2015 Annual Report

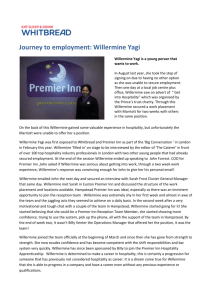

advertisement