Palaseja - MDH DiVA

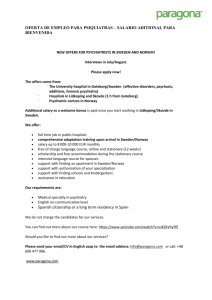

advertisement