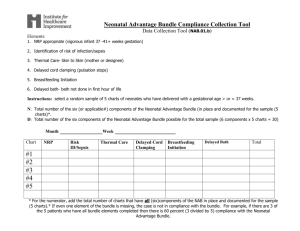

Triple play as a separate market? Zoltán Pápai 22ndEuropean Regional ITS Conference Budapest, 18-21 September, 2011 The paper: Zoltán Pápai - László Lőrincz – Balázs Édes Triple play as a separate market? Empirical findings and consequences to broadband market definition Bundling Bundling is a widespread phenomena on the current electronic communications markets Strategic advantages are the main motivations on the side of service providers increasing subscriber base or „revenue generating units” increasing customer loyalty thereby reducing churn marketing complementarities Price discounts and one stop shopping/single bill are the main considerations of customers 3 Terminology used only considering subscriptions definitely to a bundle multiplay: at least two services bundled 2-play: two services bundled, but the composition can be: telephony + internet television + internet television + telephony 3-play: telephony + internet +television no mobile telephony or mobile internet are considered here telephone 2-play (i+t) 2-play (t+tv) 3-play (i + t + tv) internet 2-play (i+tv) television 4 Multiplay in Europe 2-play and 3-play household penetration in the EU* (2009) penetration is growing 60% 50% 40% 2-play 3-play 30% corelation with GDP mixed picture 20% 10% 0% BE BG CZ CY DK DE EE EL ES FR IE IT LT LU LV MT NL PL PT SE SI SK UK source: EU 15th Report • lack of data from some countries • methodological confusion 5 The regulatory problem how increasing presence of bundles affect market definition of single services? broadband, telephony retail markets, wholesale markets what if a bundle is a separate market? testing against market power is needed on the bundle market tendency towards bundles may pose competition concerns even on the single product market under the current European regulatory framework it is not a theoretical issue market definition according the rules and requirements have to give the answer it is an empirical question 6 Aim of the study Testing empirical methodolgy for giving answer to the market definition question pilot study using survey data Critical Loss test for SSNIP Supported by the grant from Hungarian Competition Office budget and time constraints 7 The Survey sample: N=1000 ; national survey; representative by: sex, age, strata 2010 April – May face to face electronic questionnaire supported by laptop combined revealed preference and stated preference approach subgroups: questions tailored to the current (revealed) choice context testing reactions: to the 10% relative price increase of the used bundle (who subscribed to a bundle) to a bundle offer getting 10%, 20% discount (who hasn’t got a bundle) investigation of attitudes behind revealed and stated choice 8 Service share by technology telephone N=1000 internet N=1000 television N=100 0 PSTN/ISDN 37,4% Cable 20,5% Cable 56,1% Cable 5,9% ADSL 16,2% Analog terrestrial or free 19,0% satellite VOIP 0,2% Mobile internet 4,2% Paid Satellite 15,4% Micro, Wifi 2,3% IPTV 3,5% ISDN 0,5% Digital terrestrial 4,0% Other 2,8% Other 2,0% Total: 100% No 56,5% No 53,5% Total: 100% Total: 100% Hungarian special characteristics: high share of cable in TV, and leading role in broadband 9 Service combinations and bundles 3-play: 8.6% Multiplay: 31.2% 10 Bundle types Relative popularity of different bundles 3-play 25% tv + net 44% tel+net 16% tv + tel 15% 11 Reactions: having 2 servicess 12 Reactions: having three services (1) 13 Reactions: having three services (2) 14 Reactions to price increase ~275HUF = 1EUR 15 Critical Loss test widely used in competition cases for market definition according to SSNIP hypothetical monopolist of the product increase the price with 10%, if expected loss is higher than the CL threshold → 10% price increase resulted in profit loss → not a separate relevant market CL threshold value depends on the proportion of fixed costs in price (Lerner index- L) minimum is 9.1% if L=1, maximum100% if L=0, nonlinear we used L=0.9 → CL threshold = 10% conservative accounting of the results: bias towards refusing the separate market hypothesis 16 Expected loss at 10% increase in price TV+net TV+phone phone+net 3-play All bundles Do not switch 69.6% 73.6% 72.3% 59.6% 68.0% Search for a cheaper bundle 24.9% 16.2% 18.7% 31.8% 24.5% Break up the bundle 4.8% 3.3% 3.9% 7.4% 5.1% Break up and discard one of the services 0.7% 6.9% 5.2% 1.1% 2,4% 100.0% 100.0% 100.0% 100.0% 100.0% with corrections: those who would like to have a cheaper bundle, but cannot were recoded to break up the bundle 17 Interpretation of the results bundles expected loss: range: 5.5% -10.2% 3-play expected loss: 8,5% → suggests that it was a separate market in Hungary in 2010 the aim (i.e. to demonstrate that the methodology works) was fulfilled results are rather indicative constraints on survey competition economic approach, but sociologic methodology can be improved for regulatory purposes 18 zoltan.papai@infrapont.hu 19