RevPAR- ADJUSTED BUDGETS

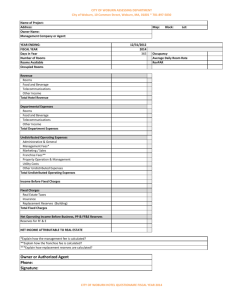

advertisement

JUNE 2011 RevPAR- ADJUSTED BUDGETS: THE ONLY ONES WORTH LOOKING AT (PART 3 OF 3) Miguel Rivera Senior Vice President, HVS Asset Management & Advisory www.hvs.com HVS Asset Management & Advisory 100 Bush Street, Suite 750, San Francisco, CA 94104 USA Budgets are a good planning tool for hotel operators, owners, and other stakeholders. However, it is inappropriate to use them as benchmarks to measure a manager’s performance. It is intriguing then that so many people in the industry use them as targets to measure and reward performance. Perversely, this very fact makes budgets even less reliable, as it gives everyone involved in the budgeting process strong incentives to sway the numbers to their own advantage. Budgets are, at best, educated guesses of future performance, but they are not a substitute for indicators of actual performance against the rest of the market. One of the best ways to make budgets relevant is to adjust them using actual RevPAR indexes as the year progresses. This article describes a way to make these adjustments. PART III This article is the third of a three-part series that explores the rationale, methodology and results related to RevPAR-adjusted budgets. Adjusting budgets for a market’s RevPAR performance is proposed as a far superior tool to measure management’s performance, compared with unadjusted budgets. This third article covers the last three steps required to perform the necessary adjustments, based on an example that was introduced in the previous article (the link to the first two article of this series are http://www.hvs.com/article/5229/revpar-adjusted-budgets-the-only-ones-worth-looking-at/, and http://www.hvs.com/article/5241/revpar-adjusted-budgets-the-only-ones-worth-looking-at/) In the previous part of this series, we presented the 2010 Budget for a hypothetical hotel and identified four steps required to restate the budget, adjusting for actual market performance. The four steps are restated below. 1. Adjust the budgeted occupancy and ADR (and, therefore, RevPAR) for actual market performance using penetration indexes. 2. Adjust other departmental revenue based on the revised RevPAR assumptions. 3. Adjust departmental expenses based on new revenue levels. 4. Adjust undistributed operating expenses, and fixed expenses based on adjusted RevPAR. The previous article covered the first of these four steps. The remainder of this article will explain the last three steps. For convenience, the unadjusted budget for our hypothetical hotel is restated below. REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 2 TABLE 1: HYPOTHETICAL 2009 ACTUAL AND BUDGETED 2010 RESULTS 2009 Actual Number of Rooms: Days Opened Available Rooms Occupied Rooms: Occupancy: Average Rate: RevPAR: RevPAR Penetration: REVENUE Rooms Food & Beverage Other Operating Depts Other Income Total DEPARTMENTAL EXPENSES Rooms Food & Beverage (Hotel) Other Operating Depts Other Expenses Total DEPARTMENTAL INCOME UNDISTRIBUTED OPERATING EXPENSES Administrative & General Marketing Prop. Operations & Maint. Utilities Total HOUSE PROFIT Management Fee INCOME BEF FIXED EXPENSES FIXED EXPENSES Property Taxes Insurance Reserve for Replacement Total NET INCOME Mgmt Fee as % of Owner CF 200 365 73,000 45,260 62.0% $143.00 $88.66 141.8% 2010 Budget % of Gross % Actual Market 2009 60.0% $130.00 $78.00 POR/PAR 200 365 73,000 45,990 63.0% $135.85 $85.59 144.6% $143.00 52.57 10.51 4.21 210.29 $6,248 2,173 453 181 9,055 69.0 24.0 5.0 2.0 100.0 40.04 41.01 8.41 2.10 91.56 118.73 1,878 1,924 395 99 4,295 4,760 30.1 88.5 87.2 54.5 47.4 52.6 % of Gross POR/PAR $6,472 2,379 476 190 9,518 68.0 25.0 5.0 2.0 100.0 % $135.85 47.25 9.84 3.94 196.88 1,812 1,856 381 95 4,144 5,374 28.0 78.0 80.0 50.0 43.5 56.5 857 666 476 476 2,475 2,899 286 2,614 9.0 7.0 5.0 5.0 26.0 30.5 3.0 27.5 4,283 3,331 2,379 2,379 12,373 14,496 1,428 13,068 874 680 485 485 2,524 2,235 272 1,964 9.6 7.5 5.4 5.4 27.9 24.7 3.0 21.7 4,369 3,398 2,427 2,427 12,621 11,177 1,358 9,819 381 143 286 809 4.0 1.5 3.0 8.5 1,904 714 1,428 4,045 388 146 272 806 4.1 1.5 3.0 8.5 1,942 728 1,358 4,028 1,805 19.0 % 9,023 1,158 12.2 % 21.1 % 33.5 % 40.84 41.83 8.58 2.15 93.39 103.49 5,791 REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 3 Step 2: Departmental Revenue Adjustments There are two ways in which departmental revenue can reasonably be adjusted, using a POR adjustment, or a percentage of revenue adjustment. To use a POR adjustment, take the budgeted revenue POR for each department other than rooms, and multiply it by the new number of occupied rooms implied by the adjusted occupancy percentage. For example, the budget contemplated Food & Beverage (F&B) revenue of $47.25 POR in 2010. The adjusted 2010 occupancy for our hotel is 65.3%, implying 47,634 occupied