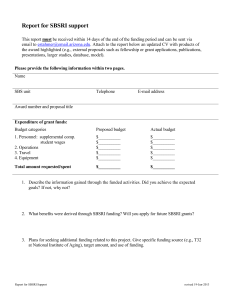

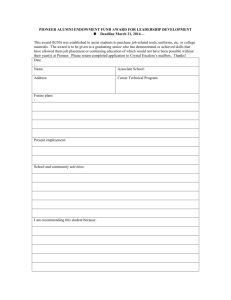

How to Manage a Federal Grant or Cooperative

advertisement