2012 AnnuAl RepoRt

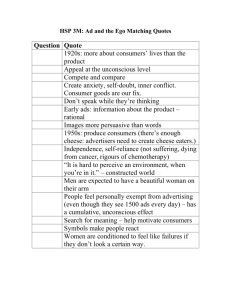

advertisement