rooms (65.3% X 200 rooms X 365 days). Thus, the adjusted F&B budget revenue for 2010 is $2,346,684, compared with the $2,173,000 budgeted. To use a percentage of revenue adjustment, adjust the revenue for each department to match the percentage of total revenue indicated by the budget. For example, to calculate the adjusted F&B revenue, take the adjusted Rooms Revenue of $6,743,842 and divide by 69.0% to get the total revenue that is consistent with the budget expectation that Rooms Revenue would account for 69.0% of total revenue. The result is $9,774,684. Take that number and multiply it by 24.0%, the budgeted F&B Revenue percentage of total revenue. The result is $2,345,684. There are several factors to consider in deciding which of the two adjustment approaches to use. If, for instance, actual market RevPAR turned out to be better than expected primarily because occupancy was greater than anticipated, it may make more sense to use a POR adjustment. If market ADR turned out to be higher than estimated (possibly as an indication that guests are becoming less price sensitive), a percentage of revenue adjustment may be more appropriate. It is, of course, possible that both occupancy and ADR turn out to be significantly different than projected. Attention should be paid as to whether market segmentation changed significantly, as some segments tend to spend more throughout the hotel than others. For instance, groups tend to consume more F&B (through catering events) than individual travelers. There is no single perfect adjustment, but making one simple adjustment that is reasonable is a good starting point. In any case, the result should provide a more relevant comparison than the unadjusted budget. Step 3: Departmental Expense Adjustments Adjusting departmental expenses can be done based on POR or departmental expense percentages. For the Rooms department, using the same expense POR as the original budget usually makes the most sense. For other departments, adjusting the dollar amounts to keep the same expense ratios as the original budget is generally the best policy. Departmental expense ratios tend to decrease—i.e., get better—as related revenue increases (because fixed expenses logically stay the same while only variable expenses increase). However, determining the exact ratio of fixed to variable expenses can be somewhat subjective. In order to avoid introducing such subjectivity, we favor a simplistic approach. Individual cases may warrant different treatment. Step 4: Undistributed and Fixed Expense Adjustments Undistributed operating expenses and fixed expenses tend to be more fixed than departmental expenses. Hence, keeping them more in line with the original budget tends to make the most sense. In our example, we kept Marketing, Property Operations & Maintenance (POM), and Utilities expenses the same as the original budget. We also kept Administrative & General expense the same, but we introduced a REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 4 small adjustment for credit card commissions. We added 2.5% of the difference in total revenue between the adjusted and original budgets. In cases where there are wide differences in occupancy between the adjusted and original budgets, adjusting POM and Utilities expenses in the adjusted budget to match the original budget’s percentages of total revenue or POR amounts could be warranted. With the exception of Reserve for Replacement, fixed expenses do not vary with changes in revenue. In our example, we kept Property Taxes and Insurance the same as in the original budget. We assumed Reserve for Replacement would remain at a constant 3.0% of total revenue. Financial Pro Forma Review Table 5 on the following page shows the 2010 budget adjusted for actual market performance, as well as the hypothetical 2010 actual performance. We added two variance columns, one comparing the percentage differences between 2010 actual and the original budget, and a second one comparing actual results against the adjusted budget. As can be seen, had our hotel maintained the same occupancy and ADR penetration levels it held in 2009, it should have been able to produce income of $1.7 million, compared with the $1.3 million that was actually generated and the $1.2 million that was budgeted. The difference between the originally budgeted $1.2 million and the adjusted $1.7 million can be attributed primarily to a more favorable market than the budget anticipated. While management produced actual net income that was 8.0% better than budgeted, this result fell 24.8% below where it should have been had the hotel’s competitiveness been maintained. As with any financial review, it is important to look at more than one point of comparison. Reviewing previous-year performance and longer-standing historical trends should also be part of a thorough financial