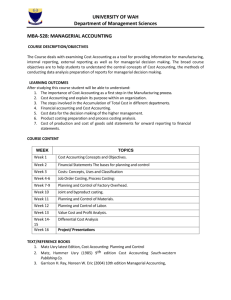

The Target Costing Bull's Eye

advertisement

The Target Costing Bull's Eye Business Finance Magazine by Tad Leahy Companies that are locked into traditional costing methods may be missing out on a valuable competitive tool — the design-to-cost approach. But target costing presents many challenges in implementation — hurdles that controllers can help engineering and manufacturing overcome. Think about conventional costing methods. Now turn them inside out. That's one way to look at target costing — a cost management process that promises greater profits and customer satisfaction than traditional costing methods could ever provide. What makes target costing different? The conventional approach is to evaluate costs after production. Target costing says, "Let's evaluate costs before production begins. Let's design a product based on a pre-specified cost by gathering marketing input on customer needs, and let's get everyone in the company to work toward hitting this target cost." OK, so if there's a motor that costs $3 and another motor that's exactly the same for $10, is picking the $3 motor target costing? No. That's "should" costing, and that decision comes out of the purchasing department. Target costing is an ongoing process that reaches far beyond just smart shopping. "Target costing inverts the P/L," says John Dutton, director of new product development services at Arthur Andersen LLP in Chicago and a target costing consultant. "Instead of looking at cost as an independent variable, target costing makes cost a dependent variable." Best Practices Study in Target Costing A worldwide research study to identify best practices in target costing will be launched this month by the Consortium for Advanced Manufacturing-International (CAM-1 in Dallas (http://biz.onramp.net/cam)and The University of Akron. The objectives of the study are to identify how companies implement target costing, the resources utilized in target costing implementation, key success factors for effective target costing implementation and to make specific recommendations for implementing target costing to participants in the study. CAM-1 and The University of Akron will mail a questionnaire to companies that utilize target costing, then analyze the completed surveys, identify best practices, conduct visits to companies identified as achieving best practices in target costing, and produce a final report which will be released to participants this summer. The traditional method is to estimate the cost of design and production, add in profit, and that becomes the product's price. The target costing method determines the market price requirement, the price required to win the customer's business, then subtracts the target profit to arrive at the target cost. To succeed, target costing requires multifunctional teamwork, communication and cooperation. You don't want to end up with this type of scenario: An engineer comes to you and says, "Here's our proposed cost for this product." You say, "Based on our target costing analysis, that price is too high. We'll have to cut it by 50 percent to win the customer's business." Then the engineer says, "Why didn't you tell me the winning price up front so we could design a product to meet the customer's expectations?" Target Costing's Roots The roots of target costing trace back to World War II when, due to a shortage of materials, U.S. manufacturers made an organized effort to build the most function into a product for the lowest cost. It was called value engineering. The Japanese adopted and expanded the concept in the 1960s and target costing was born — a long-term profit planning system that is customer-driven and price-led. Today, 80 percent to 85 percent of all Japanese manufacturing companies use the concept, including well-known names like Sony, Toyota, Nissan, Canon, NEC and Olympus. However, it hasn't caught on in America. Even the few U.S. companies that have begun to use target costing, like Chrysler Corp. and The Boeing Co., are a long way from an integrated, companywide system. Avoiding the Pitfalls What are the obstacles in target costing? It takes time and money to bring sweeping changes into an organization. There's also the problem of changing workers' behavior. Why rock the boat if things are going well? The answer, target costing proponents say, is simple: In the long run your company will be better positioned to compete in the marketplace with target costing than without target costing. "Most American companies are working in silos," says Keith Hallin, senior manager of finance in the Boeing Commercial Airplane Group in Seattle, who has introduced pilot programs in target costing at his company. "For instance, engineers focus on the specifications of the product. Target costing requires them to think beyond those traditional tasks and factor in the cost of the engineering, to perform cross-functionally." American companies tend to build something and discover after it's produced that the price they need to charge to make a profit is too expensive for their customers. Then they try to find piecemeal solutions for reducing the cost. The target costing process requires that the desired cost to manufacture a product be spelled out ahead of time. Since target costing is customer-driven, it can improve customer satisfaction. It also allows more people in the company to understand the company's objectives and how they are going to be achieved, because it encourages people with different functions to work on the same team to meet the collective target costing goals. Target costing, ideally, arrives at a price that works for the company as well as the customer. That makes it a more effective way to do business, and companies that have used target costing have indeed found that they reach their profit goals more effectively. Controllers who introduce target costing successfully into their organization may change how coworkers perceive financial types, from a policeman or someone with a big stick to a valued partner working on everyone's behalf. Workers can understand that the reasons behind your cost objectives are directly related to gaining a competitive advantage, not merely a dictum from senior management. Here is a look at some of the basic benefits and processes behind the concept of target costing. Product and Customer Influences A number of factors influence target costing, including senior management's objectives and your company's long-term profit objectives. But while every company uses target