Final Exam Micro A Sep/Oct 2011 Sample Exam 3

advertisement

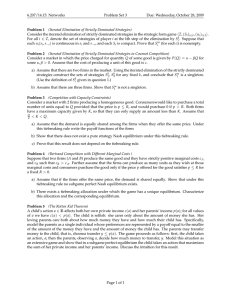

PhD, P1 Sep–Oct 2009 Microeconomics A Timothy Van Zandt Final Exam Pace yourself. If you get stuck in one part of a problem, do your best to proceed to the next part. I will grade this exam strictly. I am looking for clarity, precision, and rigor. Conciseness, when not excessively sacrificing rigor, is one aspect of clarity. This is a closed-book exam, but you are permitted to have three A4 “cheat sheets” (both sides) prepared for this exam. Answer the questions on pages of white paper. Honor Code Students are expected, individually and collectively, to uphold the rules of the PhD program and the professional norms regarding cheating and plagiarism. Examples of cheating in the context of this exam include (a) copying from another student’s examination paper; (b) allowing another student to copy from your paper; (c) any other form of collaboration during an exam; (d) consulting materials other than your A4 sheets as outlined above; and (e) revising and resubmitting a the exam for regrading, without the instructor’s knowledge and consent. At the beginning of your exam paper, you must must write out and sign the following pledge: “I pledge my honor that I have not violated the Honor Code during this examination.” Micro A Sep/Oct 2011 Sample Exam 3 Microeconomics A • Final Exam 1 Problem 1. [9 points] Consider the following two-player simultaneous-move game. Firm 2 B A 16 A 18 16 Firm 1 10 −4 12 18 12 −8 C 30 −8 10 B C 8 8 −4 30 6 6 These are monetary payoffs. 1.1. [2 points] Suppose that players care only about their monetary payoff, so that the game payoffs are exactly as shown in the matrix. What is the Nash equilibrium of this game? 1.2. [2 points] Suppose instead that players are somewhat altruistic. Specifically, each player’s payoff in a cell of the game is equal to his own monetary payoff + 1 (other 2 player’s monetary payoff). This leads to the following payoff matrix: Firm 2 B A 24 A 24 Firm 1 23 19 19 B 23 7 18 26 26 18 7 C C 0 6 6 0 9 9 Show that each player ends up with a lower monetary payoff in the Nash equilibrium of this game. 1.3. [5 points] Consider the Stackelberg version of the game with altruism, in which player 1 is leader. Find the backward induction solution. Compare the payoffs of both players with those of the Nash equilibrium. Micro A Sep/Oct 2011 Sample Exam 3 Microeconomics A • Final Exam 2 1.4. [0 points] Show that, no matter what the monetary payoffs we had started with, player 1 would get a higher payoff as leader in the Stackelberg version of the game with altruism than in the Nash equilibrium of the game without altruism. Problem 2. [10 points] In my MBA course, we play a pricing game in which the two firms, L and H, produce perfect complements. This means that each buyer needs one unit of each good. We refer to this combination as a “package”. For the buyers, the price of the package is P = PL + PH . Demand for the package is given by d(P ). Assume that each firm has constant marginal cost. 2.1. Write down the formula for firm L’s demand function, d L (PL , PH ). Decompose the own-price elasticity of d L into two components, one of which is the elasticity of d. Consider the effect of an increase in PH on each of these two components, and explain therefore that it is ambiguous whether the pricing decisions are strategic complements or substitutes. Show that, if d is a constant-elasticity demand curve, then the prices are strategic complements. (You should do this last step without actually calculating the reaction curves.) 2.2. Assume then that d is a constant-elasticity demand curve. Assume that MCL < MCH (firm L has lower marginal cost than firm H). Prove that, in any Nash equilibrium (PLN , PHN ), PLN ≤ PHN . Hint, sort of: Once you properly frame this question, it becomes a simple exercise in monotone comparative statics. You can take as given, i.e., as an assumption, the result from the previous exercise that d L becomes less elastic when PH goes up (and likewise reversing the rolls of L and H). Micro A Sep/Oct 2011 Sample Exam 3 Microeconomics A • Final Exam 3 Problem 3. [19 points] A monopolist can develop quality Θ of its good at a cost g(Θ), where g is strictly increasing in Θ. It can then produce q units of the good at a cost c(q ), where c is strictly increasing in q. The inverse demand curve for its good when the quality is Θ is given by Θp (q ), for a strictly decreasing function p. Thus, the monopolist’s profit function is Π(q, Θ) = (Θp (q ))q − c(q ) − g(Θ). 3.1. [4 points] Suppose that all functions are differentiable. For the monopolist’s profit-maximization problem, what are the first-order conditions for an interior optimum? 3.2. [3 points] State plausible assumptions on p, c, and/or g under which Π(q, Θ) is strictly concave in Θ. Avoid calculus when answering this question. 3.3. [3 points] State plausible assumption (which I do not ask you to show) under which Π(q, Θ) is concave in q. Show that, however, h(q, Θ) ≡ (Θp (q ))q is not concave jointly in (Θ, q ). Do this only for the case where p is twice differentiable, by showing that the Hessian of h is not negative semi-definite as long as r (q ) = 0 (which holds in the range of optimal q). 3.4. [4 points] State the formula for welfare (total surplus) w (q, Θ) as a function of q and Θ. You should only use expressions that are either part of the data given above or that are derived from that data. Assume that p is a strictly decreasing continuous function and use the fact that, for fixed Θ, the inverse demand curve is the marginal valuation curve. 3.5. [5 points] Use monotone comparative statics to show that the social planner chooses both Θ and q higher than the monopolist does. Micro A Sep/Oct 2011 Sample Exam 3 Microeconomics A • Final Exam 4 Problem 4. [6 points] Recall the exercise you did on Cournot competition with free entry. Problem 19 of the MBA exam was based on this exercise. I attach that problem and its solution to this exam. A year ago I presented this exercise in my MBA class, and one reaction I got was roughly along these lines: I see the calculations but don’t get the intuition. Also, I don’t see why this would work even with increasing marginal cost. My own intuition is as follows. Suppose that there is no exit following integration and each firm produces the same quantity as before. Then total output would be the same, the market price would be the same, and each firm would earn the same profit (compared to before integration). Why isn’t this the equilibrium after integration? What changes? I gave the following answer, based on a story in which the two independent countries were “France” and “Germany”. Market power is more about how many firms you share the market with (market shares) than about the quantity that each firm sells. Makes sense, right? Whenever anyone talks about industry concentration, he or she provides data on market shares. Suppose I manage one of the German firms. After integration, but starting at the pre-integration status quo (before any exit or any changes in output takes place), my output decision has a smaller effect on price than before integration because now I am one of 10 firms rather than one of 5 firms. An increase in my output by 20 units represents a smaller percentage increase in total output in the European market than it would have represented in the national market. Hence it leads to a smaller decrease in the European price that it would have caused in the German price. Therefore, my incentive to produce more goes up compared to before integration. (In more technical terms: one can show that, whether it is Cournot competition or price competition, each firm’s marginal revenue shifts up at the pre-integration status quo following integration, hence each firm has an incentive to raise output and/or lower price.) All firms are thinking alike; each firm increases output until the new equilibrium is reached, and the market price falls. Your task: Formulate my statement about MR as a theorem and prove it. Micro A Sep/Oct 2011 Sample Exam 3