evaluation. Management’s job is to maximize both cash flow and long-term asset value. Customer and employee satisfaction, service delivery, life and safety issues, physical maintenance, and community development are only some of the additional elements that can play an important part in building an asset’s long-term value. Focusing on short-term financial results, while important, should not be the only measure to evaluate management’s performance. REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 5 TABLE 5: HYPOTHETICAL 2010 ADJUSTED BUDGET AND ACTUAL RESULTS 2010 Budget Adjusted for Actual Market Performance Number of Rooms: Days Opened Available Rooms Occupied Rooms: Occupancy: Average Rate: RevPAR: RevPAR Penetration: REVENUE Rooms Food & Beverage Other Operating Depts Other Income Total DEPARTMENTAL EXPENSES Rooms Food & Beverage (Hotel) Other Operating Depts Other Expenses Total DEPARTMENTAL INCOME UNDISTRIBUTED OPERATING EXPENSES Administrative & General Marketing Prop. Operations & Maint. Utilities Total HOUSE PROFIT Management Fee INCOME BEF FIXED EXPENSES FIXED EXPENSES Property Taxes Insurance Reserve for Replacement Total NET INCOME Mgmt Fee as % of Owner CF 200 365 73,000 47,634 65.3% $141.58 $92.38 127.2% Variance vs. Adjusted Budget 1.2% 1.2% 0.9% 2.1% -2.3% -2.3% -3.2% -5.4% $137.07 47.68 9.93 3.97 198.65 2.1% 2.1% 2.1% 2.1% 2.1% -5.4% -5.4% -5.4% -5.4% -5.4% 2010 Actual POR/PAR 200 365 73,000 46,558 63.8% $137.07 $87.42 144.6% $141.58 49.24 10.26 4.10 205.18 $6,382 2,220 462 185 9,249 69.0 24.0 5.0 2.0 100.0 % of Gross % Variance vs. Budget Actual Market 2010 63.1% $128.71 $81.27 POR/PAR % of Gross $6,744 2,346 489 195 9,774 69.0 24.0 5.0 2.0 100.0 % 1,945 1,992 409 102 4,449 5,325 28.8 84.9 83.6 52.3 45.5 54.5 40.84 41.83 8.58 2.15 93.39 111.79 1,939 1,947 399 100 4,386 4,864 30.4 87.7 86.4 54.0 47.4 52.6 41.64 41.83 8.58 2.15 94.19 104.46 3.2% 1.2% 1.2% 1.2% 2.1% 2.2% -0.3% -2.3% -2.3% -2.3% -1.4% -8.7% 892 680 485 485 2,542 2,783 293 2,490 9.1 7.0 5.0 5.0 26.0 28.5 3.0 25.5 4,369 3,398 2,427 2,427 12,711 13,914 1,466 12,448 874 680 485 485 2,524 2,339 277 2,062 9.4 7.3 5.4 5.4 27.3 25.3 3.0 22.3 4,369 3,398 2,427 2,427 12,621 11,697 1,387 10,309 0.0% 0.0% 0.0% 0.0% 0.0% 4.7% 2.1% 5.0% -2.0% 0.0% 0.0% 0.0% -0.7% -15.9% -5.4% -17.2% 388 146 293 827 4.0 1.5 3.0 8.5 1,942 728 1,466 4,136 388 146 277 811 4.2 1.5 3.0 8.5 1,942 728 1,387 4,057 0.0% 0.0% 2.1% 0.7% 0.0% 0.0% -5.4% -1.9% $1,662 17.5 % $8,312 $1,250 13.1 % $6,252 8.0% -24.8% 23.4 % 31.1 % REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 6 CONCLUSION The purpose of the analysis presented in this three-part series was to make a distinction between results that are the consequence of market performance—and beyond management’s control—and those that are the result of management skill. The approach advocated takes a simplified approach to making many of the individual adjustments required. The overall result is not meant to perfectly represent the net income that could have been generated at a higher/lower level of rooms revenue. It is, however, meant to show objectively what net income could have been more realistically than an unadjusted budget, making morerelevant comparisons possible. REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 7 About HVS About the Author HVS is the world’s leading consulting and services organization focused on the hotel, restaurant, shared ownership, gaming, and leisure industries. Established in 1980, the company performs more than 2,000 assignments per year for virtually every major industry participant. HVS principals are regarded as the leading professionals in their respective regions of the globe. Through a worldwide network of 30 offices staffed by 400 seasoned industry professionals, HVS provides an unparalleled range of complementary services for the hospitality industry. For further information regarding our expertise and specifics about our services, please visit www.hvs.com. Miguel Rivera is SVP of Asset Management & Strategic Advisory at HVS. He advises clients on maximizing real estate value and aligning a property's operations with its investment goals. He has more than 14 years of experience in real estate finance, including asset management, brokerage, financing, credit ratings, and appraisals. Prior to joining HVS, he was SVP at Jones Lang LaSalle Hotels, where he worked on more than $880-million worth of hotel real estate transactions while leading that group’s Latin American operations. He holds an MBA from Yale and a BS in Hotel Administration from Cornell. For further information, Mr. Rivera can be contacted at: HVS Asset Management & Advisory 100 Bush Street, Suite 750 San Francisco, California 94104 United States of America Tel: +1 (415) 268-0368 Fax: +1 (415) 896-0516 mrivera@hvs.com REVPAR- ADJUSTMENT BUDGETS: (PART 3 OF 3) | PAGE 8