costing differently, there are some things that will influence your target costing efforts no matter what type of business you're in or what your corporate culture is. They are the type of customer you sell to and the type of product you make or service you offer. It may seem obvious to tie the cost of your product or service to the needs of your customers. But target costing makes more of a defined effort to achieve this objective than traditional costing methods. That effort extends to researching customer needs, something Boeing takes very seriously. "In research-gathering seminars, I ask how many people own one of our products, and no one raises their hand," says Boeing's Hallin. "Then I ask how many people have ever flown in one of our planes, and everyone's hand goes up. Although ours is a business-to-business company, we want to understand not only how our immediate customers [airplane purchasers and lessors] use our product, but how their customers, the passengers, use it as well." Target costing says you need to match your firm's activities to your customer's requirements. Dr. Judith E. Hennessey, professor and chairwoman of the marketing department in the College of Business Administration and Economics at California State University, Northridge, Calif., offers an example. 10 Advantages of Target Costing If you are successful in implementing and maintaining an effective target costing system, you may be able to: 1. Determine an expected cost of manufacturing a product or providing a service. 2. Achieve greater cost efficiencies. 3. Spend money where it will have the greatest impact. 4. Identify customers' real needs. 5. Match your firm's activities to your customers' requirements. 6. Increase customer satisfaction. 7. Give co-workers a better understanding of cost objectives. 8. Allow co-workers to participate in setting quality, cost and time targets. 9. Transform your image of "policeman" into that of a valued partner working on everyone's behalf. 10. Become more competitive globally. "Suppose you're an automaker and you've determined your customers want comfort," says Hennessey. "Evaluate your product as it relates to enhancing customer comfort, perhaps by looking at the springs in the seat, the upholstery, the angle of the seat, the car's suspension. Enhance those things and reduce costs in areas that aren't as important to the customer." Uncovering customers' real needs can occasionally be difficult even with a simple product, and even for the best of companies. "When Procter & Gamble developed their Pringle's potato chip, they asked people what they wanted from a potato chip, and the answer uniformly was freshness," Hennessey says. "The product was launched in a vacuum-sealed can to maximize freshness, and initially, it was successful. But then customers found out that the product didn't taste very good. Procter & Gamble had missed taste as a customer need." If in creating product functions that reflect what the customer wants your costs become too high to hit your target, don't give up. Find other areas less important for customer satisfaction and try to reduce those costs. If the process doesn't work the first time around, try again. "Sometimes, target costing needs many iterations to carry it through," says Hennessey. How does your product influence target cost? Generally, the longer your product development cycle from the design stage to the production stage, the more difficult it may be to establish firm target costs early on. For instance, if your cycle is up to four years, which is how long it typically takes at Boeing according to Hallin, the target cost you establish may need to be revised over the years. Some companies with a long product development cycle take the process in incremental steps. They have an allowable cost for each component function, then the total allowable costs of all the functions for making the product are added to arrive at an expected cost of manufacturing the product. It's usually impractical for a company with hundreds of design and production components to evaluate all of them, so a representative sample of allowable costs is taken and applied to all components. From these costs comes an updated target cost. Companies with shorter product development cycles may find they can stick to their initial target cost more easily because they are not as susceptible to the changes that time can impose. "The simpler and more straightforward your product, the easier it is to implement target costing," says George Millush, program director for project redesign on all financial processes at Chrysler Corp. in Auburn Hills, Mich. "We're very interested in target costing, but it takes time to put the pieces in motion, and we're just in the infant stages here." Don't Keep Costs To Yourself Suppose you have a nine-month product development cycle from start to market roll out. If a company using target costing finds that an engineer needs to look at an alternate design in order to hit the target cost, that engineer will need costing information immediately to stay on track. If engineers have to search for that information themselves, they may give up on the target costing process, figuring they don't have time to spend investigating less expensive design alternatives because they're under a tight deadline. It's up to you and your target costing team to provide the engineer with costing information. Don't keep that information a secret. "Finance is a conservative group that like to keep costs to themselves," says Hallin. "For target costing to work, you need to share that information across different job functions and figure out a way to assist engineering and manufacturing in understanding the costs." Hallin adds that to avoid employee burnout, let engineering and design people participate in setting quality, cost and time targets. Build in some slack time so workers won't have to operate in a constant crisis mode. Target costing is not about cutting costs by 10 percent across-the-board. Its purpose is to spend money where it will have the greatest impact on meeting customer needs and paring back expenses in other areas that are less critical for winning their business. "We call it quality function deployment, or QFD," says Dutton. "QFD identifies what the customer needs or wants and what the competition is doing so you can spend limited engineering resources more wisely." Dutton says he can conduct a best practices diagnostic assessment of companies worldwide to see which ones are most effective with target costing, then