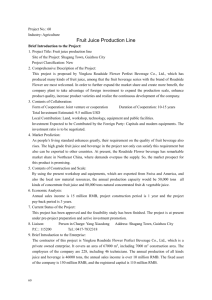

European Fruit Juice Association Liquid Fruit

advertisement