update on oklahoma real property title authority

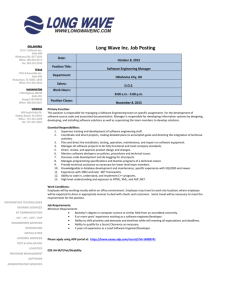

advertisement