use that analysis to show the gap between where your company stands and where those best practice companies stand in terms of cost efficiencies. Those are some of the major benefits and processes of target costing. But setting a target costing process in motion requires some guidelines on how to gain senior management's buy-in and overcome potential resistance from your co-workers. Implementing Target Costing Implementing a successful target costing program is no slam dunk. Deeply embedded cultural issues can derail even the most carefully crafted plan. But cost managers at leading-edge companies are developing innovative approaches to keep their projects on track. Target costing just might be the recipe for cost management in the future. It has all the ingredients, including all three elements of the strategic cost management triangle: quality, cost and time. It manages costs before they are incurred by setting a target cost for the product or service based on the market, the customer and the amount of profit desired. Clearly, it's an improvement over conventional methods that attempt to control costs after production. It's externally focused on the competition. It organizes workers from different departments into cross-functional teams that all strive for the same cost goal, forming an integrated planning and execution system. There's just one problem — how do you implement it? While nearly everyone can see the builtin advantages of a system that promises greater customer satisfaction and profitability, putting the theory into practice and getting everyone to accept a new way of doing their jobs is another story. Old habits die hard. "I never met any opposition when presenting the concept of target costing or had anyone tell me it was a dumb idea," says David Schwendeman, senior manager of finance, business resources and finance focal for the 757-300, at the Boeing Commercial Group, Seattle. "When it comes to implementation, however, any tactics that challenge legacies are pushed back. So 80 percent of this is culture, not process. If you stomp on culture, they'll stomp back." Boeing's 757-300 is an innovative design that stretches 24 feet longer than the standard passenger plane, which makes it 10 percent more economical for airlines on a per-seat basis. Schwendeman has completed a pilot target costing program on one application of the plane and is now applying target costing more broadly. However, he had to deal with initial resistance, not from the cross-functional team members he assembled but from individual departments that felt they might be losing their control. The corporate mind-set focuses on individual performance. Target costing requires performance to be judged on a team basis. That's not an easy sell, especially if the perception among departmental heads is that target costing will erode the power, authority and legacies they've worked to build up over the years. For Schwendeman, the solution was a compromise of sorts. He developed a matrix business plan that allows departments to continue to function as they have in the past, while adding the cross-functional teams to the effort as well. Each side does 50 percent of the work. Rather than make sweeping changes within his business unit, Schwendeman introduced the concept of target costing gradually, careful not to step on any toes. "What we're saying to the departments is that we're expanding on the work you've done already," says Schwendeman. "You've got to figure out a way for the functional departments [traditional organizational structure] and the cross-functional teams to live together. It's working for us here, but I was surprised at how hard it was for people to accept it." Boeing is currently in the process of applying target costing to three other airplane products. Is Your Company Ready for Target Costing? The seven questions below are excerpted from the book "Target Costing," by Shahid L. Ansari and Jan E. Bell, (Irwin Professional Publishing, Chicago, 1997). They can help reveal how prepared you and your company are to embark on a target costing program. If you answer "no" to most of these questions, then you should take a harder look at more serious preparation before attempting to launch a target costing program. Have we made the reason for target costing clear? Is its connection to our business strategy clear? Does top management support target costing? Is this the right time to introduce target costing? Are people ready for change? Is there a readiness to embrace the key principles of target costing? Is the organization ready to commit the necessary resources? Are all management levels ready to respond quickly to the changes target costing will bring? Schwendeman attributes the success he's had with target costing implementation in part to the fact that his business plan is product oriented, not functionally oriented. "Business plans that emphasize function tend to focus more on staffing than value engineering," says Schwendeman. "The product-oriented business plan consists of integrated product teams, creating a structure that channels people's energies into those things that are highly valued by the customer. With the old business plan, we were putting lots of energy into some things that weren't highly valued by the customer." Two Implementation Models John Dutton, senior finance manager with Arthur Anderson LLP in Chicago, says there are two basic ways to implement target costing into an organization, the mega model and the incremental model. Boeing chose the incremental route. "Boeing's target costing proponents raised awareness among key executives about target costing and the business benefits of investing in this process, gained approval for a pilot program, and now they're expanding on that effort," says Dutton. "That's an example of using the incremental model. You're not trying to change the whole organization all at once." The mega model is more ambitious. It's a long-term strategy of changing a company's entire business management system. It's time-consuming, and the verdict is still out on whether it works or not. But Dutton points to Italian companies like Magnetti and Morrelli as examples of companies that have utilized it successfully. The mega model may be better suited for companies that are at the enterprise level, according to Dutton, and aren't yet steeped in bureaucracy or legacies. "The incremental model is a more practical way to go," says Dutton. "If there is a problem with this model, it may be that, while you may have a few successes, you have to keep working to change people's minds who aren't yet involved with the process and still don't understand how it's going to affect them." There is no one right way to do target costing. However, the principles of target costing remain constant no matter how they are applied, or what the corporate culture. "Just as there's no one way to do cost accounting, the basic principles of cost accounting don't change," says Dutton. The Extended Enterprise A precept of target costing is to better manage and motivate suppliers by providing greater access to your organization, telling suppliers your target cost, and rewarding exceptional effort. By bringing the supplier closer to the way you operate, in effect you are extending your enterprise. Among companies that have made substantial strides in this area is Chrysler Corp. Its working relationship with a bearing supplier, The Timken Co. in Canton, Ohio, exemplifies the extended enterprise concept. "Chrysler has established a program to reduce the total cost of the extended enterprise by eliminating stifling bureaucratic procedures, redundant checking and testing, and other practices that have historically hampered customer-supplier relationships," says Robert Leibensperger, executive vice president of Timken and president of the firm's bearings division. "Chrysler allowed a team from our company to have a virtually free run of 12 plants that use Timken bearings. The team observed material flow, processing and assembly, then made suggestions to Chrysler for improvement." The team generated 46 quality and cost-improvement ideas, which are expected to save Chrysler more than $3 million annually, according to Leibensperger. Another example of Timken's ability to add value to Chrysler's operations came in the late 1980s. Chrysler had decided to increase power in one of its transmissions. In the past, Chrysler would have developed a new transmission design, tooled it, procured the parts and spent millions to bring it to market. Under the extended enterprise concept, Chrysler brought the challenge to Timken. "Through specialized knowledge of advanced finishing and bearing technology and by working closely as a team with Chrysler engineers, we were able to increase the capacity of the existing power train to handle the new performance requirement," says Leibensperger. "Value was created for the end user, too, who received increased performance without having to pay the added cost that would have come from developing a new transmission." Such relationships help tear down walls between suppliers and original equipment manufacturers (OEMs). Information, including target costs, should be shared by both parties and among all functions, including purchasing, engineering and manufacturing, with a reward for the team as opposed to individual targets, as a performance incentive. Ford's total cost management and Mercedes Benz's Tandem are other examples of extended enterprise programs, but Leibensperger believes that Chrysler's program is more robust. Tom Stallkamp, president of Chrysler Corp., supports that contention. "We started before other companies did — not outsourcing but finding a partner that has technical competence, and not just manufacturing competence but also the ability to design the part," says Stallkamp. "Sorting out the supply base and its responsibilities will be more difficult in the future, because the supplier will pick their customers rather than the manufacturers picking their suppliers. The reason is that every auto maker is asking suppliers to do programs for them, and there is a limit to the capabilities of suppliers. They will be forced to pick one manufacturer over another. That's why Chrysler believes its close supplier relationships will pay off." Keith Hallin, senior finance manager at the Boeing Commercial Airplane Group, sees four main areas that need to be addressed in target costing implementation: technical, behavioral, cultural and political. "For target costing to work, you need to create a plan to obtain new data, new tools like value engineering and benchmarking, and the cross-functional teams deal with these challenges first," says Hallin. Second are behavioral considerations. For instance, an engineer needs to begin thinking not just about the product's technical specifications, but also to keep watch over the cost of the product. Third are the cultural issues of working with other functions instead of protecting your own area of interest. And fourth are the political aspects — getting buy-in from senior management, he says. It's also been said that for target costing to work, it must be diffused throughout the value chain. Everyone in the organization must accept it. If one department says no, the rest of the target costing system can break down. Even so, Schwendeman and Hallin have found ways to allow the old and the new to peacefully co-exist. At Boeing, which has done more to implement target costing than nearly any other American company, the traditional costing methods and the target costing method live in a precarious harmony. Target costing has tremendous power in the marketplace when you and your company become good at it. "Don't wait to get started," says Hallin. "Start immediately. And the place to start is with your customers, what they need and how they use your product. Get the engineers, manufacturing people and the finance people in one room together and begin discussing customer needs." Hallin adds that a good way to start is by setting up a target costing office as an adjunct to the product development department. Trying to get a target costing program off the ground only to watch it crash and burn due to poor preparation is not something you can recover from easily. If you don't have the energy or time to commit to it, you may want to seek help from a qualified professional consultant on target costing. "If your attempt to implement target costing fails, it could take as long as two years to bring it to the table again, and you're going to have to rename it," says Dutton. "There's also the question of how receptive senior management will be to a second try at a program that didn't work the first time around." Targets are commitments. If people see your target cost as negotiable or something they can try to approximate, the value of target costing is weakened. That behavior needs to change to one of serious commitment that goes beyond good intentions and is seen in actual results. Originally printed in the January 1998 issue of Controller Magazine. Copyright 2007 Penton Media